How an AI layer works in payroll.

Dec 22, 2025

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

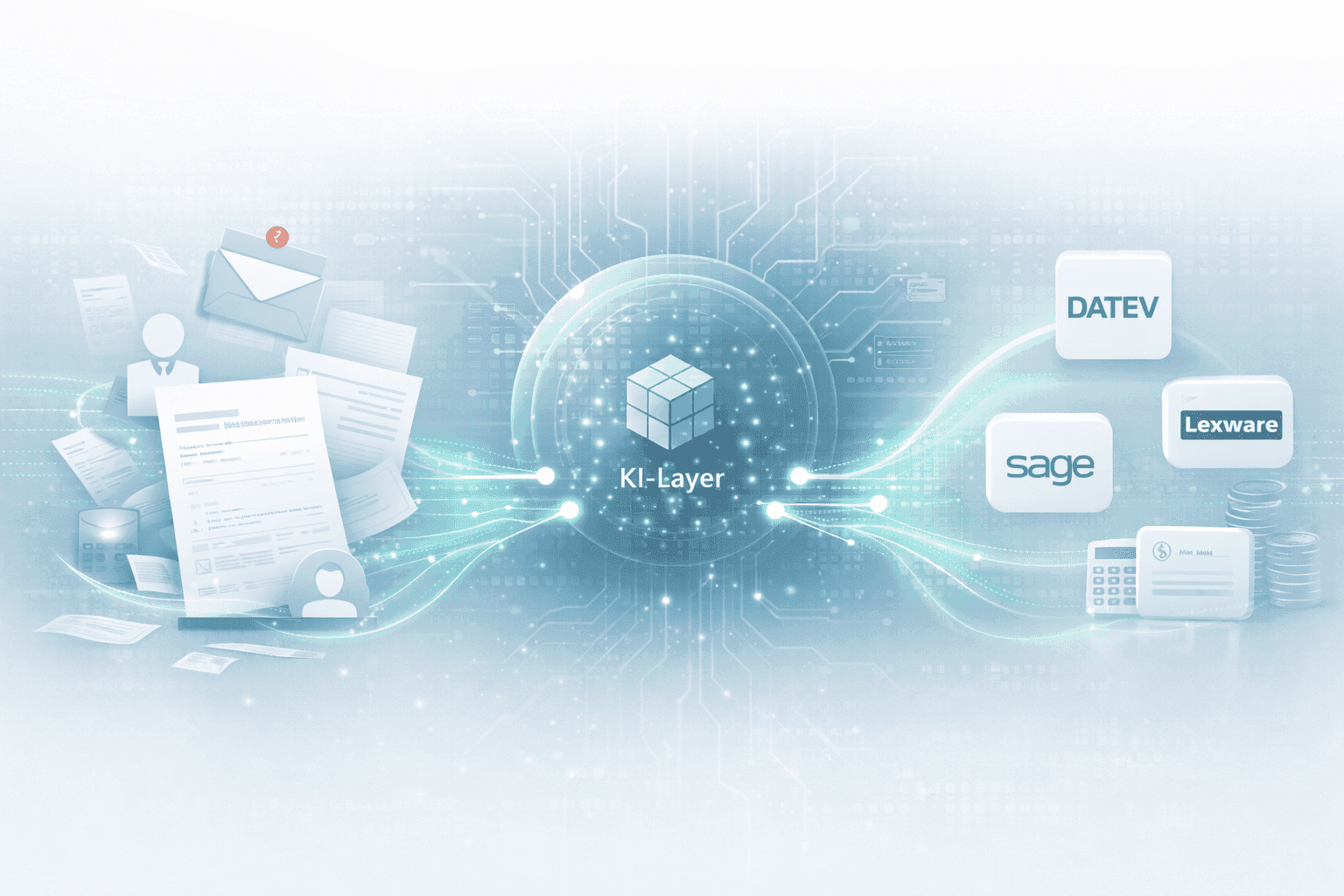

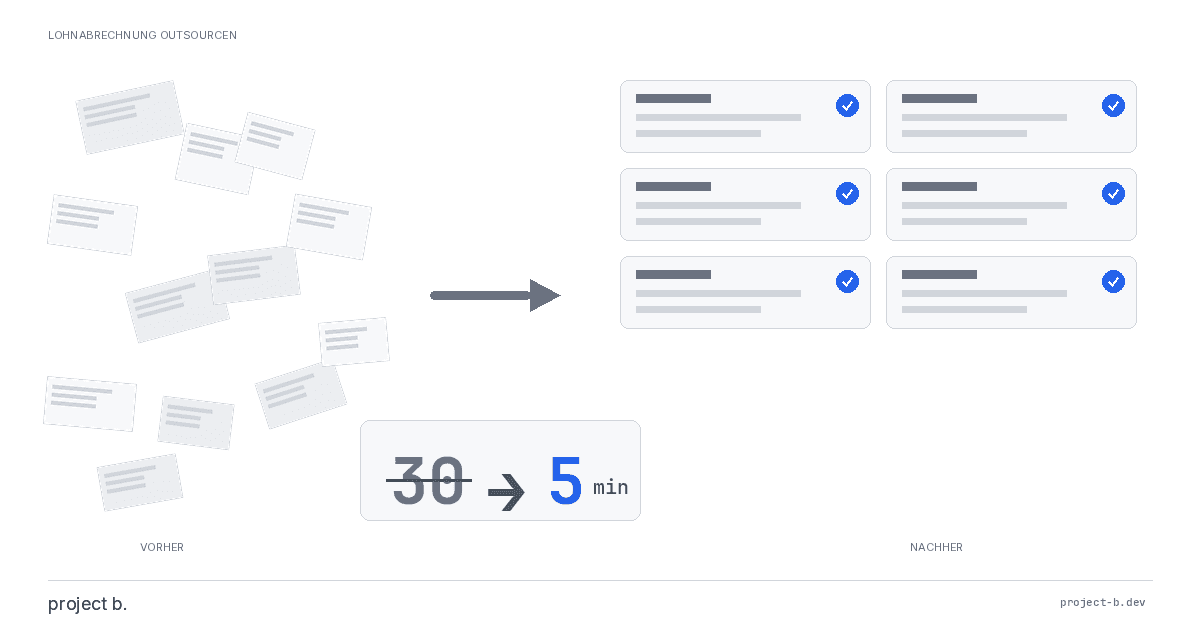

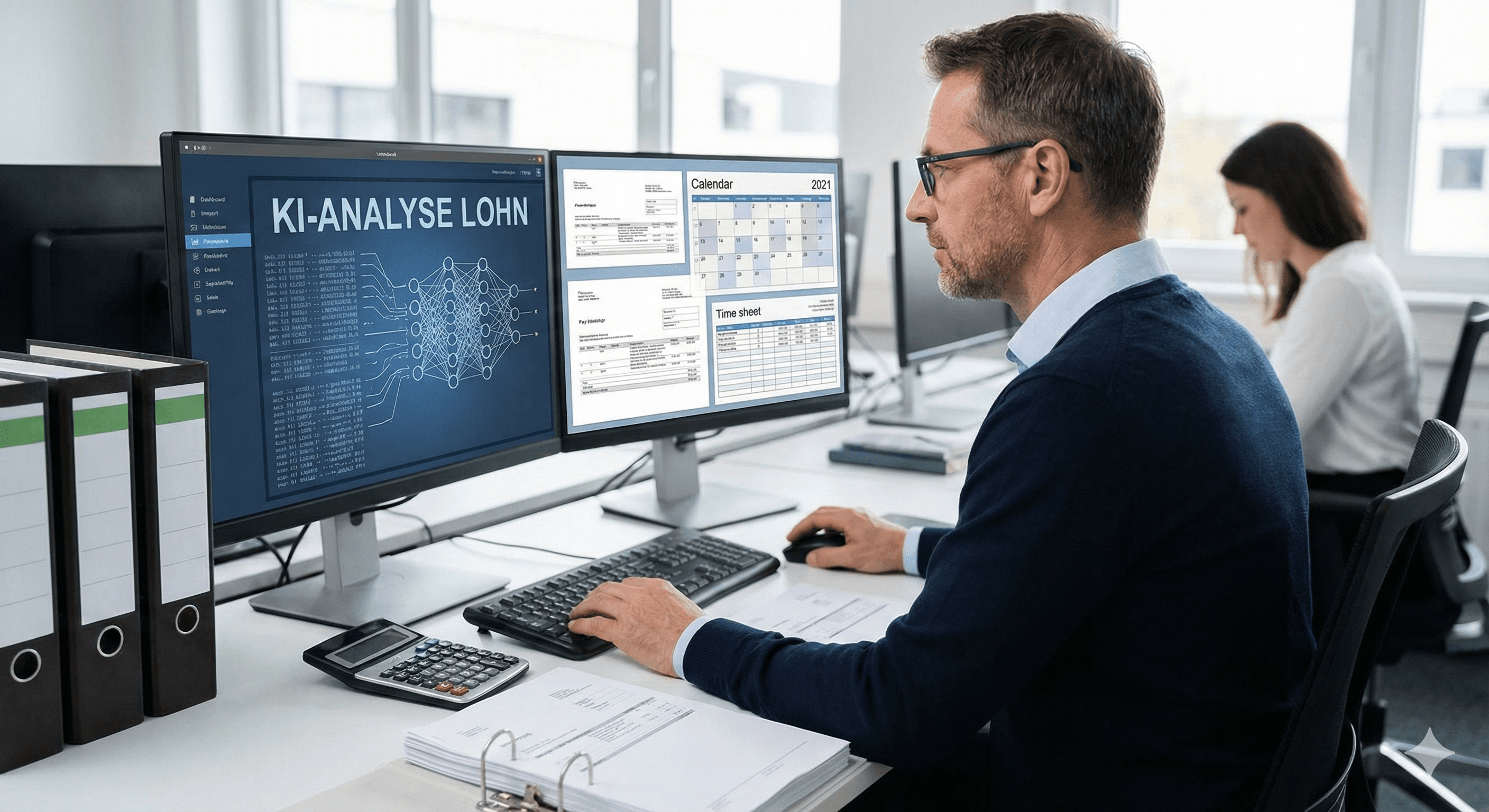

The payroll in German companies has long been digitized. DATEV, Sage, and Lexware process millions of payrolls every month. Nevertheless, HR departments spend a significant portion of their working time on manual data entry. The paradox: The actual calculations run automatically, but the path of the data into the system remains manual labor.

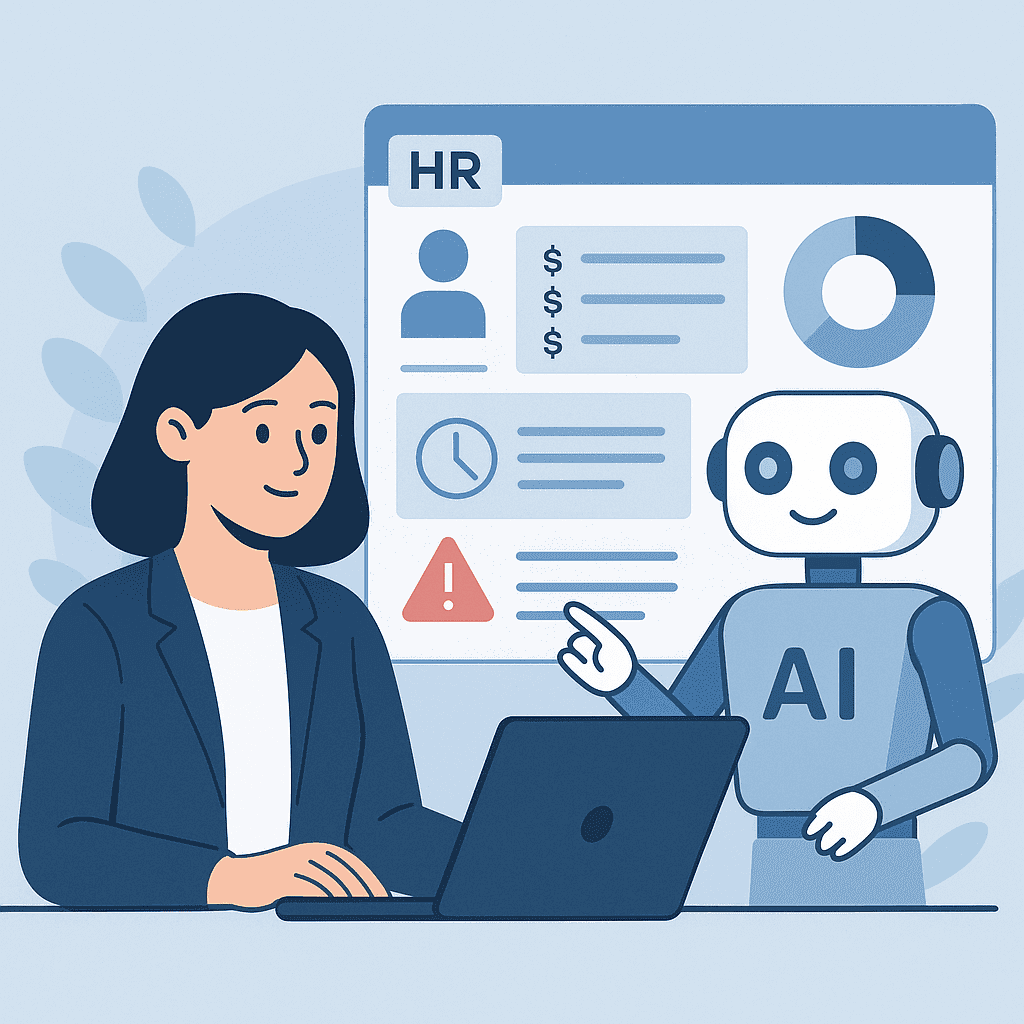

An AI layer solves this problem. It acts as an intelligent layer between employees, HR systems, and payroll software. Instead of manually transmitting data, the AI layer interprets incoming information and forwards it in a structured manner.

The Reality: Proven Systems with Manual Effort

DATEV LODAS and payroll software dominate the German market. Many companies also rely on Sage or Lexware. These systems are mature, legally compliant, and continuously adapted to new legal requirements.

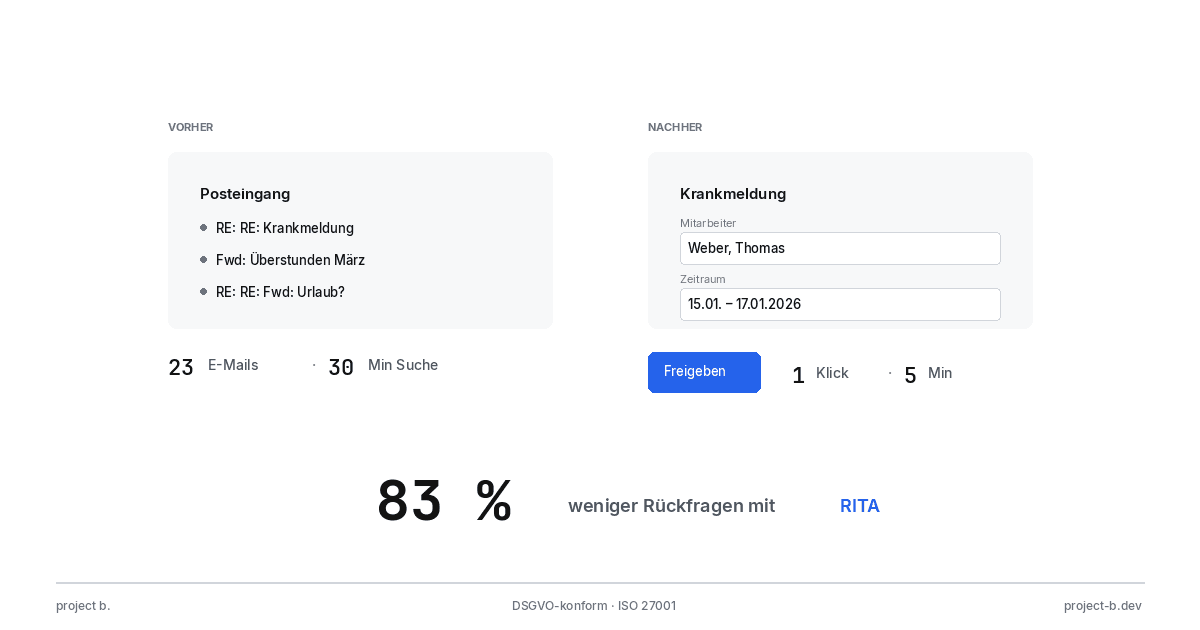

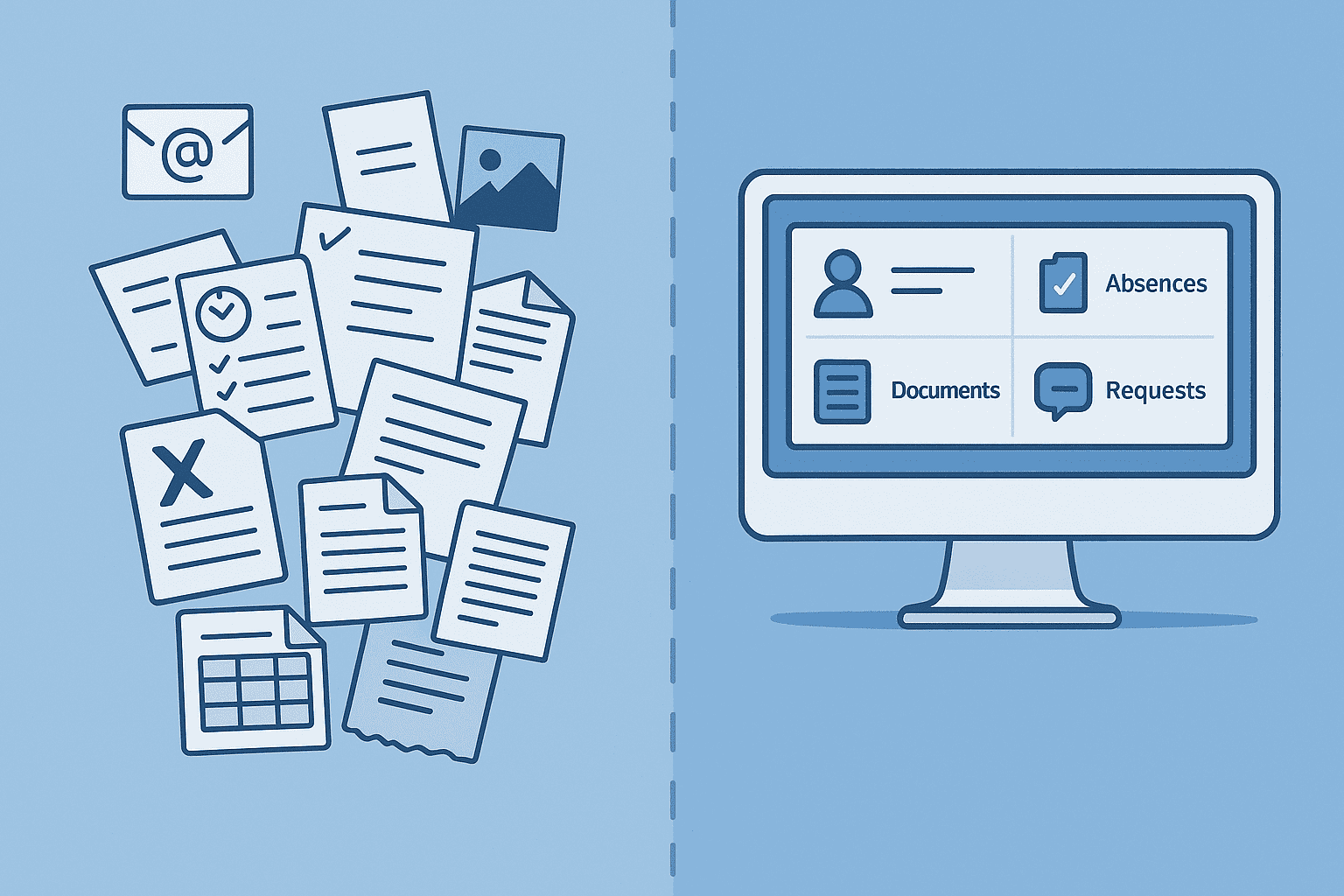

The challenge is not in the software itself. It lies in the process before it. Before DATEV can create a payroll, all relevant data must be in the system: working hours, sick leave notifications, vacation days, changes in bank details, or tax classes. This information reaches the HR department through various channels: by email, through HR portals, as scans, or via phone.

System of Record: The Foundation Remains

DATEV and comparable solutions are known as Systems of Record. They form the binding data basis for all payroll-relevant processes. Every booking, every calculation, every proof runs through this system. Legal requirements such as GoBD-compliant archiving are implemented here. Replacing these systems is not up for debate for most companies. An overview of the integration options for DATEV can be found at project b. in their DATEV documentation.

The Problem of Manual Data Entry

The bottleneck occurs during data entry. An employee informs by email that their bank details have changed. The HR department must manually transfer this information to DATEV. The same applies to sick leave notifications, changes in working hours, or new employees.

For larger companies, this effort adds up significantly. Each manual entry carries the risk of errors: transposed numbers in the IBAN, incorrectly transferred dates, forgotten changes. Correcting such errors takes additional time and can, in the worst case, lead to incorrect payrolls.

System of Engagement: The New Interaction Layer

This is where the concept of the System of Engagement comes into play. While the System of Record retains data control, the System of Engagement takes on interaction with users. It receives requests, processes them, and forwards the structured data to the core system. Gartner describes this architecture as a supplement to existing systems, not as a replacement.

An AI layer is such a System of Engagement. It understands natural language, recognizes contexts, and can handle various data sources. Fraunhofer IAO describes how AI systems enhance existing enterprise software rather than replace it.

How the AI Layer Works

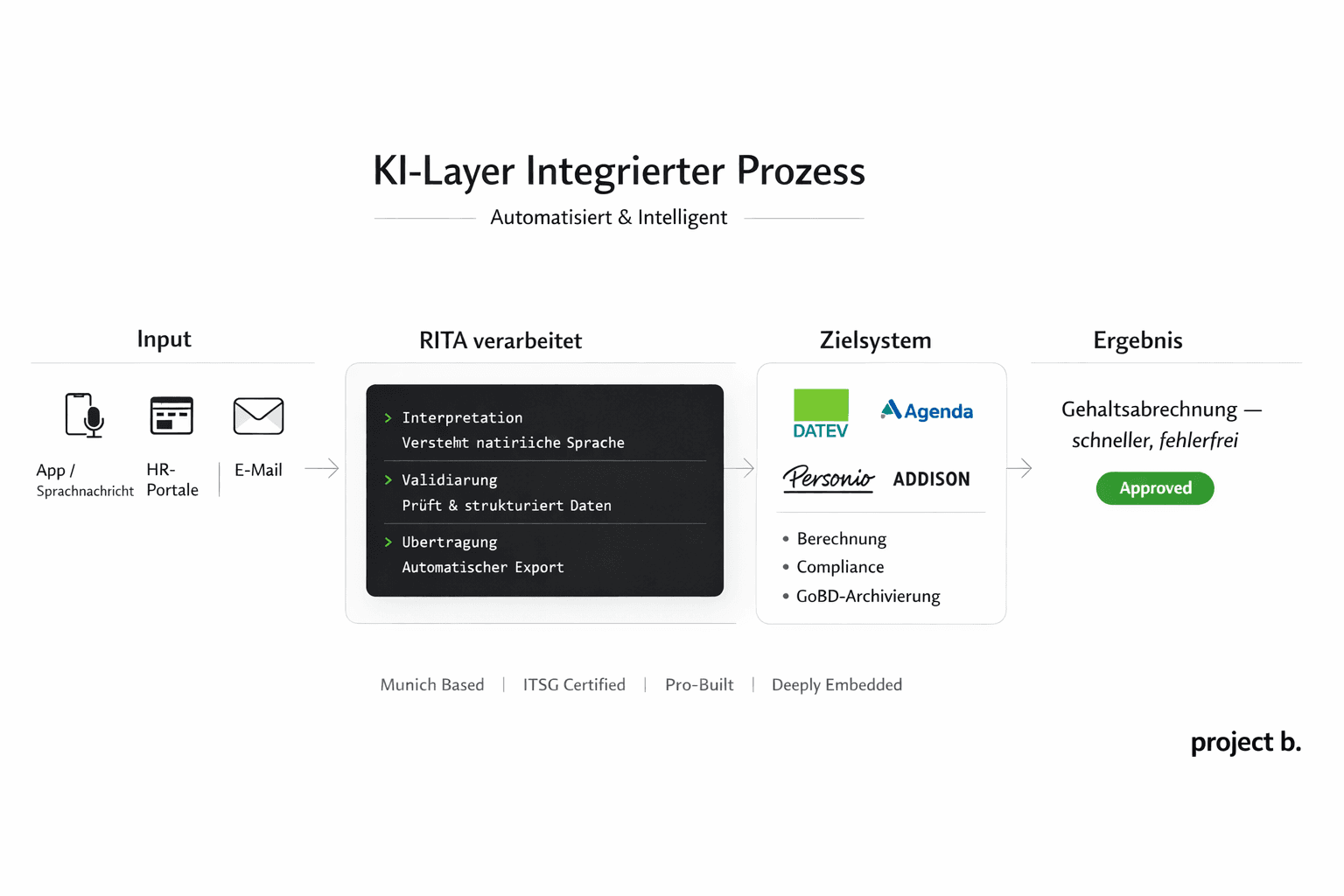

The AI layer acts as a mediator. It receives data from different sources and translates it into the format needed by the payroll system. The process follows a clear pattern:

Data Entry: Information reaches the system, for example, via email, form, or app.

Interpretation: The AI layer analyzes the content and determines what type of change it is.

Validation: The system checks whether all necessary information is present and plausible.

Structuring: The data is brought into the required format.

Transmission: The AI layer forwards the structured data to DATEV, Sage, or the respective target system.

Confirmation: Employees and the HR department receive feedback on the processing status.

Practical Example: Change of Bank Details

An employee changes their bank. Previously, the process was as follows: write an email to the HR department, wait for processing, hope that no errors occur. With an AI layer, the procedure changes fundamentally.

The employee enters the new IBAN in an app or shares it via voice message. The AI layer automatically recognizes that this is a change in bank details. It validates the IBAN for formal correctness, assigns the change to the correct employee record, and transfers it to the payroll system. The HR department receives a notification for approval, and the employee receives a confirmation.

Benefits for Companies and Employees

Implementing an AI layer significantly reduces manual effort in the HR department. Routine tasks, such as transferring master data, are eliminated. The error rate decreases because fewer manual entries are made. Employees benefit from faster processing times and direct feedback. KPMG shows in a study how AI applications in human resources enable efficiency gains while increasing employee satisfaction.

At the same time, the proven payroll system remains unchanged. Companies do not need to replace DATEV or Sage. The AI layer connects to the existing infrastructure and enhances it with an intelligent input layer.

project b. as an AI Layer for Existing Payroll Systems

project b. is an example of such an AI layer in practice. The platform connects with DATEV, Sage, Lexware, and other payroll systems without changing their functionality. Employees record data via a central interface: changes to master data, working time records, sick leave notices, or expense reports. The integrated AI assistant RITA supports data entry, identifies inconsistencies, and answers follow-up questions directly in the system.

The data flow operates automatically. Entries are validated, translated into the respective target format, and handed over to the payroll system. For DATEV users, this means: The familiar software remains the leading system while project b. simplifies the entire process before it. Digital personnel files, pay slip distribution, and change logs are centrally available. Tax consulting firms that bill for multiple clients significantly reduce the effort for reconciliations.

Conclusion

An AI layer in payroll does not replace existing systems. It makes them more accessible. The actual computation remains with DATEV, Sage, or Lexware. The AI layer takes on the task of bringing data from the real world into these systems without humans having to act as translators.

For companies, this means: less routine work, fewer errors, faster processes. For employees: easier communication with the HR department. For IT: no replacement of proven systems, but a meaningful addition.

Sources

1. project b. – DATEV integration and interfaces

2. Gartner – Definition of System of Engagement

3. Fraunhofer IAO – AI enhances enterprise software

What is a AI layer?

An AI layer is an intelligent software layer that operates between users and existing systems. In payroll processing, the AI layer receives data from various sources, automatically interprets it, and transfers it in a structured manner to the accounting system. Unlike traditional interfaces, it also understands unstructured inputs such as free text or voice commands.

Does a AI layer replace DATEV or Sage?

No. An AI layer does not replace the existing billing system, but rather complements it. DATEV, Sage, or Lexware will remain as the system of record. They will continue to perform the actual calculations and ensure legal compliance. The AI layer takes over data input and communication, while the core system operates unchanged.

What data does the AI layer process?

The AI layer processes all typical payroll movement data: working time recording, sick leave notifications, vacation requests, master data changes such as new bank details or address changes, as well as variable compensation such as bonuses or overtime. It can receive this data from emails, forms, HR systems, or employee apps.

Aaron H.

Further articles

Feb 9, 2026

·

Payment

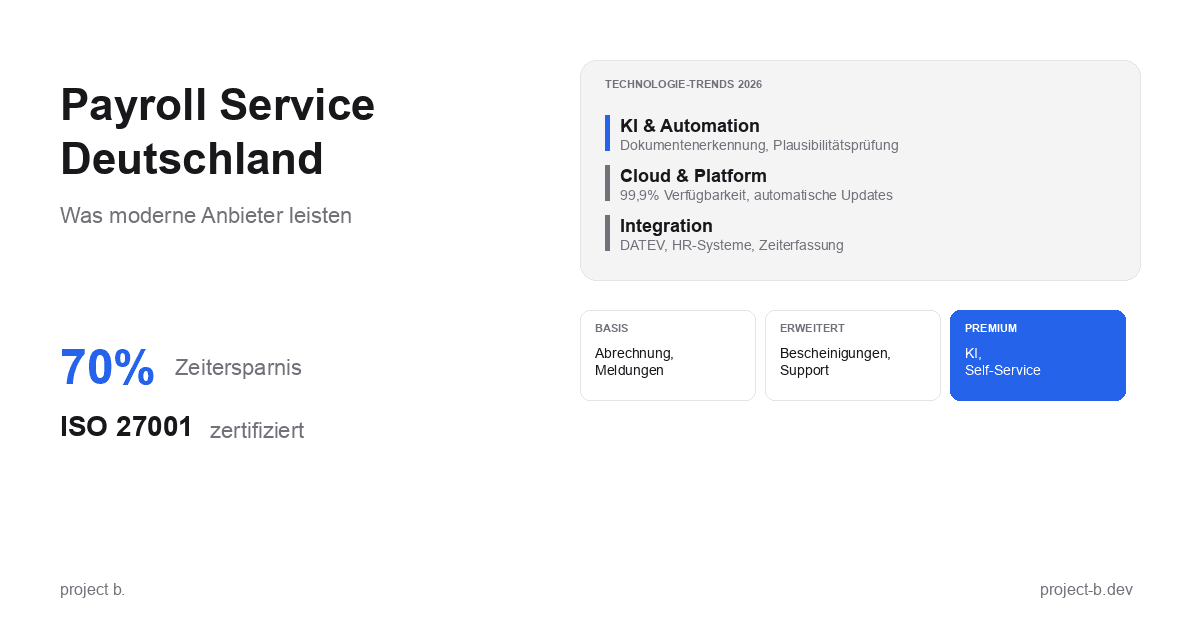

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

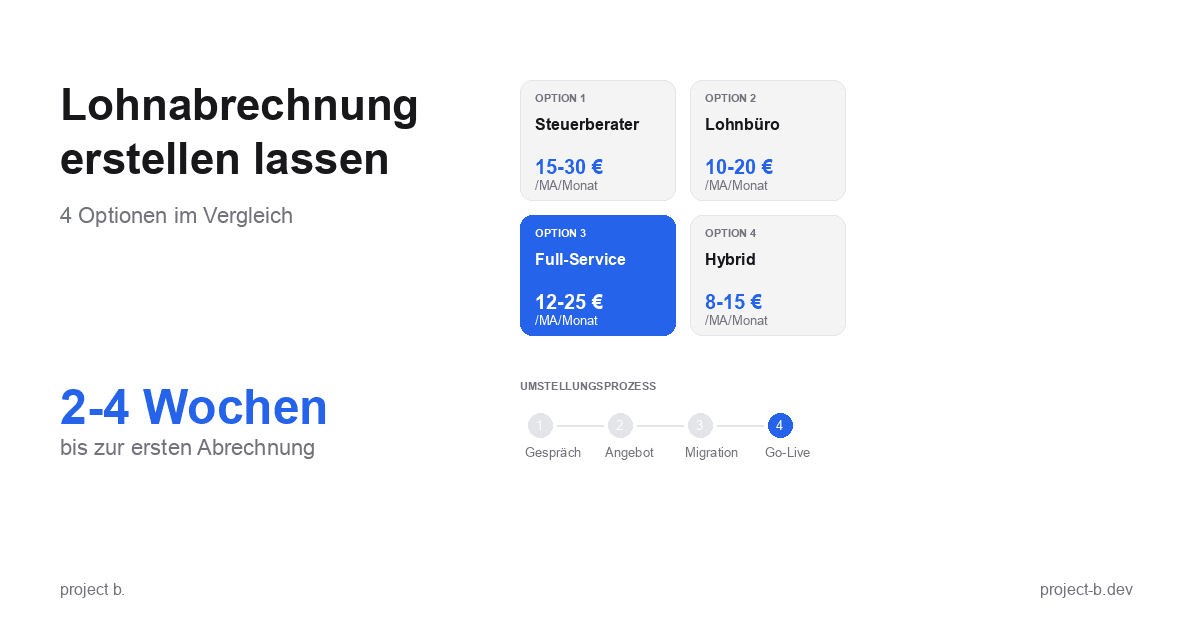

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

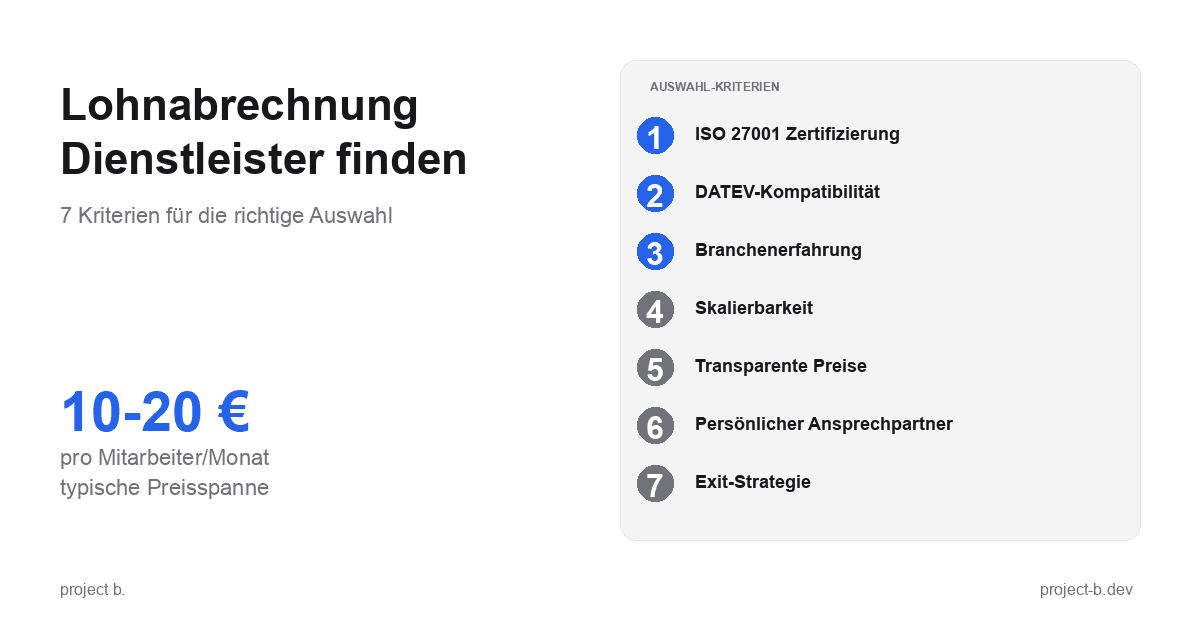

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

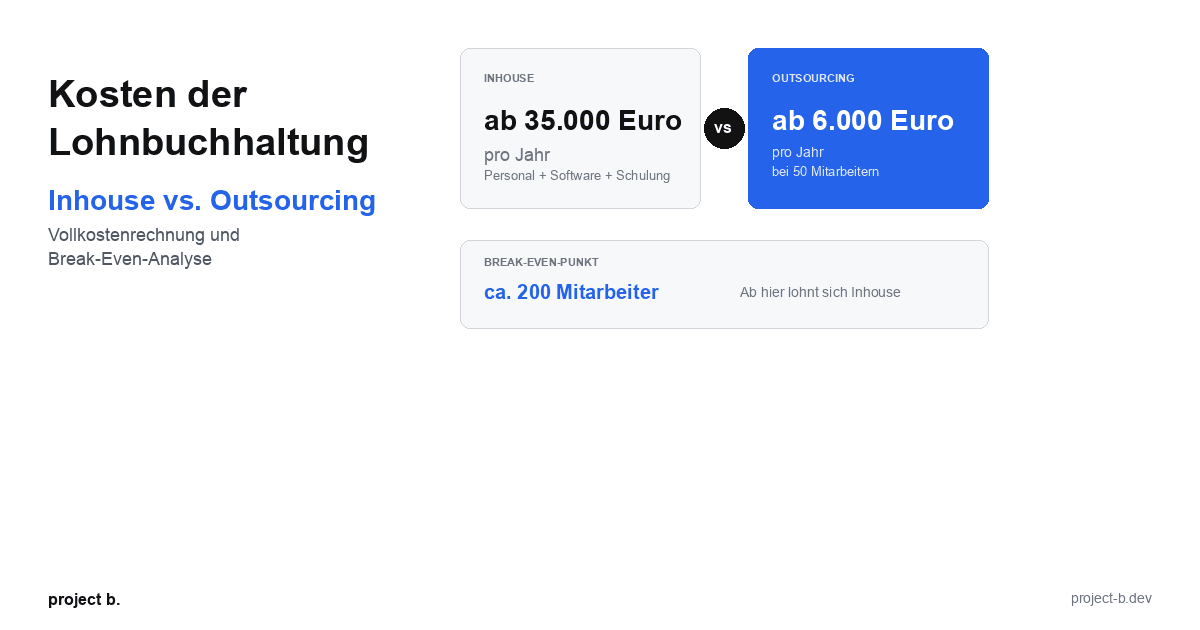

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

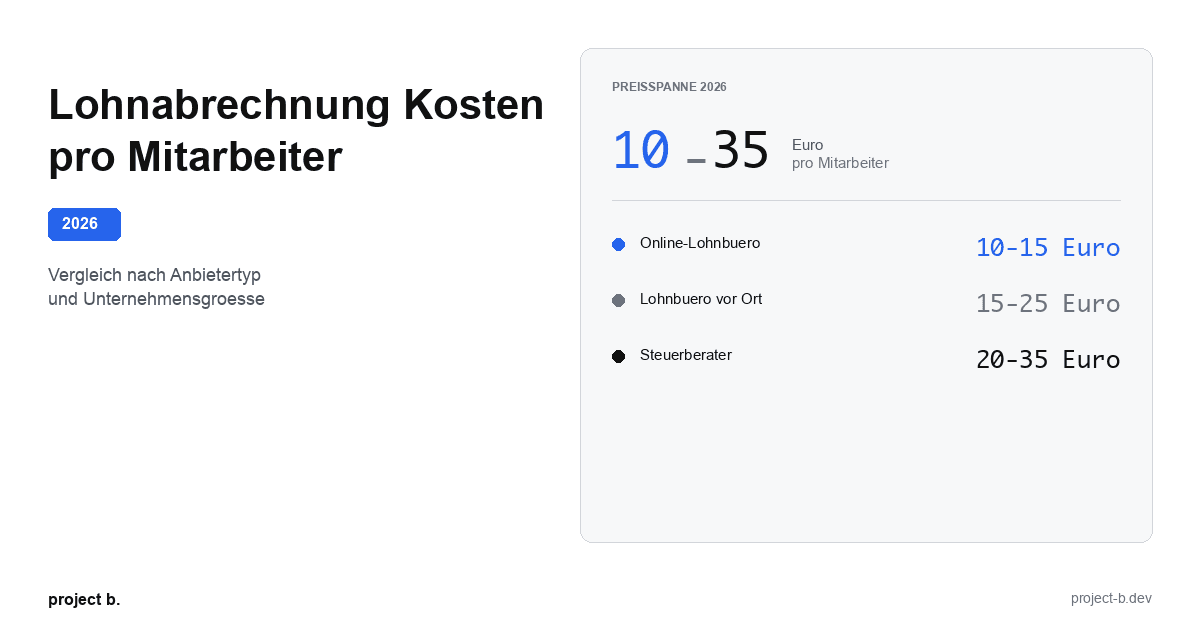

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

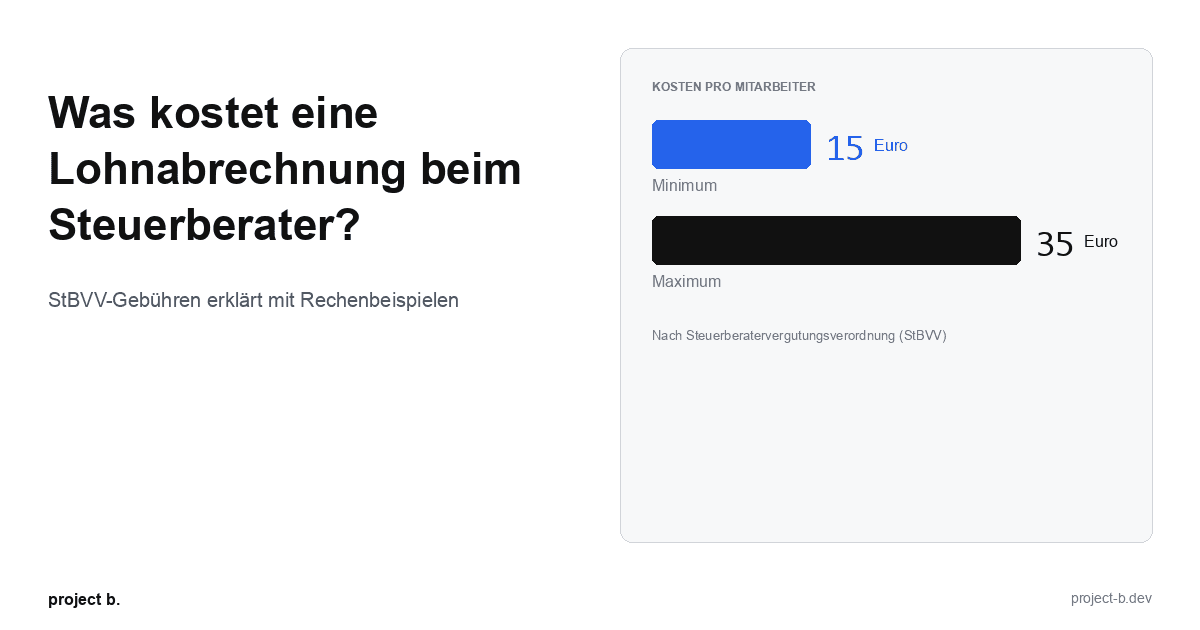

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

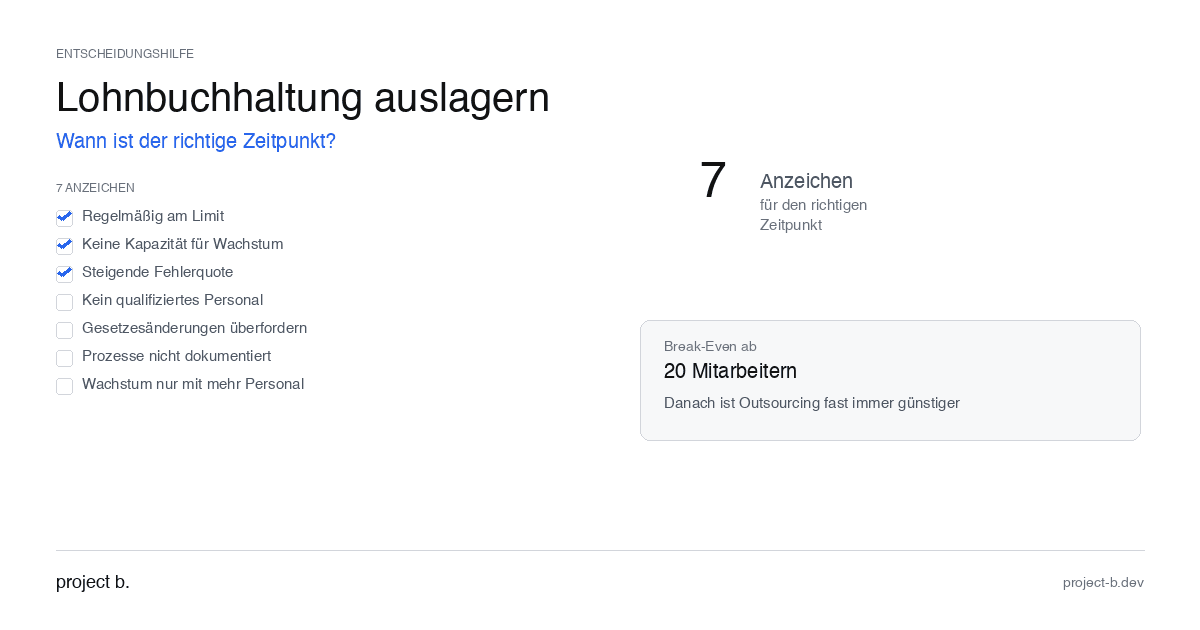

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

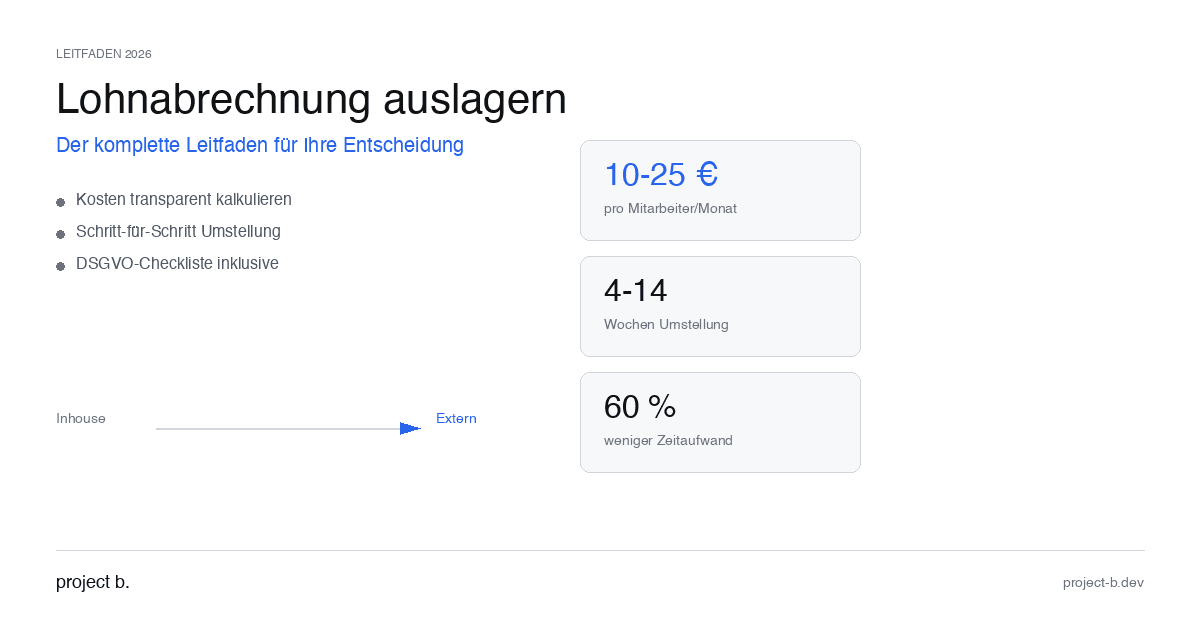

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.