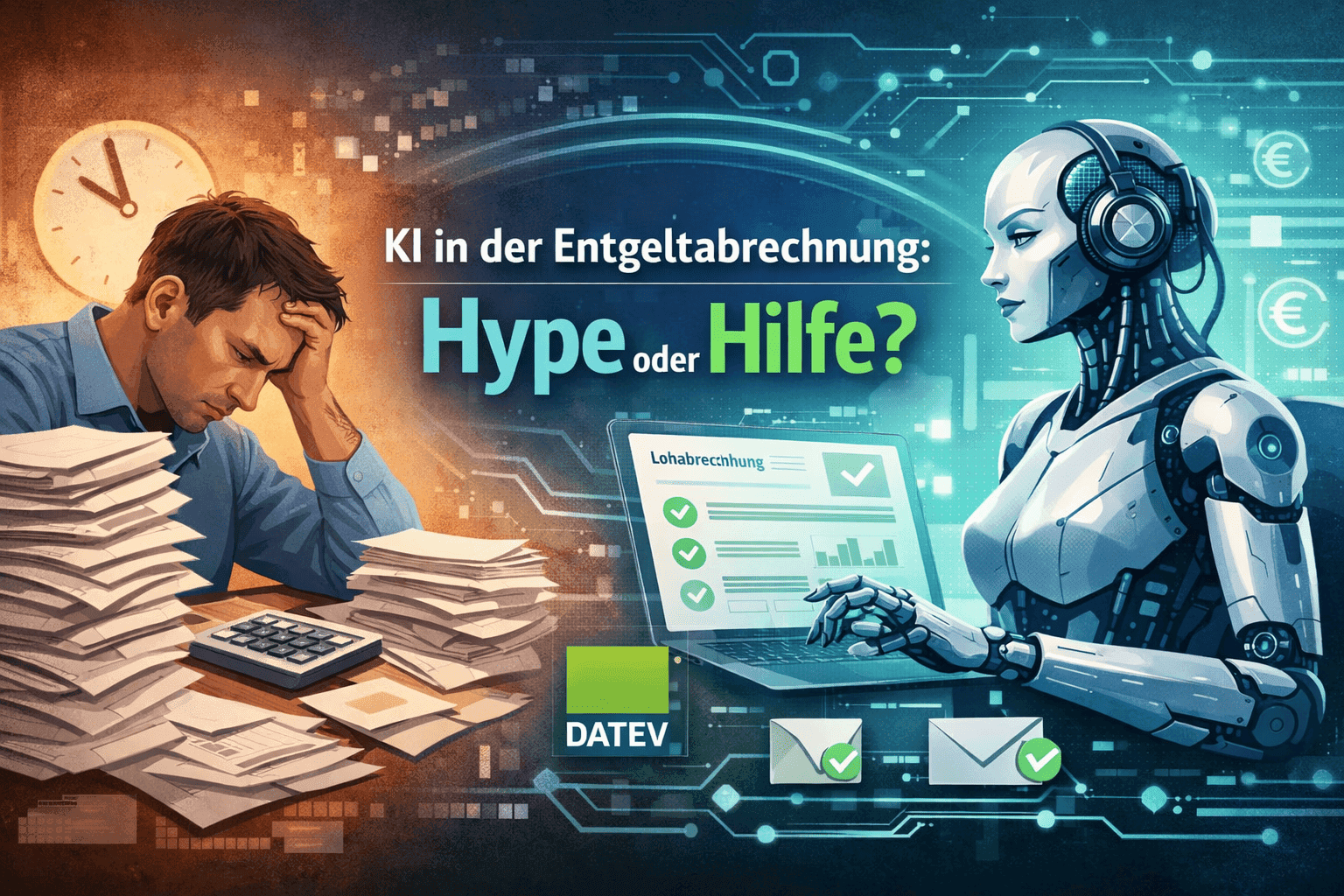

AI in Payroll: Hype or Help?

Dec 31, 2025

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

You are sitting in front of a pile of sick leave notifications. The monthly closing is in three days. The new colleague has already left after six weeks because she felt the work was "too detailed." And then someone comes and tells you that AI will solve all problems.

It's understandable if you wave that off at first.

This article is written for you if you're among the 67 percent of payroll accountants and tax advisors who have heard of AI but don't exactly know what it means for their everyday work. No marketing promises, no buzzwords. Instead: concrete answers to the questions that really concern you.

Why this topic is currently on everyone's mind

The numbers speak a clear language. According to DIHK Skilled Workers Report, 42 percent of companies cannot fill open positions in accounting long-term. A study by SD Worx from 2024 found that two-thirds of the surveyed executives are already considering using AI in payroll.

The reason is obvious. The requirements are becoming more complex: new collective agreements, changed social security contributions, minimum wage increases. At the same time, there are not enough people to handle all of this.

What used to be handled by three employees is now shouldered by one and a half. The error rate is increasing. So are the overtime hours. And the frustration as well.

In this situation, the word "AI" is mentioned more and more frequently. Not as futuristic speculation, but as a possible way out of a very real problem.

What AI can actually take over in payroll

For a moment, forget the images of robots replacing humans. The reality looks different.

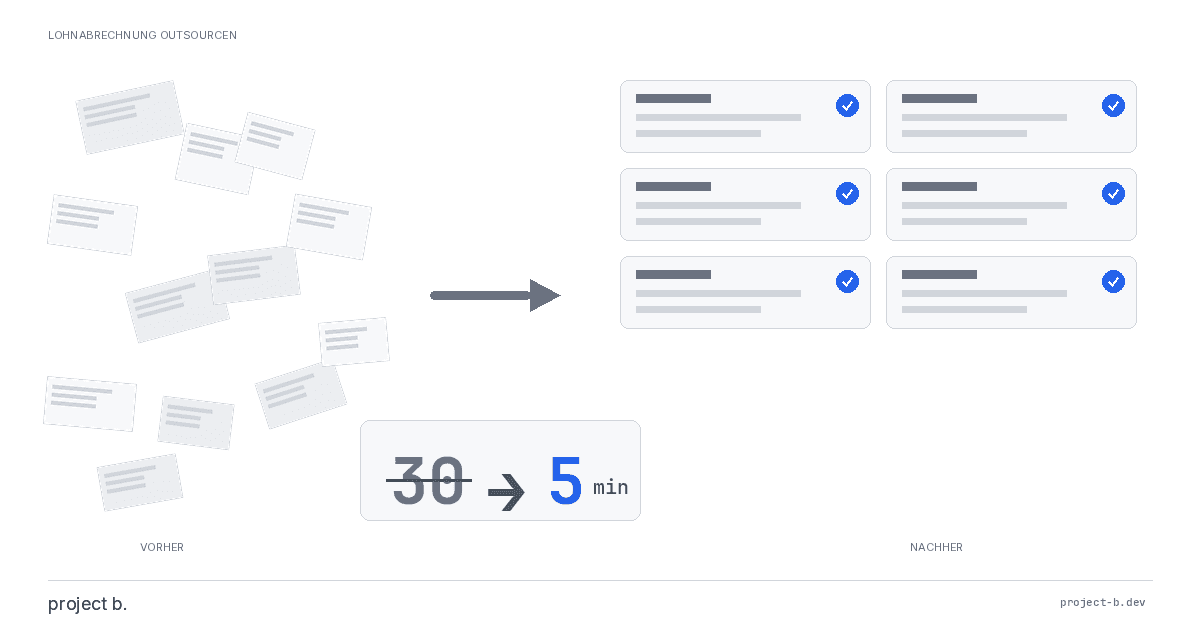

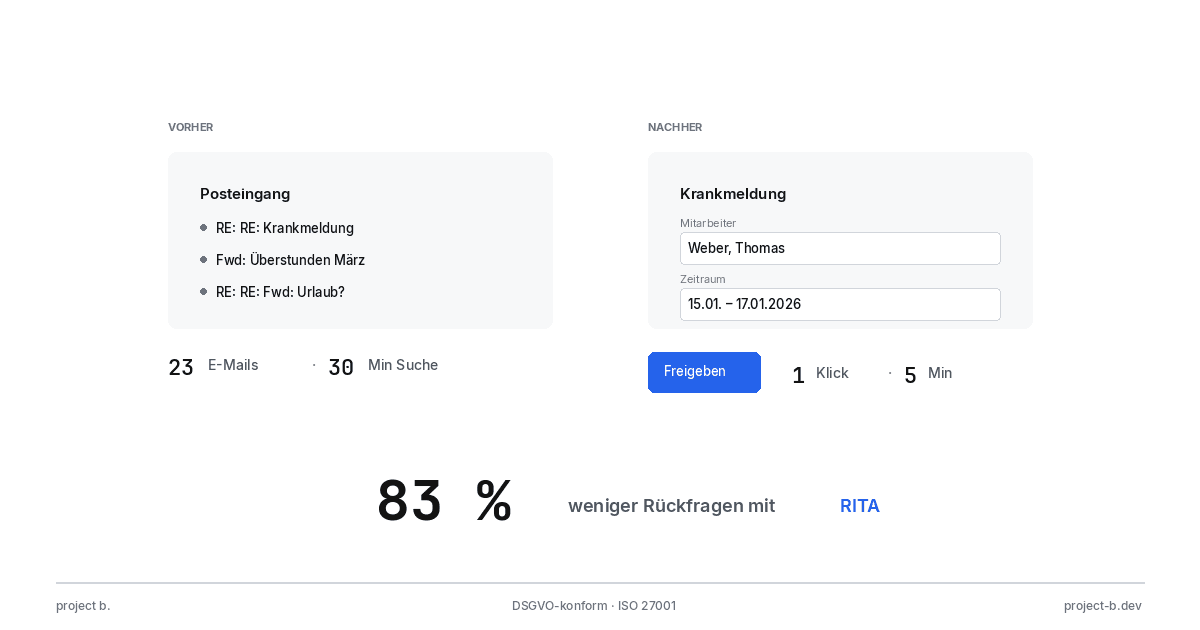

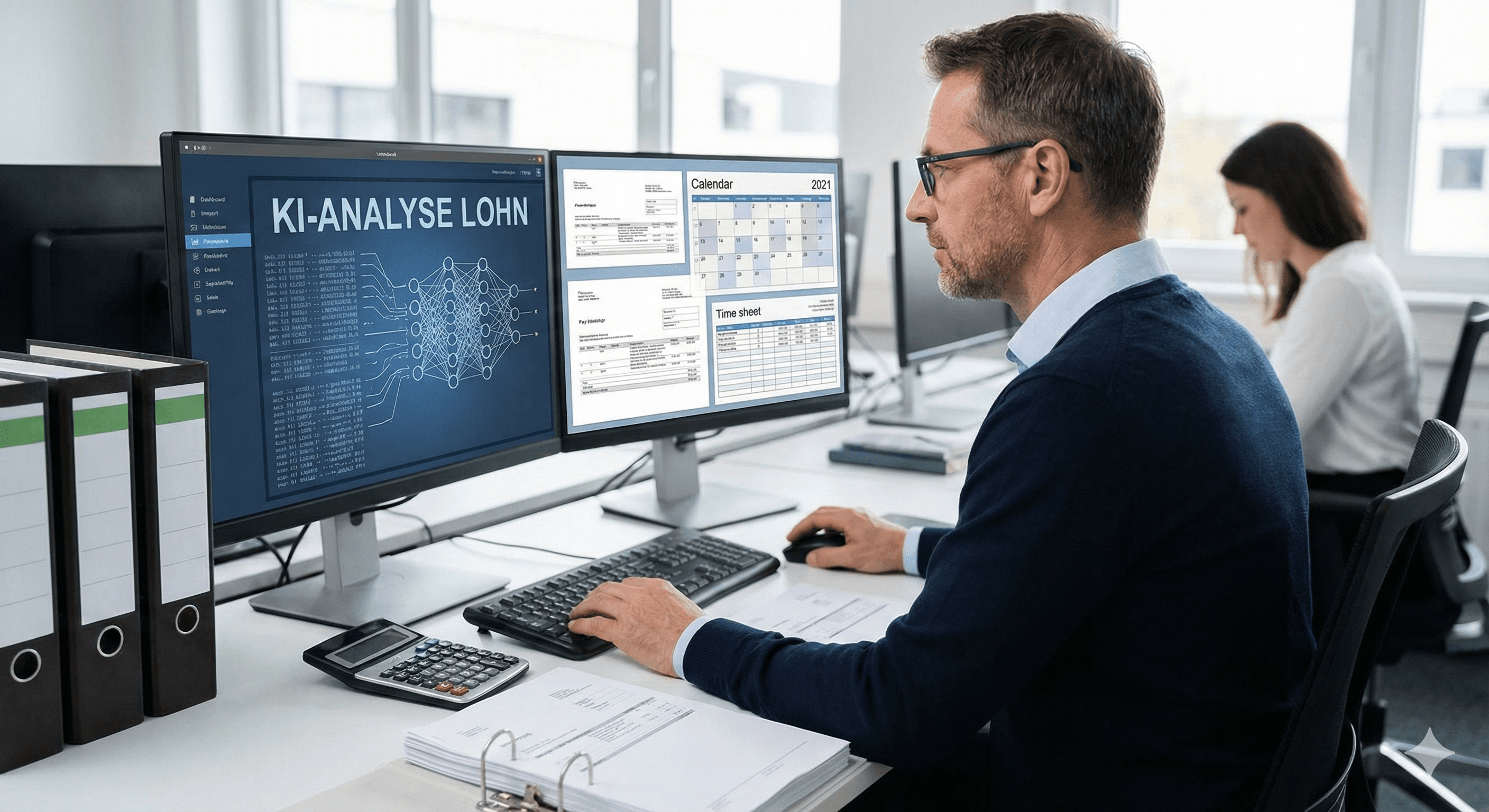

AI in payroll means software that recognizes patterns, validates data, and automates routine tasks. A concrete example: A sick leave notification comes in. Until now, you opened the document, entered the data manually into the system, calculated the continued payment of wages, and prepared the notification for the health insurance. Time spent: about 30 minutes.

With an AI-supported system, it works differently. The software recognizes the document, extracts the relevant data, checks it for plausibility, and creates the necessary notifications. Your task: to take a quick look and approve it. Time spent: under five minutes.

It works similarly for:

Certificates (employment certificates, earnings certificates)

Master data changes (new address, bank account, tax class)

Travel expense reports

Preliminary notifications to social insurance carriers

The error rate decreases measurably. While manual data entry has a 3 to 4 percent error rate, AI-supported systems have an error rate of under 0.1 percent.

What AI cannot do

Here it gets honest. AI has clear limits:

Special cases that require discretionary power cannot be decided by software alone. An employee asks whether their training counts as working time? This requires human judgment. A complicated divorce case with maintenance claims? The same applies.

Communication with employees remains human. If someone has questions about billing, they want to talk to a person, not a chatbot.

And finally: Strategic consulting of management on compensation models, social benefits, or personnel costs. This requires experience, context, and sensitivity.

The formula is simple: AI takes care of the repetitive tasks. You focus on what requires expertise.

"Will my job become obsolete?"

The short answer: No. The longer answer: The job profile is changing.

The facts speak for themselves. In companies that are already using AI, no payroll jobs have been eliminated so far. What has happened is that the work has shifted. Less data entry, more quality assurance. Less routine work, more consulting.

An example from practice: A medium-sized company with 350 employees switched to an AI-supported precursor system. The responsible payroll accountant previously needed four days for the monthly closing. Now it takes six hours. The remaining time is spent on tasks that were left undone before: optimization of the company pension scheme, consulting department heads on bonus models, training for new managers.

Your comment: "I am finally doing what I was actually trained for."

The Federal Employment Agency forecasts a transformation of the job profile by 2026. There will be an increasing demand for "Digital Payroll Managers" who combine expertise with technological understanding. Salaries in this field are rising.

DATEV and AI: Not either-or

A question that comes up regularly: "What is better than DATEV?"

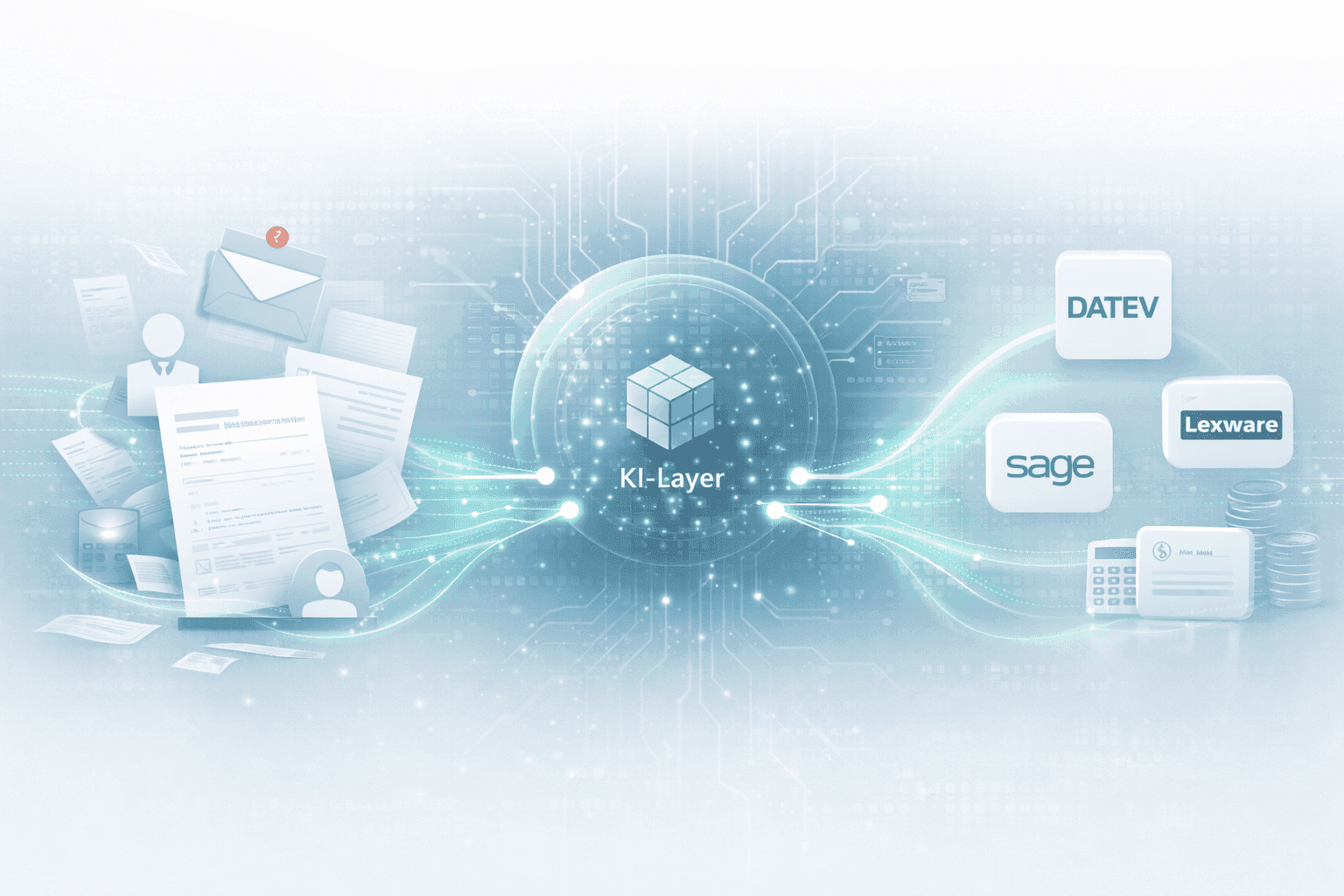

The question is wrongly formulated. Modern AI solutions do not replace DATEV. They work in front of it.

The concept is called "precursor system." It works like this: All data from the company, from various sources and formats, first flows into the AI system. There, they are checked, structured, and prepared. Only then do they go on to DATEV, in the correct format, complete and validated.

For tax advisors, this means: The client data no longer comes as Excel chaos or through email ping-pong. It comes well-prepared, with documented changes and clear origins.

The DATEV itself is working on similar approaches. The integration of AI precursor systems into existing DATEV workflows is now technically solved and certified.

Who is behind project b.

Before you engage with a new provider, you want to know who is behind it. A legitimate question.

project b. was founded in 2023 in Munich. The two founders bring completely different, but perfectly complementary experiences:

Stephan Weber is a real expert in payroll accounting. As Head of Product at PayFit, he helped build the German product for payroll. His stages at PayFit France and Monite have shown him how complex the German payroll landscape really is. It is no coincidence that Germany ranks second among countries with the highest complexity in payroll. Weber knows the pain points firsthand.

Aaron Hayos brings the Silicon Valley perspective. As VP Finance at Homebound, a fast-growing US startup, he has experienced what happens when financial processes do not keep pace with company growth. His experience from the American startup and scale-up world: Processes must be designed to be scalable from the outset.

The combination works: Weber understands the intricacies of German payroll accounting in detail. Hayos knows how to build technology that grows with companies. Together, they have developed software for two years, directly embedded in payroll offices and tax consulting firms. Not in the back office, but in everyday work.

In October 2023, project b. completed a seed financing round. The investors:

Lakestar (known for investments in Spotify, Delivery Hero)

QED Investors (Klarna, Credit Karma)

These investors evaluate hundreds of startups per year. That they have chosen a payroll tool shows that the problem is significant enough, and the solution promising.

Three ways to approach the topic

You don’t have to decide anything today. But if you want to find out whether AI in payroll is relevant for you, there are straightforward options:

Webinars: project b. regularly offers free online sessions. No sales events, but insights into concrete use cases. What works? What doesn’t? What mistakes do others make? An hour that provides orientation.

Personal conversation: If you prefer to talk specifically about your situation, you can book a non-binding consultation. 30 minutes during which you can ask questions and assess whether this topic is a priority for you.

Demo access: For all those who like it practical. Test the platform with real data and see for yourself what automation in everyday life would look like.

All three options are free of charge. No subscription, no hidden catches.

Conclusion: Understanding comes before deciding

AI in payroll is not a hype that will disappear. The technology is here, it works, and it is being used by more and more companies.

This does not mean that you must change everything tomorrow. But it does mean that it is worth understanding the topic. Knowing what is possible. And then deciding whether and when it becomes relevant for you.

project b. offers an entry point that costs nothing but a little time. The rest is up to you.

Sources

Can AI completely replace accounting?

As of now, no. AI automates routine tasks, but special cases, consulting, and strategic decisions still require human expertise.

How can I digitize my accounting?

The first step is to take stock: Which processes are the most time-consuming? Where do the most errors occur? This is where automation makes the most sense. A consultation can help prioritize.

Does accounting have a future?

The accounting function will continue to exist. The job profile is changing: less data entry, more analysis and consulting. Those who are willing to evolve have good prospects.

Aaron H.

Further articles

Feb 9, 2026

·

Payment

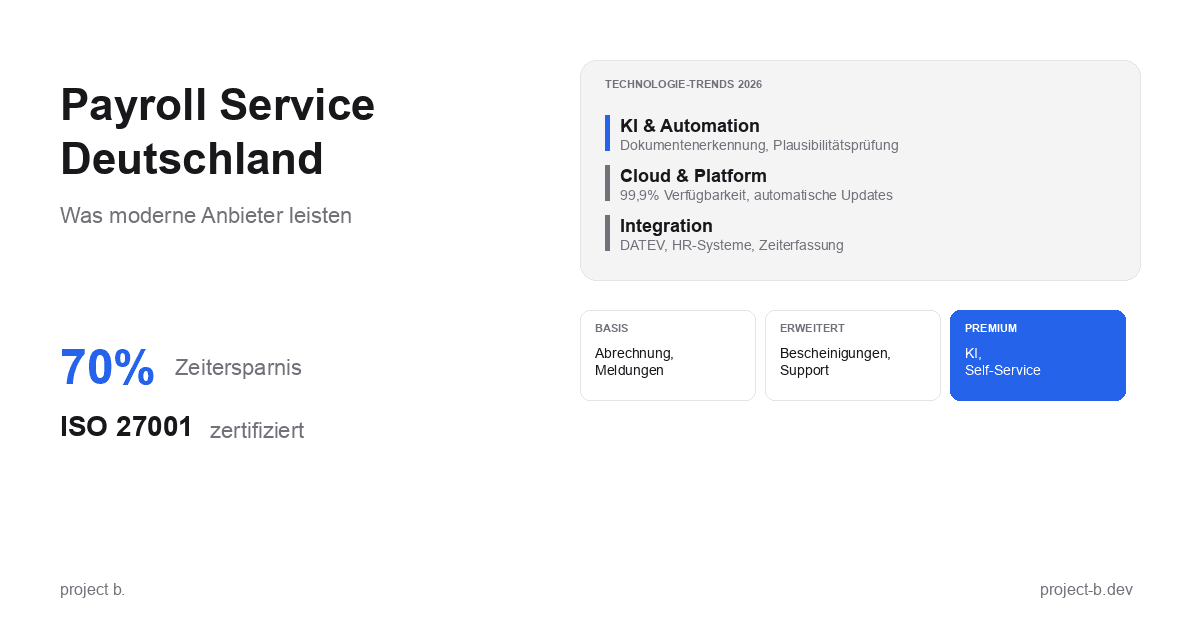

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

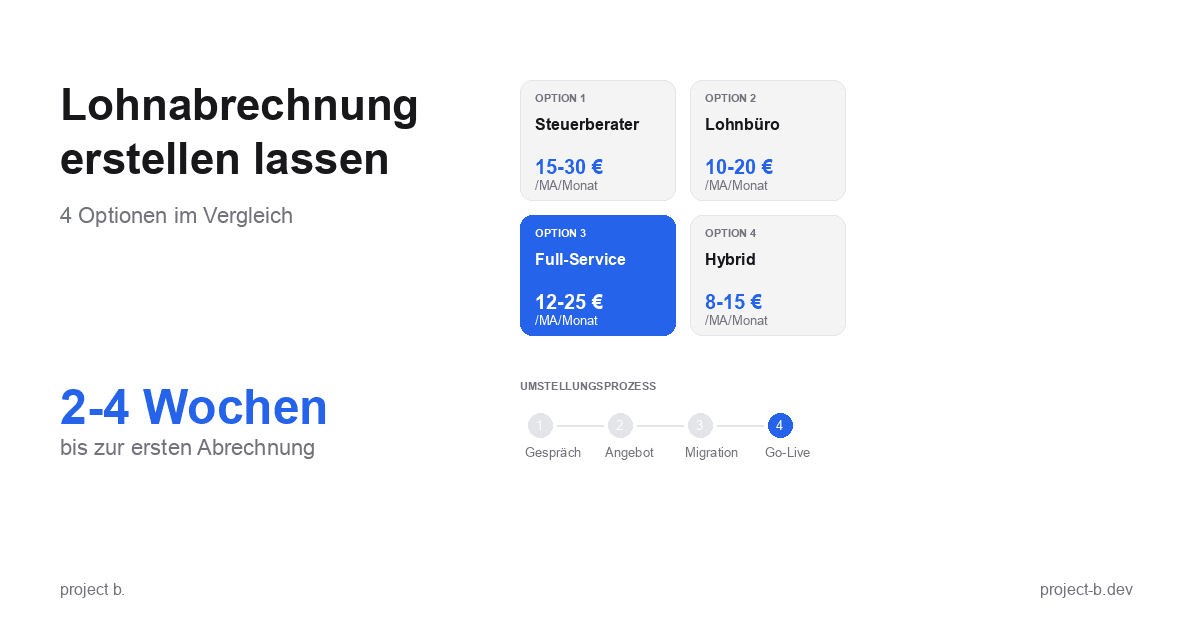

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

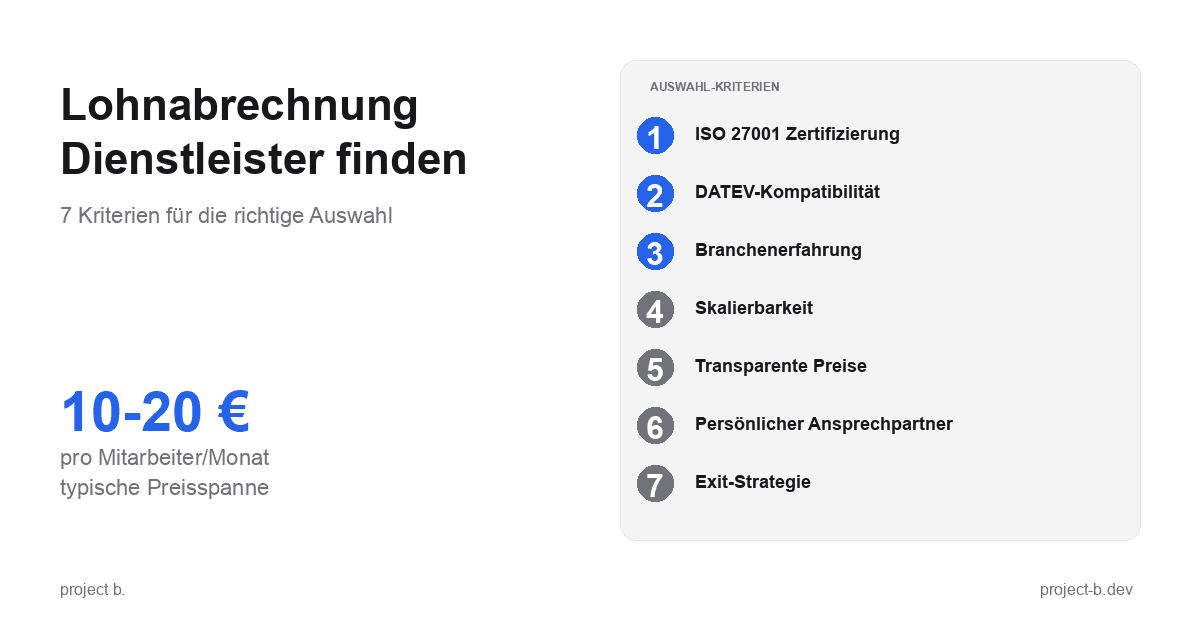

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

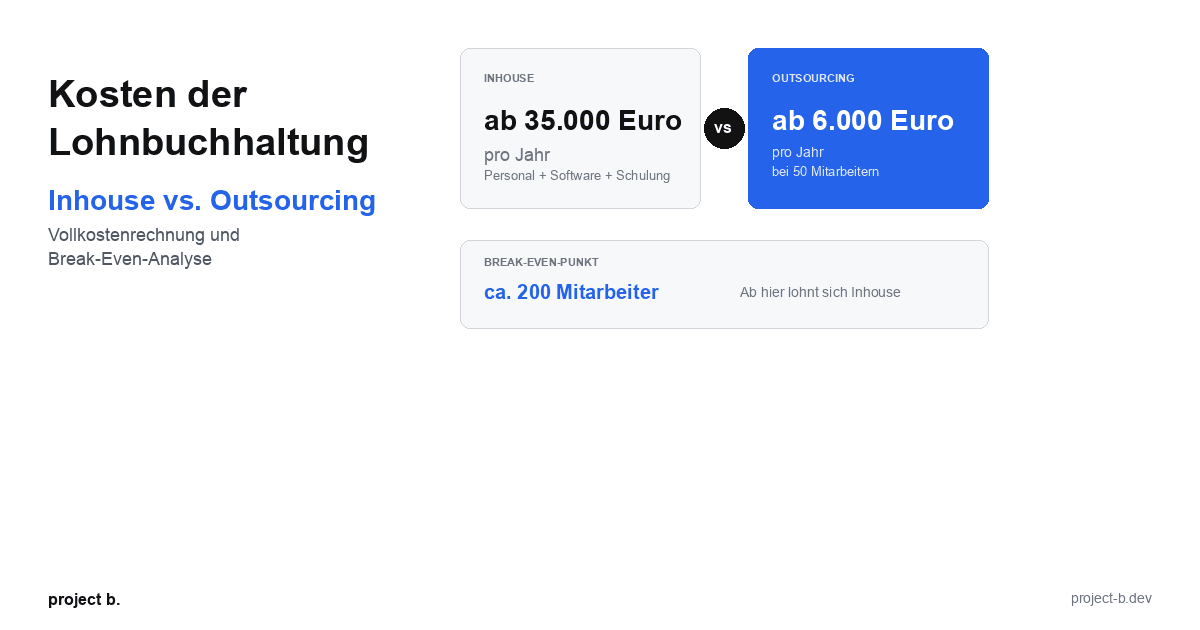

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

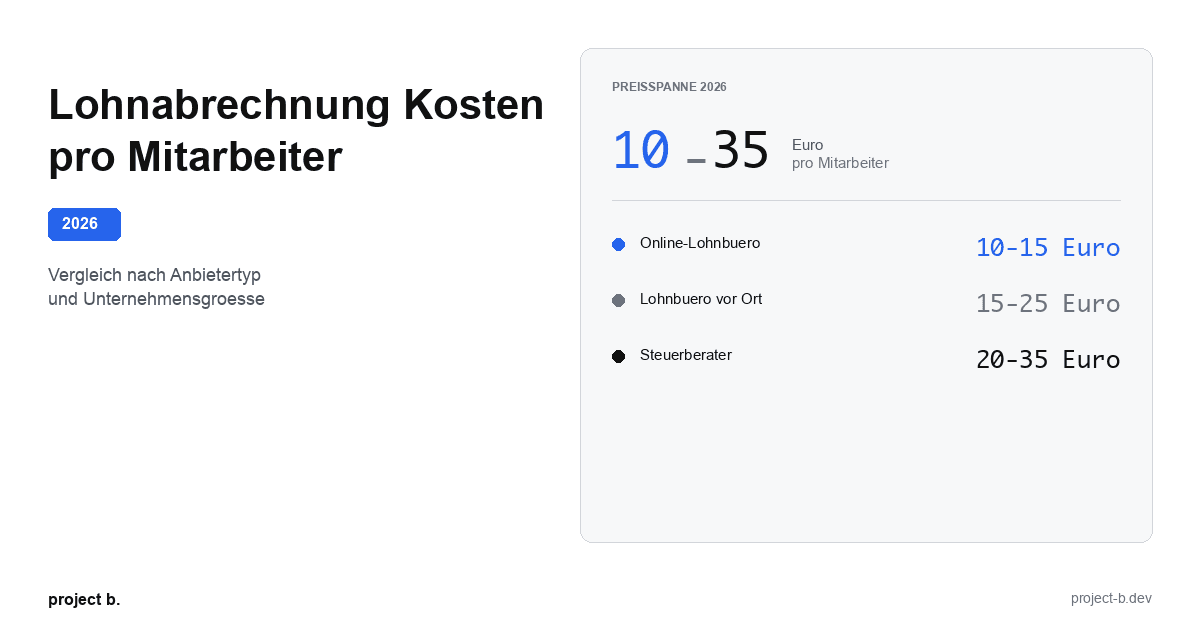

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

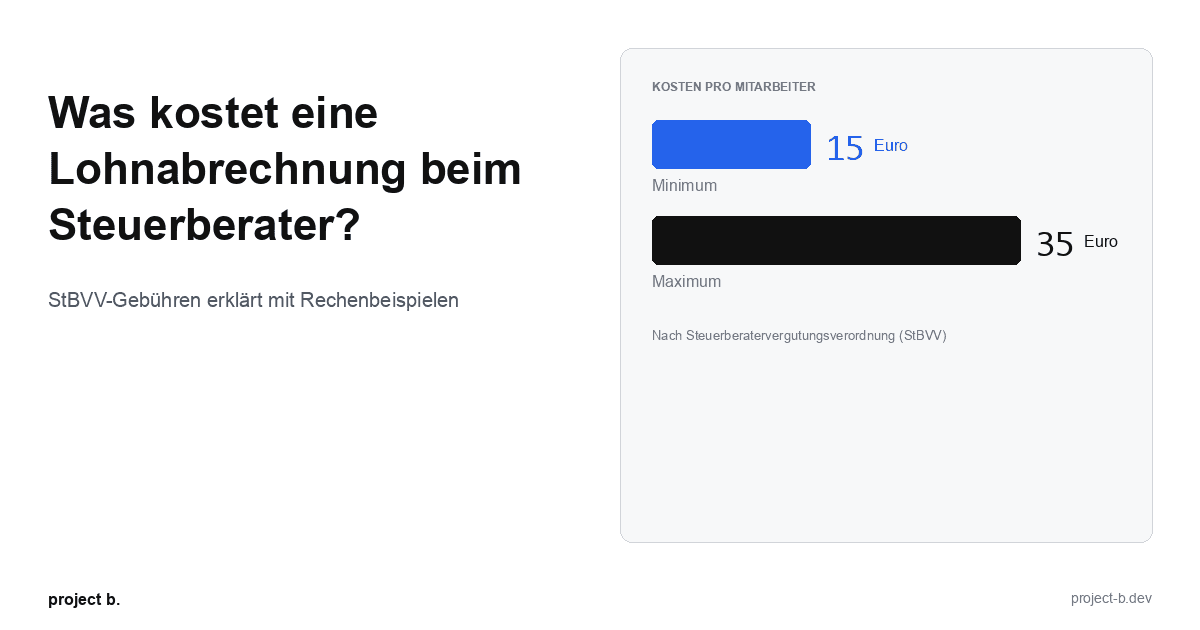

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

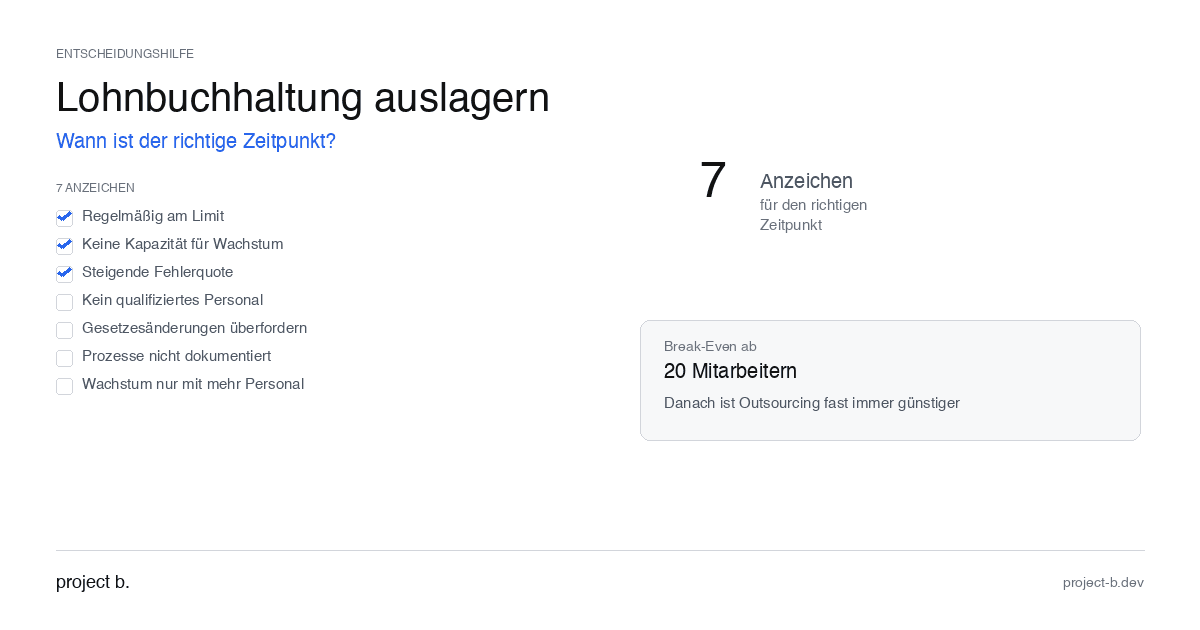

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

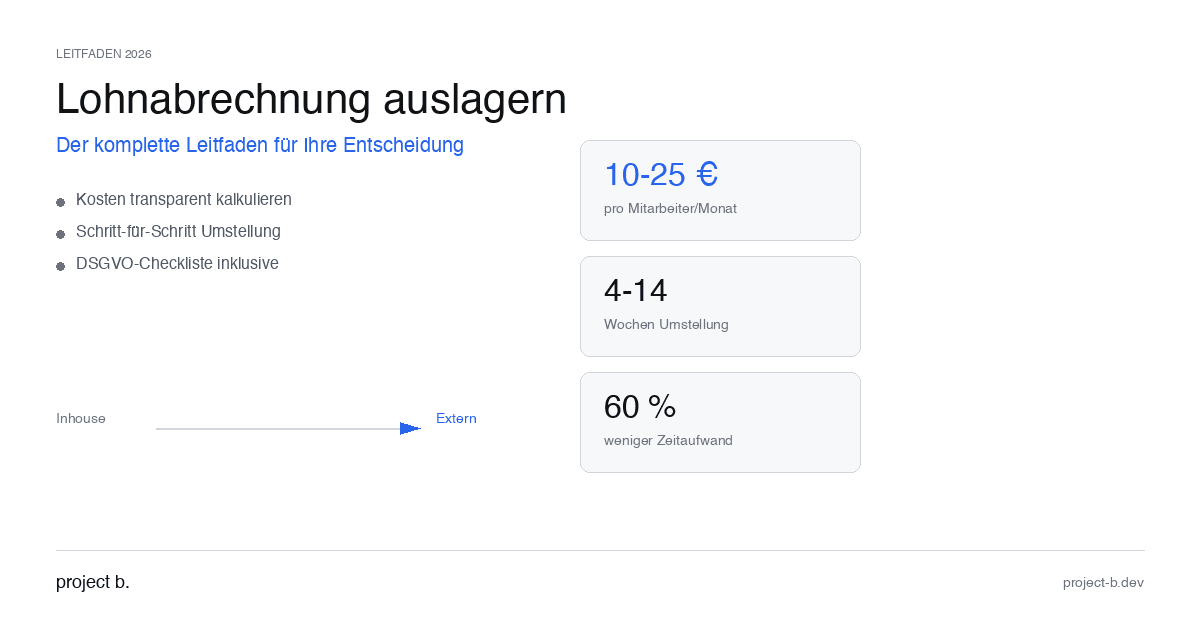

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

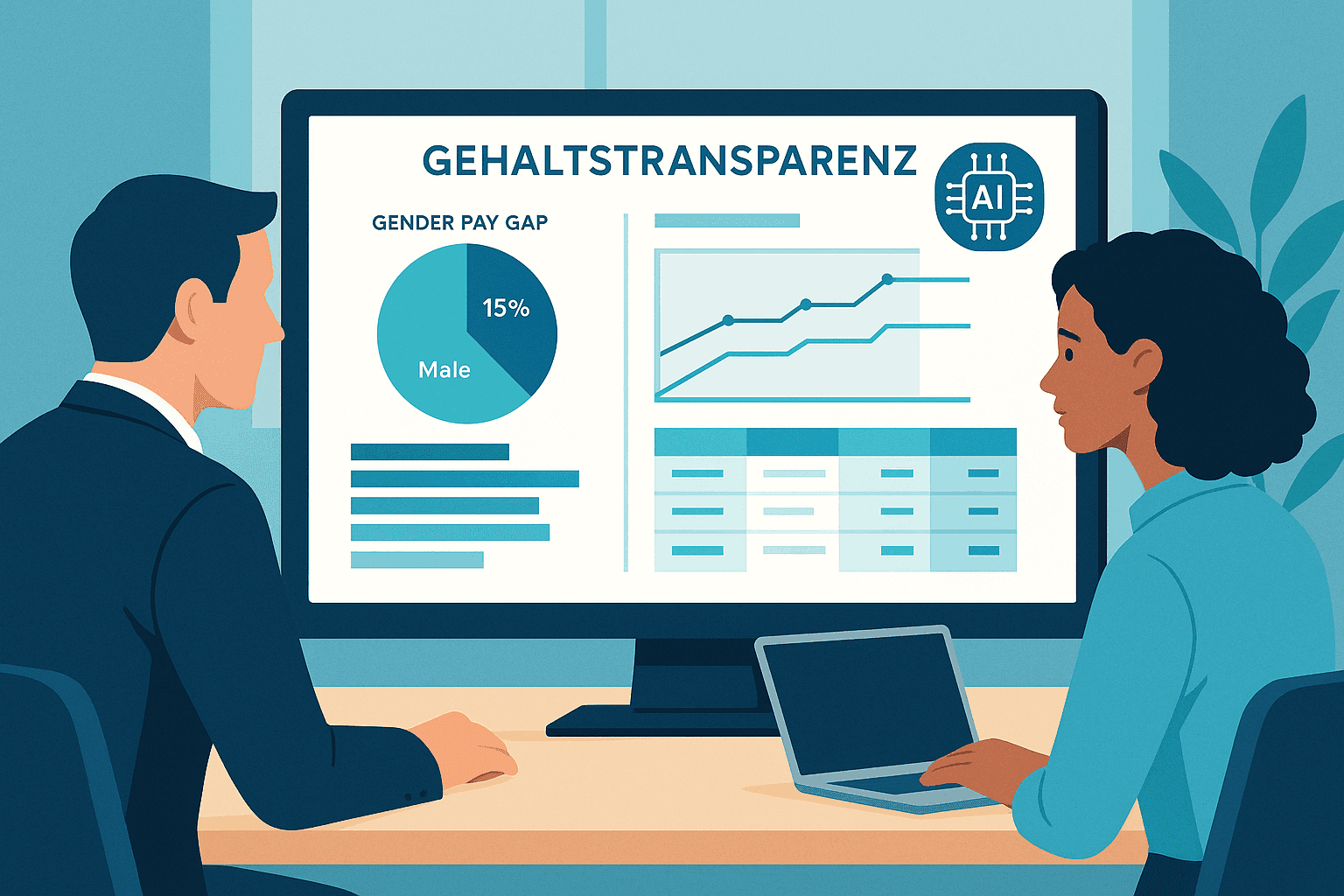

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.