How companies automate payroll accounting with Rita

Dec 10, 2025

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

How Companies Automate Payroll Accounting with Rita

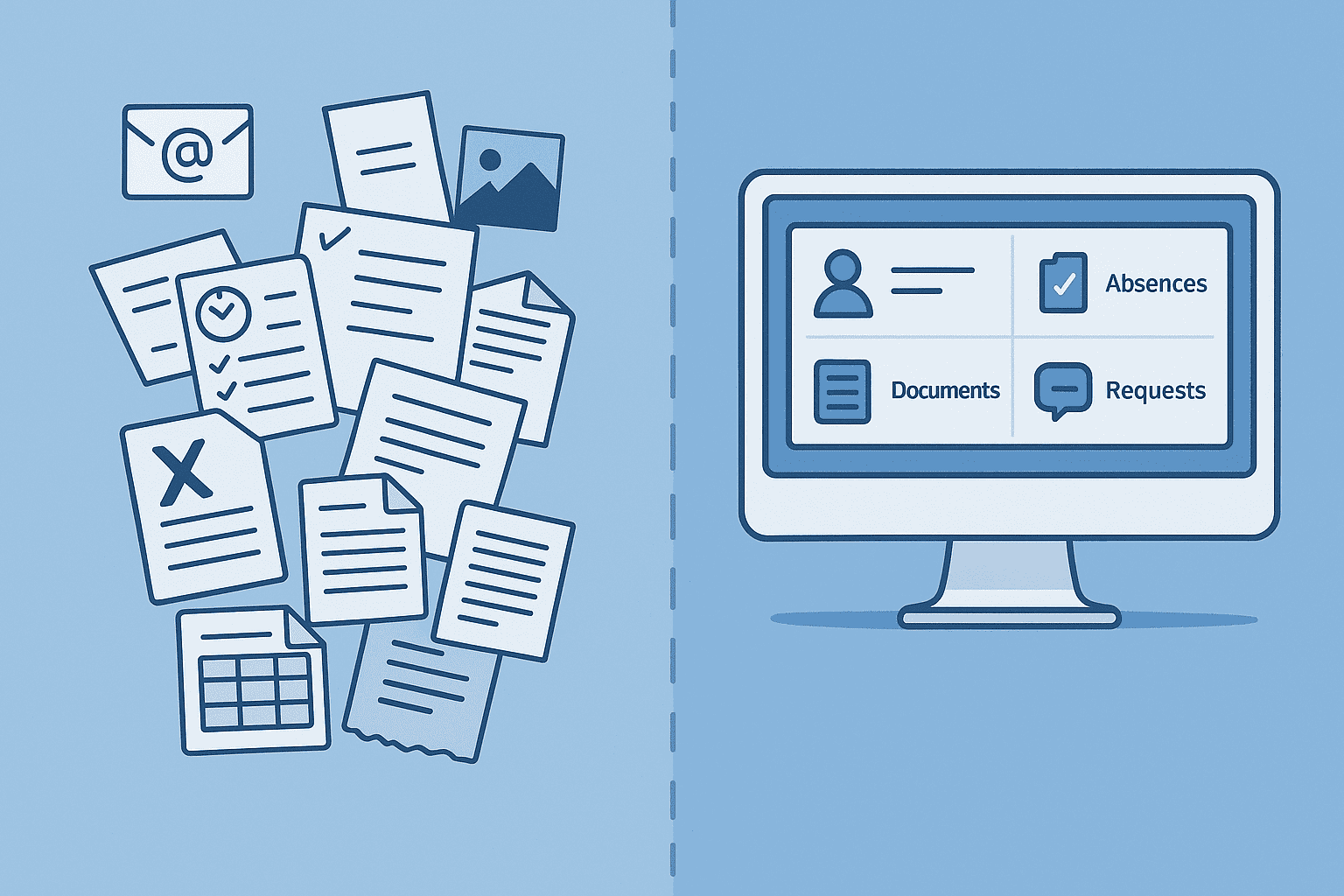

Anyone working in a payroll office or a tax consultancy knows the scene: The desk is overflowing with sick notes, Excel sheets, and emails with payroll data. The client has once again sent the overtime as a photo from the timesheet. The colleague next door is already typing the third correction of the day because someone has transmitted a bank account incorrectly.

The preliminary payroll accounting consumes time. It is not the actual accounting that causes the effort, but rather the gathering, checking, and structuring of the data beforehand. This is exactly where Rita comes in.

What is Rita and what does she do differently?

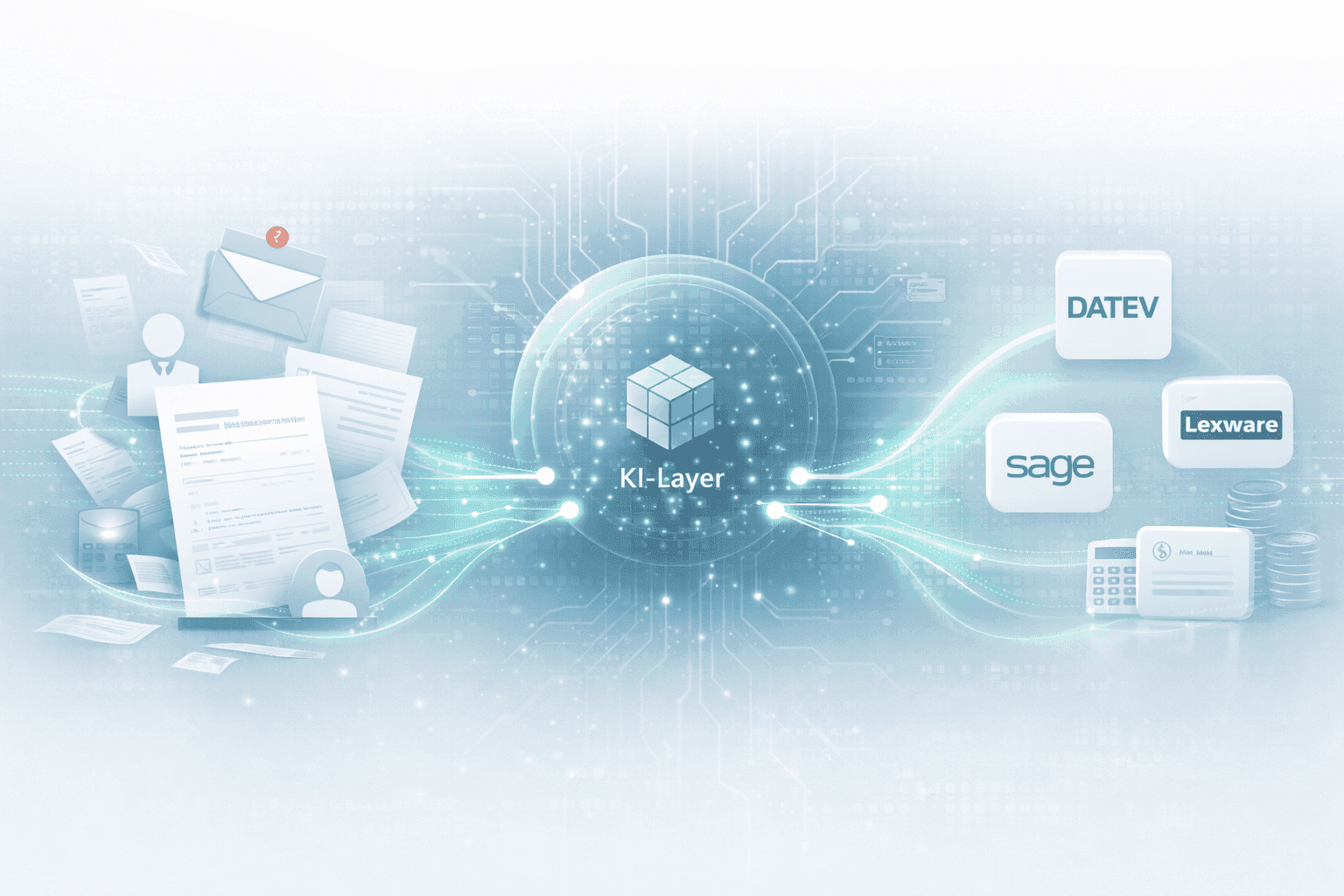

Rita is the AI assistant from project b., a Munich-based startup founded in 2023 by experienced payroll professionals. Unlike traditional payroll software, Rita does not replace DATEV, Agenda, or Lexware. She works as an intelligent layer beforehand.

The principle: Clients still send their payroll data via email, upload, or portal. Rita recognizes what is in the documents, structures the information, and prepares everything for payroll processing. Only when a staff member releases the data does it flow into the payroll system.

Rita's core functions at a glance

Function | What Rita does | What you gain from it |

Document recognition | Scans PDFs, photos, emails via OCR | No more manual typing |

Data extraction | Recognizes sick notes, overtime, changes to employee data | Automatic assignment to employees |

Plausibility check | Marks inconsistencies and missing information | Errors are detected before the accounting |

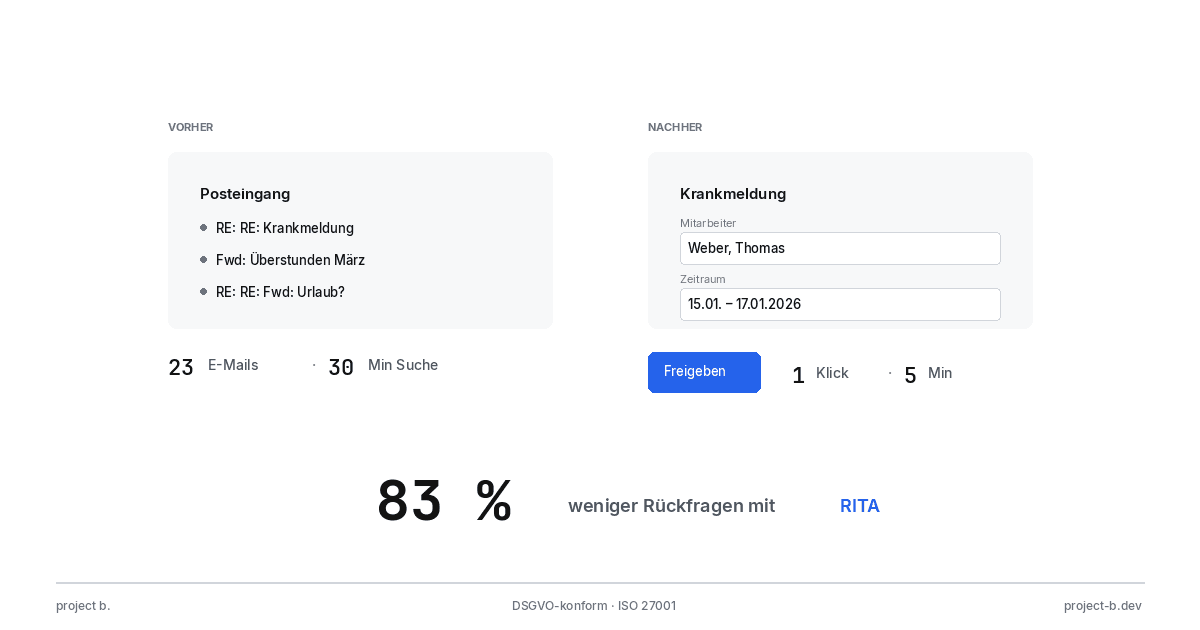

Inquiry management | Bundles open issues in the client portal | Less email back-and-forth |

System integration | Transfers released data to DATEV, Agenda, SBS | No media breaks |

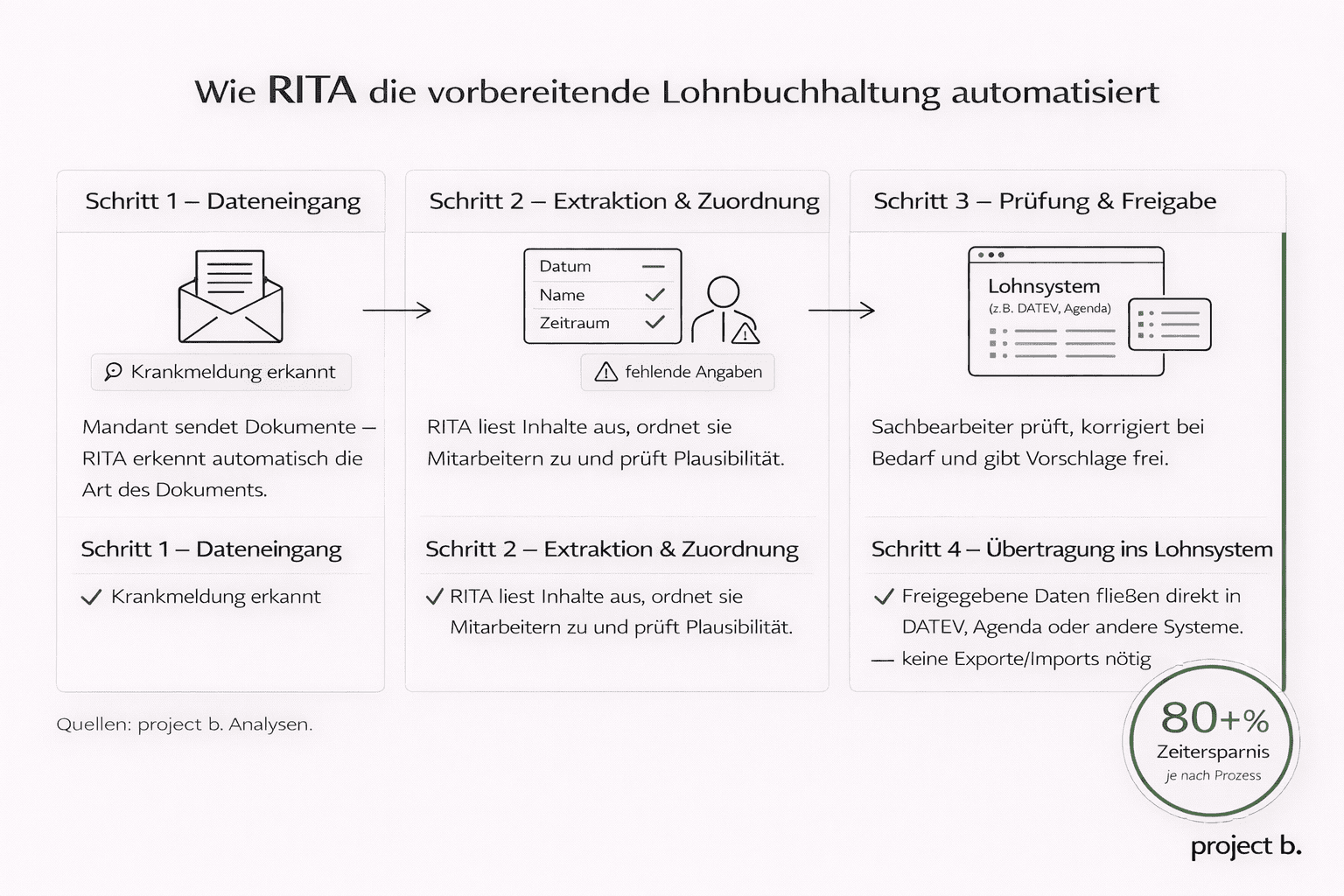

The typical process: From email to completed preliminary entry

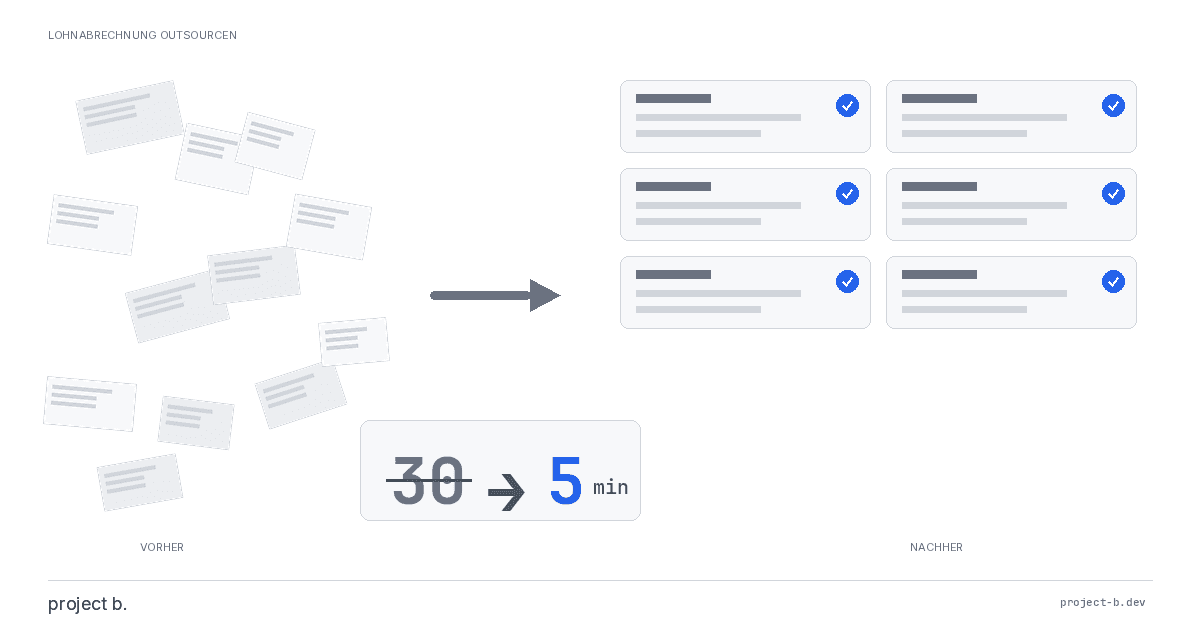

An example from practice: A nursing service with 80 employees sends about 200 documents to its tax consultancy each month. Sick notes, vacation requests, overtime lists, new hires. Previously, the responsible staff member took three days to record and check everything.

With Rita, the process looks like this:

Step 1: Data entry: The client uploads their documents or sends them via email. Rita automatically recognizes the type of document.

Step 2: Extraction and assignment: A sick note is scanned. Rita reads the date, the period, and the employee's name. She assigns the document to the correct employee records and checks whether the data is plausible.

Step 3: Review and release: The staff member sees all the prepared changes in the cockpit. Green marked: complete and plausible. Yellow: inquiries needed. They review, correct if necessary, and release.

Step 4: Transfer: The released data flows directly into DATEV LODAS. No export, no import, no intermediate step.

The result: The three days have been reduced to half a day.

What tasks of preliminary payroll accounting does Rita take over?

Preliminary payroll accounting includes all activities that must be completed before the actual payroll run.

Maintaining master data

Creating new employees, recording address changes, updating bank account information. Rita recognizes these changes in incoming documents and suggests the corresponding adjustments. When a new bank account is added, she automatically checks the IBAN format. When there is an address change, she matches the postal code with the city.

A logistics company with 500 employees processes around 50 master data changes each month. Before Rita: 4 hours of effort. With Rita: 30 minutes for review and release.

Absence management

Vacation, illness, parental leave, training. Each type of absence affects payroll processing differently. Rita automatically categorizes absences based on the submitted documents and the employee's historical patterns.

Particularly valuable: Rita recognizes when continued pay during illness is expiring and the transition to sick pay is imminent. She warns in time before it is too late.

Time recording check

Time sheets, shift plans, project time recordings. Rita checks the reported hours against the required hours and marks anomalies: missing clock-ins, unrealistically long working hours without breaks, deviations from the usual pattern.

For a nursing service with shift work, the automatic detection of shift allowance errors alone saves 8 hours per month. Night shifts that were not marked as such are immediately noticeable.

Document processing

Sick notes, certificates, employment contracts, terminations. Rita scans incoming documents via OCR, extracts the relevant data, and stores them in the digital personnel file. The recognition rate is between 85 and 95 percent for well-trained systems.

Why control remains with humans

A question that regularly arises in discussions with payroll offices: What happens if the AI makes a mistake?

The response from project b. is clear: Rita makes suggestions, but the decision is always made by a human. This is not marketing jargon, but technical reality. Every change must be approved before it flows into the payroll system.

This principle has several reasons:

Legal responsibility: The employer is liable for errors in payroll accounting, not the software.

Professional requirements: Tax consultants are subject to special duties of care.

Client trust: Clients expect that a professional checks their accounting.

Integration into existing systems

A common obstacle with new software: The fear of a large transition. New training, data migration, weeks of onboarding. With Rita, that is eliminated.

Supported payroll systems

DATEV LODAS

DATEV Payroll

Agenda Payroll

SBS Payroll

Other systems available upon request

The integration works via standardized interfaces. Released changes are transferred directly. The existing payroll system remains as it is. The processes beforehand become more efficient.

Who benefits from Rita?

Tax consultancies with payroll clients

Firms that manage 20 or more payroll clients benefit the most. The effort for preliminary entry scales with the number of clients. The more diverse the clients, the greater the effect.

Payroll offices and accounting service providers

For specialized payroll offices, efficiency is vital. Margins are tight, and competition is fierce. Those who work faster can serve more clients or deliver higher quality.

Companies with internal payroll departments

Even companies that handle their payroll accounting themselves can use Rita. Especially in decentralized structures, the central data collection significantly simplifies the process.

Time savings in numbers

Activity | Effort before | Effort with Rita | Saved |

Maintaining master data (50 changes/month) | 4 hours | 30 minutes | 88% |

Document capture (200 documents/month) | 3 days | 4 hours | 83% |

Time recording check (12,000 bookings/month) | 3 days | 4 hours | 83% |

Inquiry management (120 emails/week) | 10 hours | 2 hours | 80% |

The figures come from the experience of project b. and may vary depending on the starting situation.

FAQ: Frequently Asked Questions About Automating Payroll Accounting

Can payroll processing be fully automated?

Technically, full automation is not yet possible. German payroll accounting is complex: collective agreements, allowances, special cases, regional peculiarities. Rita automates the preliminary entry and data validation. The actual accounting and final review remain with humans.

What is done in preliminary payroll accounting?

Preliminary payroll accounting encompasses all activities before the payroll run: recording working hours, maintaining master data, processing sick notes and vacation requests, checking for completeness and plausibility. These tasks are exactly what Rita handles.

How does outsourcing payroll accounting with Rita work?

Rita does not replace outsourcing but complements it. If you outsource payroll accounting to a tax consultant or payroll office, you can use Rita to simplify data transfer. Your service provider benefits from structured, verified data instead of email chaos.

Which program is best for payroll accounting?

It depends on your situation. DATEV is the standard in tax consultancies. Agenda and Lexware are alternatives for smaller firms or companies. Rita works as a front-end system and can be combined with all common programs.

What are the costs for automation?

The costs vary depending on the number of clients and the range of functions. The key factor is the time saved: If Rita saves you 20 hours per month and your staff hour costs 40 euros, the investment is worthwhile from a savings of 800 euros monthly.

Conclusion: Less data chaos, more consulting time

Payroll accounting will not disappear. But the way it is done is changing. Rita takes over the tedious tasks: scanning documents, extracting data, finding errors, bundling inquiries. What remains is the professional review and consulting.

For payroll offices and tax consultancies, this means: More clients with the same team. Or more time for clients with complex questions. For staff members, it means: Timely finishing work, even in payroll week.

Project b. developed Rita together with practitioners. You can tell. The software thinks in accounting cycles, not in features. It knows the pitfalls of German payroll accounting. And it understands that in the end, a human bears the responsibility.

Sources and further links

project b.: https://project-b.dev

DATEV: https://www.datev.de

Federal Chamber of Tax Consultants: https://www.bstbk.de

How does the outsourcing of payroll accounting work with Rita?

Rita does not replace outsourcing, but rather complements it. If you outsource payroll to a tax consultant or payroll office, you can use Rita to simplify data transmission. Your service provider benefits from structured, verified data instead of email chaos.

Which program is best for payroll accounting?

This depends on your situation. DATEV is the standard in tax consulting firms. Agenda and Lexware are alternatives for smaller firms or companies. Rita works as a preliminary system and can be combined with all common programs.

What are the costs for automating payroll?

The costs vary depending on the number of clients and the scope of functions. The crucial factor is the time saved: If Rita saves you 20 hours per month and your staff member's hourly rate is 40 euros, the investment pays off with a savings of 800 euros per month.

Aaron H.

Further articles

Feb 9, 2026

·

Payment

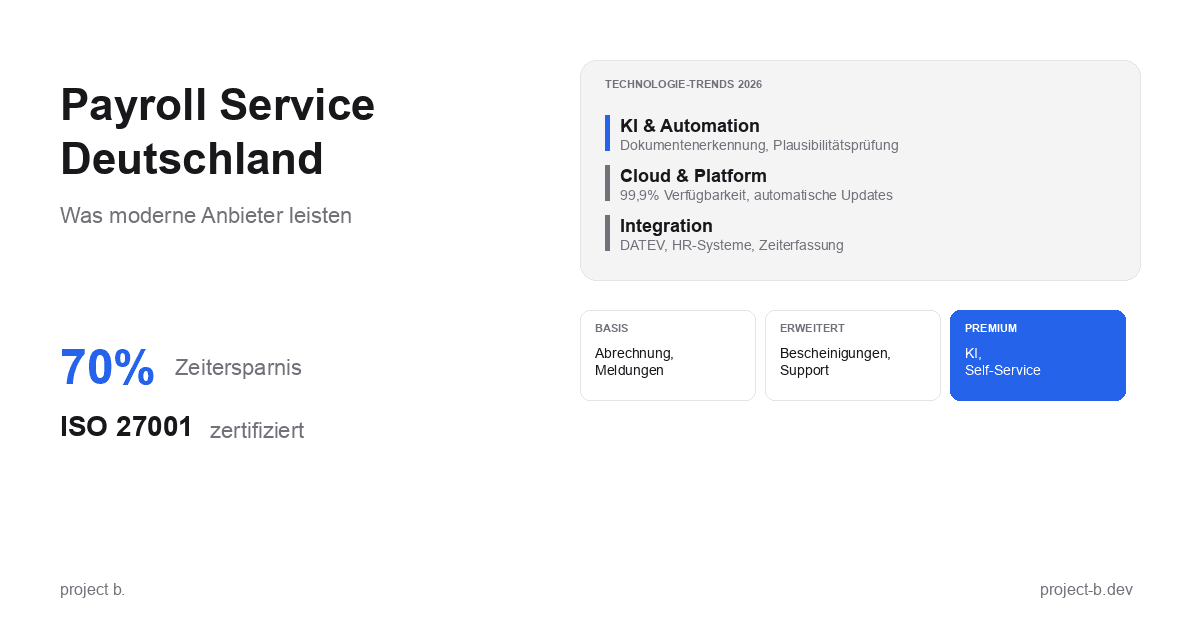

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

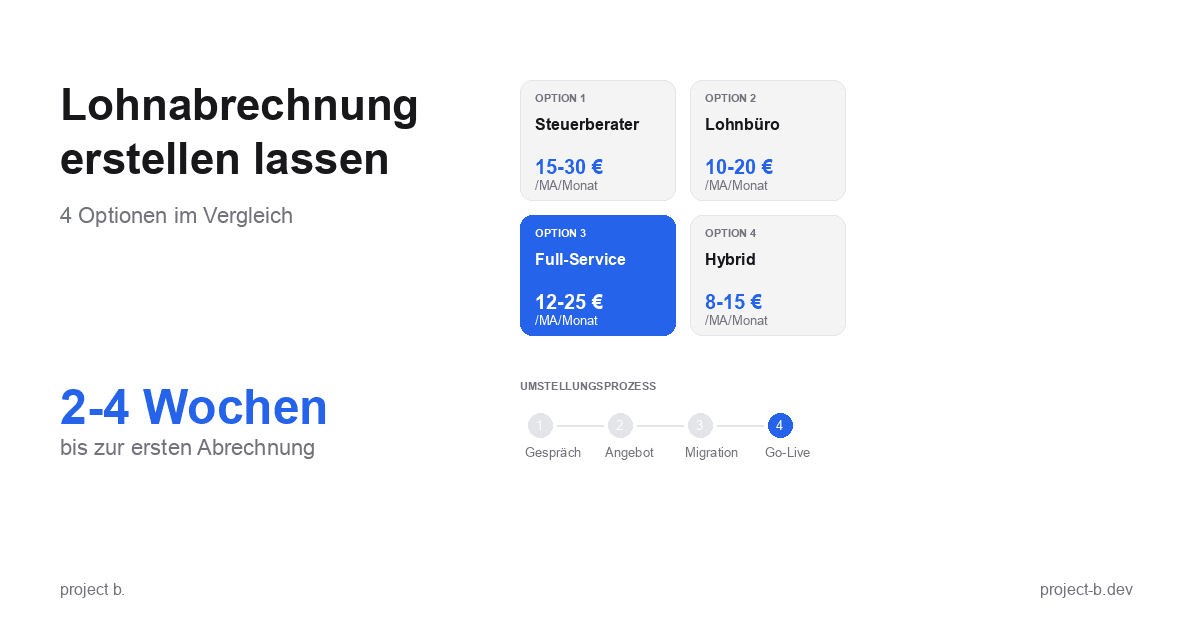

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

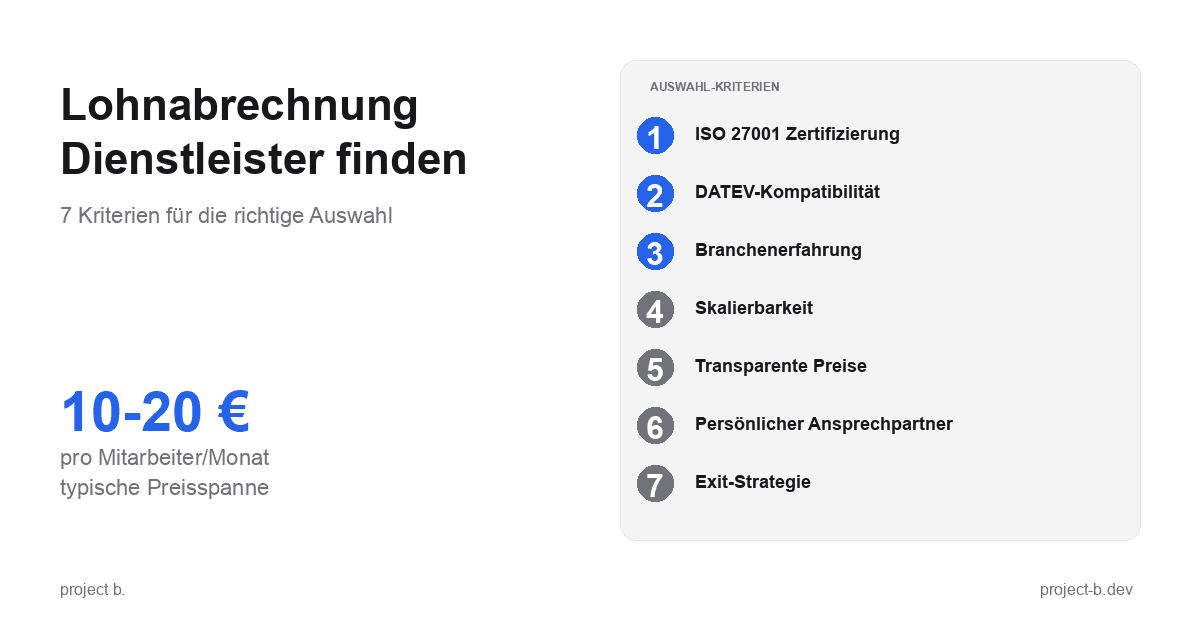

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

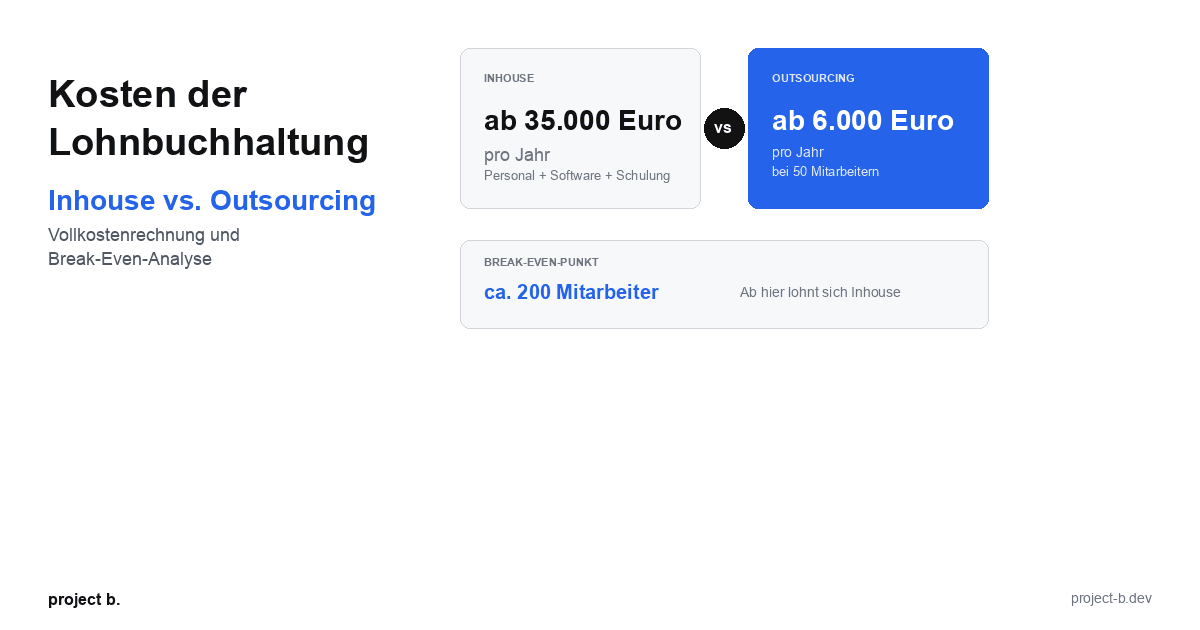

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

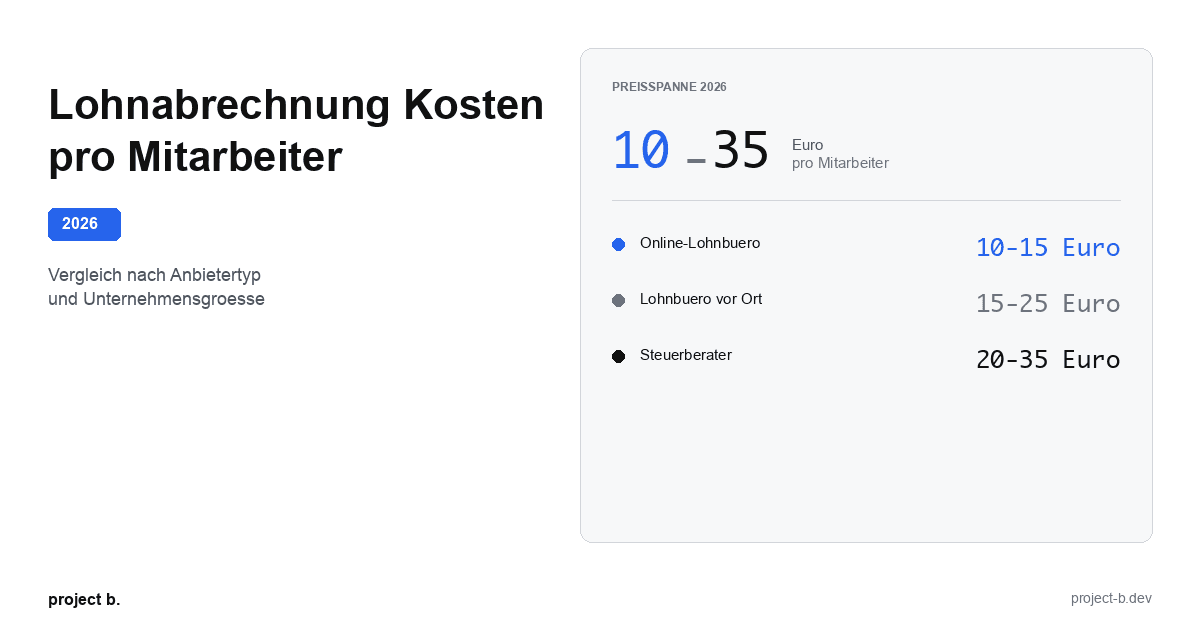

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

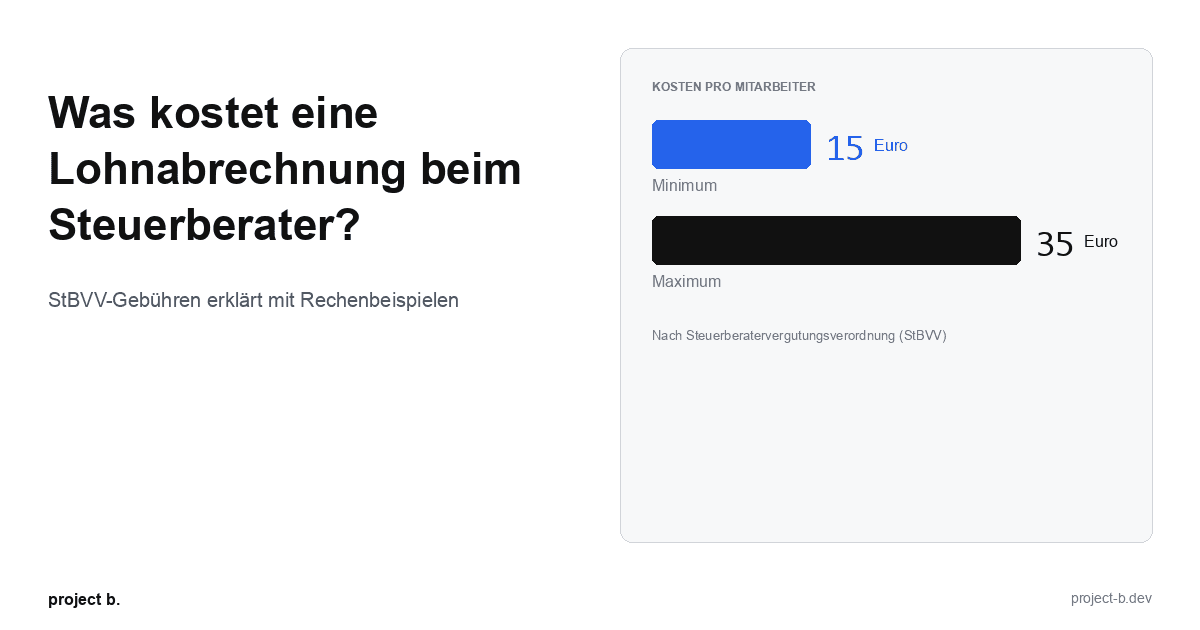

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

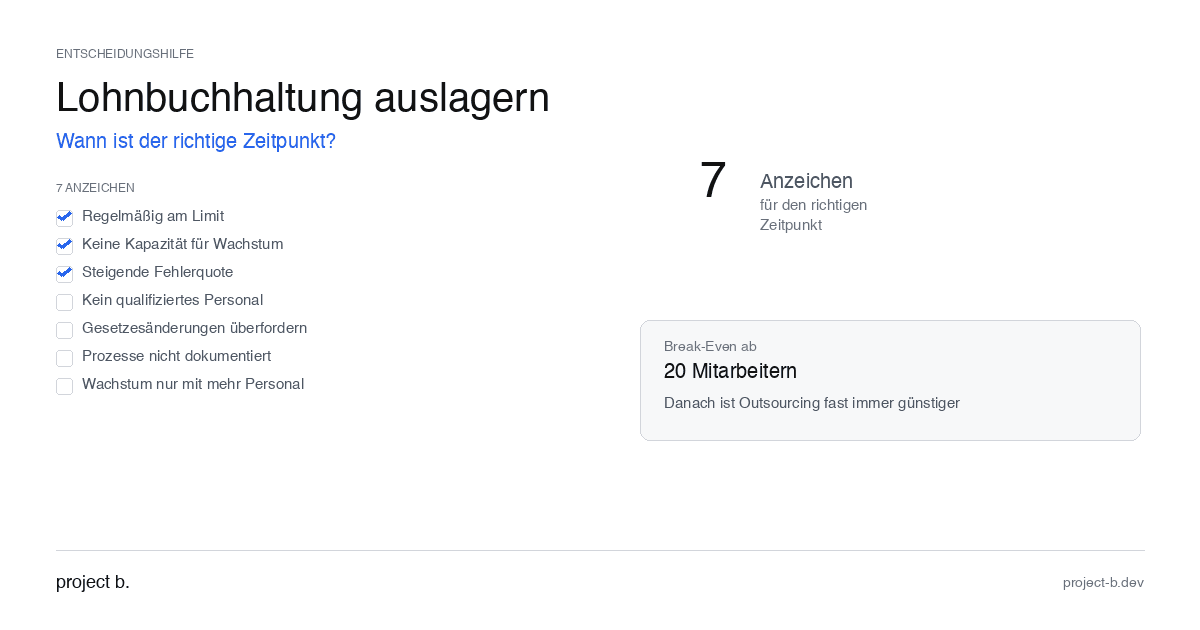

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

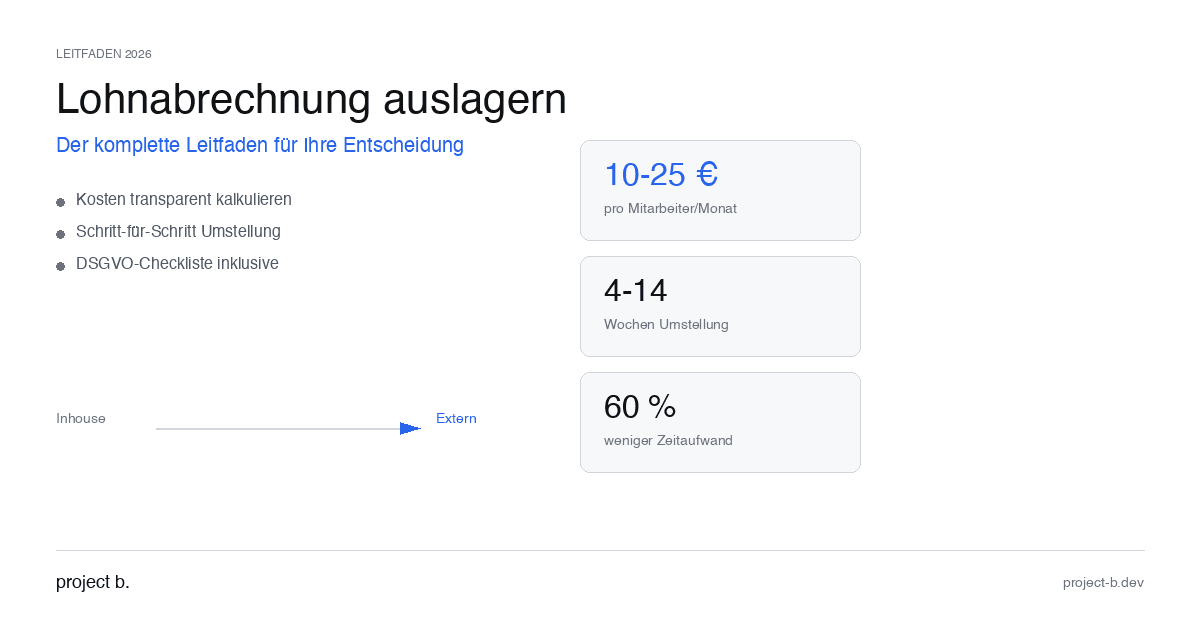

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.