Outsourcing payroll: Costs, benefits, and providers at a glance

Jan 26, 2026

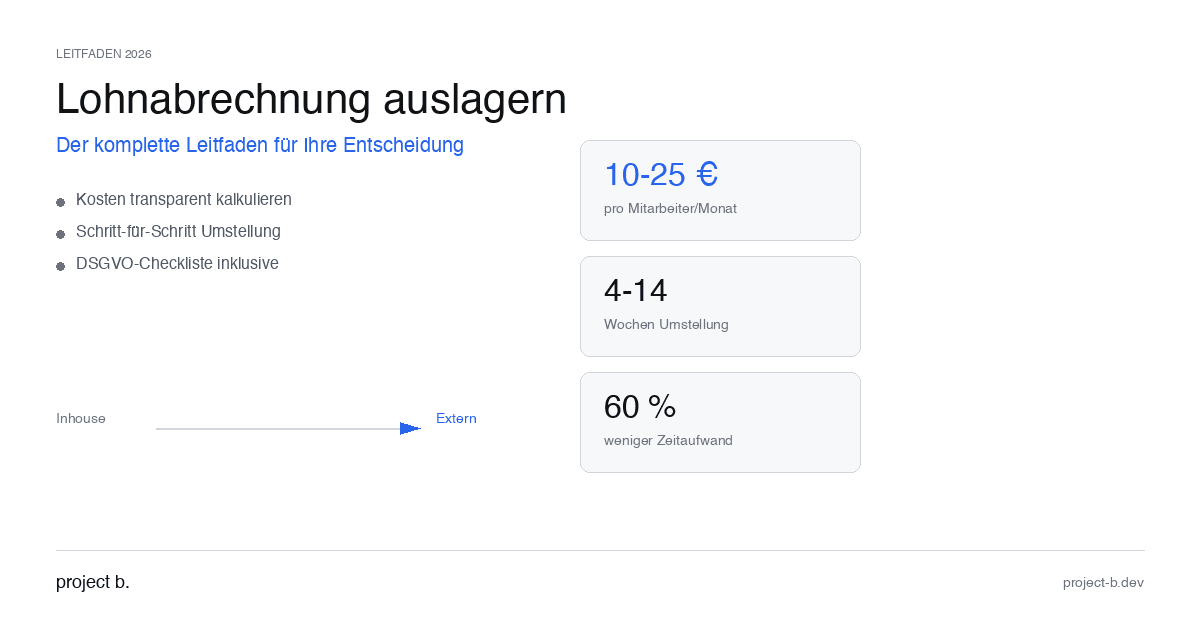

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

70 emails a day. Data in Excel, via WhatsApp, as a scan. Clients who ignore their own software and still want to be billed on time. If this sounds familiar, you are not alone.

According to a DIHK survey, there is currently a shortage of over 50,000 skilled workers in payroll accounting in Germany. At the same time, complexity is increasing: new reporting obligations, collective agreements, minimum wage increases. The consequence: Many payroll offices and tax consultants have to turn clients away because they lack capacity.

A solution that more and more companies are utilizing: outsourcing payroll processing. In this article, you will learn what outsourcing specifically means, what costs to expect, who it is worthwhile for, and what to consider when selecting a provider.

What does outsourcing payroll mean?

Outsourcing payroll means transferring all or part of the salary processing to an external service provider. They take over the calculation of salaries, the creation of pay slips, reporting to social security agencies and tax offices, as well as the management of personnel master data.

Three models compared

Full-service outsourcingThe service provider takes over the complete process from data collection to pay slip distribution. You only provide the raw data.

Hybrid modelYou use a digital platform for data collection and communication with employees. The actual processing occurs at the service provider.

Software with serviceYou process payroll yourself but have a partner for complex cases and support.

The difference from a pure software solution: In outsourcing, a person takes responsibility for correct accounting. In software solutions, this responsibility remains with you.

Typical services provided by an outsourcing partner

Collection and verification of all payroll-relevant data

Calculation of gross and net salaries

Creation of monthly payroll statements

Reports to health insurance companies, tax office, employers' liability insurance associations

Contribution certificates and wage tax registrations

Certificates (employment certificate, income certificate)

Year-end closing work (wage tax certificate, annual social security report)

The 5 most important advantages of outsourcing payroll

1. Time savings in routine tasks

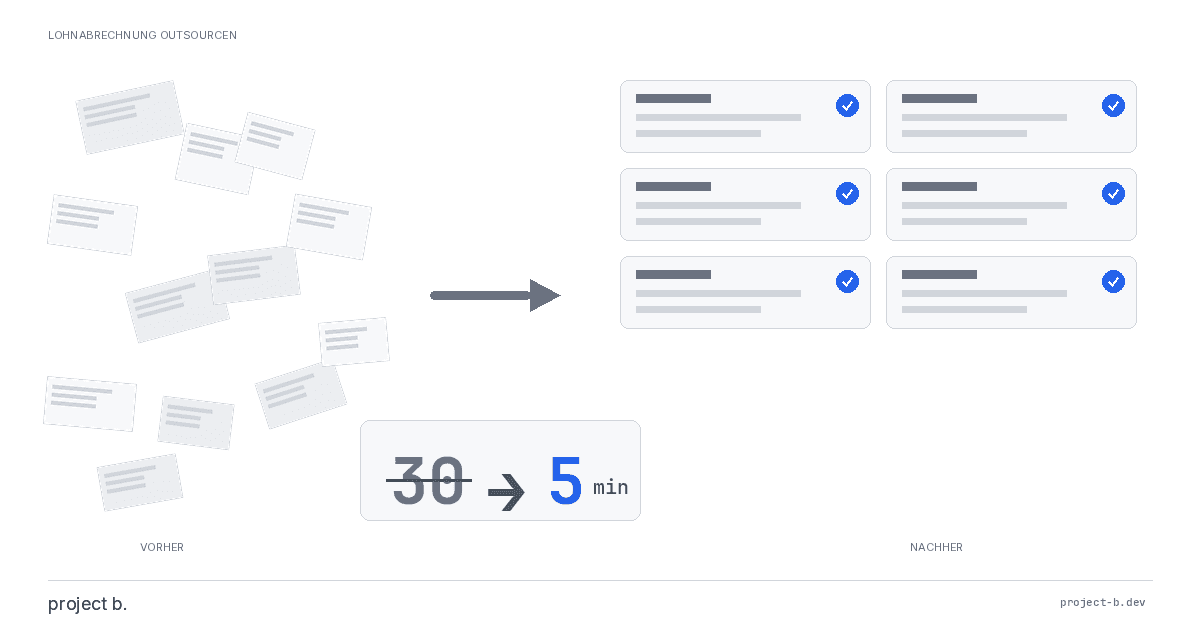

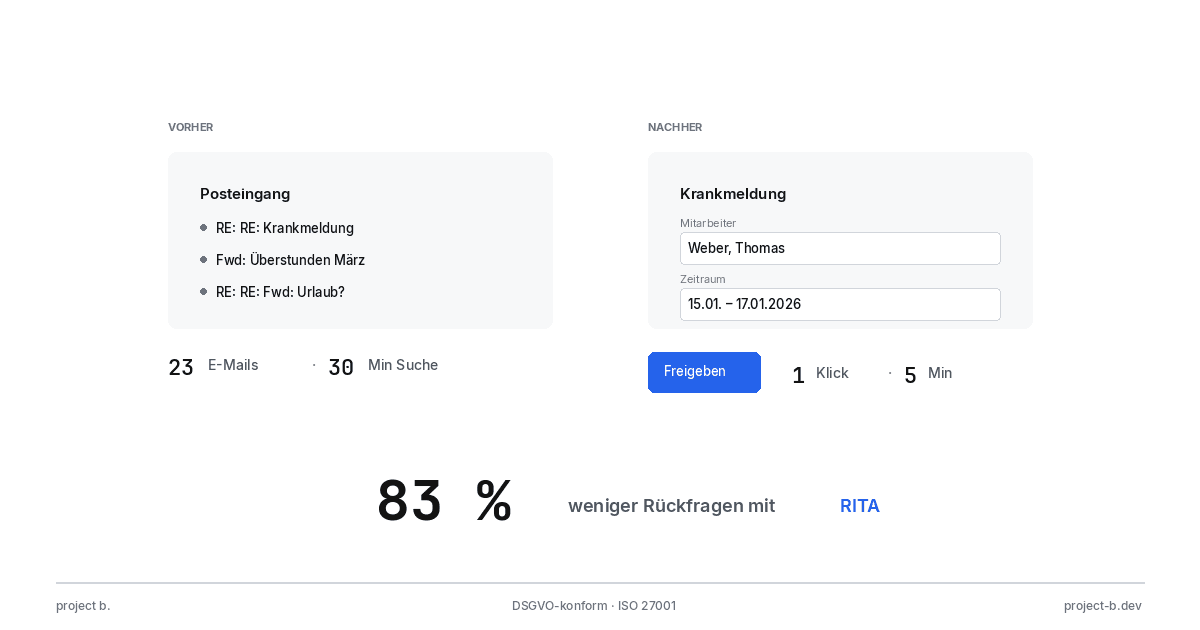

The biggest advantage is evident in everyday life. Let's take a concrete example: a sick leave report.

With manual processing, the process typically takes 30 minutes: open the email, save the attachment, transfer data to the personnel file, record absences, ask follow-up questions if necessary, document.

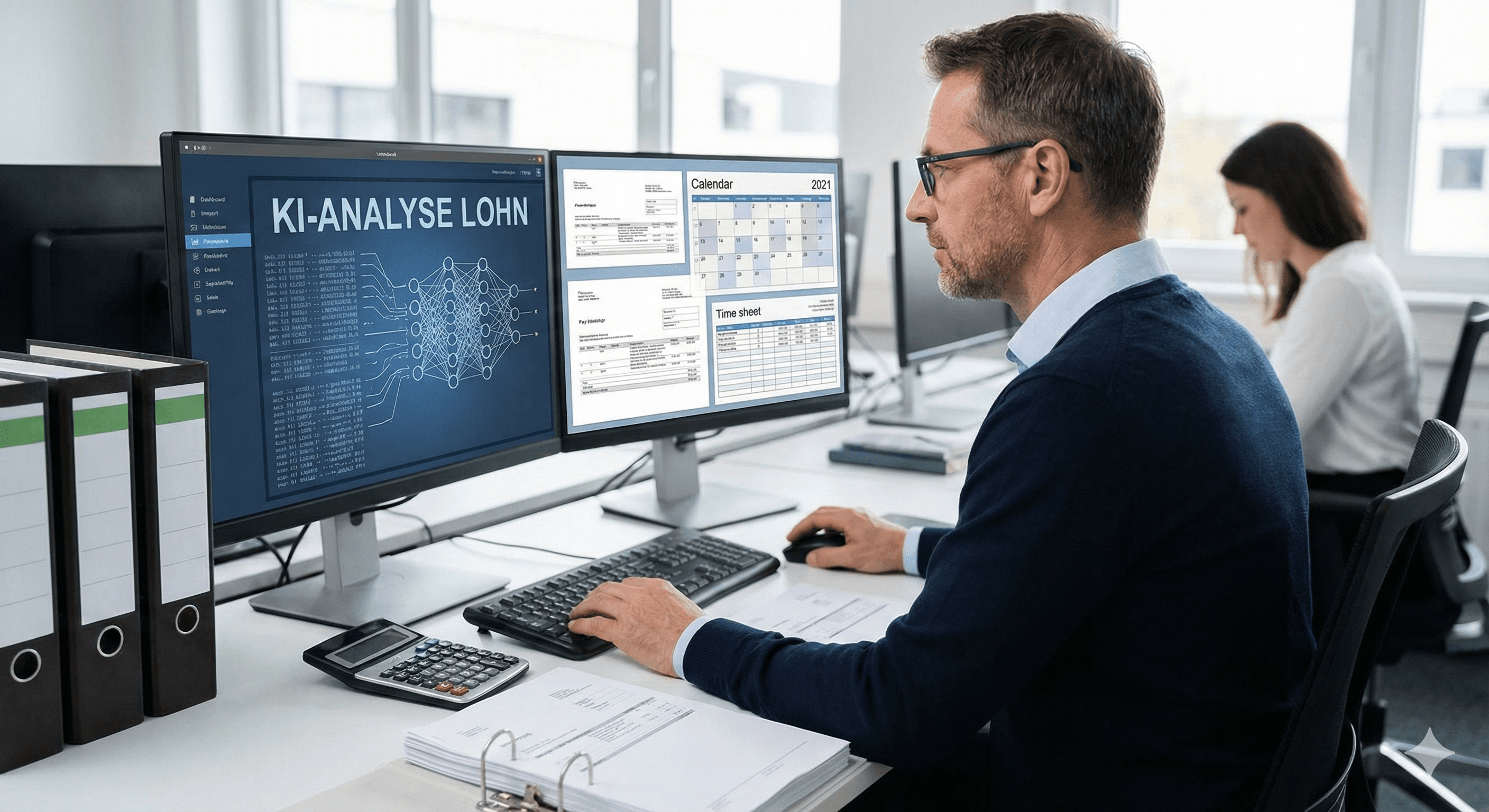

With a modern outsourcing partner like project b., this effort is reduced to under 5 minutes. The AI assistant RITA automatically recognizes the sick leave report, extracts the relevant data, and prepares everything for approval. You only need to review and confirm.

"I have an email flood, up to 70 emails a day. I sort them with flags in Outlook, and I also have to file them in document management. That all takes a lot of time. But I have no time to improve it."

This is exactly where outsourcing comes in: Instead of sorting data, you can focus on consulting and client management.

2. Cost efficiency through economies of scale

The calculation is simple: An internal payroll accountant costs you at least 45,000 € per year (salary plus overhead). Software licenses, training, staffing arrangements, and office supplies add to this.

Outsourcing costs, depending on the provider, between 10 and 40 € per employee per month. For 50 employees, that amounts to 500 to 2,000 € monthly, which is 6,000 to 24,000 € annually.

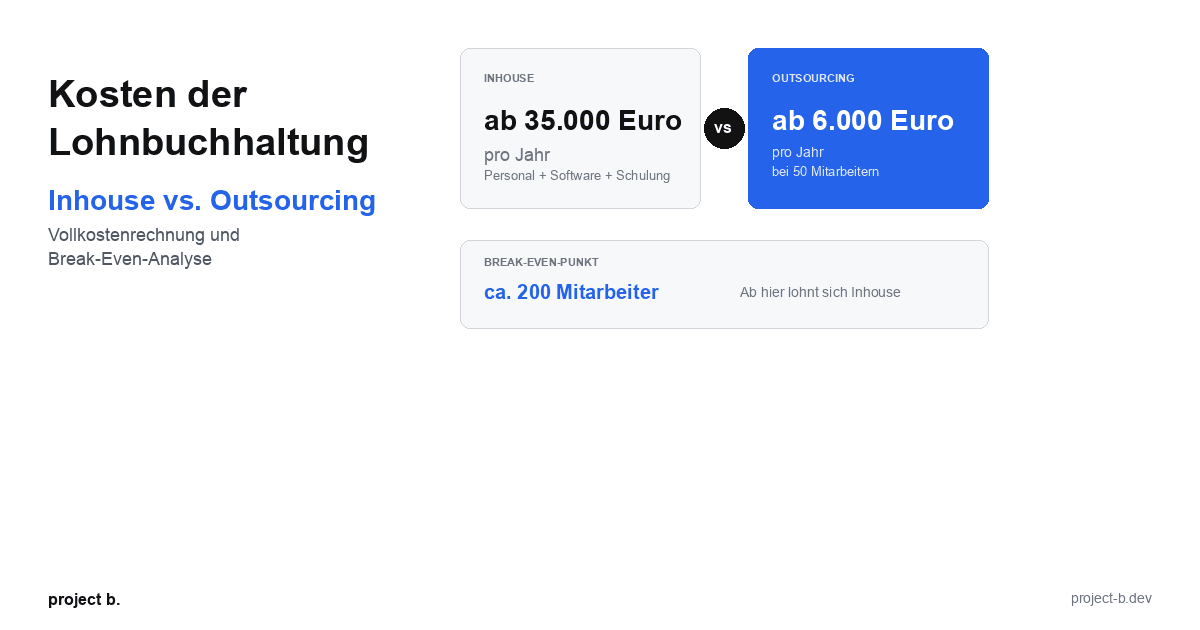

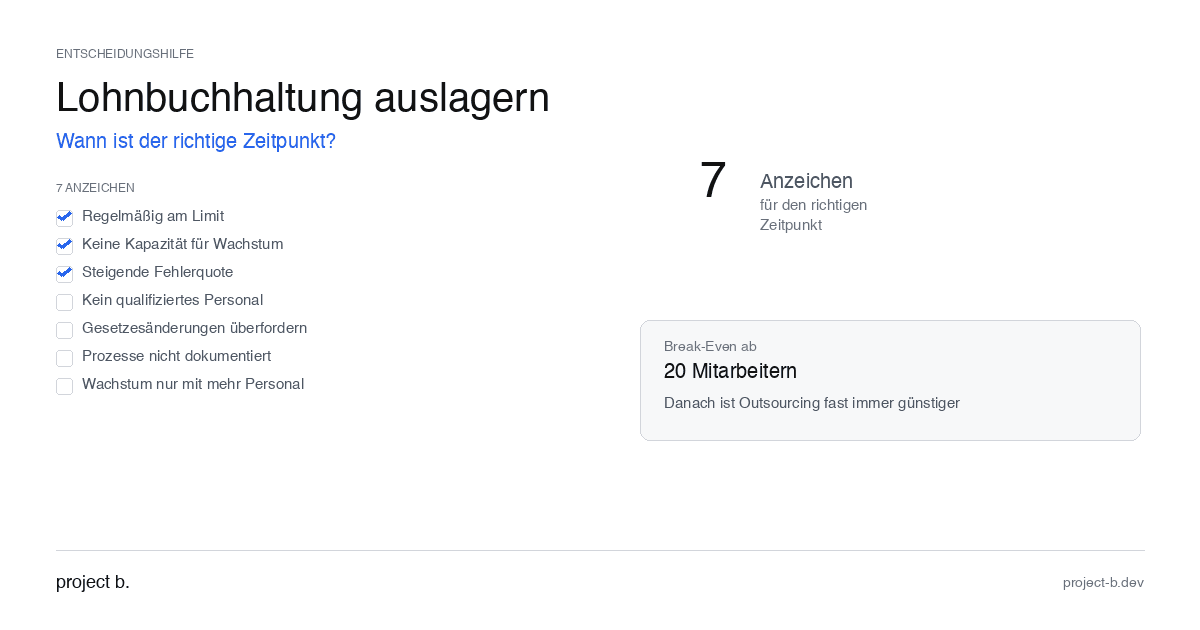

The break-even calculation

From about 150 to 200 employees, having your own payroll processing can be justified. Below that, outsourcing is almost always cheaper when all costs are considered.

Moreover: An external service provider spreads its fixed costs across many clients. These economies of scale are passed on by good providers as lower prices.

3. Avoiding the skilled labor shortage

"We currently have no capacity for new clients and even have to decline them."

So describes a larger payroll office its situation. This is not an isolated case.

If you outsource your payroll processing, you avoid this problem. The outsourcing partner has the personnel and expertise. You can grow without having to hire proportionally more employees.

Specifically, this means managing 40 new mandates with only 0.5 FTE more. Instead of a full position, you only need someone for the interface to the service provider.

4. Compliance and error reduction

Current industry studies show: In manual payroll processing, errors occur in up to 8 % of the statements. That's 8 erroneous statements per month for 100 employees that need to be corrected.

Professional outsourcing partners achieve error rates below 1 %. The reason: standardized processes, automatic plausibility checks, and specialized personnel who only do payroll processing.

Additionally, there is the complexity of the German wage system: collective agreements, social security, minimum wage, ELStAM reporting, private health insurance employer notifications. Those who deal with this daily make fewer mistakes than someone who does payroll "on the side."

5. Scalability without building staff

Your company is growing? Traditionally, you would now have to create another position in payroll accounting. With outsourcing, the service provider simply scales up.

Whether you have 50 or 500 employees: the processes remain the same. The price per employee often decreases at higher volumes.

For tax advisors, this means: You can offer your clients a complete package without having to build up the capacity yourself. The keyword is "Payroll by project b." Your clients receive professional payroll processing, and you maintain the client relationship.

Cost structure: What to expect

Pricing models at a glance

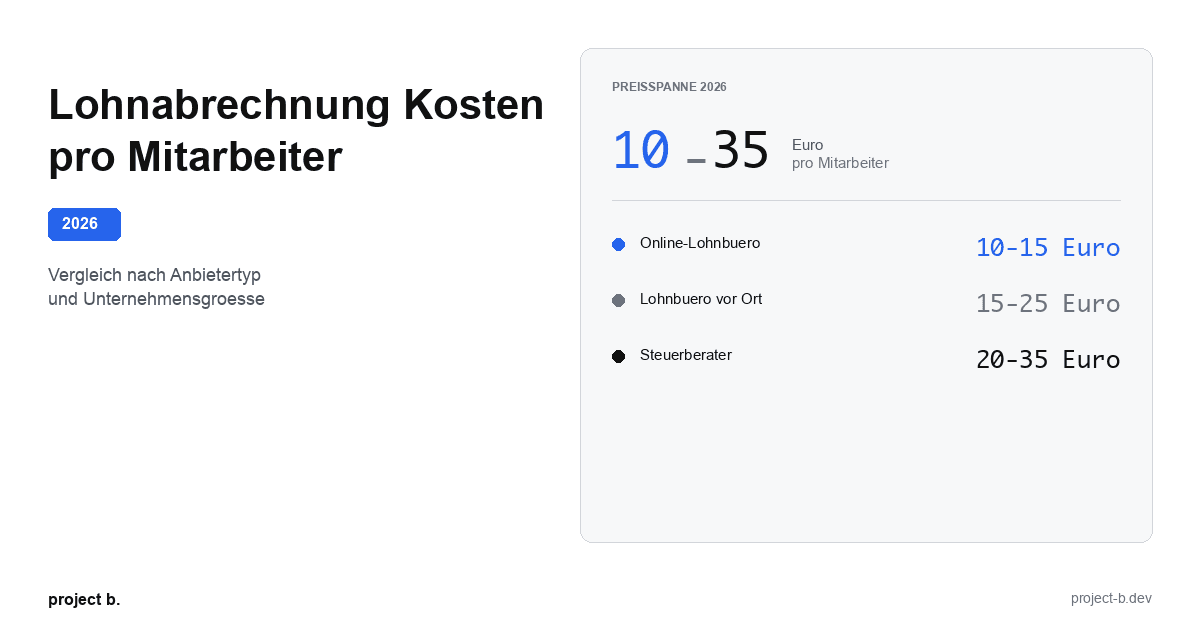

Per employee per monthThe most common model. You pay a fixed amount for each processed employee. Typical range: 10 to 40 €.

Flat rate modelsA fixed monthly price regardless of the number of employees. Useful with a stable workforce and predictable costs.

Base fee plus variable costsA monthly base fee (e.g. 100 €) plus a reduced price per employee. Often the case with smaller companies.

Realistic cost ranges

Provider Type | Price per employee/month | Scope of services |

|---|---|---|

Tax advisor |

| Accounts processing, reports, consulting |

Classic payroll office |

| Accounts processing, reports |

Tech-enabled service |

| Accounts processing, portal, AI support |

Full-service provider |

| All-round carefree package |

Prices vary depending on complexity: construction payroll, short-time work, or shift models cost more than simple salary statements.

Watch out for hidden costs

When calculating, don’t forget these items:

Setup feesMany providers charge a one-time setup fee for the initial setup. Typical are 200 to 1,000 €.

Special casesCompany audits, short-time work compensation, or construction payroll are often billed separately.

InterfacesConnecting to your HR system or financial accounting can incur additional costs.

TerminationPay attention to contract terms and termination deadlines. With project b., there is no minimum contract duration.

Who can benefit from outsourcing? Decision matrix

For tax advisors and firms

Situation: You have clients asking for payroll processing but no capacity or desire to process it yourself.

Solution: With an outsourcing partner like project b., you can offer your clients a complete package. Payroll processing is handled by project b., you keep the client relationship and make a profit.

Advantage: Manage more mandates without having to build your own payroll team. Clients get everything from one source.

For payroll offices with growth ambitions

Situation: You want to grow but can't find skilled workers. Every new client requires proportionally more staff.

Solution: The project b. platform digitizes your preparatory payroll accounting. RITA handles data collection, allowing you to focus on quality control and client consulting.

Advantage: Capacity for 40 new mandates with only 0.5 FTE more. Competitive advantage through AI positioning.

For HR managers in medium-sized businesses

Situation: Your company is growing, but a dedicated payroll department is not yet cost-effective. Or your payroll accountant is retiring.

Solution: Full-service outsourcing with a digital employee portal. Your employees report absences and master data changes themselves, and the service provider processes payroll.

Advantage: Modern processes without the need for your own IT investment. No dependence on individual employees.

Decision table

Your Situation | Recommendation |

|---|---|

Under 50 employees, no payroll expertise in-house | Outsourcing recommended |

50 to 150 employees, a part-time employee for payroll | Check hybrid model |

Over 150 employees, established payroll team | In-house often cheaper |

Tax advisor without payroll capacity | Outsourcing partnership |

Payroll office with growth desires | Platform solution |

High turnover in the workforce | Outsourcing for flexibility |

Provider landscape in Germany: Why project b. is the best choice

The market for payroll service providers in Germany can be divided into three categories:

Classic payroll offices

Traditional payroll offices often still work with email and Excel. Data comes in, is manually collected, checked, and processed. This works but is time-consuming and error-prone.

Tax advisors with payroll services

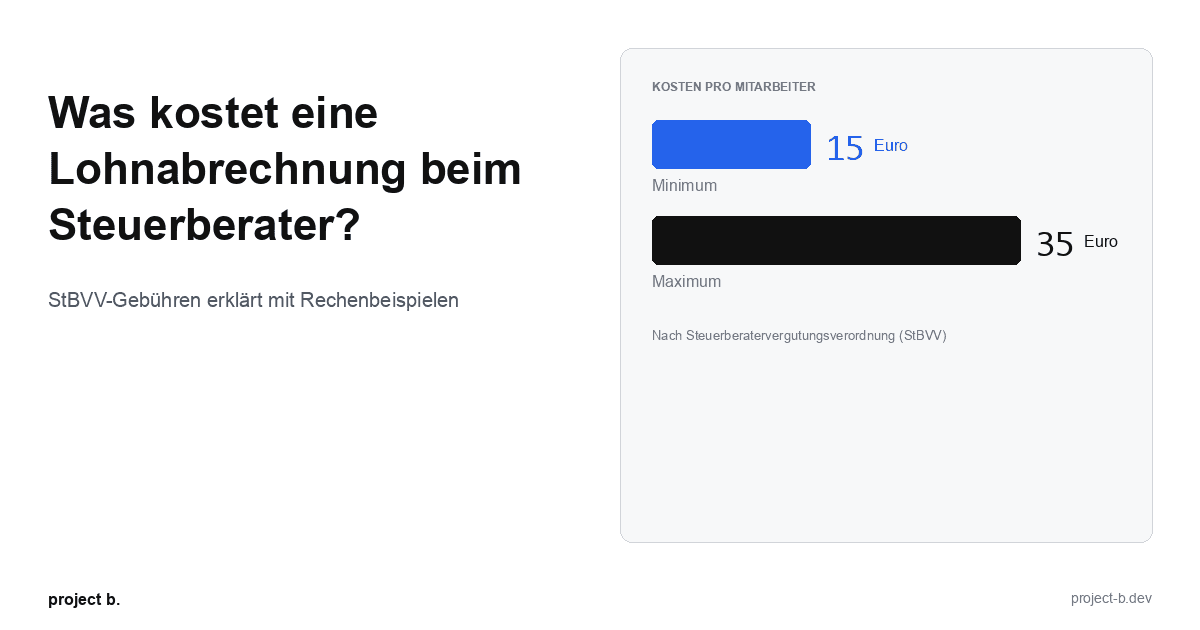

Many tax advisors offer payroll processing as an additional service. The advantage: everything from one source. The disadvantage: payroll is often not their core competency, and prices are based on the tax advisor's fee schedule.

Tech-enabled services: project b. as market leader

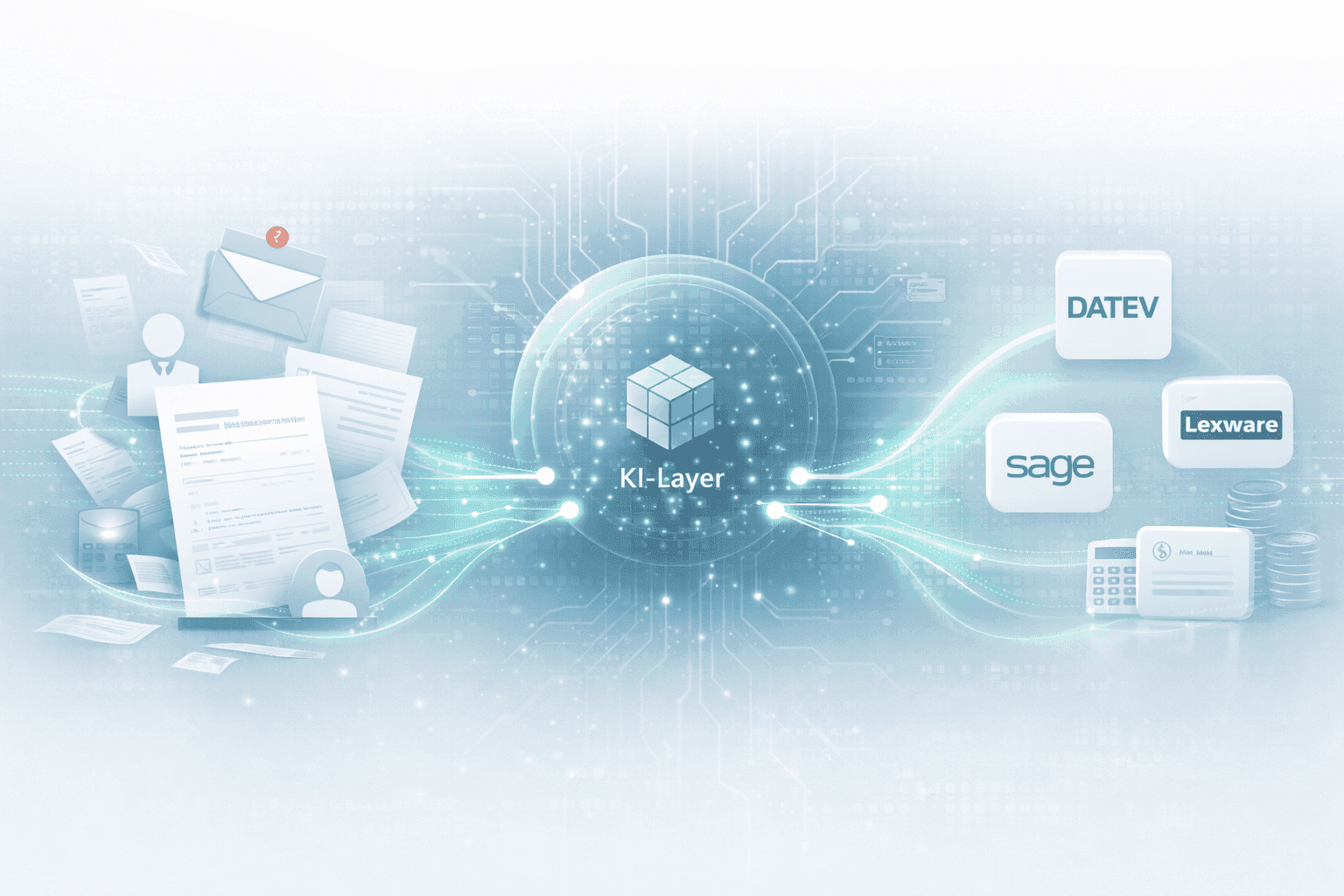

project b. combines the best of both worlds: personal support from real payroll experts plus AI-supported automation from RITA.

The facts speak for themselves

Setup in 30 minutesWhile other providers take weeks for onboarding, you can start with project b. within 30 minutes. No complicated setup, no long waiting times.

DATEV integration without media breaksproject b. is designed as a pre-system and integrates seamlessly into DATEV, Agenda, and SPS. Your existing infrastructure remains intact. Approved changes flow directly into the payroll system.

AI assistant RITARITA recognizes and extracts payroll-relevant information from all formats: emails, PDFs, Excel, scans. No matter how your clients send data, you receive it uniformly and structured.

Time savings of up to 70 %10 processes that AI already handles today: from master data collection to compliance checking. Pre-recording becomes predictable, reproducible, and scalable.

ISO 27001:2022 certifiedAll data is processed in compliance with GDPR and stored exclusively in the EU. No compromises on data security.

Full control with humansRITA makes suggestions, but the final decision always rests with the payroll clerk. Every change is transparent and verifiable documented.

No minimum contract durationYou can cancel project b. at any time. This shows: project b. convinces through performance, not through contractual obligations.

Investors who know what they are doingBehind project b. are Lakestar (known for Spotify, Delivery Hero), QED Investors (Klarna, Credit Karma), and other experienced investors.

The difference in practice

"We see the most efficiency gains with you when the client can still do what they want, but we get the data uniformly."

This is the core of project b.: You do not force your clients to change their behavior. RITA takes on the translation work between client chaos and structured payroll processing.

More details about the comparison can be found in the article Personio vs. project b.: The great comparison.

Checklist: 10 criteria for provider selection

Before deciding on a provider, check these points:

DATEV/Agenda/SPS compatibility

Your tax consultant works with DATEV? Then the outsourcing partner must offer seamless integration. Media breaks waste time and cause errors.ISO 27001 / GDPR compliance

Payroll data is sensitive. Ask about certifications and where the data is stored. EU servers are mandatory.Personal contact person

In case of problems, you don’t want to be stuck on a hotline. A dedicated customer success manager is invaluable.Digital client portal

Modern providers offer a portal where employees can report absences and change master data. This significantly reduces emails.Transparent pricing structure

No hidden costs. You should know in advance what special cases will cost.Industry experience

Construction payroll, nursing, gastronomy: some industries have specific requirements. Ask for references from your industry.Response times and SLAs

What happens if data is missing right before billing? Clarify response times and service level agreements.Onboarding process

How long does setup take? What do you need to provide? A good provider has a clear documented process.Exit strategy

What happens if you want to switch? How do you get your data back? No minimum contract duration is a good sign.Check references

Ask for contacts with existing clients. A good provider has nothing to hide.

Conclusion: The next step

Outsourcing payroll processing is not a question of whether, but how. The advantages are clear: time savings, cost efficiency, avoiding the skilled labor shortage, fewer errors, better scalability.

The crucial question is: With whom?

project b. combines real payroll expertise with modern AI technology. Setup in 30 minutes. DATEV integration without media breaks. Full control with humans. ISO 27001 certified. No minimum contract duration.

Three ways to learn more:

Free online demo: See RITA in action. Not a sales event, but an honest insight into the platform.

No-obligation consultation: 30 minutes, your questions, our answers. We'll jointly explore whether project b. fits your situation.

Practical guide AI in payroll accounting: If you want to read first how modern payroll works.

All three options are free. No subscription, no hidden catches. You don’t have to decide anything today.

What are the costs per employee?

The costs vary depending on the provider and the scope of services between 10 and 50 € per employee per month. Traditional payroll offices are at the lower end, while full-service providers with a digital platform and personal support are at the upper end. At project b., you will receive an individual offer after a short consultation.

Can I keep my DATEV connection?

Yes. Serious outsourcing partners like project b. work as a preliminary system and integrate seamlessly into DATEV, Agenda, and SPS. You do not need to change your existing infrastructure. The prepared data flows directly into your payroll system, and the tax consultant receives all documents as usual.

How long does the transition take?

It depends on the provider. With project b., you can start within 30 minutes. The complete migration of all client data typically takes 2 to 4 weeks, during which you can already work with the new system in parallel. Other providers often take 2 to 3 months for onboarding.

Finn R.

Further articles

Feb 9, 2026

·

Payment

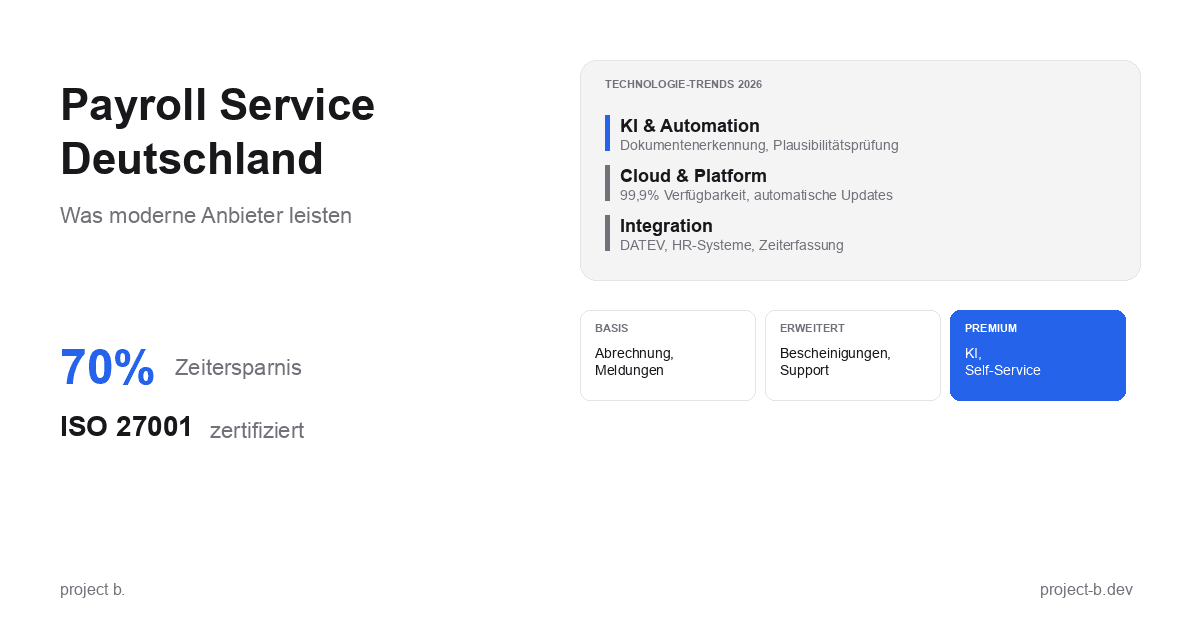

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

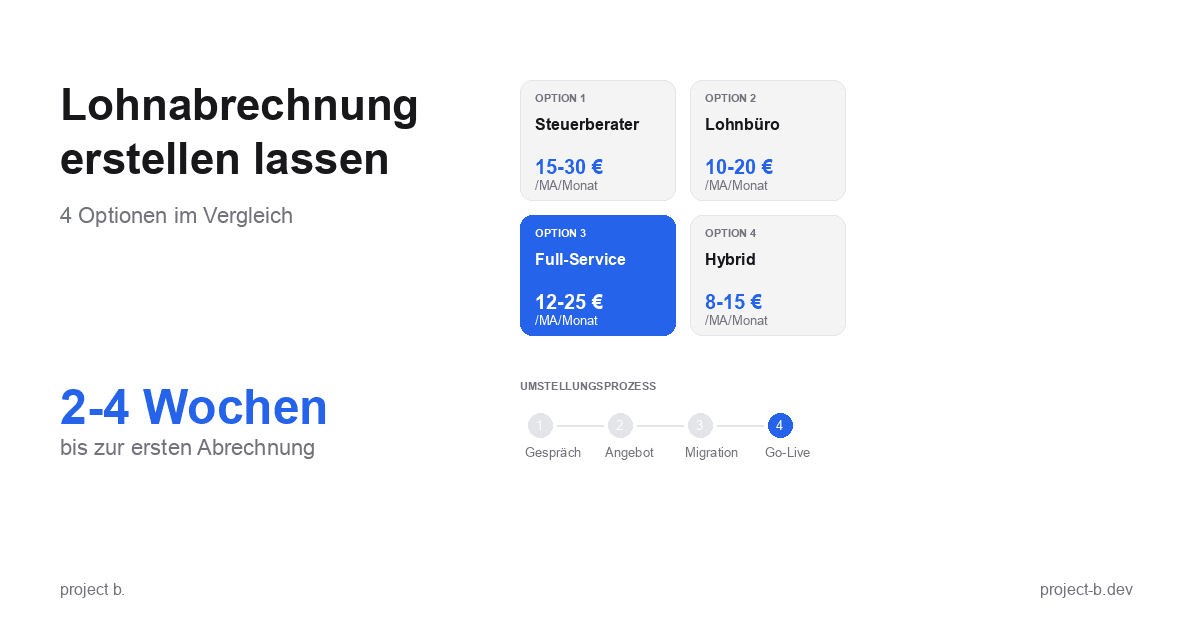

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

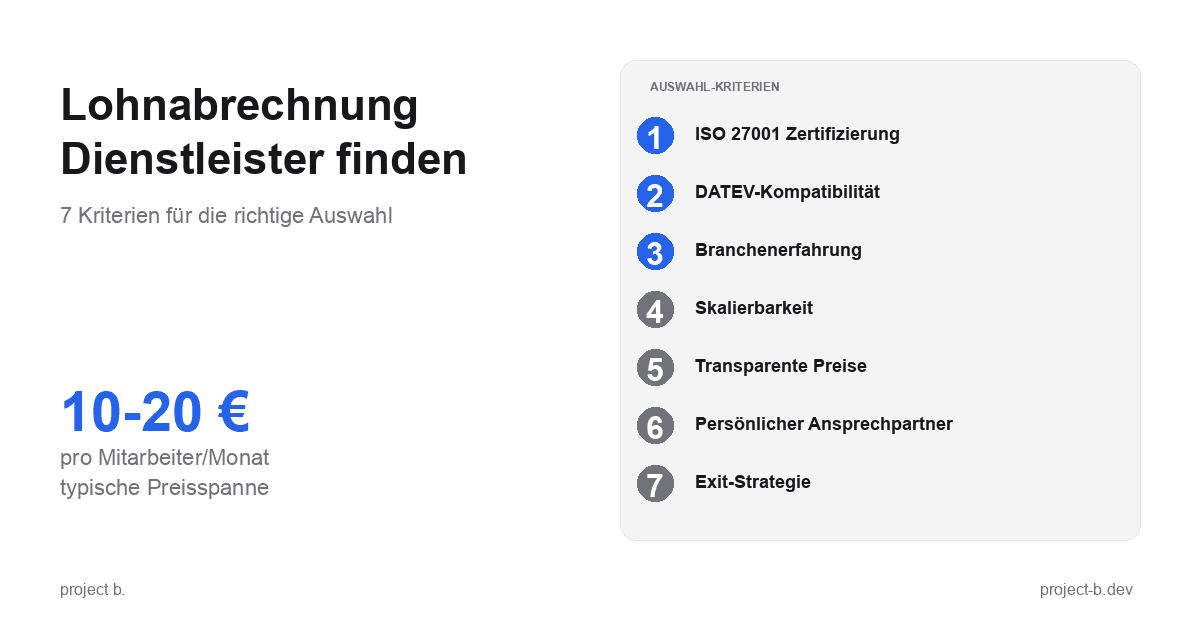

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

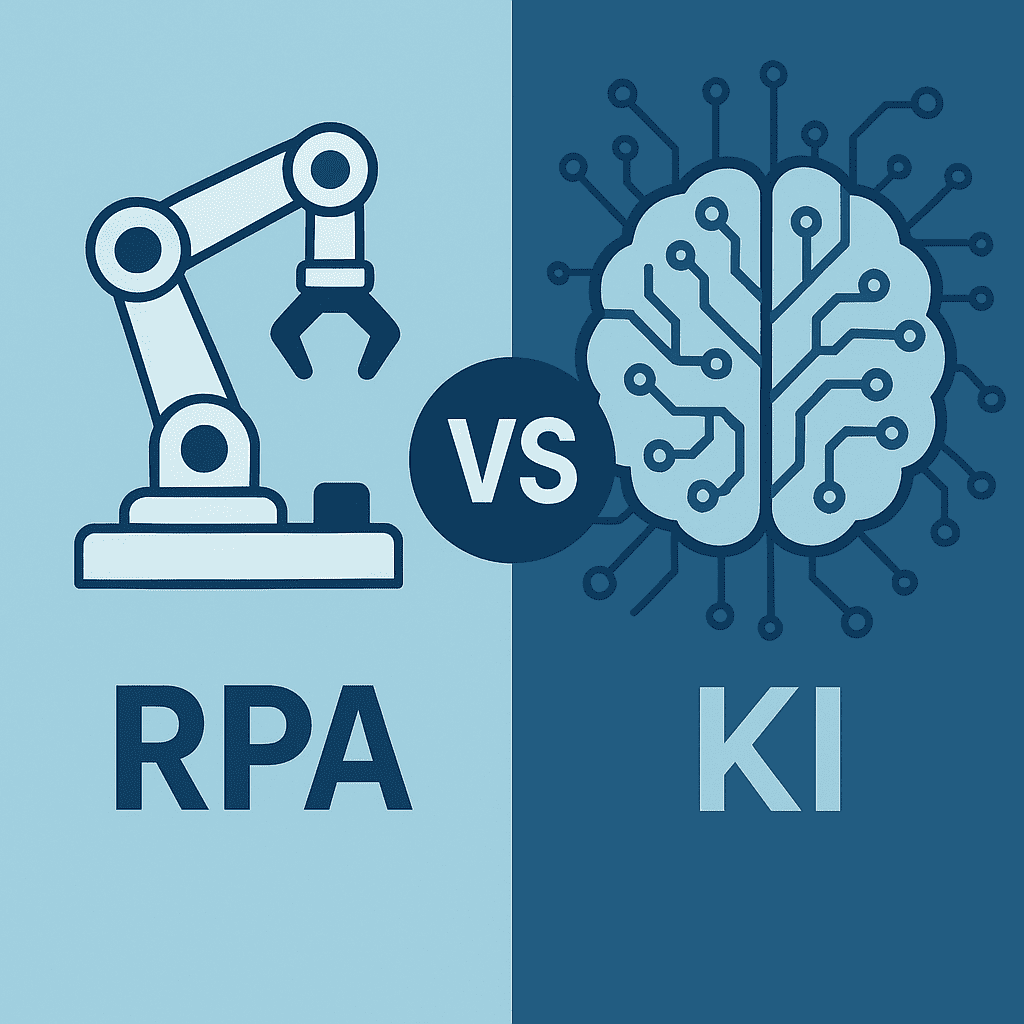

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.