Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Nov 24, 2025

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

Care Allowance Reform 2026: What Employers Need to Adjust in Their Payroll Software Now

Starting January 1, 2026, a tacit but far-reaching reform in the wage tax deduction procedure is imminent, and hardly anyone is prepared for it. The recalculation of the care allowance affects every employee and every company in Germany. While public attention is focused on AI and digitalization, payroll departments must now adjust their systems, review processes, and inform employees. Those who do not react in time risk incorrect payroll calculations and conflicts with the tax office.

The Reform That Almost No One Is Aware Of

January 1, 2026, brings one of the largest changes in the wage tax deduction procedure in years – and hardly anyone is talking about it. While everyone is discussing AI, digitalization, and new work, a reform is underway in the background that affects every individual payslip in Germany.

The care allowance will be fundamentally recalculated. For millions of employees, the net salary will change; for companies, it will be the technical handling. Those who do not timely adjust their payroll software risk incorrect calculations and trouble with the tax office.

The problem: the reform was originally announced for 2024, then postponed to 2026. Many have lost sight of it. Time is running out. The Federal Ministry of Finance published the final guidelines on August 14, 2025. Software providers must deliver updates, tax advisors must inform their clients, and companies must adjust their processes.

What Is the Care Allowance Anyway?

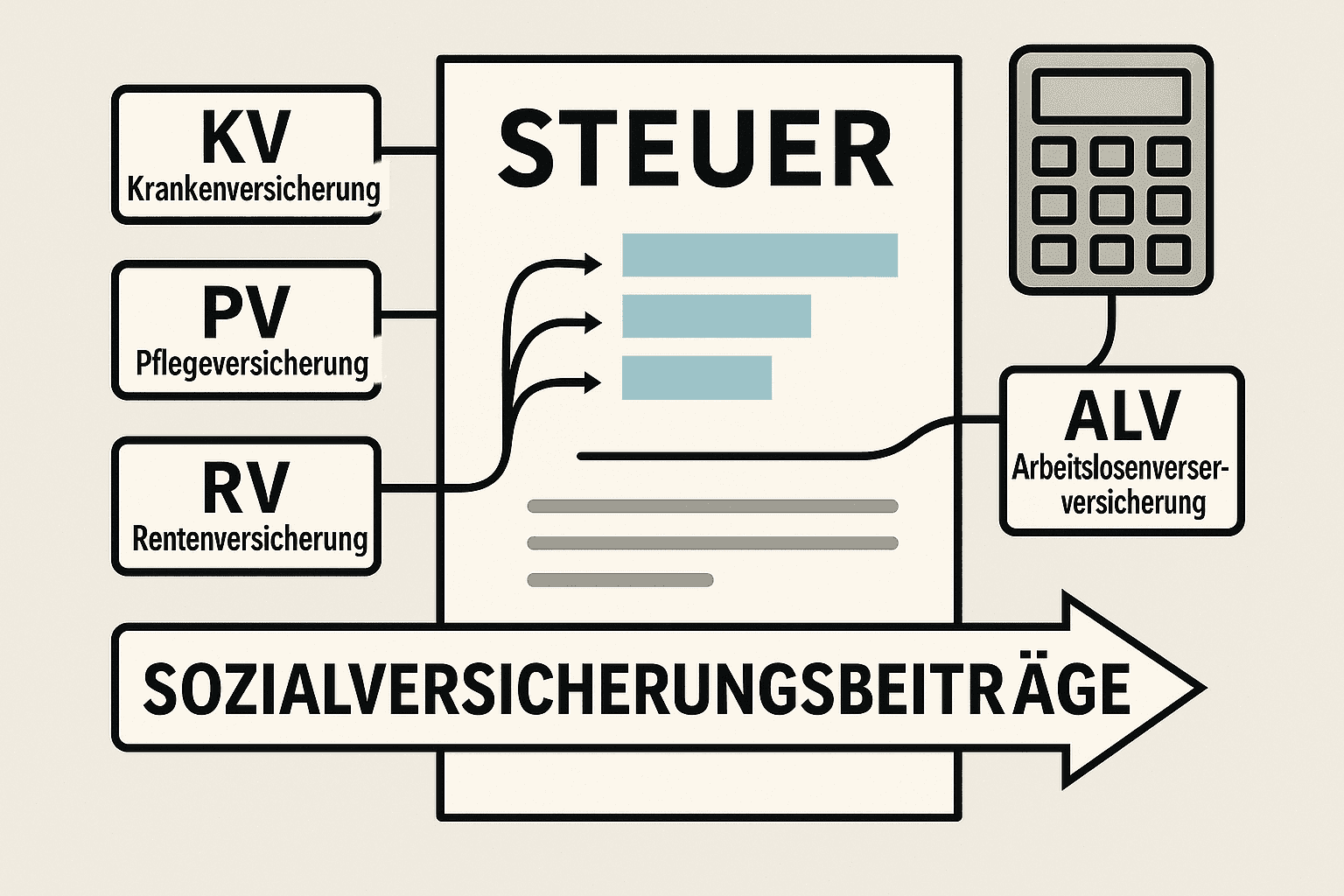

The care allowance is a tax allowance used in wage tax calculations. It takes into account that employees pay contributions to statutory health, long-term care, and pension insurance, which are tax-deductible.

Until now, the finance office assumed that every employee spends at least 12 percent of their gross salary on these insurances (a maximum of 1,900 euros for tax classes I-IV, 3,000 euros for tax class III). Even if the actual contributions were lower, this minimum amount was considered tax-deductible.

An Example from Practice

Anna earns 3,000 euros gross, tax class I. Her actual insurance contributions:

Health insurance: 120 euros

Long-term care insurance: 60 euros

Pension insurance: 280 euros

Sum: 460 euros

Until 2025, however, the minimum care allowance of 360 euros (12% of 3,000 euros) was applied. Anna did not benefit from her higher actual contributions.

Starting 2026, that changes: The actual 460 euros will be included in the calculation. Anna's net salary will slightly increase because more will be tax-deductible.

The 3 Major Changes in Detail

Change 1: Elimination of the Minimum Care Allowance

From January 1, 2026, calculations will no longer use a flat rate of 12 percent, but rather the exact amounts that the employer pays to the insurances.

This means:

Winners: Employees with high actual contributions (e.g., privately insured, well-paid employees).

Losers: Employees with low contributions (mini-jobbers, part-time workers), who previously benefited from the flat rate.

Change 2: Inclusion of Unemployment Insurance

For the first time, unemployment insurance will also be included in the care allowance. Until now, only health, long-term care, and pension insurance were considered.

Currently, unemployment insurance is 2.6 percent of the gross salary (1.3 percent from both employer and employee). With a gross salary of 4,000 euros, that amounts to 52 euros monthly, which will now become tax-deductible.

Important: The total amount from health, long-term care, and unemployment insurance is capped at 1,900 euros (tax classes I-IV) or 3,000 euros (tax class III). Those who already reach this limit will not benefit.

Change 3: Electronic Data Exchange

Insurance contributions will in the future be automatically exchanged between health insurances, tax offices, and employers. No more manual entry required.

The process:

1. Health insurance reports contribution amount to the tax administration

2. Tax administration provides data via ELStAM (electronic wage tax deduction features)

3. Employer's payroll software retrieves data

4. Automatic calculation of wage tax with exact contributions

This exchange will start in parallel from 2026. Companies must ensure that their software is ELStAM capable.

What Does This Specifically Mean for Net Salary?

The effects are individual but calculable. Here are three scenarios:

Scenario A: Well-Paid Employees (Statutory Insured)

Markus, 45, Project Manager, 6,000 euros gross, tax class III/0

Actual contributions: 1,850 euros (Health + Long-term Care + Pension + Unemployment Insurance)

Previous minimum care allowance: 720 euros (12% of 6,000 euros)

Difference: +1,130 euros deductible

Tax savings (marginal tax rate 42%): approx. 475 euros/year = 40 euros/month more net

Scenario B: Privately Insured

Julia, 38, Business Consultant, 5,500 euros gross, tax class I, privately insured

Actual contributions: 2,100 euros (Private Health + Long-term Care + Pension + Unemployment Insurance)

Capped at: 1,900 euros (maximum for tax class I)

Previous minimum care allowance: 660 euros

Difference: +1,240 euros deductible

Tax savings (marginal tax rate 35%): approx. 434 euros/year = 36 euros/month more net

Scenario C: Part-Time Worker (20 hours/week)

Tim, 24, Working Student, 1,200 euros gross, tax class I

Actual contributions: 240 euros

Previous minimum care allowance: 144 euros

Difference: +96 euros deductible

Tax savings (marginal tax rate 20%): approx. 19 euros/year = 1.60 euros/month more net

Criterion | Scenario A: Markus | Scenario B: Julia | Scenario C: Tim |

|---|---|---|---|

Profile | 45 y.o., Project Manager | 38 y.o., Business Consultant | 24 y.o., Working Student |

Gross Salary | 6,000 € | 5,500 € | 1,200 € |

Tax Class | III/0 | I | I |

Insurance | Statutory | Private | Statutory |

Working Time | Full-Time | Full-Time | 20 hours/week |

Actual Contributions | 1,850 € | 2,100 € | 240 € |

Capped Contributions | — | 1,900 € | — |

Previous Minimum Care Allowance | 720 € | 660 € | 144 € |

Difference (Deductible) | +1,130 € | +1,240 € | +96 € |

Marginal Tax Rate | 42% | 35% | 20% |

Tax Savings/Year | approx. 475 € | approx. 434 € | approx. 19 € |

More Net/Month | approx. 40 € | approx. 36 € | approx. 1.60 € |

Conclusion: The reform primarily benefits well-paid full-time employees. Low earners hardly benefit.

Technical Implementation: Checklist for Employers

The reform requires adjustments in payroll software. The following steps are necessary:

Step 1: Check Software Update

Contact your payroll provider (Personio etc.) and clarify: DATEV, Lexware, SAP,

Is an update for the care allowance 2026 planned?

When will it be delivered? (at the latest December 2025!)

Is the electronic data exchange via ELStAM already implemented?

Are there training sessions for your payroll employees?

Step 2: Test ELStAM Retrieval

From 2026, employers will no longer need to manually record insurance contributions but can retrieve them via ELStAM. This saves time but only works if the technical connection is in place.

Test in December 2025:

Does the software retrieve the current contribution data for all employees?

Are privately insured individuals correctly captured? (Separate report required)

Are there employees for whom no data is available? (e.g., voluntarily insured)

Step 3: Inform Employees

Some employees will have more net income, others less. Prepare a communication:

"Starting January 2026, the wage tax calculations will change due to a legislative reform. Your actual insurance contributions will be considered exactly in the future. This may lead to slight changes in net salary."

Prepare for questions. Create an FAQ:

Why is my net changing?

Can I influence this?

Will my gross change? (No, only the tax calculation)

Step 4: Conduct Pilot Calculation

Have a test payroll run in November/December 2025:

Compare December 2025 (old calculation) with January 2026 (new calculation)

Identify outliers: Who loses/gains more than 50 euros net?

Check if the values are plausible

Step 5: Involve Tax Advisor

If you work with a tax office: Clarify the division of responsibilities. Who is responsible for the DATEV will provide updates for tax advisors by the end of 2025. Ensure your advisor has these implemented.ELStAM retrieval? Who checks the calculations?

Special Cases and Pitfalls

Privately Insured

For privately insured individuals, there is no automatic data exchange with the private health insurance. Here, employees must provide a certificate from their insurance showing the monthly contribution.

Problem: Many private health insurance rates have fluctuating contributions. How does the software handle this? Solution: Monthly updates instead of annual averages.

Marginally Employed (Mini Jobs)

Mini-jobbers do not pay social security contributions (except for pension insurance, from which they can opt out). For them, the care allowance is virtually eliminated.

Until 2025, they benefited from the minimum allowance; starting in 2026, they will no longer. This may lead to shifts for mini-jobbers who are also insured in a primary occupation.

Cross-Border Workers and International Employees

Employees who are socially insured in other EU countries must present an A1 certificate. These cases require manual review because the electronic data exchange only works within Germany.

Multiple Jobs

Those with two jobs pay social security contributions on both. However, the care allowance is only considered with the first employer (tax classes I-VI), not the second (tax class VI).

The reform does not change this but makes the calculation clearer.

Legal Basis and BMF Letter

The reform is based on the Credit Market Promotion Act of December 22, 2023. Originally, the change was supposed to come into effect in 2024, but it was postponed by two years to give software providers and administration more lead time.

The crucial document is the BMF letter of August 14, 2025 (reference number IV C 5 - S 2367/24/10002). It regulates:

The calculation of the care allowance according to § 39b Abs. 2 Satz 5 Nr. 3 EStG

The electronic data exchange between insurances and tax offices

Transitional regulations for 2026 (hardship clauses)

Tax advisors and payroll officers should read the letter in full. It is freely available on the Federal Ministry of Finance website.

Outlook: What Comes After 2026?

The care allowance reform is a step towards a fully automated wage tax deduction procedure. In the medium term, the tax administration plans:

Real-time Wage Tax Deduction: Instead of monthly preliminary notifications, companies could in the future pay wage tax immediately after each disbursement.

Complete Data Matching: Not only insurance contributions but also business expenses, special expenses, and tax allowances could be automatically included.

Elimination of Tax Declarations: When the tax office has all the data, it will eventually no longer need an annual declaration. Estonia is leading the way.

Until then, it is a long road. The care allowance 2026 is the first major test of whether digital data exchange works.

Conclusion: Act Now, Don't Be Surprised in January

Companies like DATEV, Lexware, SAP) are prepared. Critical issues will arise with smaller, custom-made solutions or outdated on-premise systems.

Use the remaining months: the care allowance reform seems at first glance to be a technical detail. In reality, it affects every employer in Germany. Those who do not adjust their software in time will produce incorrect calculations in January 2026.

The good news: Most large payroll providers (

Order software updates (by December 2025)

Test ELStAM retrieval

Inform employees

Conduct pilot bills

Those who are prepared will hardly notice the change. Those who miss it will have a problem in January 2026.

Sources

BMF letter regarding the care allowance from 2026, reference number IV C 5 - S 2367/24/10002Federal Ministry of Finance (08/14/2025): '

Haufe (2025): 'Care allowance in the wage tax deduction procedure from 2026'. haufe.de/taxes

Smartsteuer Blog (2025): 'Payroll: What Changes in 2026'. smartsteuer.de/blog

Deloitte Tax News (2025): 'BMF: Changes to the Care Allowance from 01.01.2026'. deloitte-tax-news.de

Payroll-Info.de (2025): 'Care Allowance in the Wage Tax Deduction Procedure'. payroll-info.de

About project b.: project b. is already prepared for the ELStAM retrieval. Contact us for a demo.Care allowance reform 2026 prepared. Our software updates automatically and supports the full

What will change with the precautionary flat rate in 2026?

Starting in 2026, the care allowance will be calculated according to new rules that take into account higher health and long-term care insurance contributions. Software providers must update their program flow plans (PAP). All employers must ensure that their payroll software receives the update.

Is my payroll software already 2026-ready?

Contact your provider and specifically inquire about updates regarding the care lump sum reform, ELStAM retrieval, and new program timelines. Most major providers such as DATEV or Lexware deliver updates until December 2025. project b. has already tailored its software for the corresponding updates early on. You should contact smaller providers promptly.

What happens in case of incorrect calculation?

Incorrect provision flat rates lead to incorrect income tax and can trigger back payments. In the event of audits, there is a risk of additional claims with interest. Timely software updates completely avoid these risks.

Finn R.

Further articles

Feb 9, 2026

·

Payment

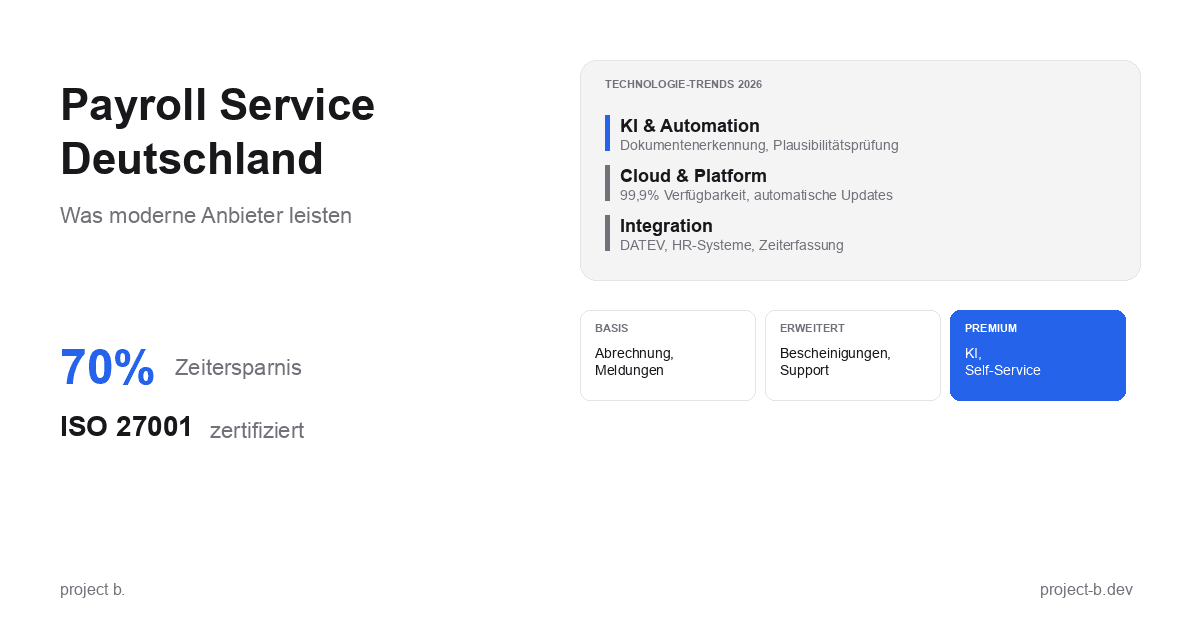

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

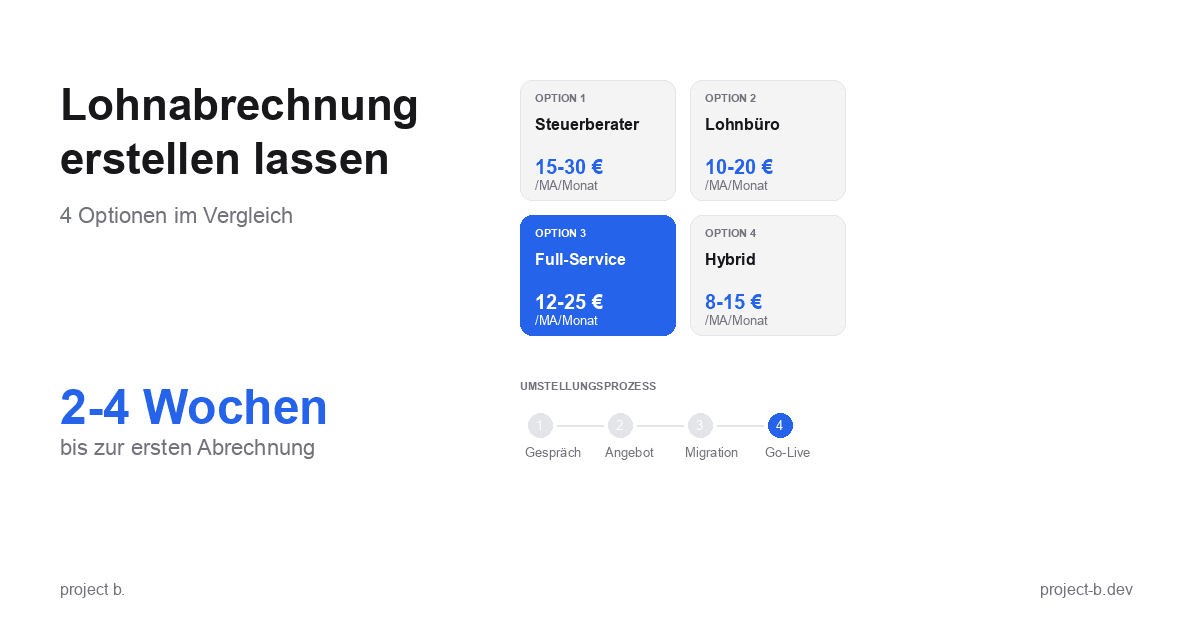

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

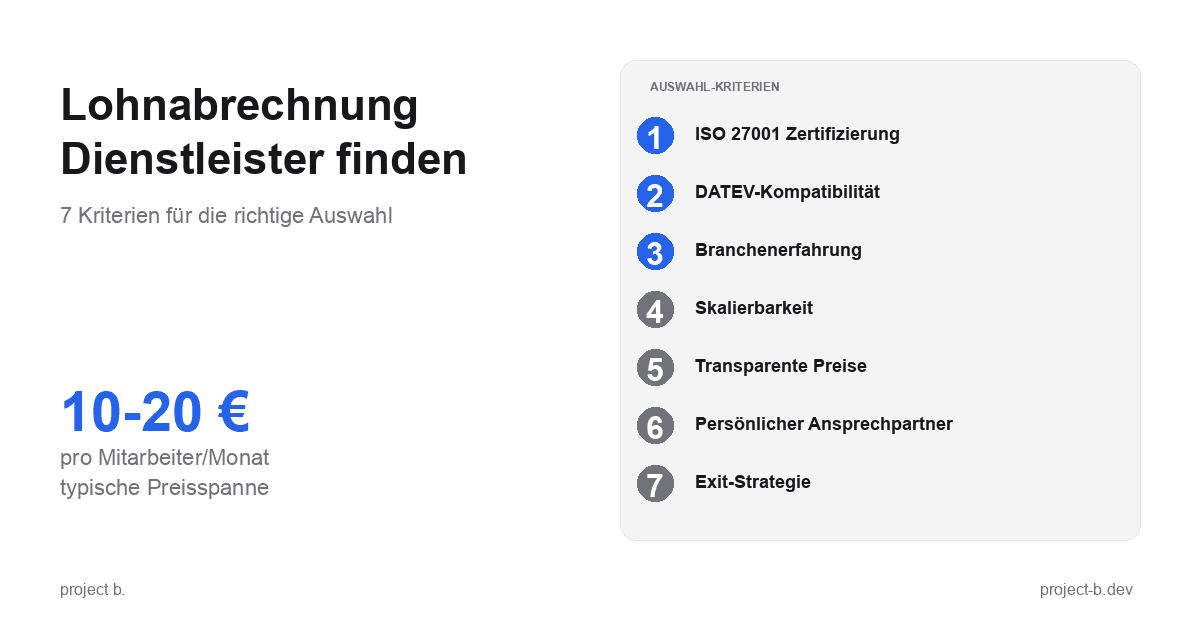

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

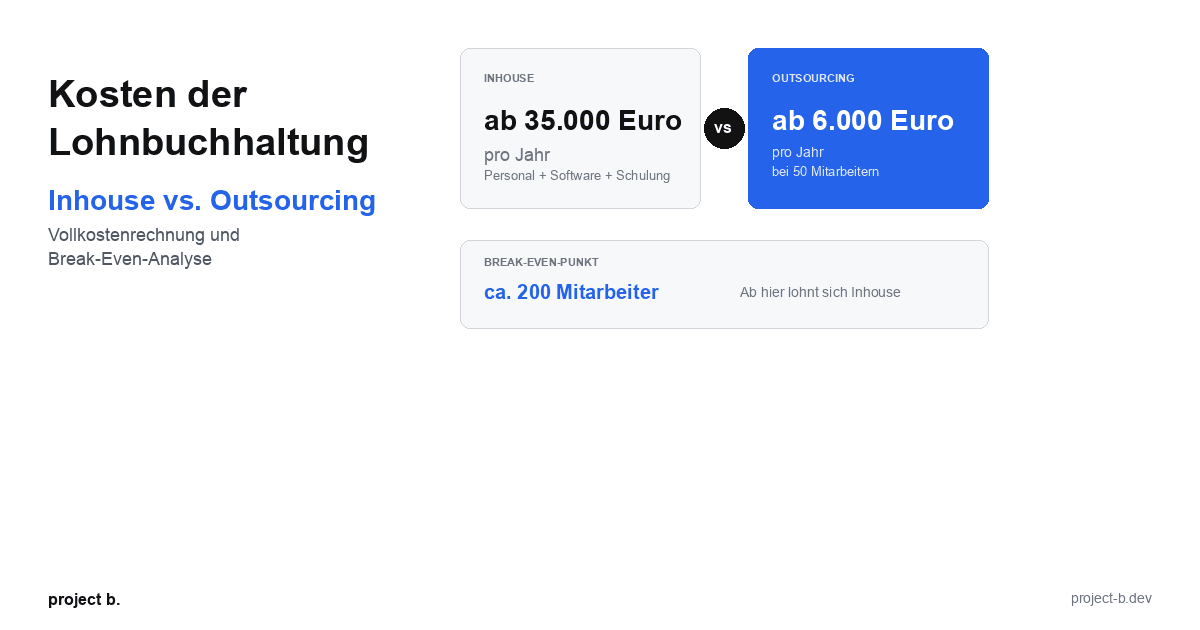

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

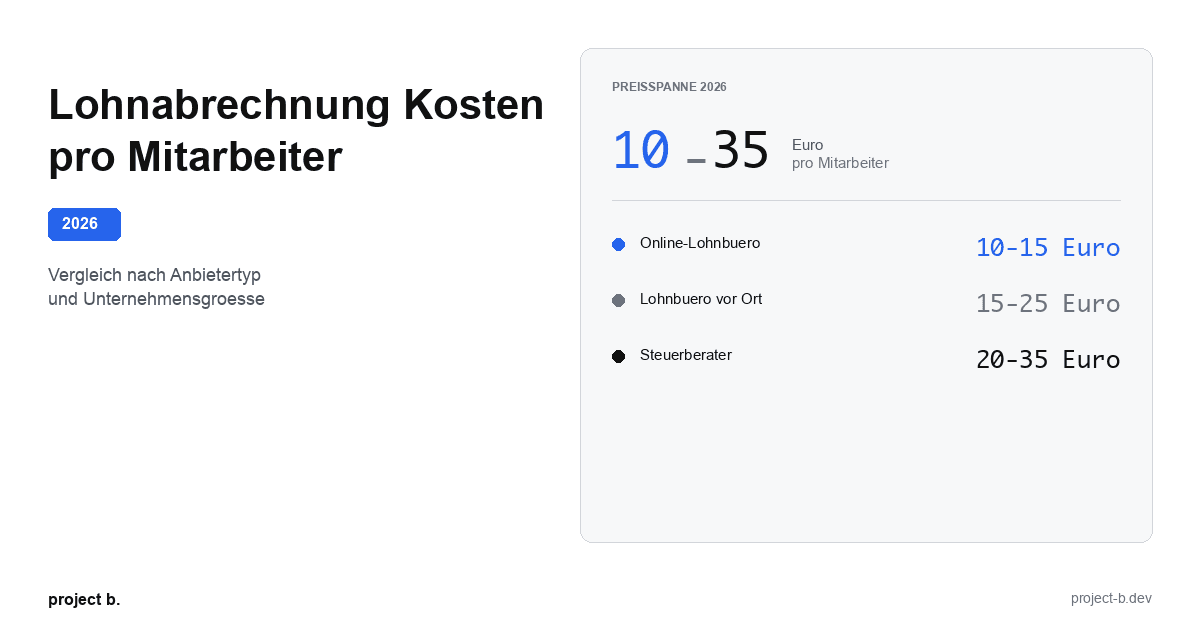

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

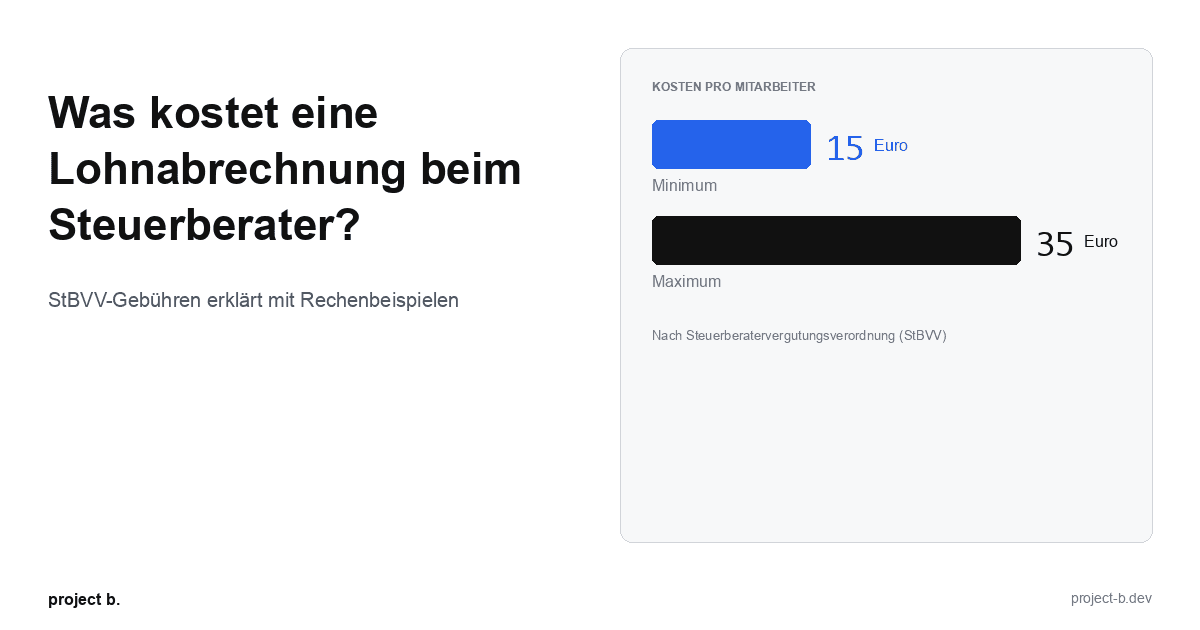

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

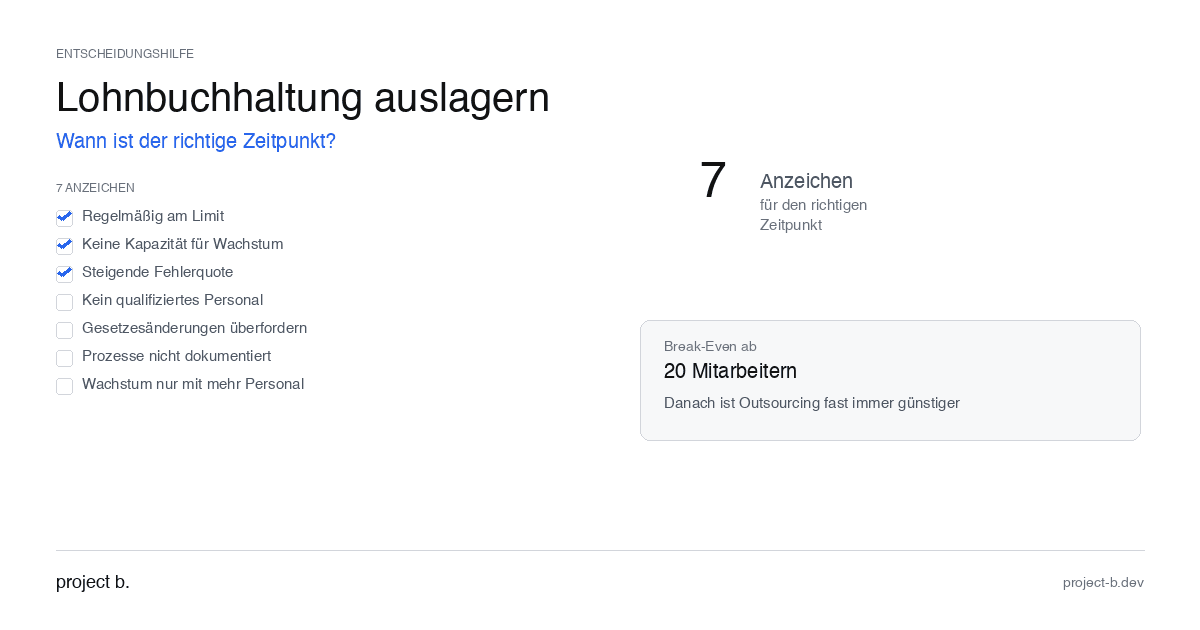

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

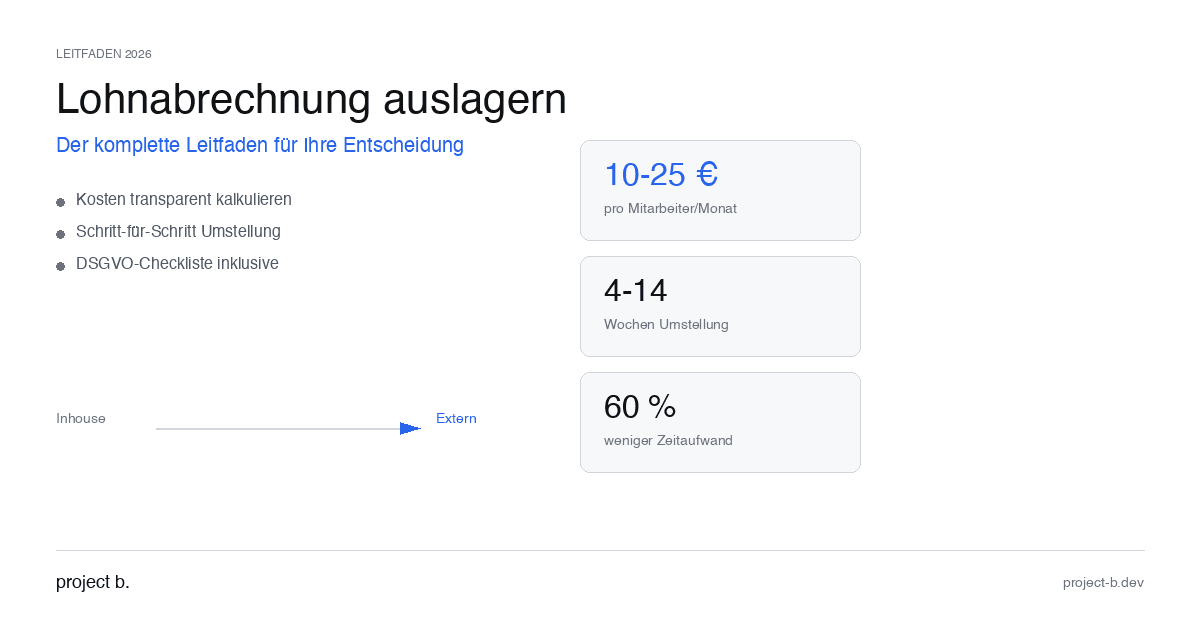

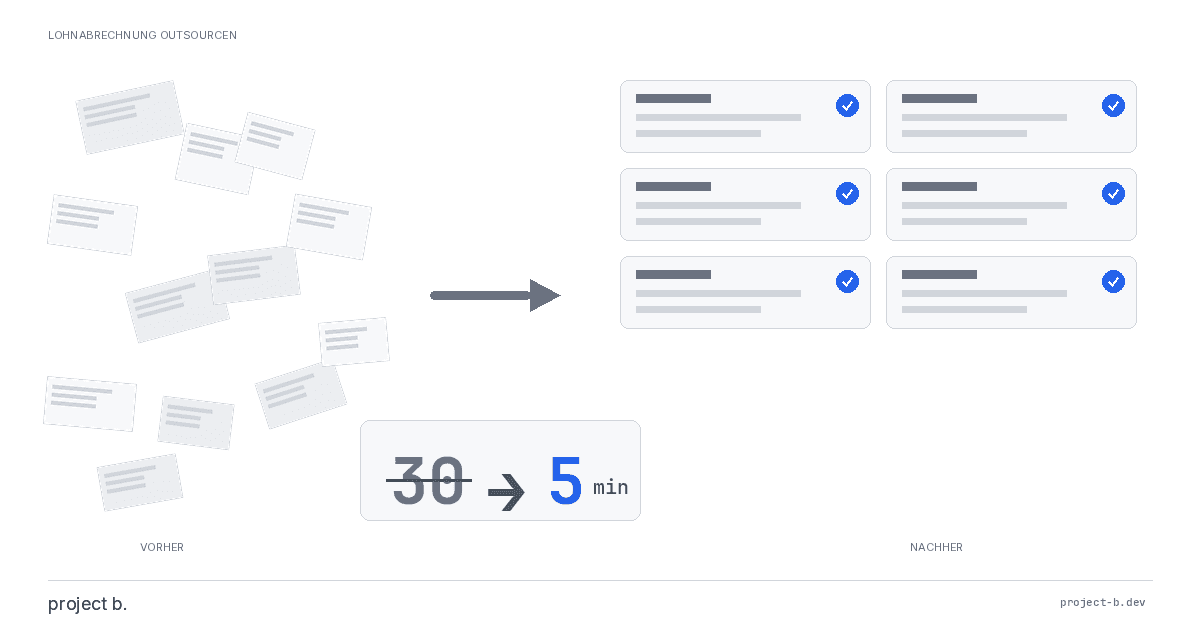

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

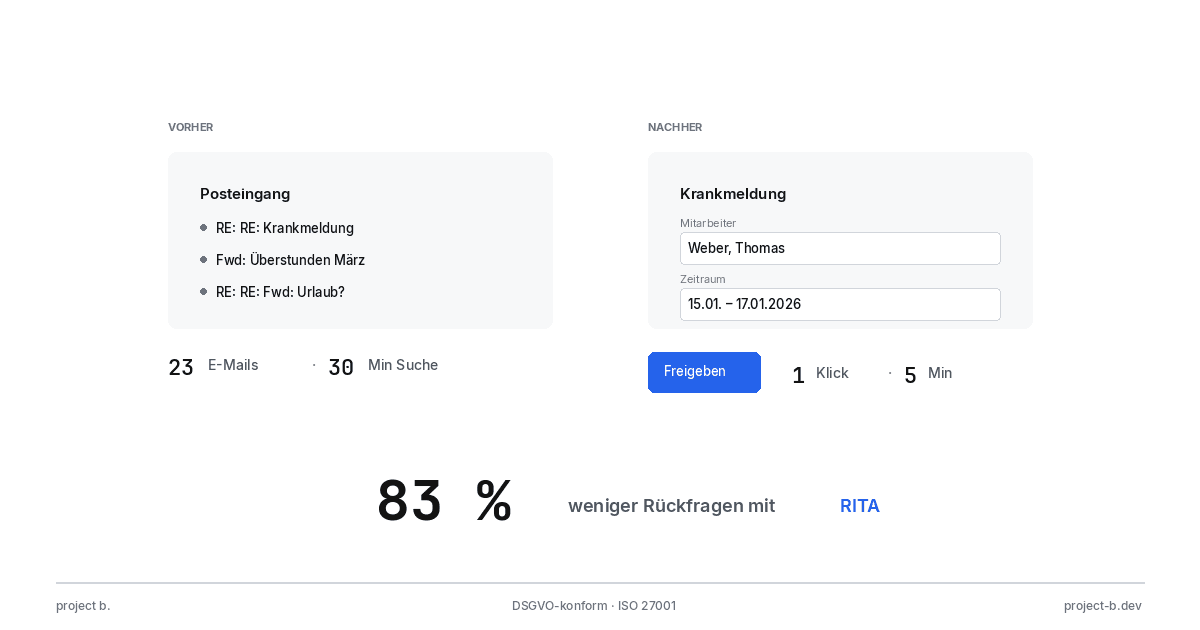

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.