EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Dec 3, 2025

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Introduction

The European Union has established the Salary Transparency Directive as part of its ongoing efforts to promote wage equality and fair working conditions. This significant directive, which must be implemented by June 2026 at the latest, requires companies across the EU to take specific measures regarding salary transparency. The aim of this directive is to reduce discrimination and inequalities in compensation and to create a fairer working environment. In this comprehensive guide, you will learn how to effectively prepare your payroll for these requirements. We will guide you step by step through the process and provide valuable tips and resources to ensure you are well prepared.

Prerequisites

Before you begin implementation, it is important to ensure that you have the necessary knowledge and tools. Here are some basic prerequisites to consider:

Understanding EU Wage Regulations: Familiarize yourself with the specific requirements of the Salary Transparency Directive. This directive is a central part of the EU's efforts to reduce wage inequality and requires companies to disclose and review their compensation practices. A thorough understanding of these requirements is crucial to avoid legal and financial risks.

Ability to Analyze Data: You should be able to effectively analyze salary data to identify inequalities. This requires not only technical knowledge of data analysis tools but also an understanding of which factors can lead to wage differences. Training or workshops on data analysis can be helpful here.

Familiarity with Payroll Software: Modern payroll software can help you automate processes and manage data efficiently. Software solutions often offer reporting and analysis features that are invaluable for implementing the Salary Transparency Directive. You can find more information about automating payroll in our blog.

Communication Skills: Salary transparency also requires effective internal communication. You must be able to communicate the changes clearly and understandably to your employees. This may include training and the development of communication strategies.

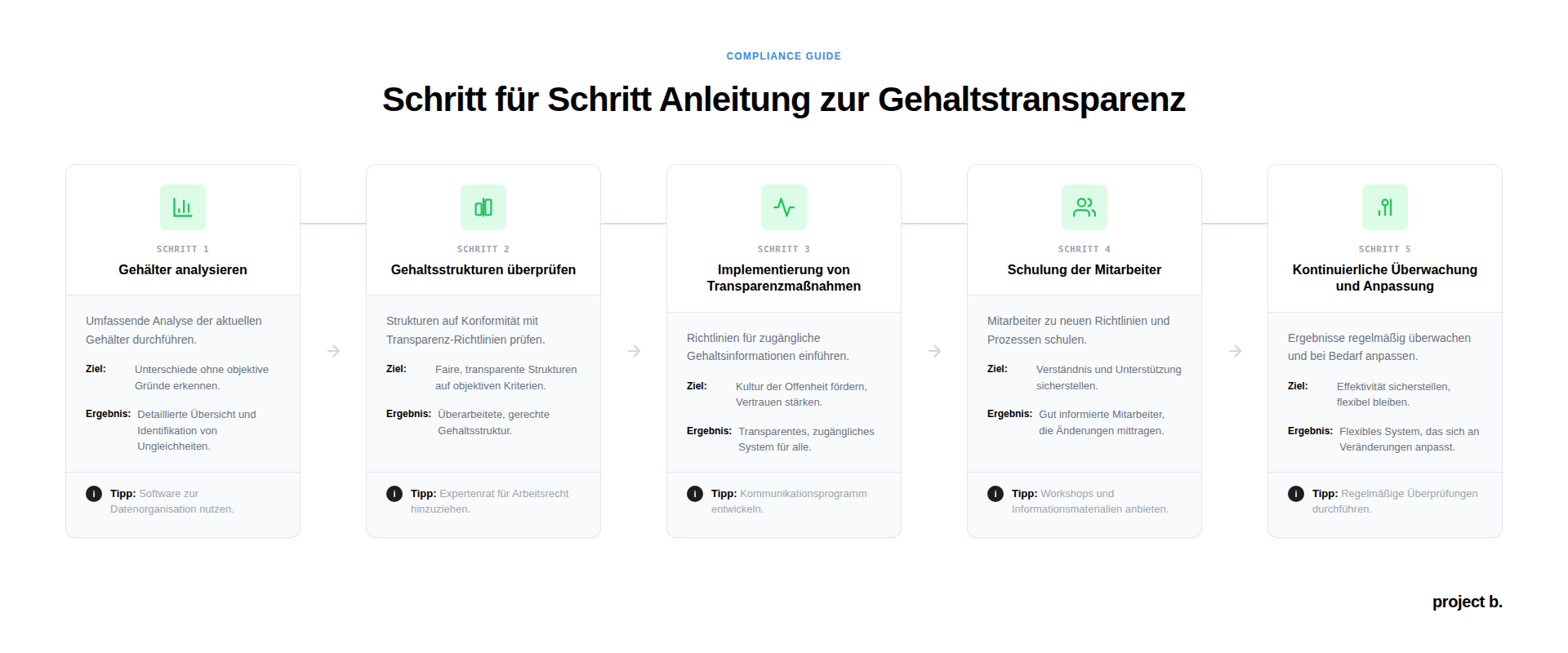

Step-by-Step Guide

Step 1: Analyze Salaries

First, you need to conduct a comprehensive analysis of the current salaries in your company. This analysis serves as the foundation for all subsequent steps and helps you gain a clear picture of the current salary situation.

Aim

The aim of this analysis is to identify salary differences that cannot be justified by objective criteria such as work experience, qualifications, or area of responsibility. Such an analysis can also uncover hidden discrimination that may have gone unnoticed.

Expected Outcome

By the end of this step, you should have a detailed overview of all salaries in your company and know where inequalities might exist. This overview should also highlight possible reasons for salary differences that require further investigation.

Tips

Use a spreadsheet program or specialized software to organize your data. These tools can help you identify patterns and create reports.

Ensure that all data is accurate and up to date. Outdated or incomplete data can lead to erroneous analyses.

Consider external factors such as market developments and economic changes that could affect salary differences.

Step 2: Review Salary Structures

After the analysis, you should review your salary structures to determine if they meet the requirements of the Salary Transparency Directive. A transparent and fair salary structure is crucial for gaining and maintaining employee trust.

Aim

Ensure that salary structures are transparent and based on objective criteria that are understandable to all employees. This helps reduce the risk of discrimination and increase employee satisfaction.

Expected Outcome

A revised salary structure that is fair, transparent, and just. This structure should also be flexible enough to adapt to future changes.

Tips

Consult with an employment law expert to ensure your structures comply with legal requirements. An expert can also help identify best practices that are common in your industry.

Consider how you communicate and document salary decisions. Clear documentation can help avoid misunderstandings and build trust.

Step 3: Implement Transparency Measures

Implement measures to promote transparency in your company. This includes establishing policies and processes that ensure salary information is accessible and understandable to all relevant parties.

Aim

Foster a culture of transparency and openness regarding salaries. Transparency can help strengthen employee trust and increase motivation.

Expected Outcome

A transparent system that is accessible to both employees and management and contributes to creating an open and trusting work environment.

Tips

Develop an internal communication program to inform employees of new policies. Regular updates and open discussions can help clarify questions and address concerns.

Utilize digital platforms to make salary information easily accessible. Intranet portals or specialized apps can be useful here.

Step 4: Train Employees

Train your employees regarding the new transparency policies and processes. This is crucial to ensure all parties understand and support the changes.

Aim

Ensure that all employees are informed and trained on the new policies. Training helps avoid misunderstandings and promotes acceptance of the new measures.

Expected Outcome

Well-informed employees who understand and support the new transparency policies. These employees can also act as ambassadors for the new culture of openness.

Tips

Organize workshops or training sessions to explain the changes to employees. These events also provide an opportunity to clarify questions and gather feedback.

Prepare informational materials that summarize the key points. These materials can serve as references and help disseminate information within the company.

Step 5: Continuous Monitoring and Adaptation

Once you have implemented the measures, it is important to continuously monitor the results and make adjustments as needed. This ongoing monitoring is crucial to ensure the goals of the Salary Transparency Directive are met.

Aim

Ensure that the implementation is effective and improved as needed. Flexibility and adaptability are vital to keep pace with changing requirements and conditions.

Expected Outcome

A flexible system that can adapt to changing circumstances and new insights. This system should be regularly reviewed and updated to ensure it meets current requirements.

Tips

Conduct regular reviews to assess the effectiveness of the measures. These reviews can also help identify and address new challenges.

Use feedback from employees to make improvements. Employee feedback is a valuable resource for assessing the effectiveness of the measures and making necessary adjustments.

Summary / Quick Reference Table

Step | Aim | Expected Outcome |

|---|---|---|

Analyze Salaries | Identify Differences | Overview of Salaries |

Review Salary Structures | Ensure Transparency | Revised Structures |

Implement Transparency Measures | Foster a Culture of Openness | Transparent System |

Train Employees | Ensure Understanding | Informed Employees |

Monitoring and Adaptation | Ensure Effectiveness | Flexible System |

Common Mistakes and Solutions

Mistake 1: Incomplete Data Collection

Solution: Ensure all relevant salary data is collected and updated regularly. Comprehensive data collection is crucial for accurate analysis and evaluation.

Mistake 2: Insufficient Communication

Solution: Develop a clear communication plan to ensure all employees are informed of changes. Open and transparent communication is critical for the success of the implementation.

Mistake 3: No Ongoing Monitoring

Solution: Implement a system for regular review and adjustment of measures. Continuous monitoring allows for early responses to problems and improvements.

Best Practices & Professional Tips

Increase Efficiency: Use software solutions to automate processes and improve efficiency. Automation can help reduce errors and optimize workflows. You can find more about this in our articles on continuous payroll.

Continuous Education: Stay informed about current developments in legislation and engage in continuous learning. This helps you remain up to date and avoid legal risks.

Seek Feedback: Regular feedback from employees can provide valuable insights for improving processes. Employees are often the best sources of information about how changes affect daily work.

Final Checklist

[ ] Analyzed salary data

[ ] Reviewed salary structures

[ ] Implemented transparency measures

[ ] Trained employees

[ ] Set up monitoring system

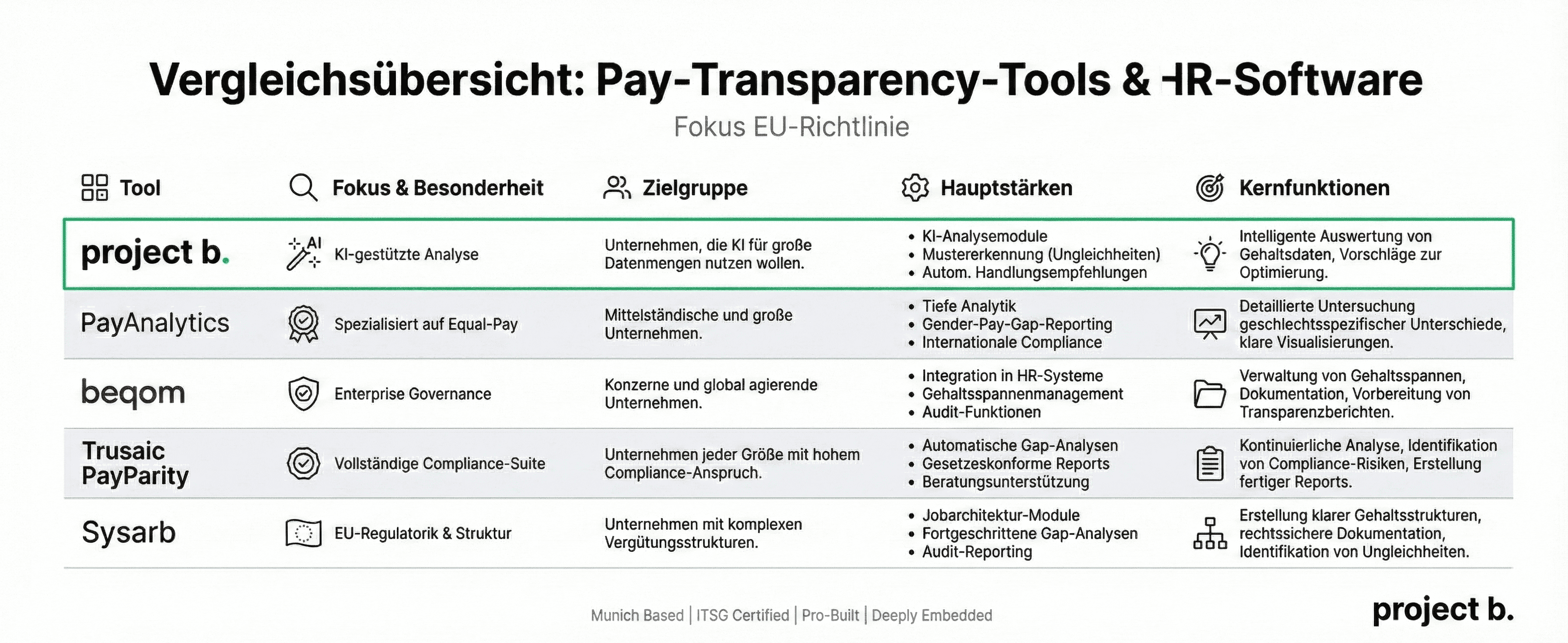

The Best Tools for Implementing the EU Salary Transparency Directive

In implementing the EU Salary Transparency Directive, many companies rely on specialized software solutions that significantly simplify analysis, reporting, and transparency processes. Below is an overview of some of the most relevant tools currently available – including AI-driven solutions, classic equal-pay platforms, and comprehensive HR systems.

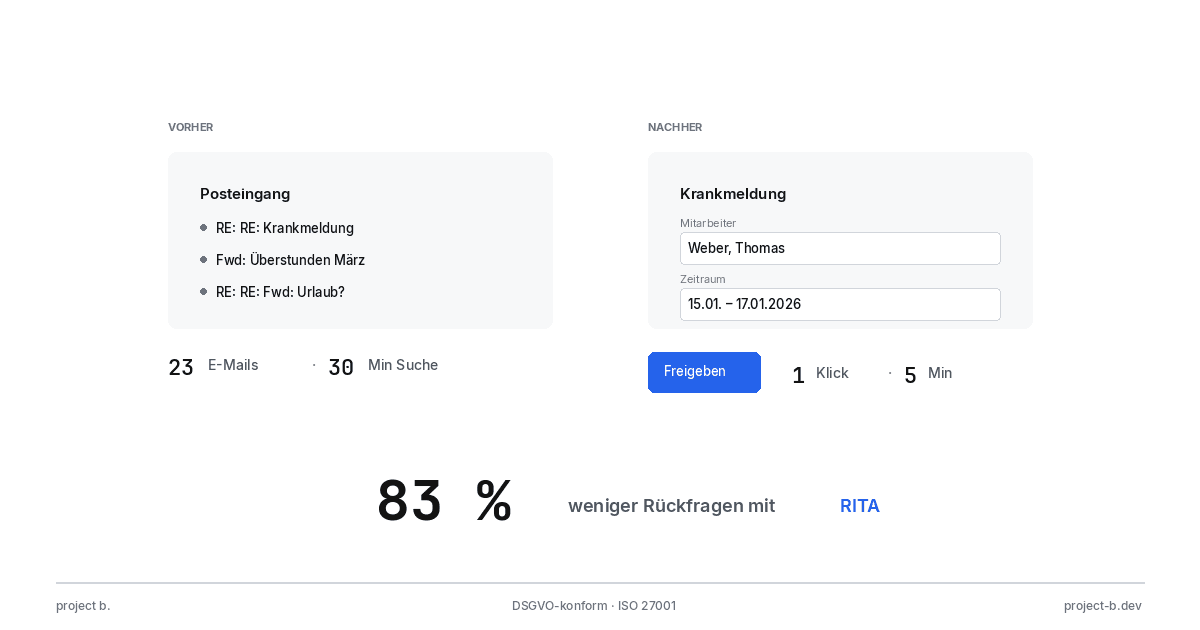

project b.: AI-Powered Salary Analysis for Modern HR Teams

Suitable for: Companies looking to leverage AI for rapid data analysis

Strengths: AI analysis modules, pattern recognition and inequalities, automated recommendations

project b. offers an innovative AI tool that intelligently evaluates salary data and recognizes patterns that may indicate inequalities. The solution is particularly suitable for companies that prefer a modern, automated approach. Through AI-driven analyses, project b. can provide suggestions for optimizing salary structures, thus contributing significantly to compliance with the EU directive.

PayAnalytics: Specialized in Equal-Pay Analyses

Suitable for: Medium and large companies

Strengths: In-depth analytics, gender pay gap reporting, international compliance

PayAnalytics is one of the best-known tools for pay equity analyses. It allows for detailed examination of gender-specific wage differences, offers clear visualizations, and helps companies meet legal requirements in various EU countries.

beqom Pay Transparency: Transparency & Governance at Enterprise Level

Suitable for: Corporations and global companies

Strengths: Integration into existing HR systems, salary range management, audit functions

beqom offers a comprehensive module specifically designed for the EU Salary Transparency Directive. The tool assists companies in managing salary ranges, documenting compensation decisions, and preparing mandatory transparency reports.

Trusaic PayParity: Complete EU Compliance in a Suite

Suitable for: Companies of all sizes with high compliance demands

Strengths: Automatic gap analyses, legally compliant reports, consulting support

With PayParity, Trusaic offers a solution specifically tailored to regulatory requirements. The platform continuously analyzes salary data, identifies compliance risks, and generates ready-made reports that cover all EU requirements.

Sysarb: Equal-Pay Platform Focused on EU Regulations

Suitable for: Companies with complex compensation structures

Strengths: Job architecture modules, advanced gap analyses, audit reporting

Sysarb is among the most advanced equal-pay platforms in Europe. It helps companies create a clear salary structure, identify wage inequalities, and document evidence that is legally secure.

Summary & Next Steps

By successfully implementing the Salary Transparency Directive, you are making a significant contribution to promoting wage equality and fairness in your company. You have completed the steps to analyze, revise, and implement transparency measures. Next, you should consider continuous education and adaptation of your processes to always meet current requirements. For further information and support, you can contact our professional payroll department.

Sources

Salary Transparency in the EU - European Council

project b. - AI-Powered Salary Analysis

PayAnalytics - Specialized in Equal-Pay Analyses

beqom Pay - Transparency & Governance at Enterprise Level

Trusaic PayParity - Complete EU Compliance in a Suite

Sysarb - Equal-Pay Platform Focused on EU Regulations

Which tools help payroll departments with salary transparency?

There are various tools such as project b., PayAnalytics, beqom, Trusaic, and Sysarb that assist companies in analyzing salary data, creating legally compliant reports, and monitoring gender pay gaps.

Which tools help with salary transparency?

AI-based tools like project b. automatically analyze large salary datasets, identify inequalities, and provide concrete recommendations for action. This makes compliance with the EU directive faster, more precise, and more efficient.

Why use software instead of manual analysis?

Digital solutions automate evaluations, minimize errors, enable rapid reporting, and provide deeper insights into compensation structures. They thereby facilitate the sustainable implementation of EU regulations.

Finn R.

Further articles

Feb 9, 2026

·

Payment

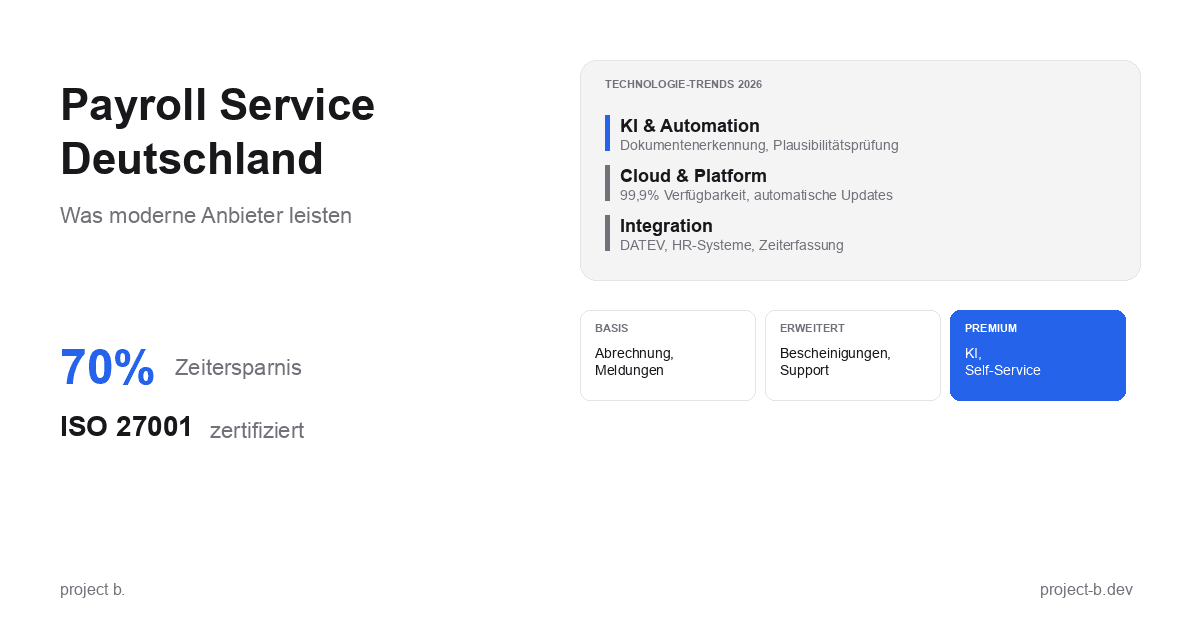

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

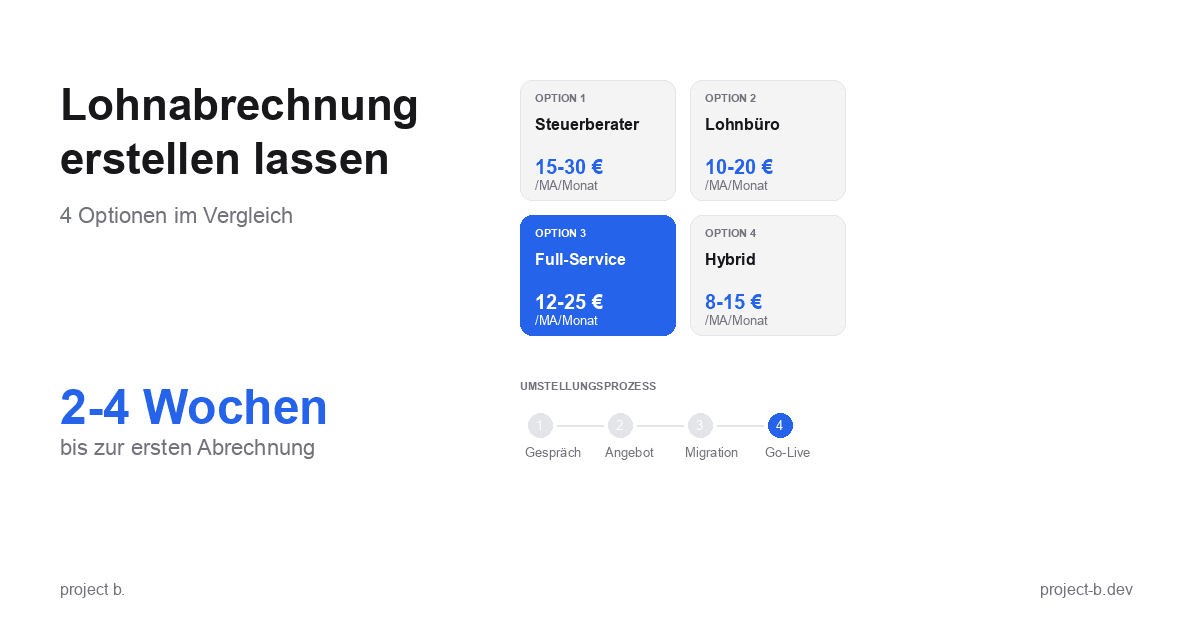

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

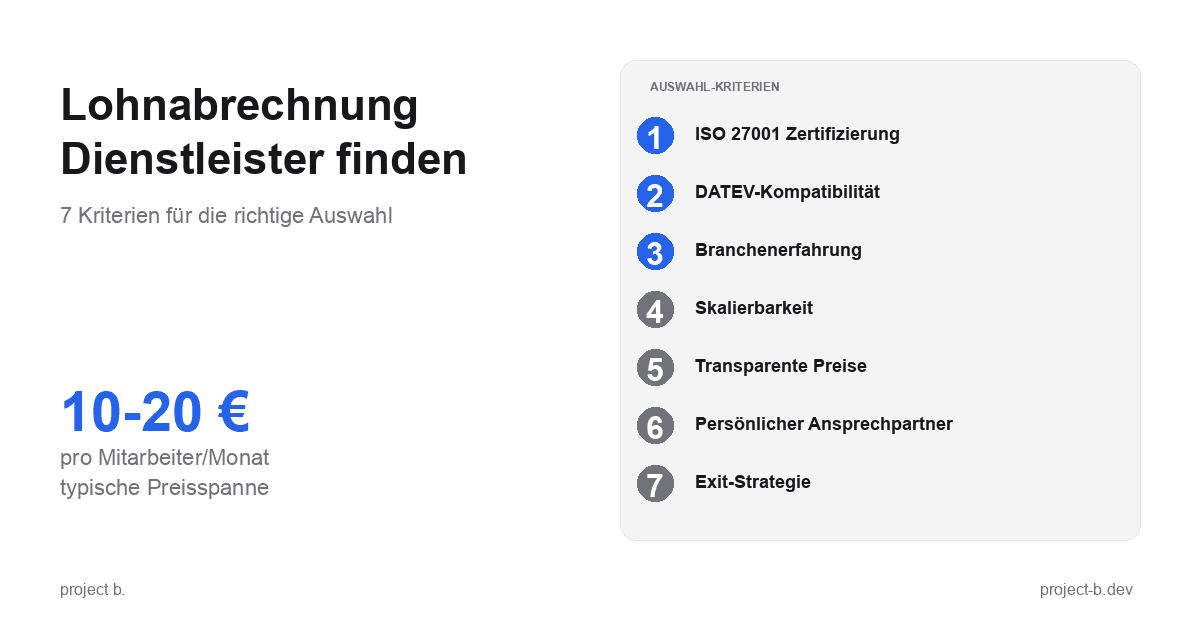

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

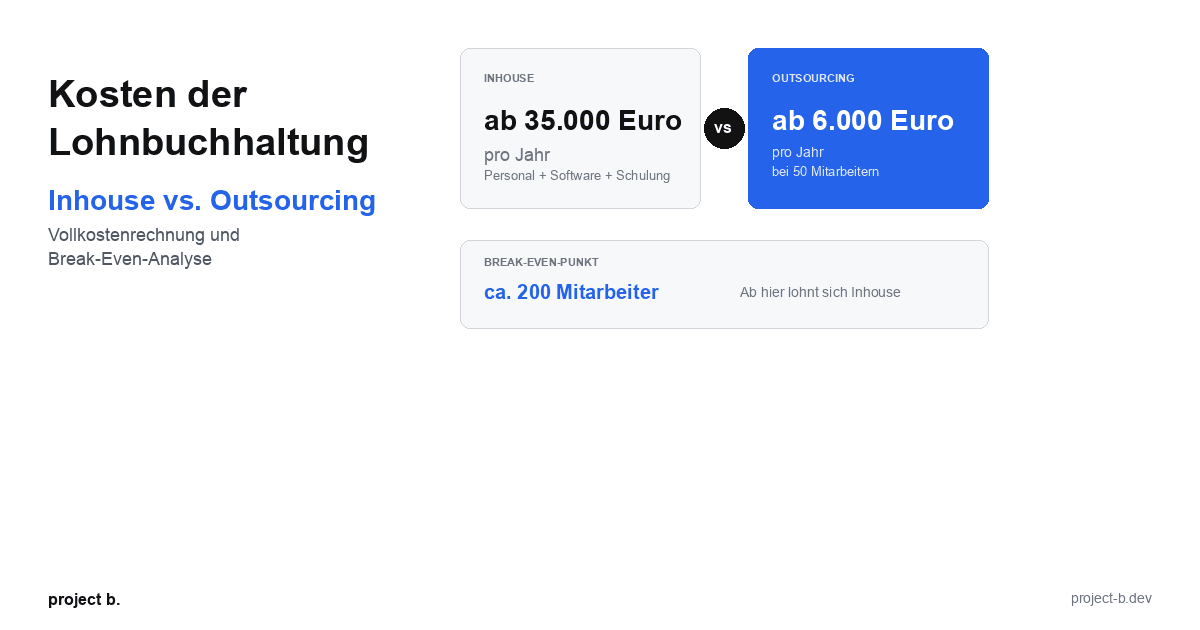

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

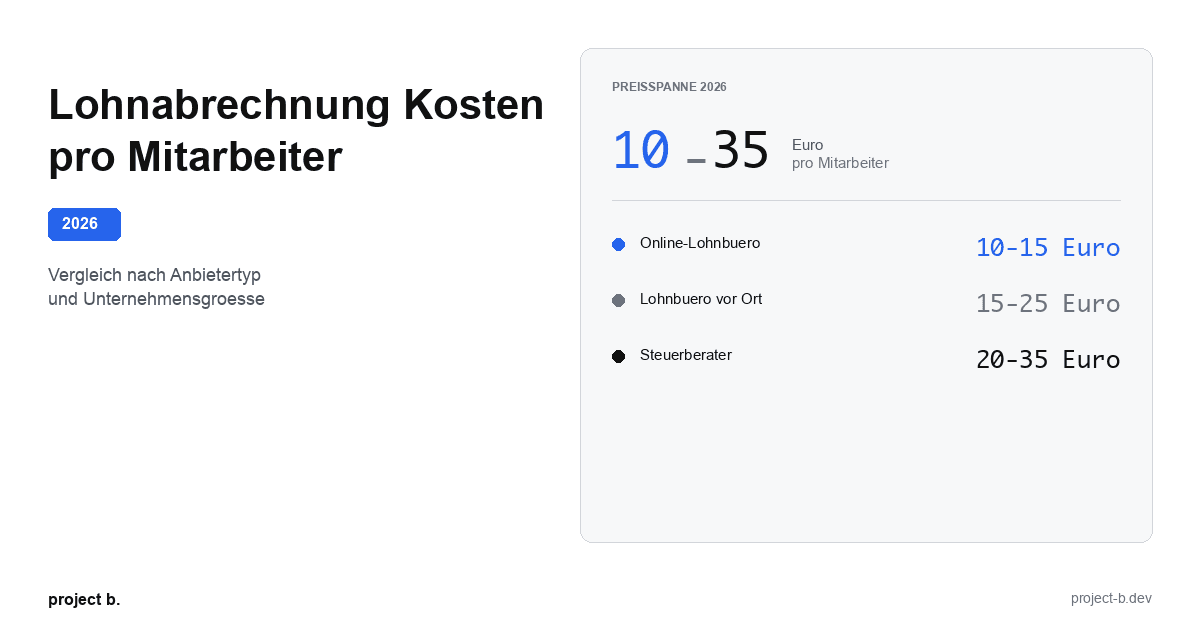

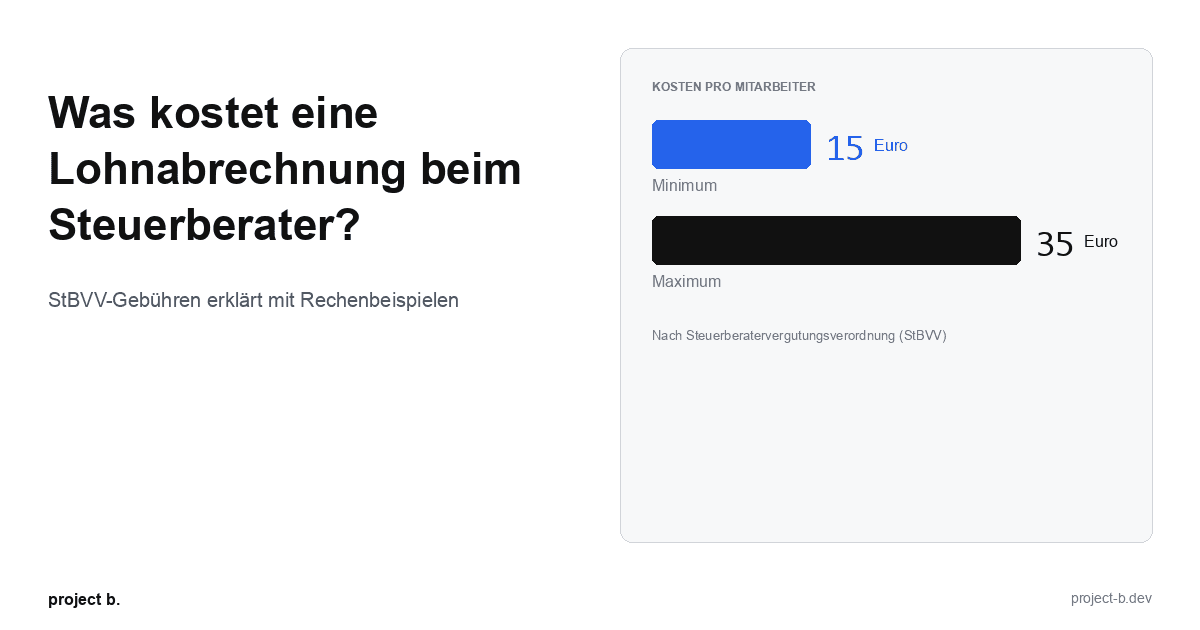

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

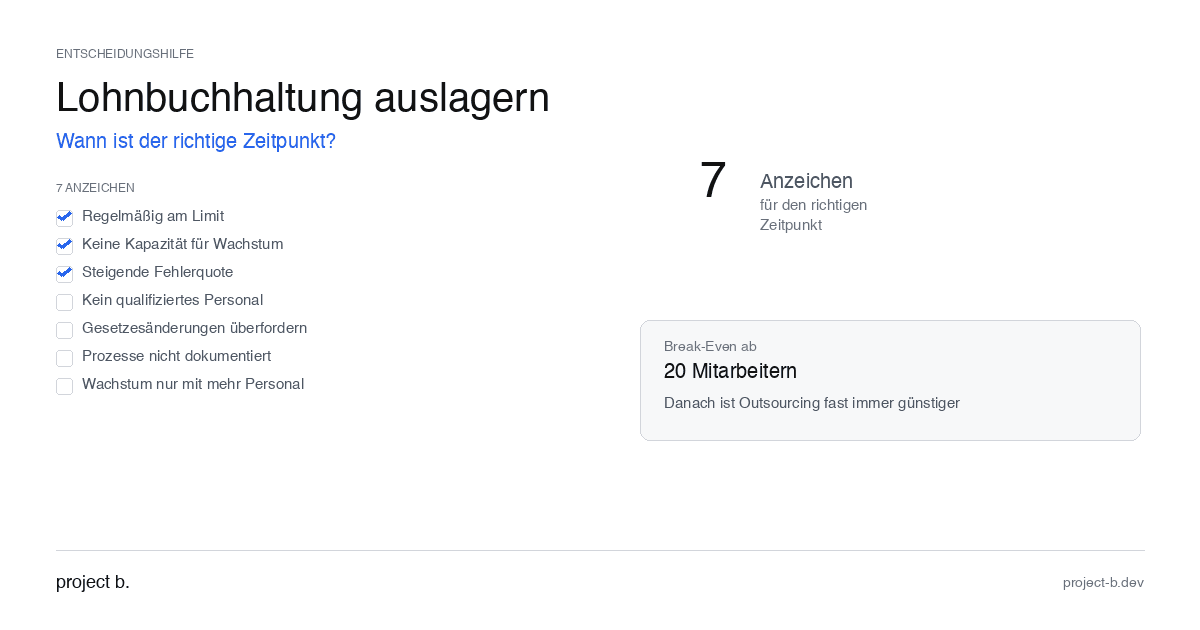

Jan 30, 2026

·

Outsourcing

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

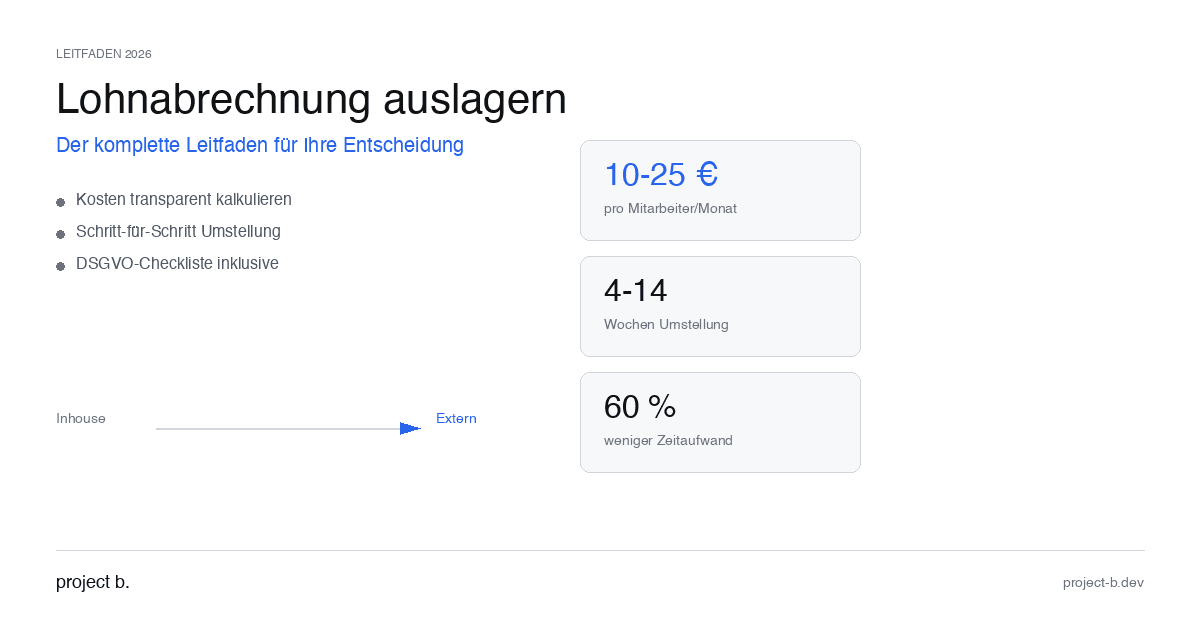

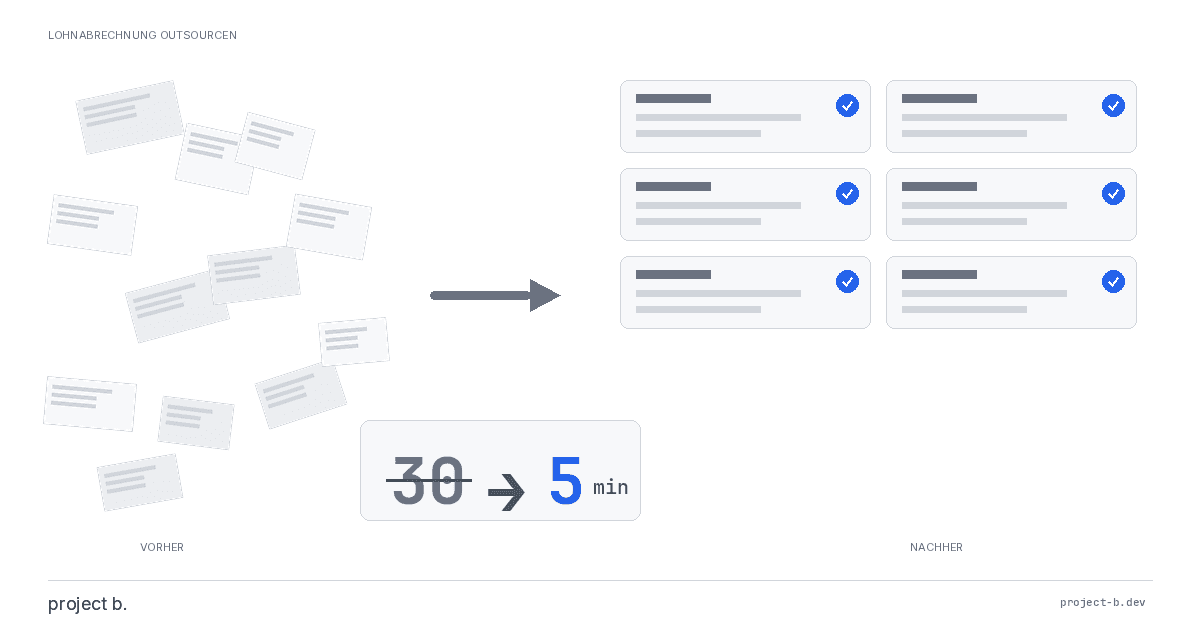

Jan 28, 2026

·

Outsourcing

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

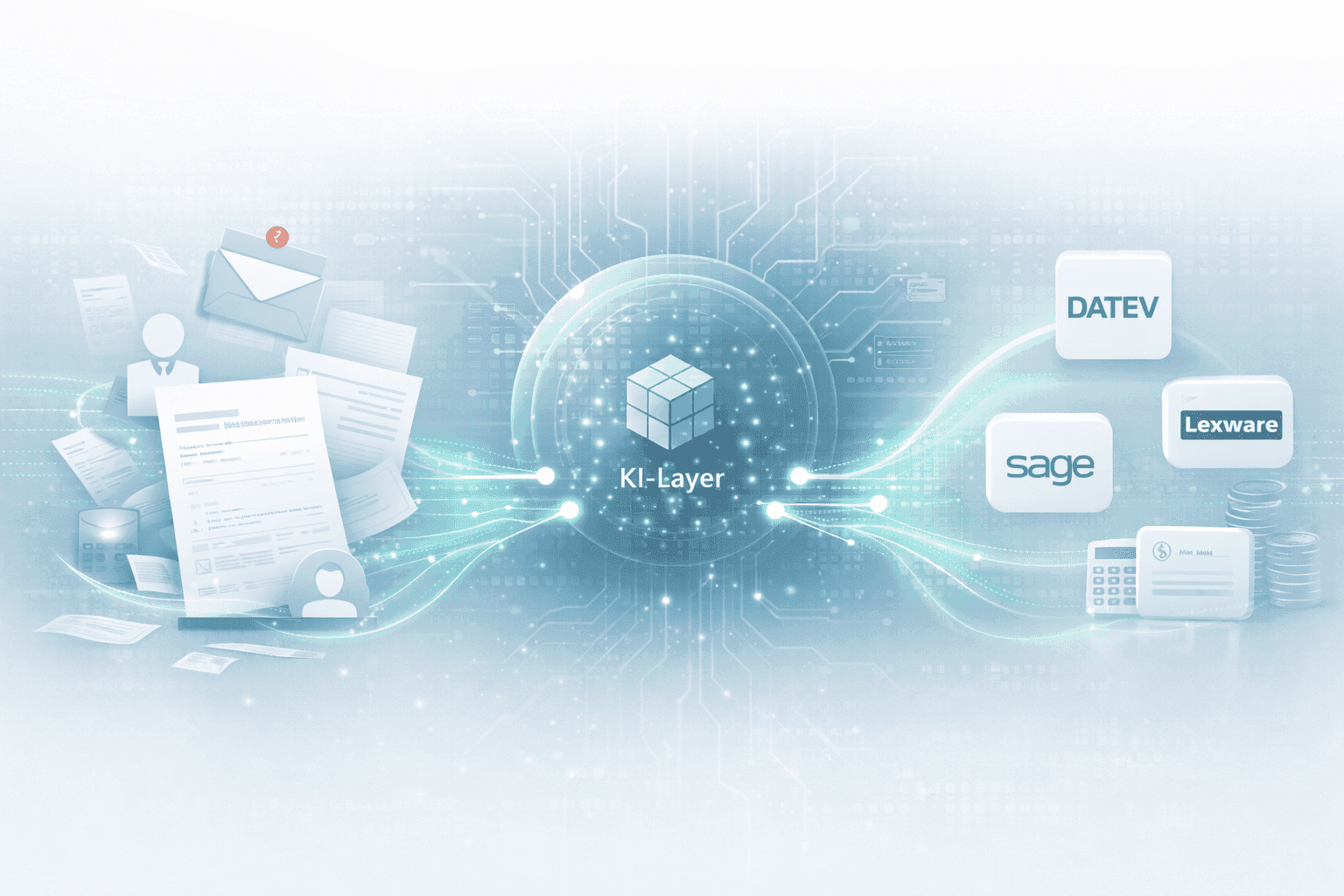

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.