10 processes in payroll that AI is already handling today

Dec 5, 2025

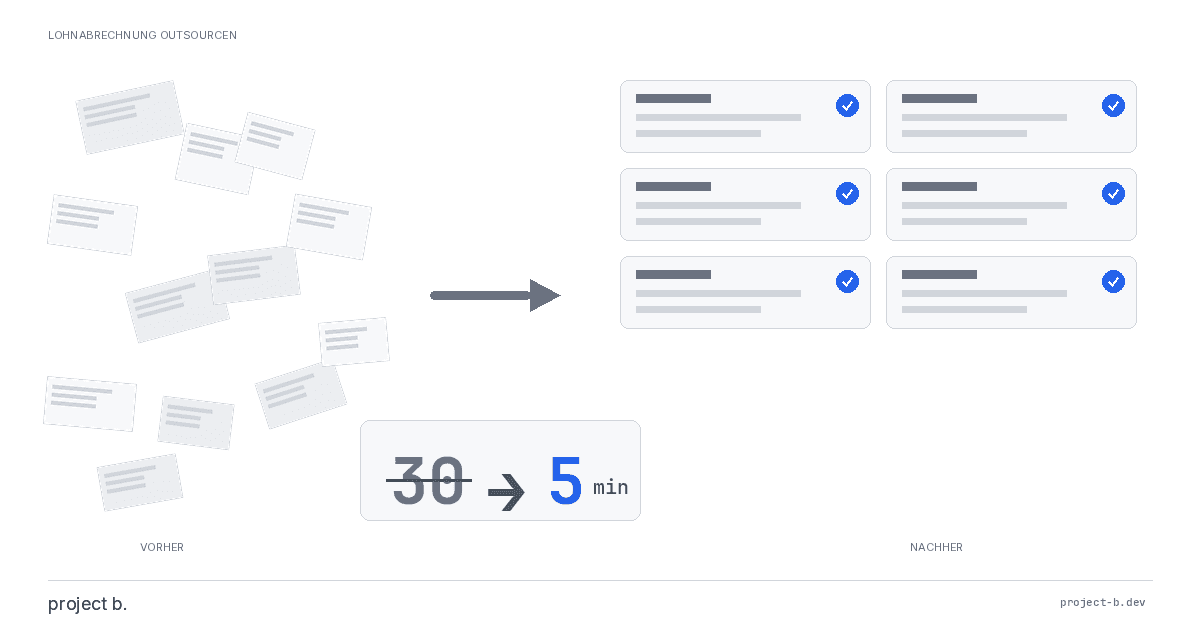

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

10 Processes in Payroll that AI Already Takes Over Today

Payroll is one of the most time-consuming tasks in HR departments. According to a study by the Institute for Employment Research (IAB), companies spend an average of 5-10 hours per month per employee on payroll-related administrative tasks. For SMEs with 50 to 300 employees, this quickly adds up to several working days.

The good news: AI-supported payroll is no longer a thing of the future. Modern payroll software already utilizes machine learning and automated processes to take over repetitive tasks. In this article, we will show you 10 concrete processes that AI can reliably handle today.

At a Glance: Time Savings through AI in Payroll

Process | Time Required Manually | Time Required with AI | Savings |

Master Data Verification | 4h/month | 15 Min | 94% |

Error Detection | 8h/month | 30 Min | 94% |

Document Processing | 6h/month | 1h | 83% |

Time Tracking Verification | 12h/month | 2h | 83% |

Absence Detection | 3h/month | 20 Min | 89% |

Tax Pre-Verification | 4h/month | 30 Min | 88% |

Anomaly Detection | 2h/month | 10 Min | 92% |

Automated Follow-ups | 5h/month | 30 Min | 90% |

Reporting | 6h/month | 15 Min | 96% |

Compliance Monitoring | 4h/month | 20 Min | 92% |

1. Master Data Validation and Maintenance

Maintaining employee master data is prone to errors and time-consuming. Incorrect bank details, outdated tax classes, or missing social security numbers lead to payroll errors and rework.

What AI Does Here:

AI systems automatically compare master data with external data sources. They detect inconsistencies such as:

Invalid IBAN formats

Inplausible tax class combinations for married couples

Missing or expired work permits

Discrepancies between reported and actual addresses

Real-World Example:

A mid-sized trading company with 120 employees reduced its monthly correction entries from an average of 15 to 2 cases through automated master data validation.

2. Error Detection Before Payroll Run

Errors in payroll can be costly. They lead to rework, annoy employees, and can result in fines from authorities. Traditionally, these errors are only discovered after the payroll run.

What AI Does Here:

Modern AI systems analyze all input data before the payroll run and identify potential issues:

Unusual overtime patterns

Missing vacation requests for booked absences

Unauthorized allowances or bonuses

Discrepancies between time tracking and shift schedules

The AI continuously learns from past corrections and independently improves its detection rate.

Real-World Example:

Logistics Company (500 Employees): The AI checks 12,000 time bookings per month in 4 hours instead of 3 days of manual verification. The error rate dropped by 87%.

3. Document Processing (Sick Leave Notifications, Certificates)

Every year, hundreds of documents arrive in the HR department: sick leave notifications, parental leave applications, study certificates for child benefit, and severely disabled identification cards. Manually processing and assigning these takes time.

What AI Does Here:

Through OCR (Optical Character Recognition) and Natural Language Processing, AI captures:

Issue date and validity period of sick leave notifications

Type of certificate and relevant data

Assignment to the correct employee through name and personnel number matching

Automatic filing in the digital personnel file

According to BITKOM, 34% of German companies are already using AI-supported document processing.

Real-World Example:

A tax consulting firm processes over 200 sick leave notifications from its clients monthly. The automated capture reduced processing time from 2 minutes to 15 seconds per document.

4. Time Tracking Verification and Plausibility Checks

Automatic time tracking provides raw data. Checking this for plausibility often remains a manual task. Did employees forget to clock out? Are the break times correct?

What AI Does Here:

AI algorithms detect anomalies in time tracking data:

Missing clock-ins or clock-outs

Unrealistically long working hours without breaks

Deviations from the usual working pattern of an employee

Double bookings or overlaps

The system automatically suggests corrections or requests missing information.

Real-World Example:

Home Care Service (80 Employees): Automatic detection of shift allowance errors saves 8 hours per month. The system recognizes when night shifts are not correctly marked as such.

5. Absence Detection and Categorization

Vacation, illness, training, parental leave: Each type of absence has different effects on payroll. Correct categorization is crucial.

What AI Does Here:

AI systems automatically categorize absences based on:

Historical patterns of the employee

Submitted documents (sick leave notifications, vacation requests)

Calendar entries and bookings

Legal regulations (public holidays, company holidays)

The software also recognizes when sickness pay ends or transitions to sick pay are imminent.

6. Tax Pre-Verification

Tax errors in payroll can be costly. Incorrectly calculated income tax, unconsidered exemptions, or incorrect church tax lead to back payments and trouble with the tax office.

What AI Does Here:

The AI checks before every payroll run:

Current electronic wage tax deduction features (ELStAM)

Correct application of exemptions

Plausibility of tax class combinations

Special cases such as multiple employments or cross-border work

In case of discrepancies, an automatic notification is sent to the responsible caseworkers.

7. Anomaly Detection in Salary Data

Unusual fluctuations in salaries can indicate errors or even fraud. Such anomalies often go unnoticed manually until months later.

What AI Does Here:

Machine learning algorithms analyze historical salary data and identify:

Unusual salary jumps (without documented promotion)

Suspicious overtime patterns of individual employees

Unplausible expense claims

Double payments or suspicious bank account changes

This anomaly detection protects against not only errors but also internal fraud. According to the Association of Certified Fraud Examiners, companies lose billions annually due to payroll fraud.

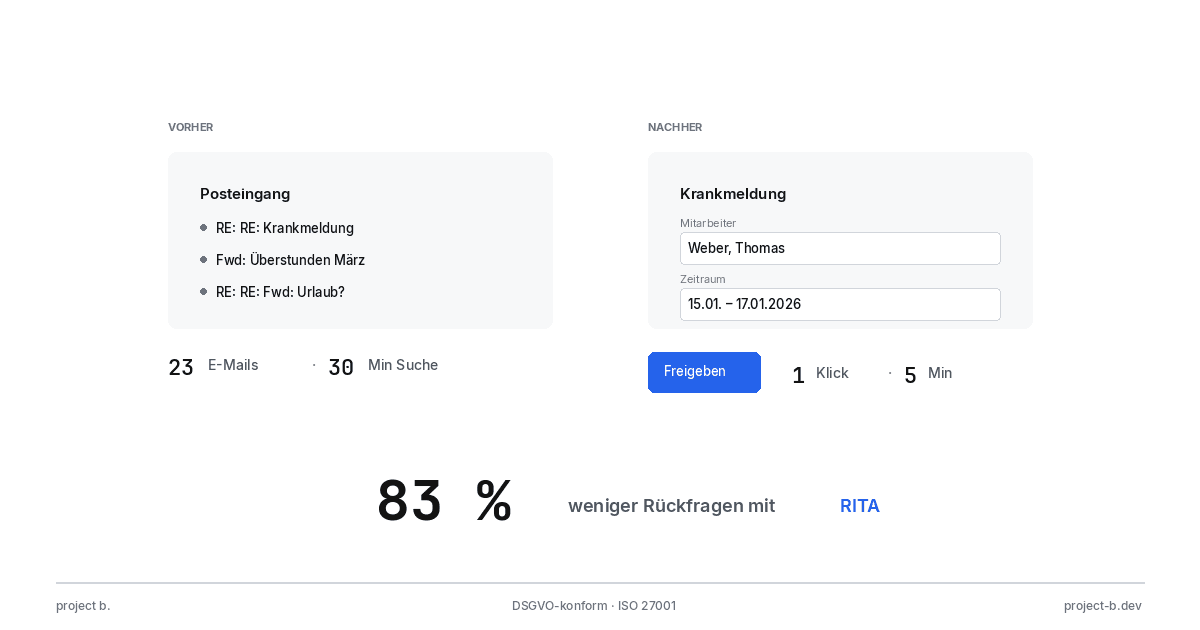

8. Automated Follow-ups with Employees

Missing information delays payroll. Traditionally, HR staff calls or sends emails to follow up. This costs time and nerves.

What AI Does Here:

Automated workflows send targeted follow-up questions:

Missing work time evidence via app notification

Reminders for expiring certificates

Requests for missing digital signatures

Confirmation of special payments or salary changes

Employees can respond directly via self-service portals. The responses are automatically processed and incorporated into the payroll.

9. Reporting and Evaluations

Management and controlling require regular evaluations: personnel costs by department, overtime development, sickness rates. Creating these manually is time-consuming.

What AI Does Here:

AI-supported reporting tools offer:

Automatically generated standard reports as of the cut-off date

Natural language queries ("Show me the overtime of production in Q3")

Predictive analytics (forecasts for personnel costs)

Automatic detection of trends and outliers

The digital payroll is thus transformed into a data source for strategic decisions.

10. Compliance Monitoring

Legal changes in labor and tax law are frequent. Increases in minimum wage, new social security contributions, changed reporting obligations: Those who do not stay updated risk penalties.

What AI Does Here:

Intelligent compliance systems:

Automatically monitor legal changes

Check existing payroll rules for currency

Warn about impending deadlines (reports, certificates)

Document all audit steps in a revision-safe manner

According to KPMG, 42% of German SMEs already utilize AI-supported compliance tools.

Can Payroll Be Fully Automated?

The honest answer: Not quite yet. AI reliably takes over repetitive, rule-based tasks. For complex individual cases, employee discussions on salary issues, or strategic decisions, human expertise is still needed.

AI is a tool that relieves HR professionals. It does not replace payroll clerks but makes their work more efficient. The time saved can be utilized by HR teams for value-adding tasks: employee development, employer branding, or strategic workforce planning.

Conclusion: The Right Time for AI in Your Payroll

The technology is matured, and the benefits are measurable. Companies with 50 to 300 employees benefit particularly: they have enough volume for significant savings but not the resources for large specialist teams.

The entry does not have to be radical. Start with one process, for example, automated time tracking verification, and gradually expand. Most providers of payroll software offer modular solutions.

The question is no longer whether but when you will use AI in your payroll. Your competitors are already doing it.

Sources

Are payroll accountants being replaced by AI?

No. AI takes over repetitive tasks such as data verification and document processing. The expertise of payroll accountants remains essential for complex cases, advising, and strategic decisions. Studies show that AI changes the role of HR professionals, but does not make it obsolete.

Which process offers the greatest savings potential?

The time tracking audit and error detection before the billing run offer the greatest potential for time savings of 83-94%. Particularly in companies with shift work or many field staff, AI systems quickly pay for themselves.

How accurate is the automatic error detection?

Modern AI systems achieve recognition rates of over 95% with standard errors. Accuracy increases with usage time as algorithms continuously learn from corrections. However, a manual final check remains advisable.

Finn R.

Further articles

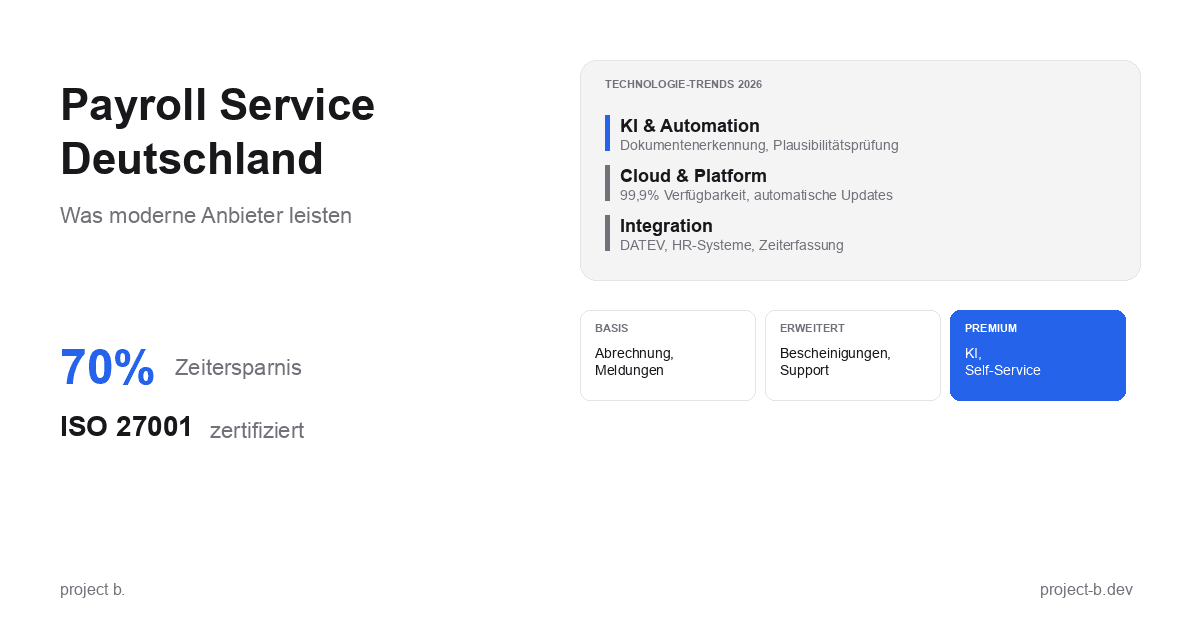

Feb 9, 2026

·

Payment

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

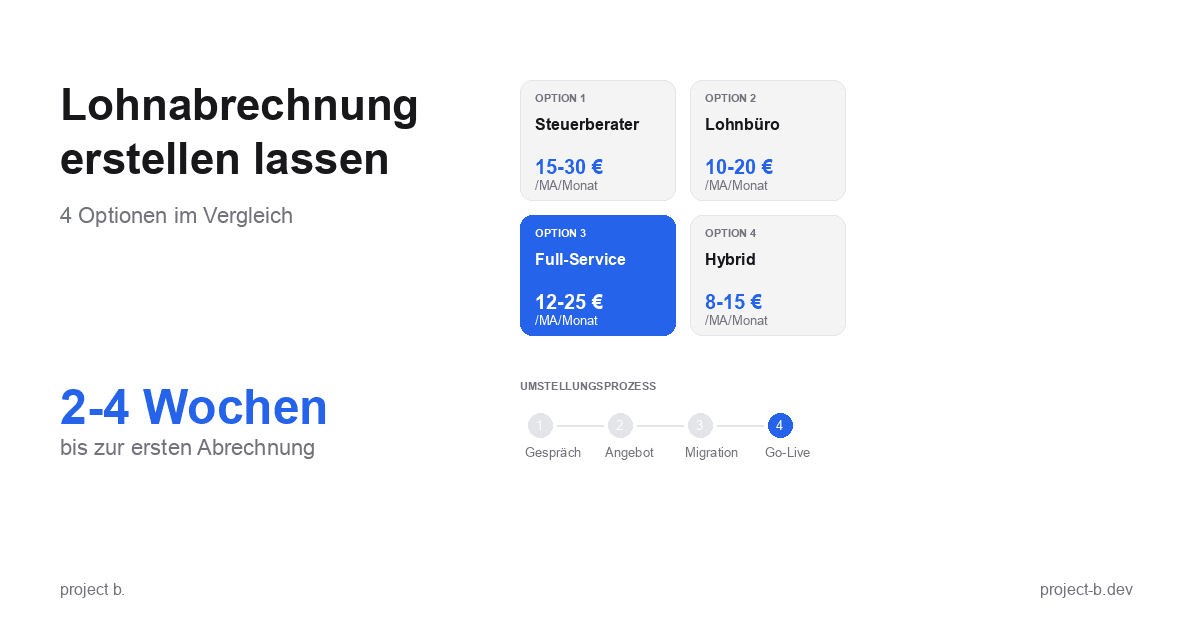

Feb 11, 2026

·

Outsourcing

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

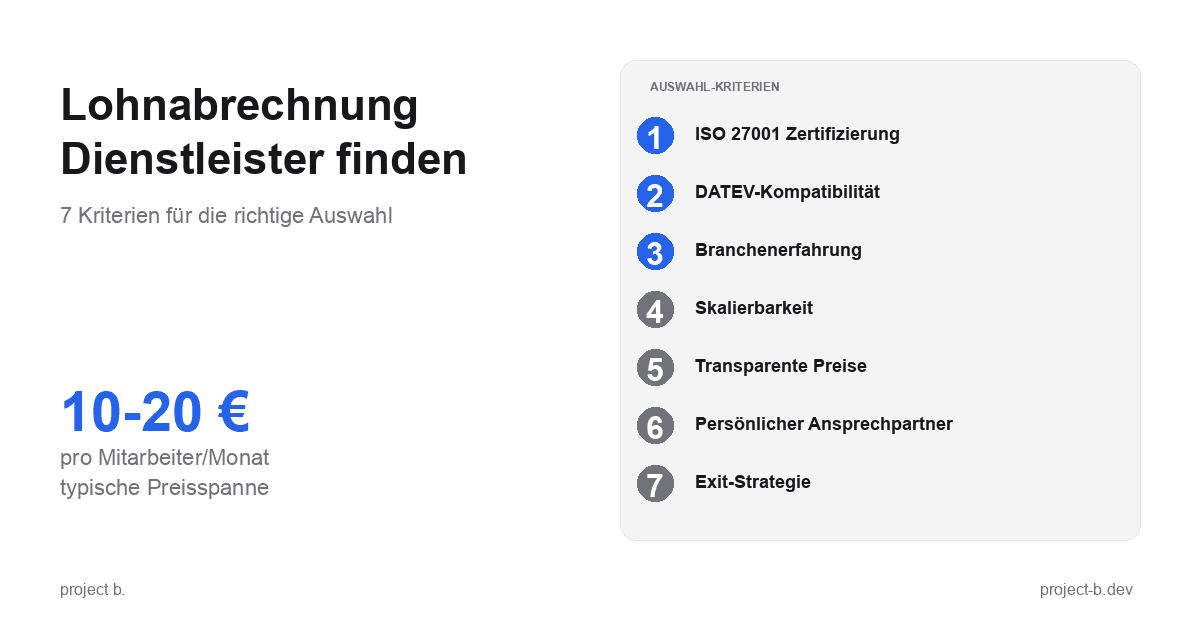

Feb 9, 2026

·

Outsourcing

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

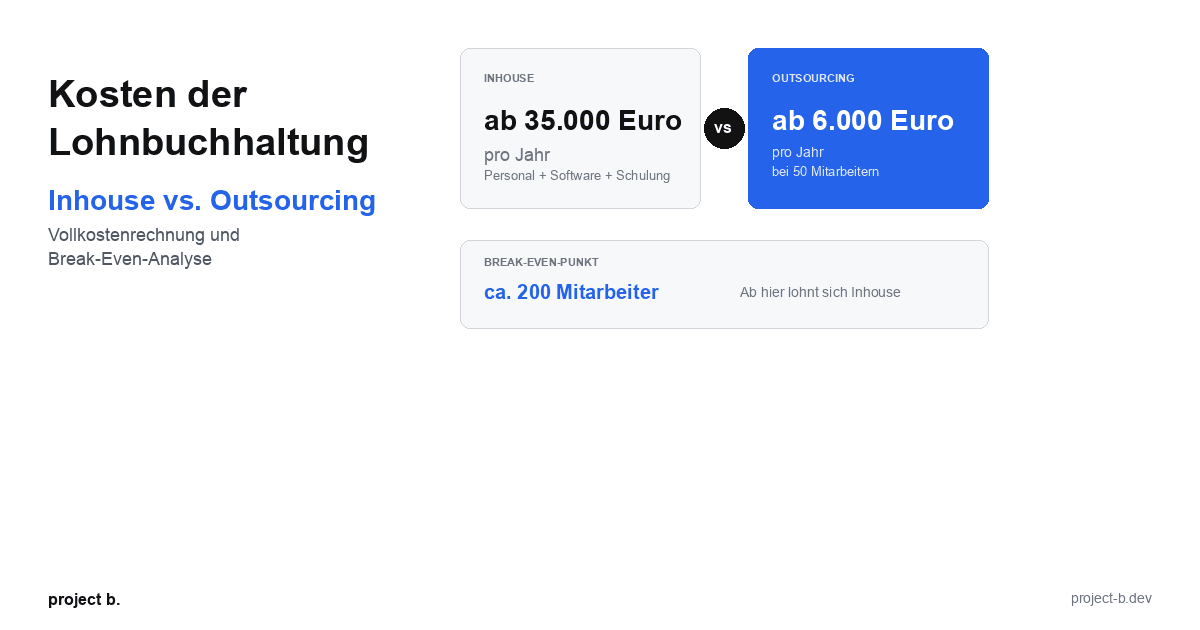

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

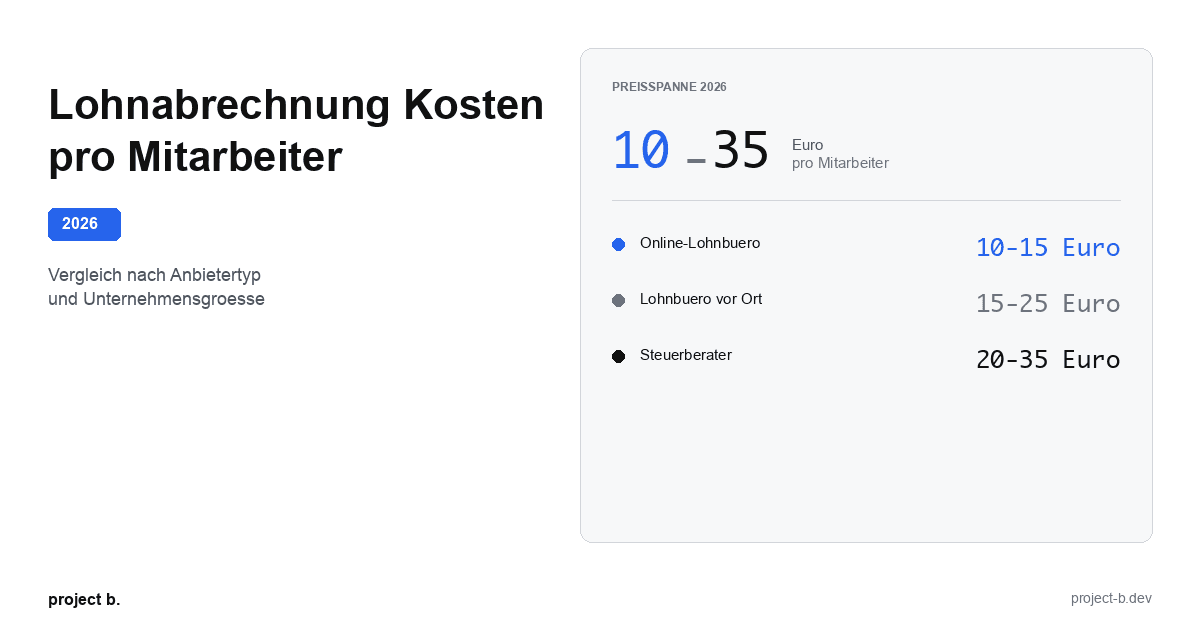

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

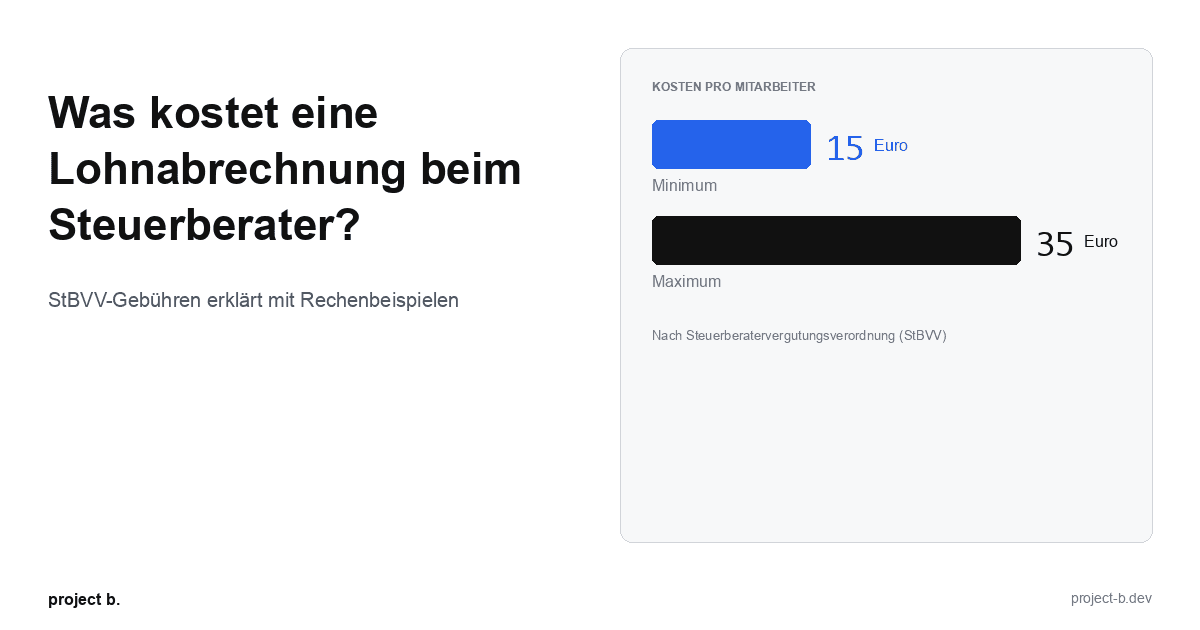

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

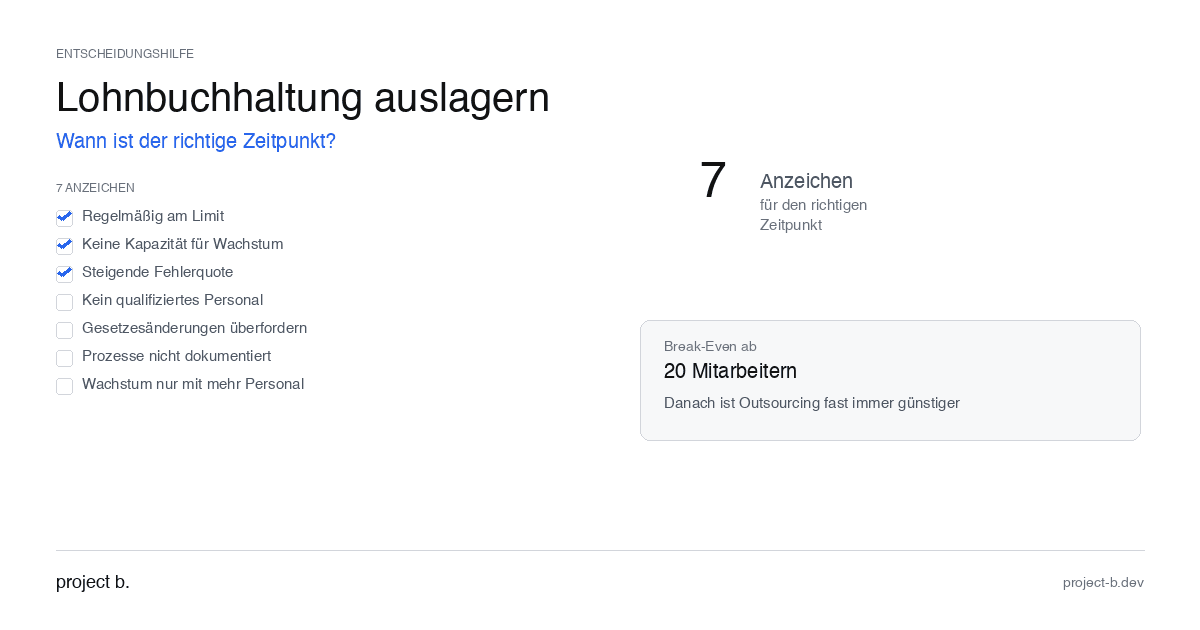

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

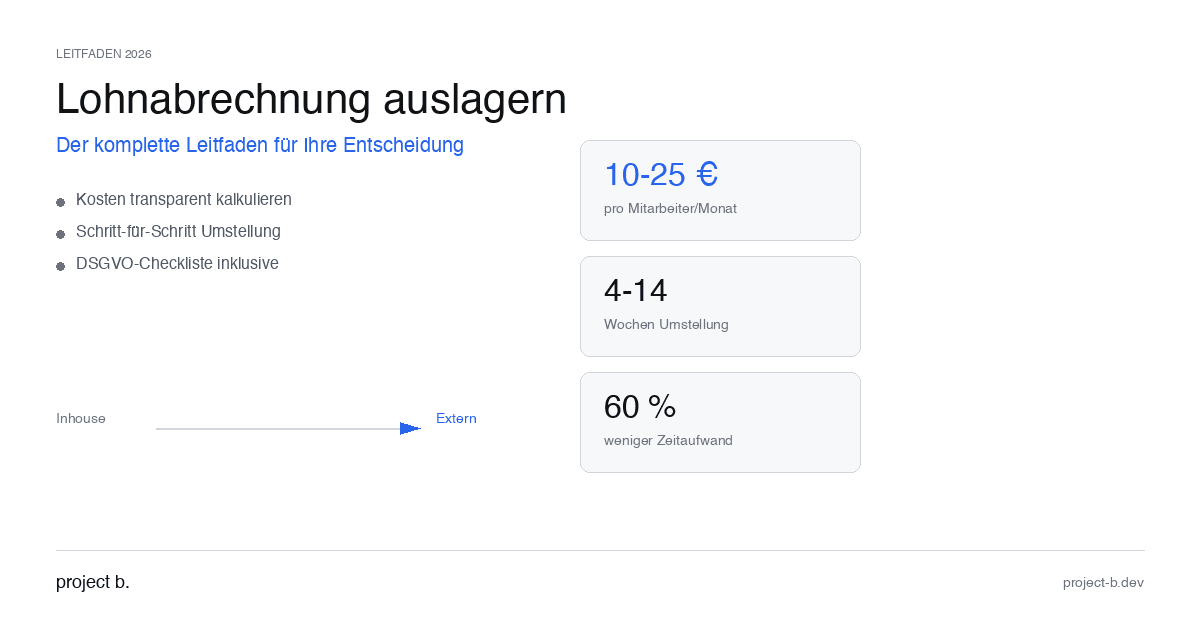

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

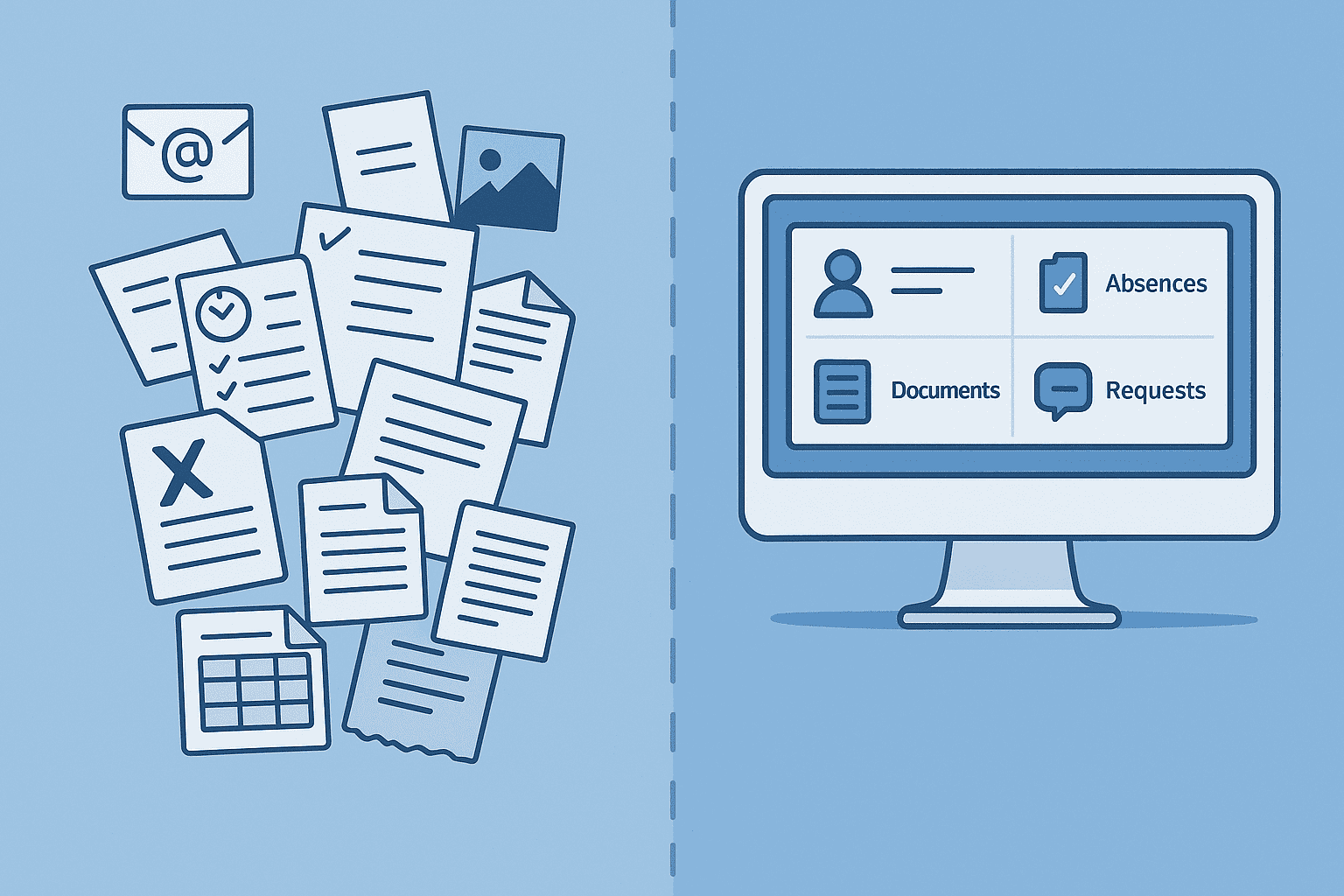

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.