Outsource payroll accounting: When is the right time?

Jan 30, 2026

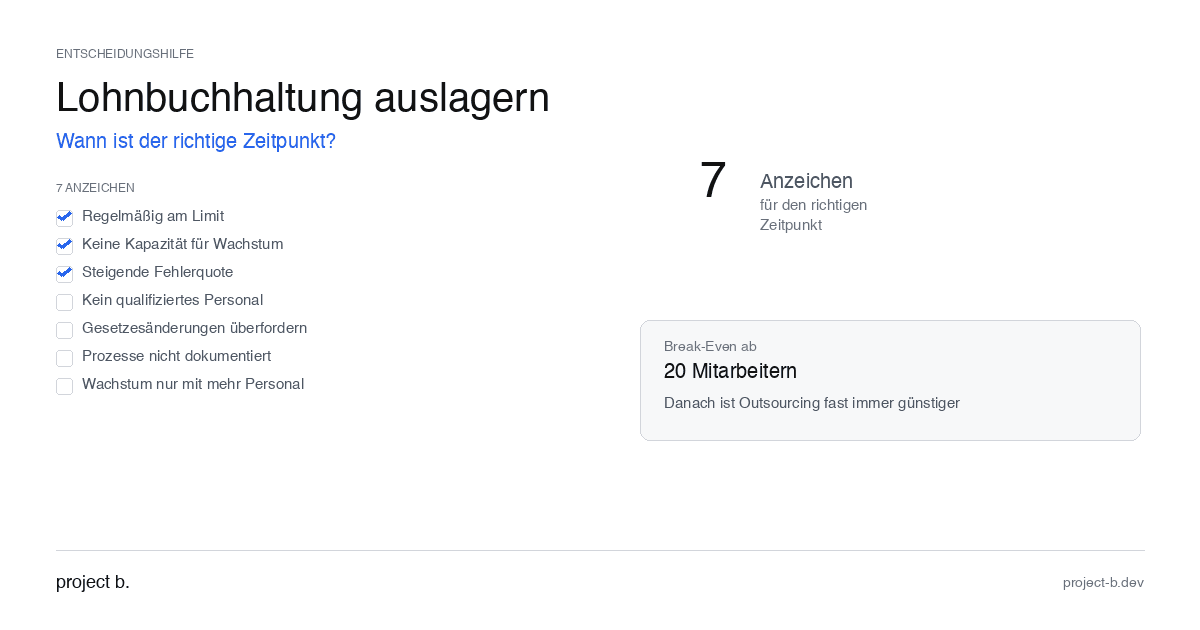

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

The question is not if, but when. At some point, almost every company reaches the point where internal payroll creates more problems than it solves. Overtime accumulates, errors creep in, and there’s no time left for strategic tasks.

But when exactly is this point reached? When does it make sense to switch to an external service provider? And how do you recognize that your company is ready for it?

This article provides you with concrete guidelines. No vague recommendations, but measurable criteria for your decision.

7 Signs That You Should Outsource

Some warning signals are obvious, others creep in slowly. Here are the seven most evident signs that the time for outsourcing has come.

1. Your payroll is regularly working at its limit

The payroll week is the most stressful period of the month. If your team regularly works overtime during this time, skips lunch breaks, and is on edge, something is wrong.

"I have a flood of emails, up to 70 emails a day. I sort them with flags in Outlook; I actually also have to file them in our law firm's document management so that others are informed in case I’m on vacation or sick. This all takes a lot of time and capacity."

This is how a payroll clerk describes her daily work. This is not an isolated case. If the basic load already fills 100% of the capacity, there’s no buffer for unforeseen events.

Check: How much overtime occurs in the payroll week? More than 10% additional working time is a warning signal.

2. You cannot take on new employees or clients

Growth is good. But if every new employee or client brings your system to its breaking point, you have a scaling problem.

"We currently have no capacity for new clients and even have to decline them."

This is reported by a payroll office owner. Declining means leaving revenue on the table. And worse: losing reputation because you cannot deliver.

Check: Have you had to decline orders or postpone clients in the last 12 months?

3. Your error rate is increasing

Errors in payroll are costly. Not only financially, but also in terms of trust. If employees need to check their pay statements because they no longer trust them, something is fundamentally wrong.

Typical signs of increasing error rates:

Frequent corrections after the payroll week

Inquiries from social security agencies

Complaints from employees about incorrect statements

Increasing number of contributions correction reports

Professional service providers have error rates of less than 1%. If your internal rate is higher, outsourcing pays off just from avoided error costs.

Check: How many corrections occur per month? More than 3% is too much.

4. You cannot find qualified personnel

The shortage of skilled workers particularly affects payroll. Experienced payroll clerks are rare, and training new employees takes months to years.

"I’m from accounting and I’m asking for my colleague from payroll, who is always very overwhelmed with all the emails that come in."

If a position has been vacant for more than six months, it will probably remain vacant for the next six months as well. The time you spend on recruiting is time missing elsewhere.

Check: Do you have open positions in payroll? How long have they been open?

5. Legal changes overwhelm your team

German payroll law is among the most complex in the world. Minimum wage, short-time work, ELStAM, social insurance reports: Requirements are constantly changing.

An internal team must manage further training alongside daily operations. This is rarely successful. The result: uncertainty with new regulations, fear of errors, and in the worst case, actual compliance violations.

Specialized service providers deal with payroll law all day long. They are informed faster and more confident in their application.

Check: When was your payroll team's last training? Longer than 12 months is too long.

6. Your processes are not documented

What happens if your payroll clerk falls ill? Or resigns? If the answer is: "Then we have a problem," then that’s a problem.

Many companies lack documented processes for payroll. The knowledge resides in the minds of individual employees. That is risky.

"But I don’t have time to improve it."

This is how a payroll clerk describes the dilemma. Daily business leaves no capacity for improvements. An external service provider brings standardized processes and reduces the personnel risk.

Check: Could a new employee understand your payroll based on the documentation?

7. You want to grow but don’t want to hire proportionally more staff

This is perhaps the strongest argument. Internal payroll scales linearly: doubling the number of employees means about double the effort.

External service providers with modern technology scale better. AI-assisted preliminary data capture, automated checks, and standardized processes make the difference.

"I am the manager (of the payroll office, 45k payrolls). I see that the same requests keep coming in and that we could save a lot of capacity here."

Managing 40 new clients with only 0.5 FTE more: That is possible with the right technology.

Check: How many employees would you need for 50% growth?

The Break-Even Point: When Does It Pay Off?

Feeling is good, calculations are better. Here’s an honest calculation of when outsourcing becomes financially worthwhile.

The full costs of internal payroll

Many companies only calculate salary. This is too short-sighted. The actual costs include:

Personnel costs:

Annual salary: €45,000 to €65,000 (depending on region and experience)

Employer’s share of social insurance: approx. 20%

Vacation and sick leave coverage: approx. 10% surcharge

Material costs:

Software licenses (DATEV, Agenda): €2,000 to €6,000 per year

Training and further education: €1,000 to €2,000 per year

Workplace, IT, office supplies: €3,000 to €5,000 per year

Indirect costs:

Recruiting due to turnover: €10,000 to €20,000 per vacancy

Training new employees: 3 to 6 months of reduced productivity

Error costs: difficult to quantify, but real

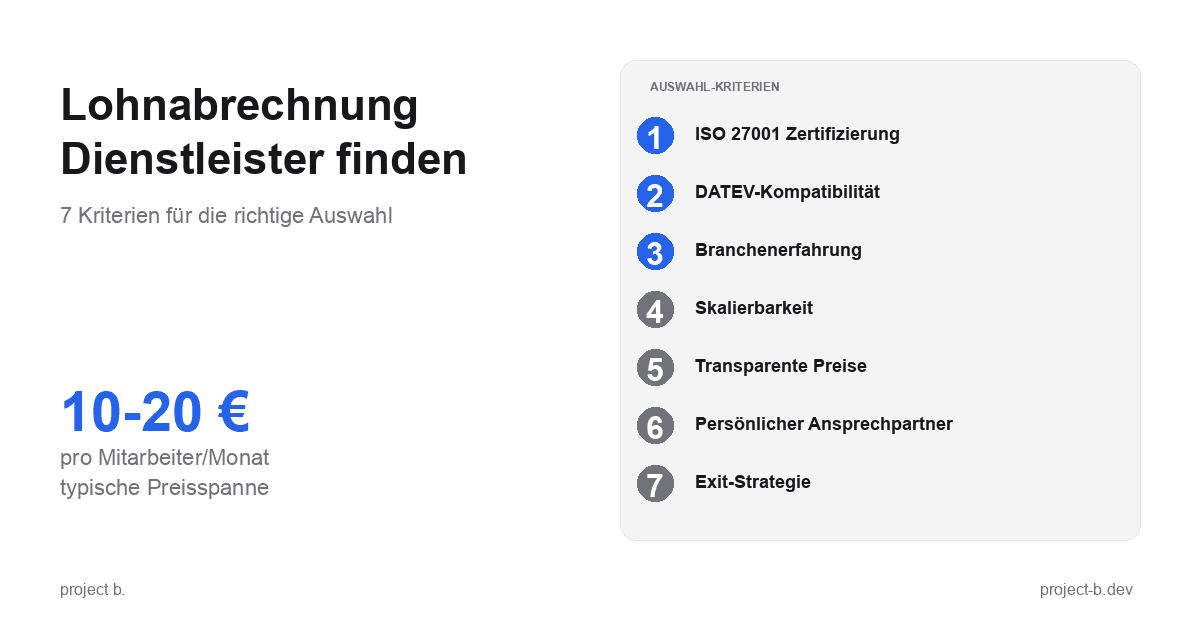

The costs of external payroll

External service providers typically charge per employee and month. The range is between €10 and €25, depending on:

Service level (Basic vs. Full-Service)

Complexity (collective agreements, shift work, construction)

Volume (tiered pricing above a certain size)

The break-even point by company size

Small companies (up to 20 employees): Internal payroll is rarely sensible. Fixed costs (software, knowledge) are spread over too few payrolls. Outsourcing is almost always cheaper.

Medium-sized companies (20 to 100 employees): Here lies the sweet spot for outsourcing. The cost savings are significant, and scalability becomes an advantage.

Larger companies (over 100 employees): Pure cost calculation becomes tighter. But: The strategic advantages (focus on core business, flexibility, expertise) often outweigh.

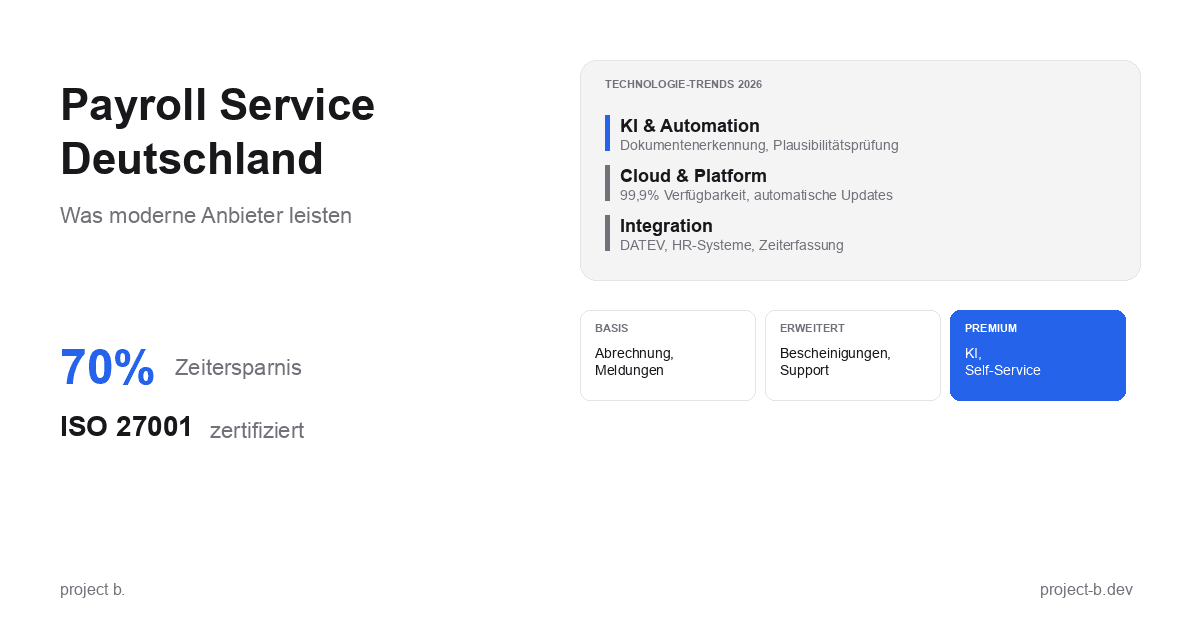

Growth Without Proportionally Increasing Personnel

This is the real game-changer. Modern payroll service providers enable growth that would not be possible with in-house accounting.

The Problem of Linear Scaling

Traditional payroll scales linearly. A payroll clerk can handle about 150 to 200 payrolls per month. More employees mean more payroll clerks.

The Solution: Tech-Enabled Services

Modern providers combine human expertise with technological efficiency. The result: non-linear scaling.

"We see most of the efficiency gains with you when the client can still do what they want – but we get the data in a standardized way."

Integration with Existing Systems

One of the most common concerns: "Do I have to give up my DATEV?"

The answer: No. Good service providers integrate into your existing infrastructure.

DATEV Integration

DATEV is the standard in German tax consultancies and many companies. A transition would be cumbersome and risky.

Modern payroll platforms therefore position themselves as a preliminary system, not as a replacement:

Data flows through the platform, then to DATEV

No double data entry

No media breaks

Familiar interface remains

Read more about DATEV integration in our article 10 processes in payroll that AI already handles today.

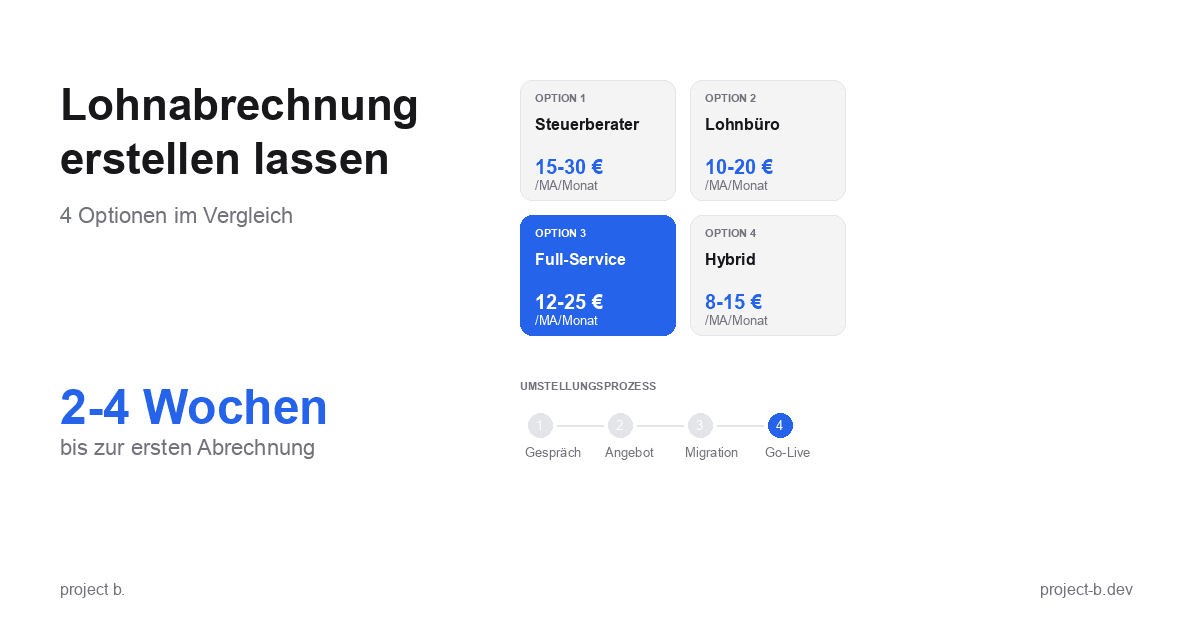

The Transition Process: Timeline and Effort

You have decided. How does the transition actually work?

Phase 1: Preparation (2 to 4 weeks)

Effort for you: Approximately 4 to 8 hours for preparation and coordination.

Phase 2: Data Migration (1 to 2 weeks)

Effort for you: Minimal. The provider leads the process; you supply the data.

Phase 3: Test Operation (1 month)

Effort for you: Increased in this month. Expect 2 to 4 hours per week for review and coordination.

Phase 4: Regular Operations

Effort for you: Significantly reduced. Most companies report 50 to 70% time savings.

Why project b. Is the Right Partner

When the time for outsourcing has come, you need the right partner. project b. offers exactly what modern payroll needs.

RITA: The AI that Takes Work Off Your Hands

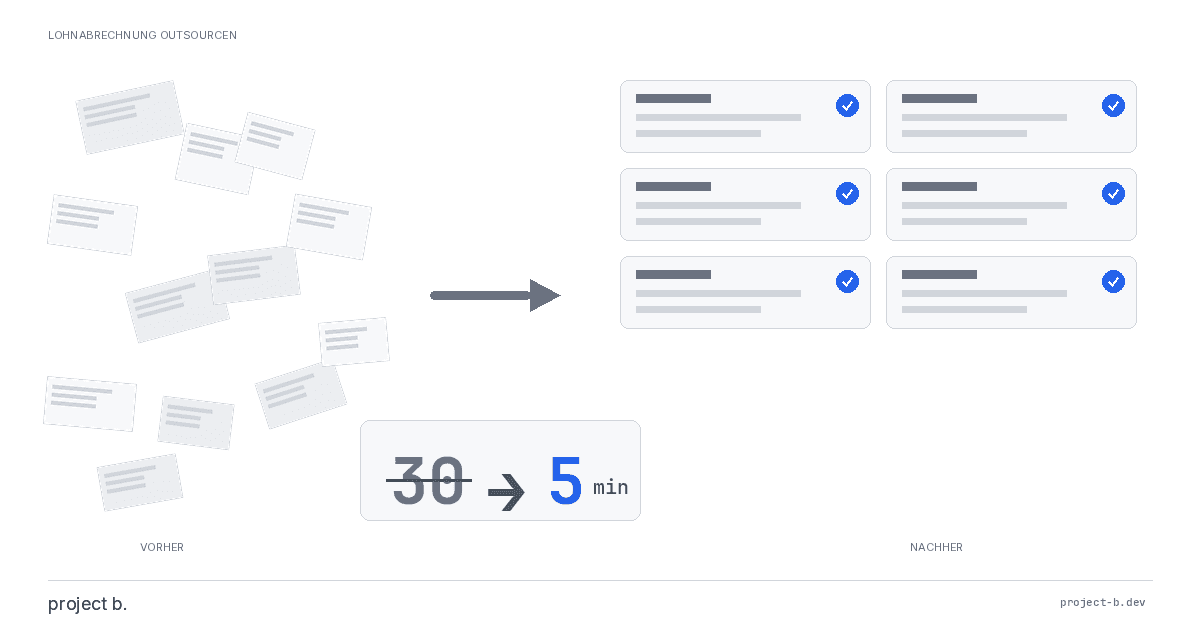

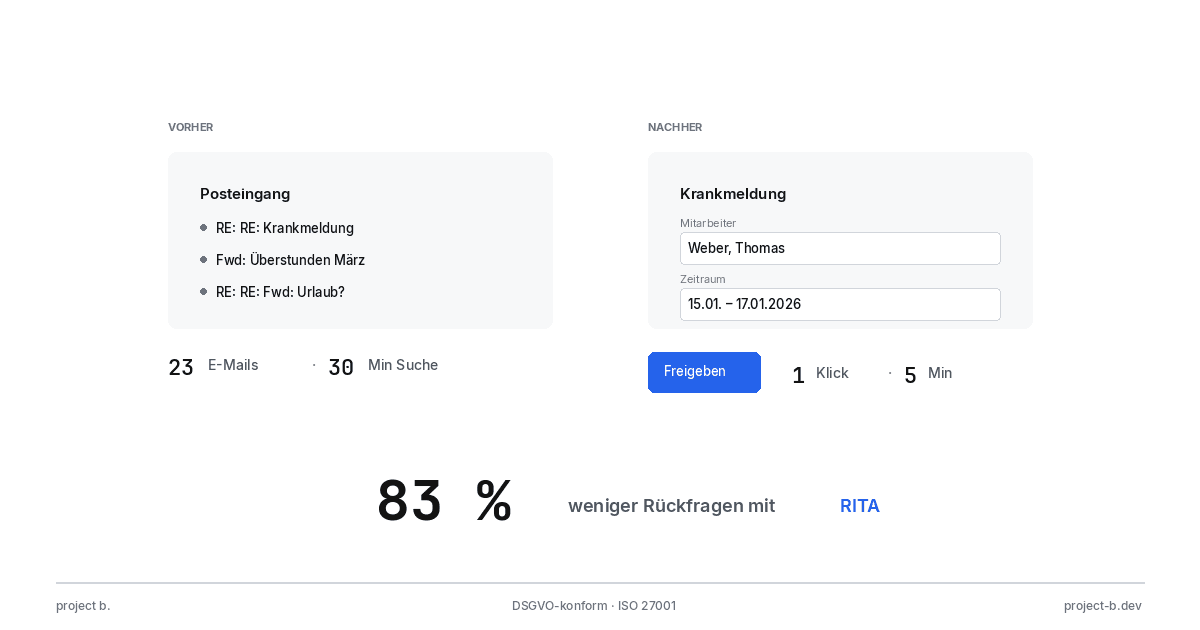

The AI assistant RITA reads incoming documents, extracts data, and checks for plausibility. What used to take 30 minutes of manual work, RITA accomplishes in under 5 minutes.

Security and Trust

ISO 27001:2022 certified

GDPR compliant, servers in Germany

No minimum contract period

Setup in 30 minutes

Comprehensive information on outsourcing can be found in our guide Outsourcing payroll: The complete guide for 2026.

Learn more on our page Payroll Outsourcing.

Conclusion: The Right Time Is Now

If you recognize more than three of the seven signs in yourself, the time for outsourcing has come. Waiting will not make it better.

Further information can be found in our overview article Outsourcing payroll: Costs, benefits, and providers.

At how many employees does outsourcing become worthwhile?

From about 20 employees, outsourcing is almost always more economical than an internal solution. The fixed costs for software and knowledge are distributed over too few invoices to be cheaper internally.

Can I keep my DATEV license?

Yes. Modern payroll platforms act as a preliminary system and integrate seamlessly with DATEV. Your familiar interface remains intact, and the data flows automatically.

How long does it take to switch to an external provider?

Depending on the size of the company, the transition takes 6 to 16 weeks. The first month is a parallel operation for comparison. After that, the service provider takes over completely.

Finn R.

Further articles

Feb 9, 2026

·

Payment

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

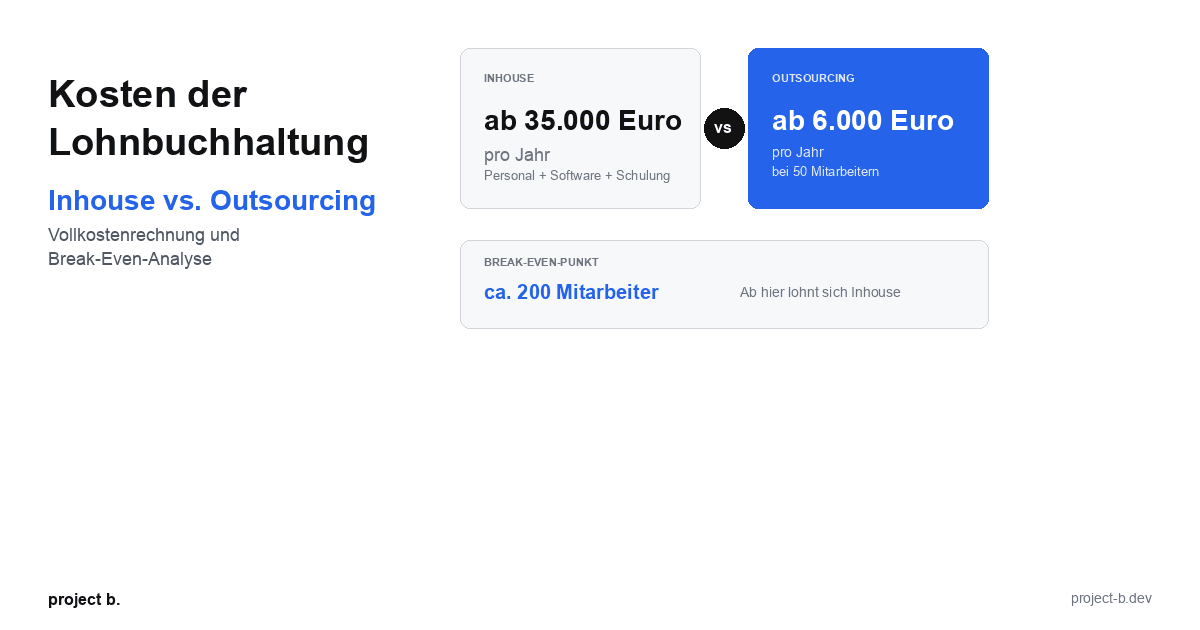

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

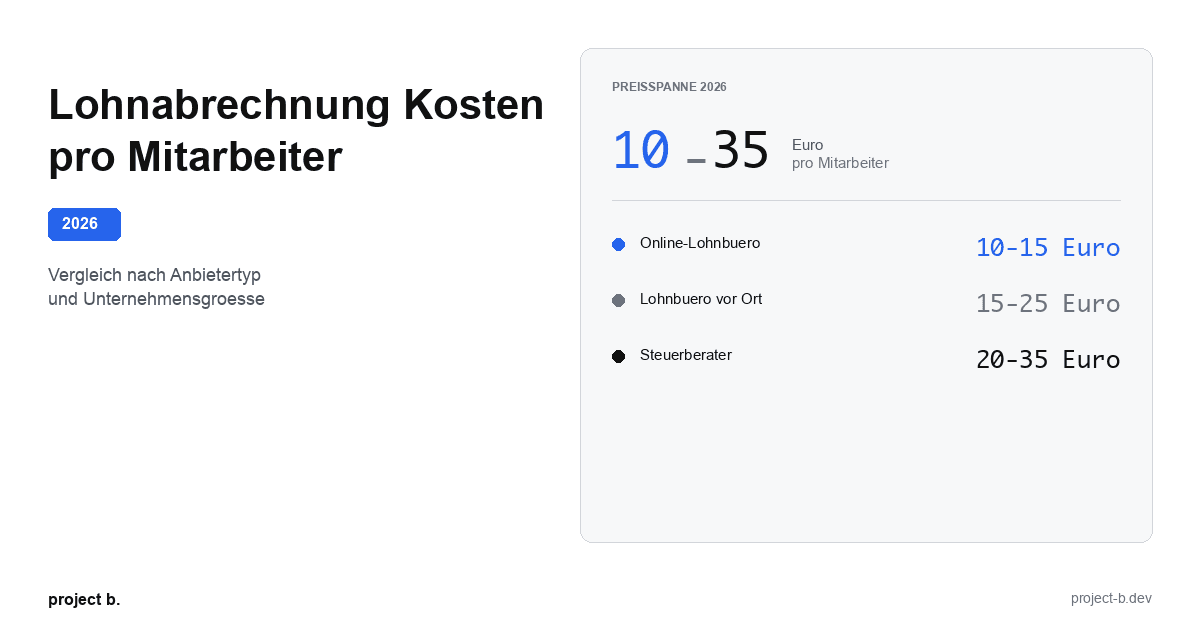

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

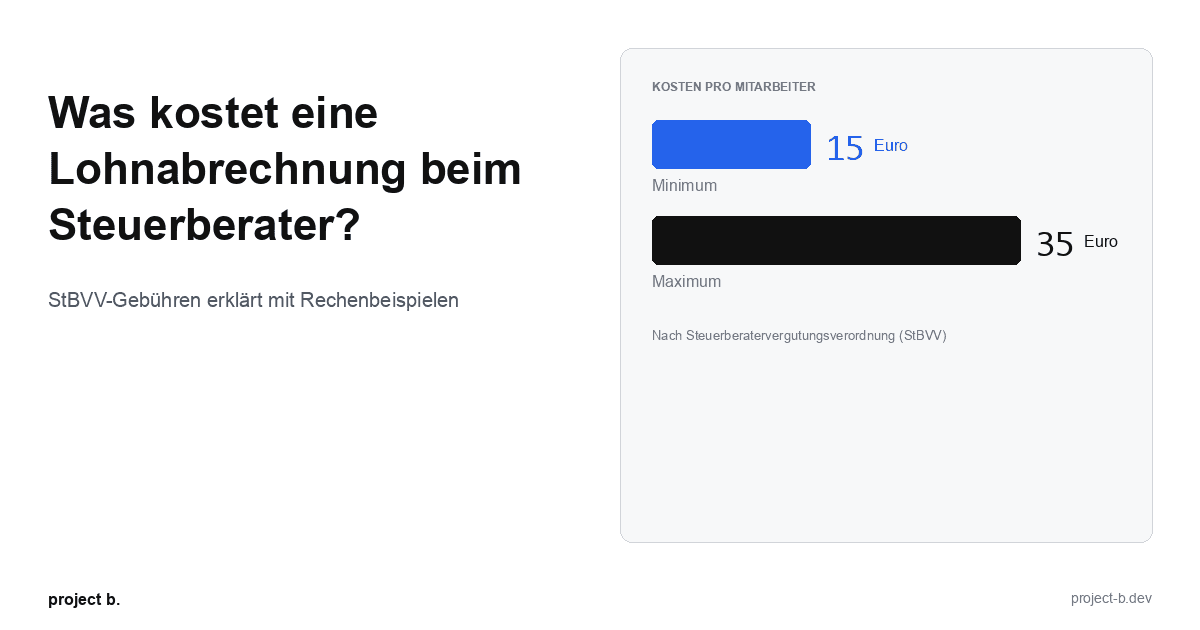

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 28, 2026

·

Outsourcing

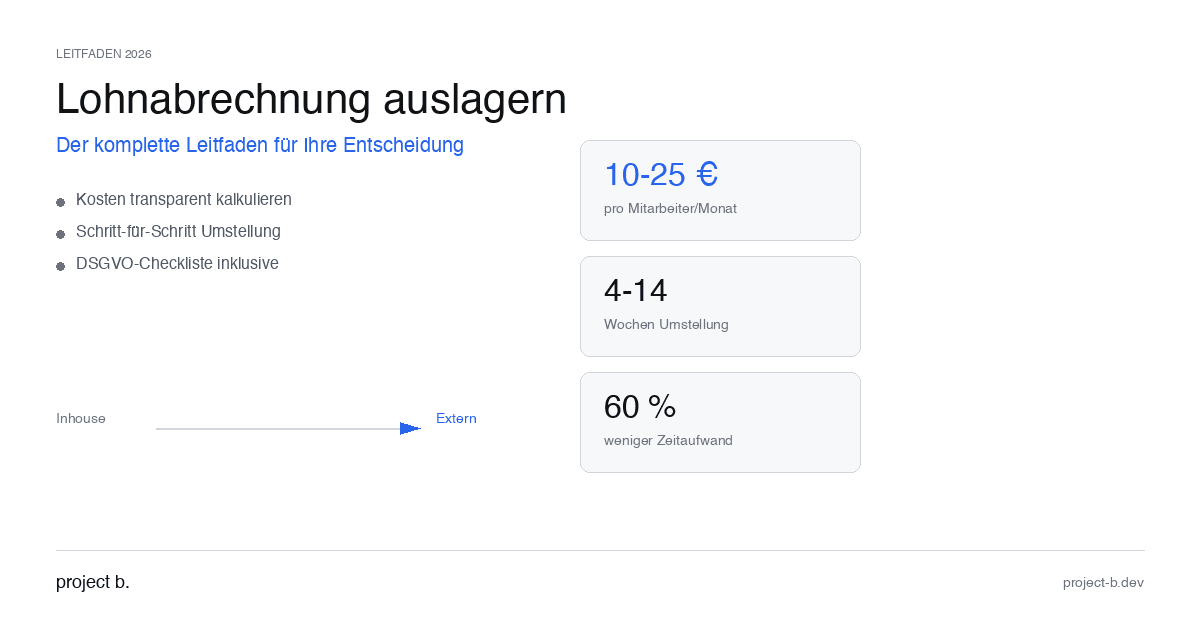

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

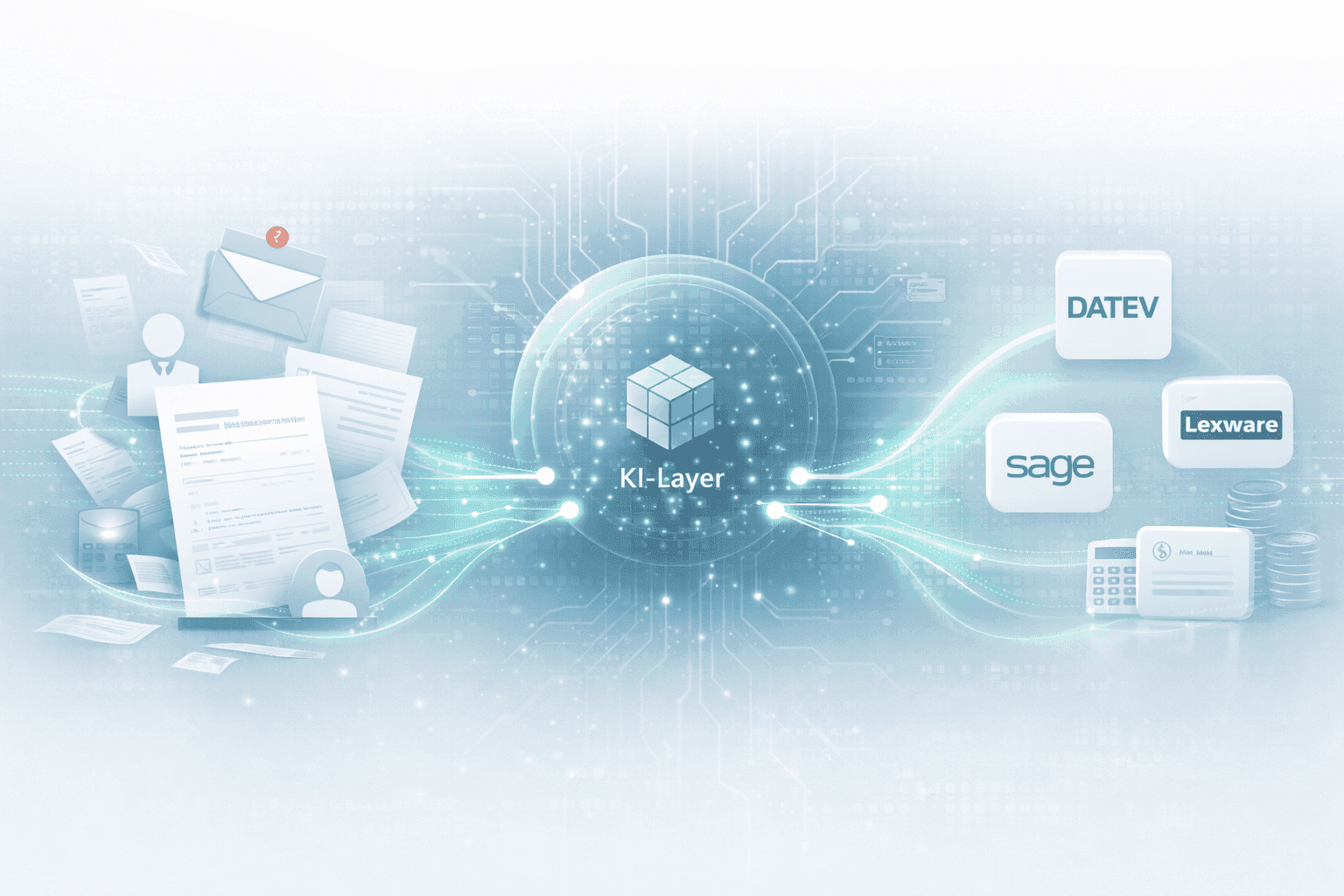

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

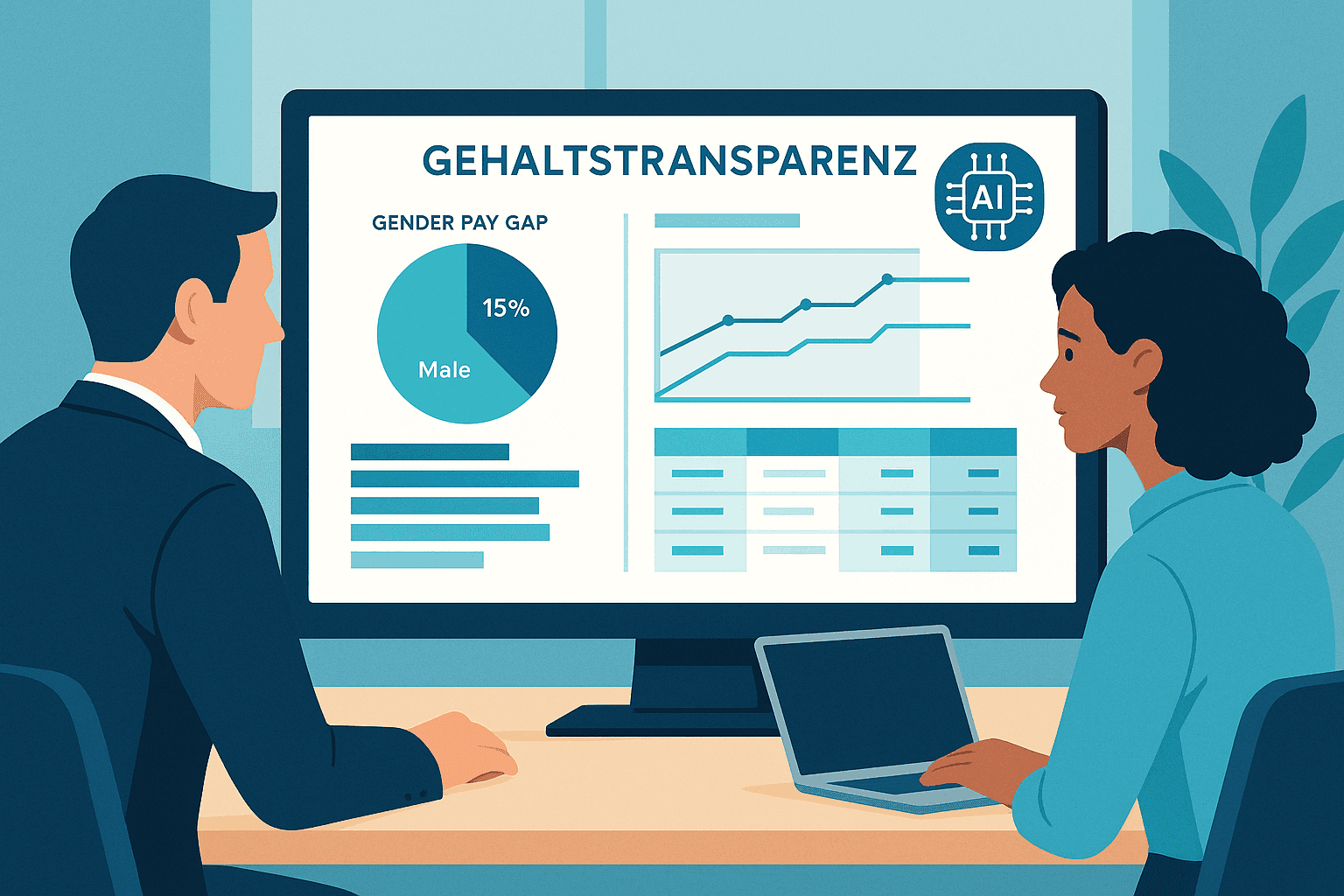

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.