RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

Nov 27, 2025

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

The digitalization of payroll is at a crossroads. Just a few years ago, Excel spreadsheets and manual data entry dominated the daily routine, but today RPA systems and AI solutions promise a revolution. However, there is often a huge gap between marketing promises and technical reality. This comparison shows where Robotic Process Automation (RPA) truly makes sense and when artificial intelligence is the better choice.

1. The Basics: What RPA and AI Can Really Do

1.1 RPA in Practice: Digital Robots at Work

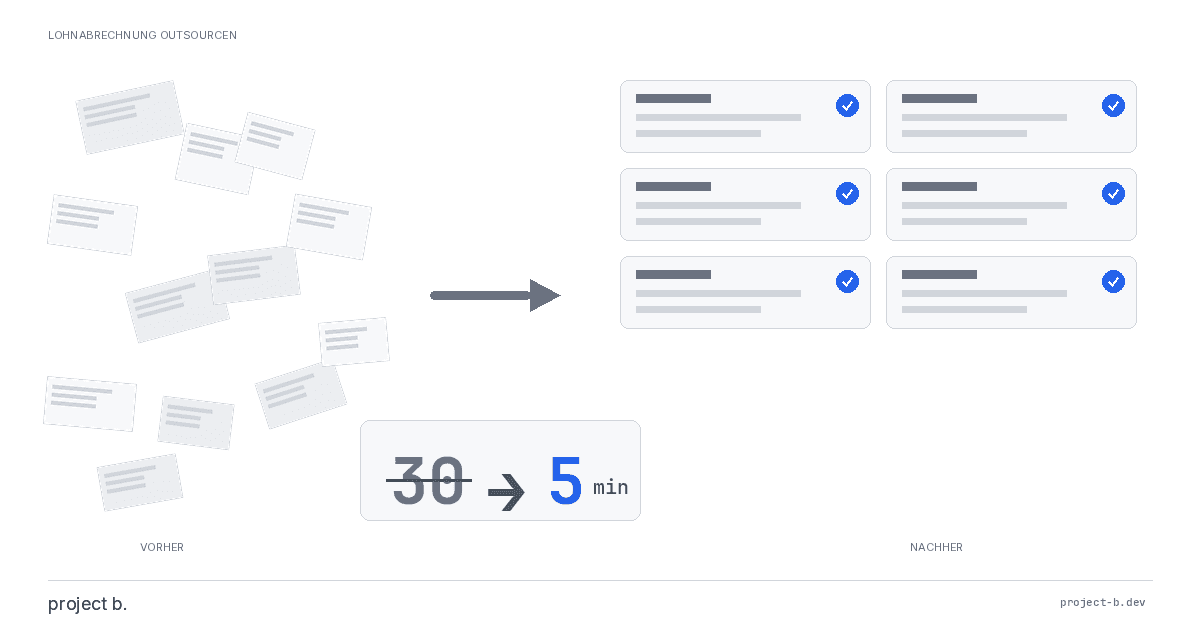

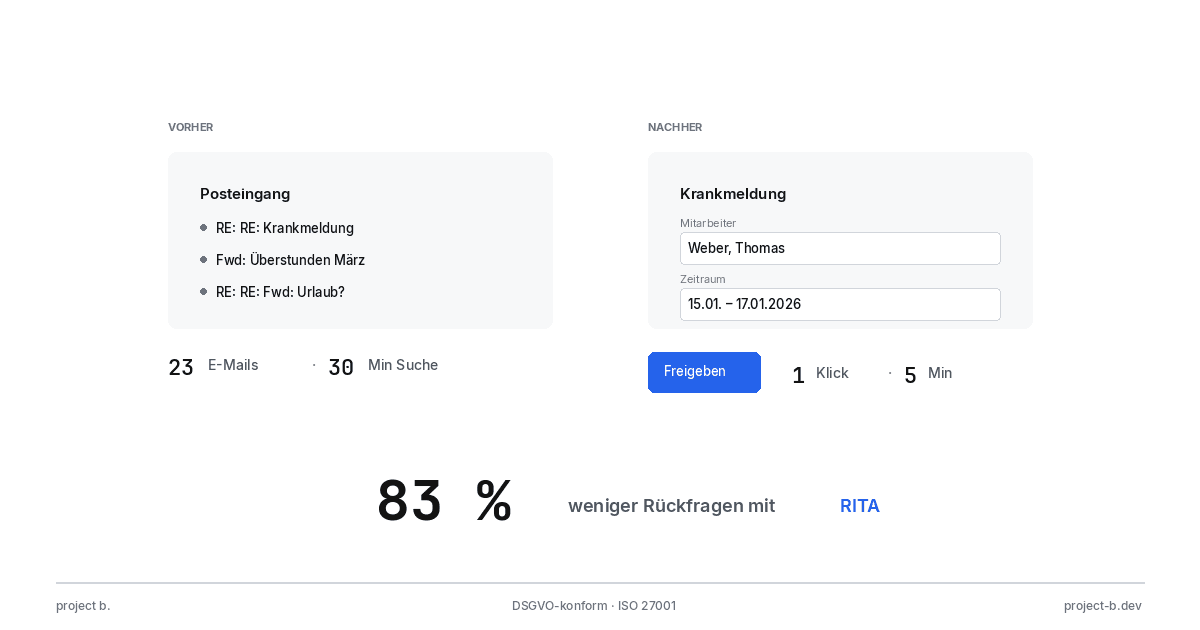

RPA systems function like virtual employees that execute predefined tasks. For example, a bot can check emails with sick leave documents every morning at 8 AM, download the PDF attachments, and transfer the absences into the payroll system. The software mimics human clicks and keyboard inputs.

Typical RPA tasks in payroll:

Data transfer between time tracking systems and payroll software (e.g., DATEV to SAP)

Automatic reading of email attachments with sick leaves

Monthly generation of standard reports for management

Transfer of master data for new hires from the HR system

Reconciliation of bank data for SEPA direct debits

The strength of RPA lies in error-free repetition. While a staff member may become unfocused during the 50th data entry of the day, the bot works with consistent precision. A mid-sized company with 200 employees can save about 15-20 hours monthly on routine tasks.

1.2 AI Systems: Learning Instead of Rigid Execution

Artificial intelligence takes a step further. Instead of following a fixed script, AI systems recognize patterns, make decisions, and learn from experiences. For instance, when processing expense reports, an AI can read photographed receipts, check plausibility, and generate questions for further clarification in case of discrepancies.

A concrete example from practice: A field salesperson submits a hotel bill of 340 euros. The AI automatically compares this with historical data of similar trips, considers the city (Munich is more expensive than Erfurt), checks the travel policy, and marks the bill for manual review if there are deviations. In standard cases, approval happens automatically within seconds.

Typical AI applications in payroll:

Intelligent OCR recognition of handwritten forms or poor scans

Automatic categorization of receipts (travel expenses, catering, overnight stays)

Prediction of personnel needs based on vacation patterns and illness rates

Detection of anomalies in overtime or surcharges

Chatbots for employee inquiries regarding payroll

2. The Direct Comparison: What Are the Differences?

2.1 Flexibility vs. Reliability

If a DATEV system moves a button, the bot may fail. The IT department then has to adjust the script. This maintenance work is often underestimated. In one of the analyzed companies with 5 RPA bots, an average of 6 hours of maintenance work per month was required.RPA systems are like train timetables: absolutely reliable as long as nothing changes. As soon as a developer in

AI systems are more error-tolerant. If a form changes slightly, the AI usually adapts itself. However, AI systems do not operate with 100% accuracy. While an RPA bot either works or crashes, an AI can sometimes read a figure incorrectly. However, with modern systems, the error rate is below 2 percent when using human-in-the-loop approaches.

2.2 Implementation Effort and Costs

The cost question often determines success or failure of a project. RPA solutions are implemented faster. A simple bot for data transfer between two systems runs after 2-3 weeks of development time. The licensing costs range between 5,000 and 15,000 euros annually per bot, depending on the provider.

Cost comparison for a company with 150 employees:

RPA solution (e.g., UiPath, Automation Anywhere):

One-time implementation: 15,000 - 25,000 euros

Annual licensing costs: 8,000 - 12,000 euros

Maintenance and adjustments: 500 - 1,000 euros monthly

Total costs Year 1: approximately 35,000 - 50,000 euros

AI-based solution (e.g., specialized payroll AI):

One-time implementation: 30,000 - 60,000 euros

Annual licensing costs: 15,000 - 25,000 euros

Training and optimization: 3,000 - 5,000 euros (one-time)

Total costs Year 1: approximately 48,000 - 90,000 euros

These figures show: RPA is cheaper at the start, but the maintenance effort adds up. AI systems are more expensive to acquire but scale better and require less ongoing support.

3. Use Cases: When Does Which Technology Fit?

3.1 Perfect for RPA: Structured Processes

RPA shines with uniform, rule-based tasks. The monthly transfer of working time data from the time tracking system to the payroll software is a prime example. The data structure does not change, the procedure is always the same, and there are clear rules without room for interpretation.

Ideal RPA scenarios:

Monthly export of wage data for financial accounting

Automatic recording of digital sick notes from an email inbox

Generation of reports to social security for standard cases

Data migration during system upgrades or changes in payroll software

Automatic sending of pay slips via email at a fixed time

A manufacturing company from Baden-Württemberg uses RPA for processing shift plans. The shift supervisors enter the plans into an Excel system, and the RPA bot automatically transfers them into the SAP system every evening. Previously, this process took 45 minutes of work time daily, now it runs fully automatically during the night.

3.2 AI as Problem Solver: Complex Decisions

As soon as interpretation is required, AI displays its strengths. When processing travel expense reports, receipts arrive daily in all sorts of formats: scanned invoices, photos of cash receipts, PDF files, sometimes even handwritten notes. An AI can process all these formats and extract the relevant information.

AI shows its strengths in:

Processing expense reports with different types of receipts

Answering employee inquiries regarding pay slips (chatbot)

Detecting errors and discrepancies in statements

Prediction of personnel needs and budget planning

Automatic categorization of special payments and benefits

A service company with 80 field sales representatives processes about 600 expense reports monthly. In the past, an employee manually checked each receipt with a turnaround time of 8-12 days. With AI support, standard cases are automatically checked, and only 15 percent of the receipts still require manual examination. Turnaround time is now: 2-3 days. This corresponds to a time saving of 25 working hours per month.

4. The Hybrid Strategy: Combining RPA and AI

The best solution is often a combination. RPA takes on the structured process steps, and AI handles the intelligent decisions. For processing applications, for instance, RPA can transfer data from the applicant management system to the payroll software as soon as a contract is signed. An AI beforehand analyzes the salary expectations and suggests appropriate classifications.

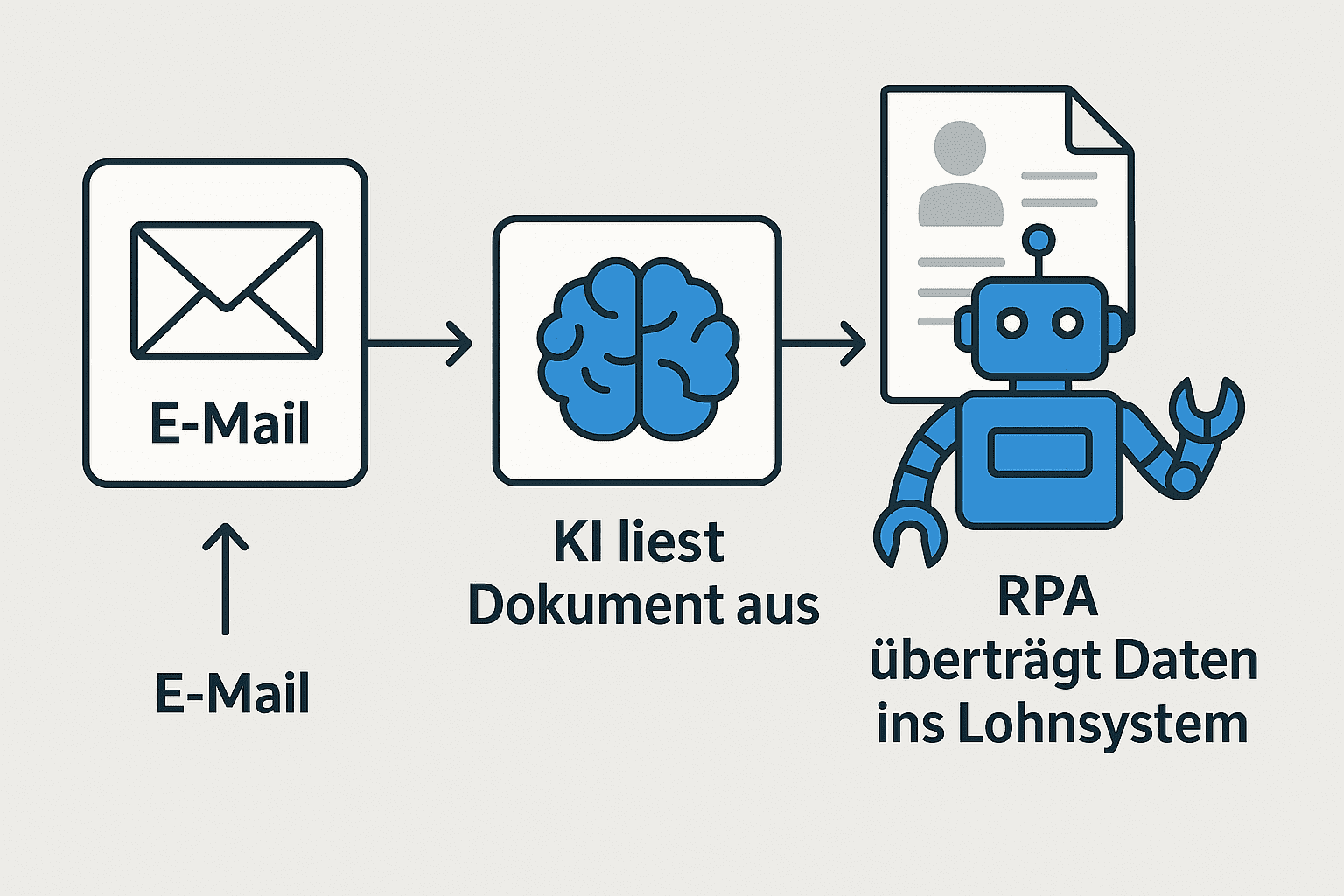

4.1 Process Example: From Sick Leave to Payroll

Step-by-Step Process with Hybrid Technology:

1 Employee sends sick leave by email (with scan or photo)

AI reads the receipt, recognizes the time period and type of illness

System automatically checks: Is a sick leave certificate required? (Rule-based)

RPA bot enters the absence into the time tracking system

If there is no certificate: AI generates automatic reminder after 3 days

RPA transfers absences into payroll at the end of the month

7. AI checks plausibility (unusually many sick days?) and marks anomalies

This hybrid approach combines the best of both worlds. The AI takes on the tricky tasks (text recognition, plausibility check), while RPA ensures reliable data transfer. An HR department with 3 employees can thus manage an additional 200-300 employees without expanding the team.

4.2 Implementation in Practice

The entry should start small. Choose a process that is currently time-consuming and well-defined. Transferring working time data is a suitable pilot project for RPA. Expense reports are a good starting point for AI.

Roadmap for the first 6 months:

Month 1: Process analysis and selection of the pilot project

Month 2: Provider comparison and decision (RPA, AI, or Hybrid)

Month 3-4: Implementation and testing with a small user group

Month 5: Rollout to all affected employees

Month 6: Evaluation and planning of the next automation step

5. Avoiding Risks and Pitfalls

5.1 Data Protection and Compliance

Payroll data is among the most sensitive information in a company. Strict data protection rules must be followed during automation. RPA bots often require privileged access to multiple systems simultaneously. These access credentials must be securely stored, ideally in a credential management system.

In AI systems, the question of data processing arises. If the AI is trained in the cloud, payroll data may leave the company. Many providers therefore offer on-premise solutions or guarantee that data is processed exclusively on German servers. Clarify this before signing the contract.

5.2 The Underestimated Change Management Task

Technology is only half the battle. Employees must accept and use the new systems. Especially in payroll, where many processes have been the same for years, there is often resistance. Communicate early that automation does not cost jobs but creates time for more demanding tasks.

A mid-sized company from Hesse introduced RPA for time tracking and simultaneously offered the two affected employees training in HR analytics. Today they focus on workforce planning and talent management instead of data entry. Motivation significantly increased.

6. Outlook: What 2026 and Beyond Will Bring

Development is progressing rapidly. Major payroll software providers are increasingly integrating AI functions directly into their products. DATEV is working on intelligent assistants that help with the accounting of complex issues. SAP is investing heavily in machine learning for workforce planning and budgeting.

At the same time, RPA tools are becoming easier to use. Low-code platforms enable even non-programmers to create simple bots by dragging and dropping. Microsoft Power Automate is an example of this. Such tools cost significantly less than traditional RPA platforms and are sufficient for many standard applications.

6.1 Regulatory Developments

The introduction of real-time reporting starting in April 2026 for monetary benefits and the ELM 5.0 migration by June 2026 increases the pressure for automation. Manual processes are reaching their limits when reports must be generated in real time. Automated systems are no longer just a nice-to-have, but become a necessity.

7. Decision Support: What Fits Your Company?

The choice between RPA and AI depends on several factors. Company size, existing IT landscape, available budget, and process complexity all play a role.

RPA is the right choice if:

Your processes are clearly defined and uniform

You need to transfer data between different systems

Your budget is below 50,000 euros

You want to see quick results (3-6 months)

Your IT department can take care of maintenance

AI makes sense if:

You work with unstructured data (receipts, emails, scans)

Interpretation and decision-making are important

You have more than 100 employees

Long-term scaling is planned

You are willing to invest 60,000+ euros

For most mid-sized companies with 50-500 employees, a gradual approach is advisable: Start with RPA for clearly defined processes. Gather experience. After 6-12 months, intentionally add AI components for more complex tasks.

8. Conclusion: Technology as an Enabler, Not for Its Own Sake

Neither RPA nor AI are magic bullets. Both technologies can make payroll significantly more efficient, but only if they are used correctly. The rule of thumb is: Automate only well-functioning processes. A poor process won’t get better through automation, it will just get faster at being poor.

Take your time for analysis. Which tasks really cost a lot of time? Where do the most errors occur? Which processes annoy your employees the most? These are the candidates for automation. Not every Excel spreadsheet needs to be replaced by a bot.

Payroll in 2026 will be hybrid: humans will take care of complex special cases and strategic questions, RPA bots will handle repetitive tasks, and AI will assist in decisions and analysis. Companies that master this combination will not only gain efficiency but also more satisfied employees and better data quality.

How project b. Supports You

project b. offers modern payroll software with integrated automation functions. Our solution combines proven RPA technology for standard processes with AI-supported features for complex tasks such as expense reports and compliance checks. You maintain full control and transparency over all processes.

Interested in a non-binding process analysis? Our experts will show you what automation potentials exist in your payroll and what can be implemented with a reasonable effort. Schedule a free consultation appointment.

Sources and Further Information

Bitkom Research (2025): Study on Automation in Payroll, Berlin

Fraunhofer IAO (2024): RPA and AI in the HR Process - Practice Study with 150 Companies, Stuttgart

Haufe (2025): Digitalization of Payroll - Trends and Technologies, Freiburg

DSAG Working Group HR (2025): SAP SuccessFactors and Automation, Walldorf

Institute of German Economy (2025): Productivity Gains Through HR Automation, Cologne

What is the difference between RPA and AI?

RPA automates rule-based, repetitive tasks according to fixed scripts. AI, on the other hand, learns from data, recognizes patterns, and makes independent decisions. In payroll, RPA handles data entry, while AI detects anomalies.

Should I start with RPA or AI?

For most companies, RPA is the better entry point as it is implemented more quickly and brings immediate efficiency gains. After a successful RPA implementation, AI modules for error prevention can be added. A hybrid approach delivers the best results.

What are the costs for RPA in payroll?

RPA licenses start at around 5,000 euros per year for smaller companies. For companies with 100-500 employees, the costs range between 15,000 and 40,000 euros, including setup. The ROI is usually achieved after 8-14 months through saved labor hours.

Finn R.

Further articles

Feb 9, 2026

·

Payment

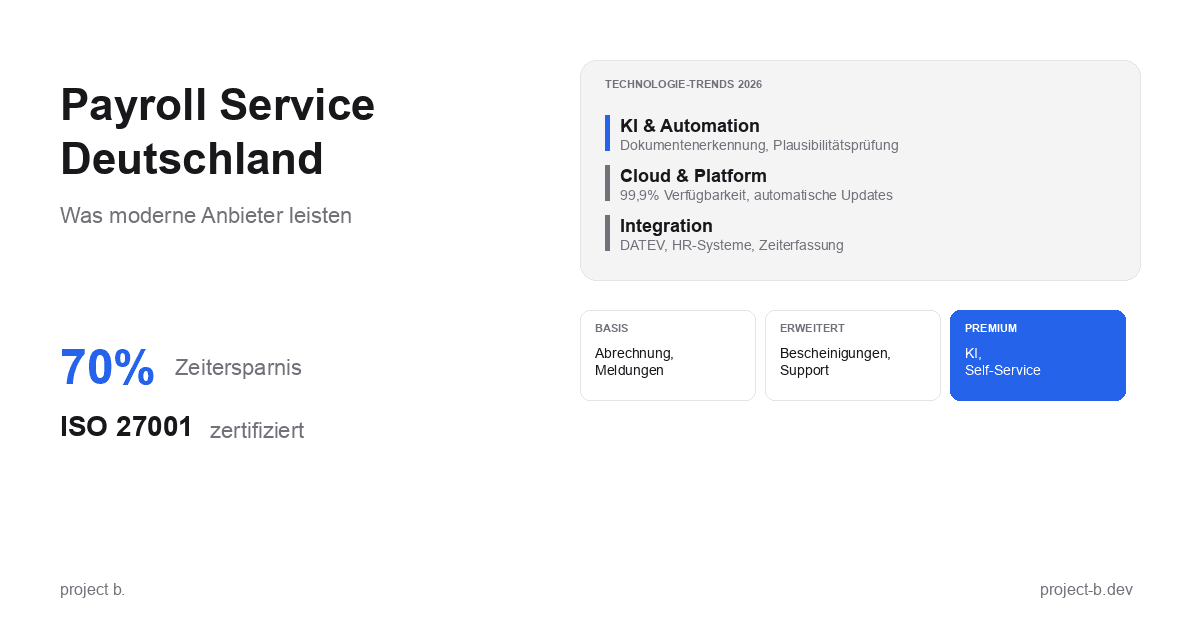

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

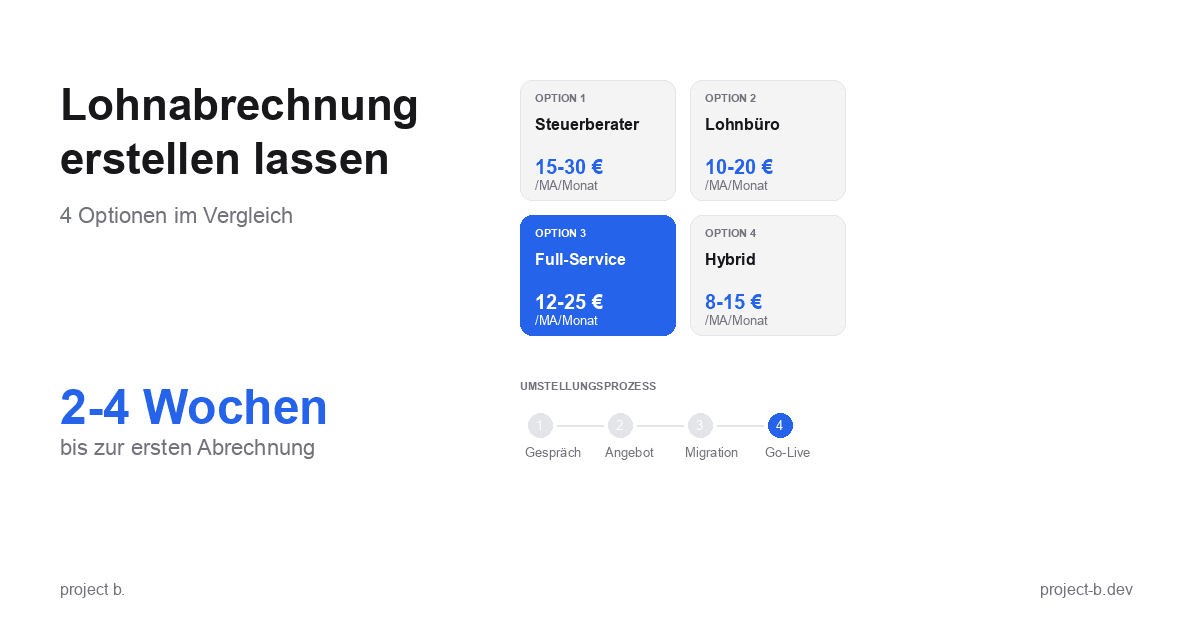

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

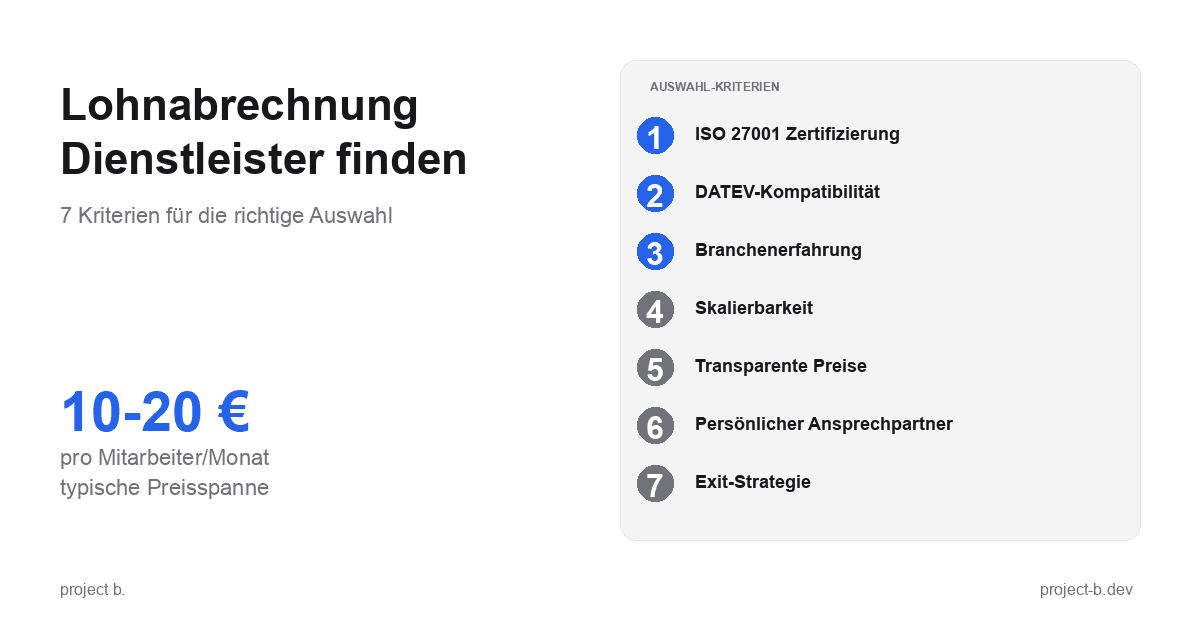

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

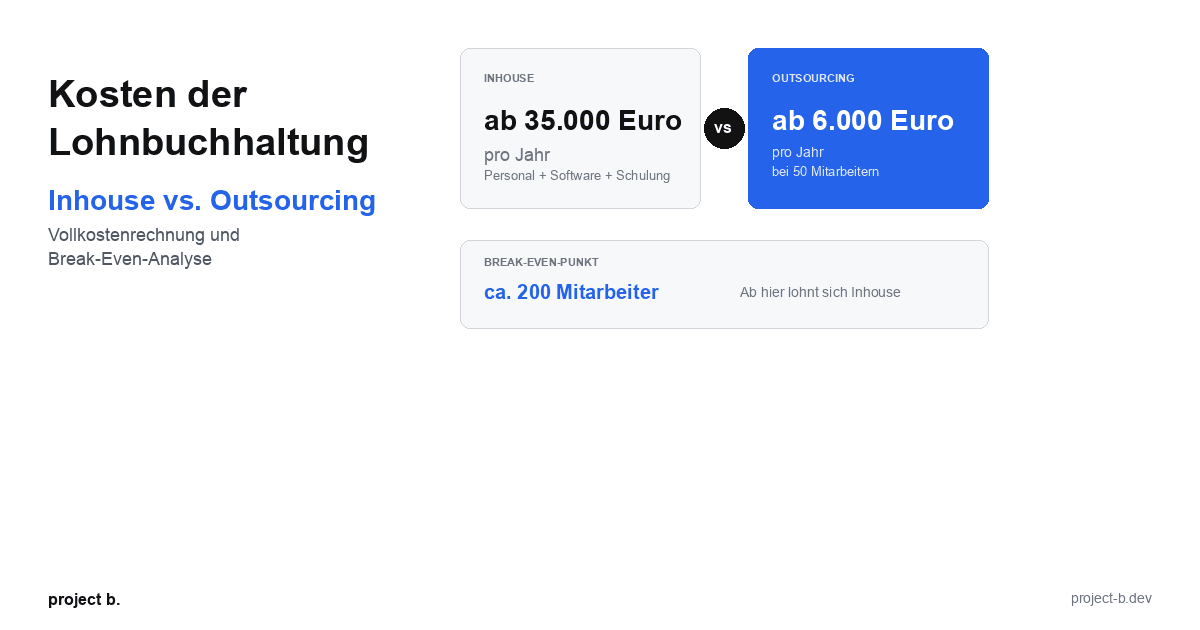

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

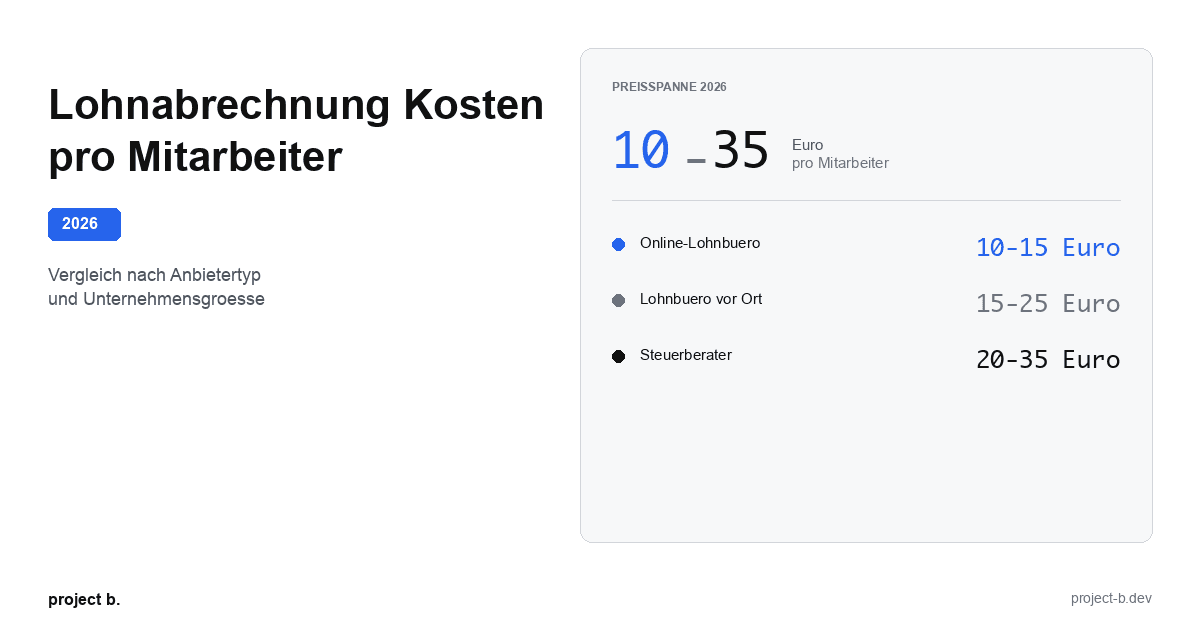

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

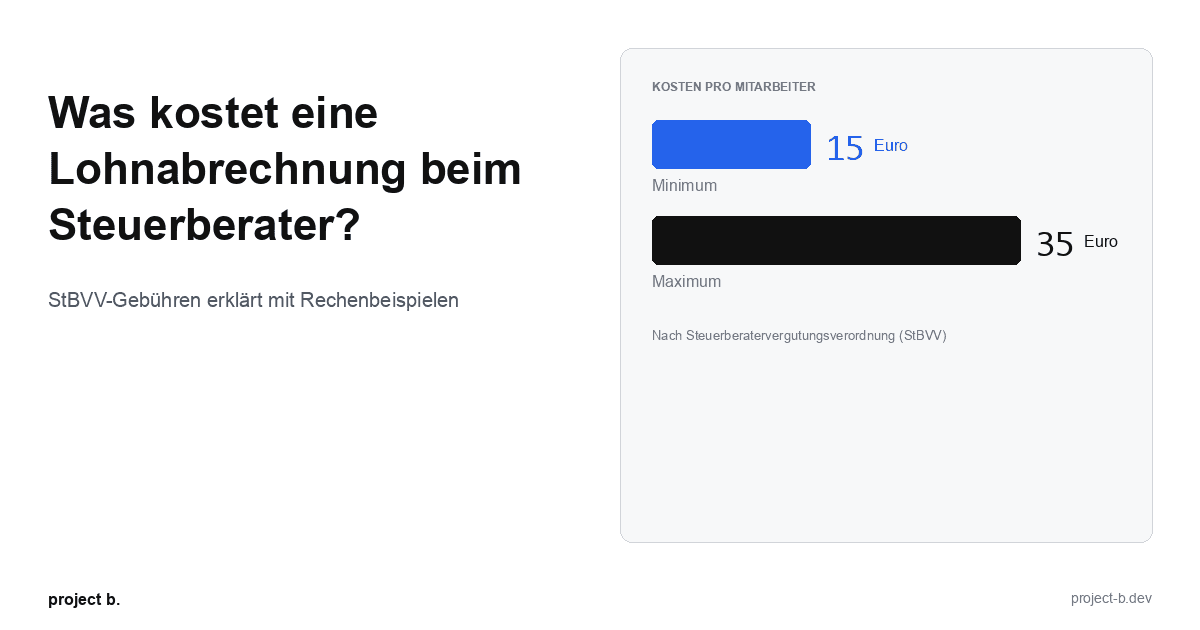

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

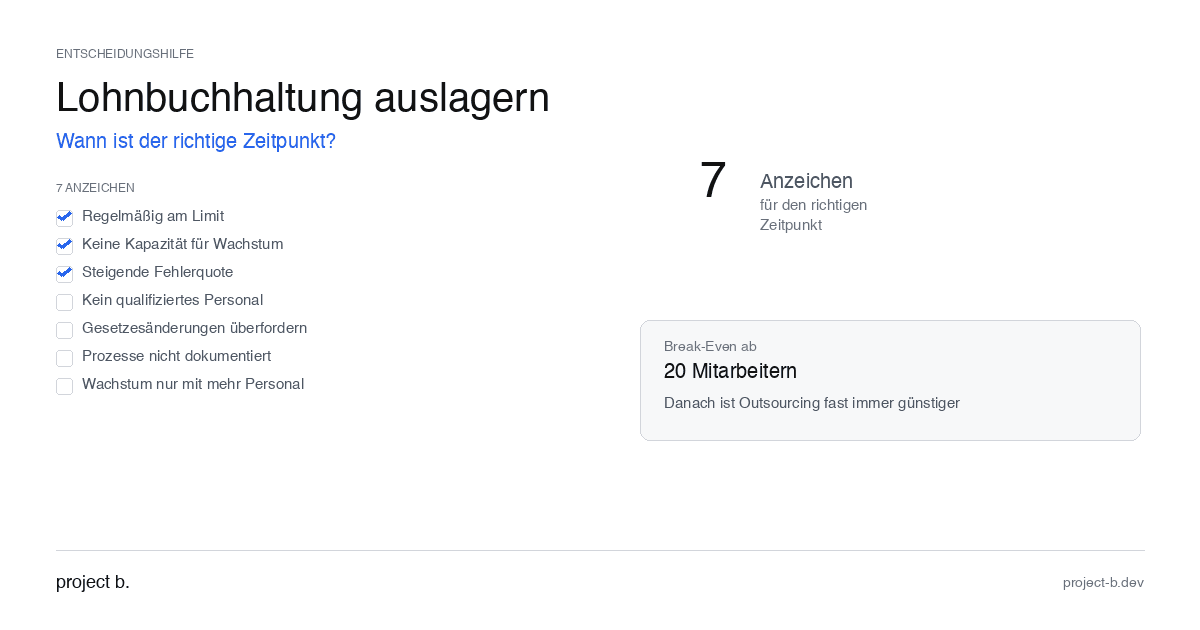

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

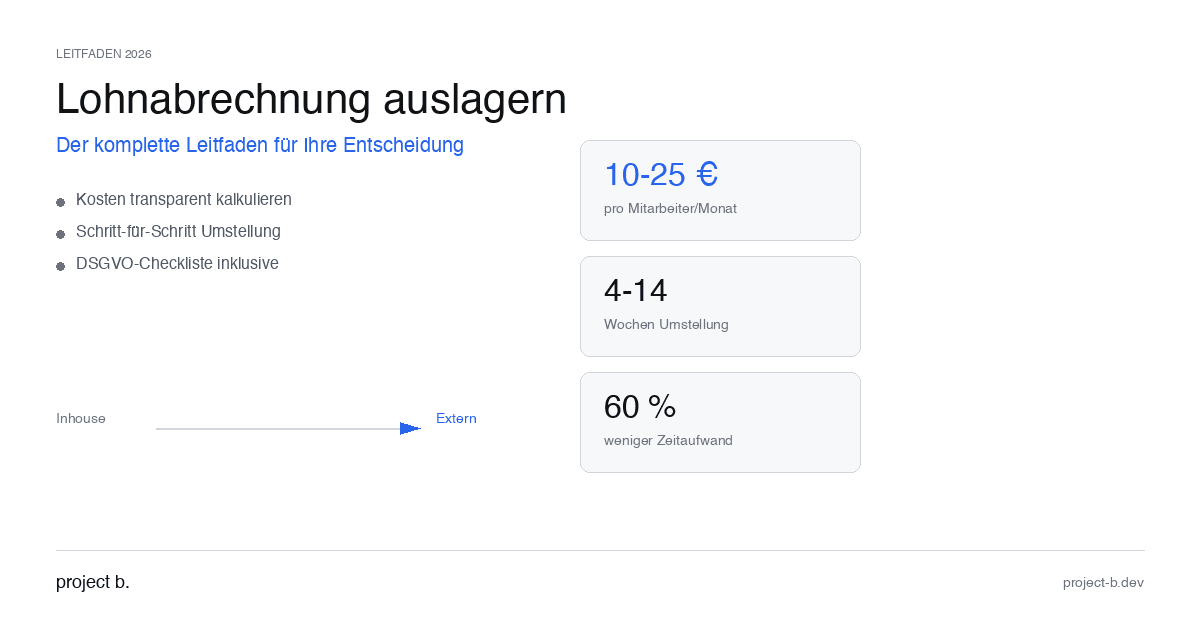

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.