Payroll without professionals? This is how AI will help in 2026

Dec 29, 2025

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

Payroll Accounting without Experts? How AI Helps in 2026

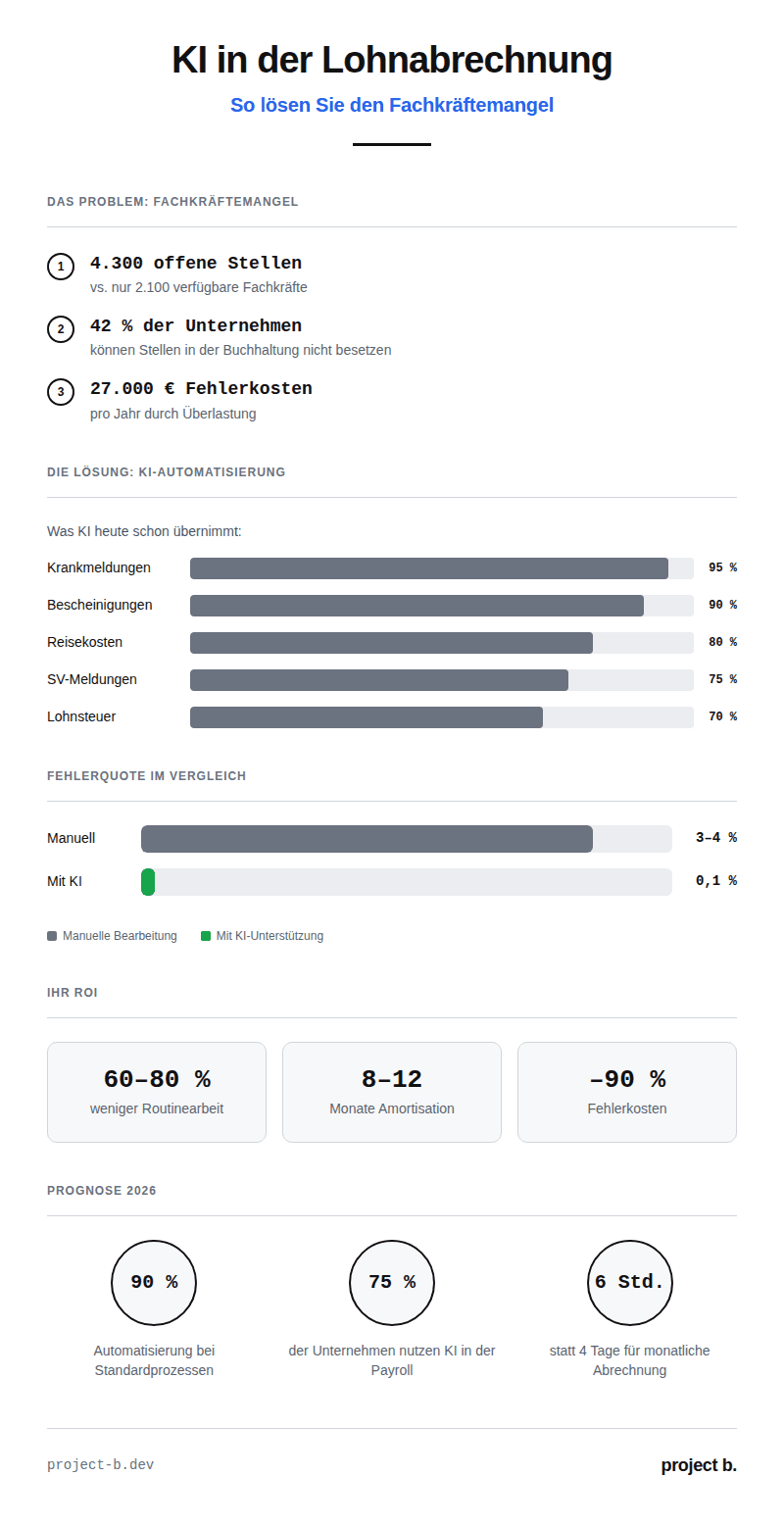

According to a recent study by the Federal Association of Personnel Managers, medium-sized companies receive an average of over 300 applications per year for positions in payroll accounting, with less than 10% meeting the required qualifications. This sobering reality is also reflected in the DIHK Skilled Workers Report 2023: 42% of companies cannot fill open positions in accounting for the long term.

The consequences are dramatic: Overworked teams, rising error rates, and delayed payroll processing. Small and medium-sized enterprises are particularly hard hit – they compete with large corporations for the few available skilled workers. Meanwhile, the demands on payroll accounting are steadily increasing: New collective agreements, more complex working time models, and constantly changing legal requirements increase the workload.

However, while HR departments desperately search for qualified staff, an alternative solution is emerging: Artificial intelligence is already taking over up to 70% of manual routine tasks in payroll accounting today. Modern AI systems validate data, check plausibility, and create standardized evaluations – and do this around the clock without signs of fatigue or careless mistakes. The crucial question is: How can companies use this technology to compensate for the shortage of skilled workers?

Current Situation: Skilled Worker Shortage in Payroll Accounting

The numbers speak a clear language: In the first quarter of 2023, positions in payroll accounting remained unfilled for an average of 187 days – a historic high. The Federal Employment Agency currently records 4,300 open positions in the field of payroll accounting, while only 2,100 job-seeking skilled workers are available.

The financial damage to companies is significant. An analysis by DATEV shows: Errors in payroll accounting cost German companies an average of 27,000 euros annually – trending upwards. Particularly critical: Due to the overload of existing employees, the error rate increases by up to 40%.

Key Figure | 2021 | 2023 | Trend |

|---|---|---|---|

Average Vacancy Duration | 143 Days | 187 Days | ↑ |

Ratio of Open Positions to Applicants | 1.5:1 | 2.1:1 | ↑ |

Average Error Costs per Year | 22,000 € | 27,000 € | ↑ |

Overwork-related Sick Days | 12.3 | 15.7 | ↑ |

The effects extend far beyond simple payroll accounting. HR departments are postponing strategic projects, digitalization efforts are stalled, and employee satisfaction is measurably declining. A survey by the Federal Association of Personnel Managers (BPM) shows: 67% of HR departments feel significantly restricted in their ability to act due to the shortage of skilled workers.

What AI Can Already Do in Payroll Accounting

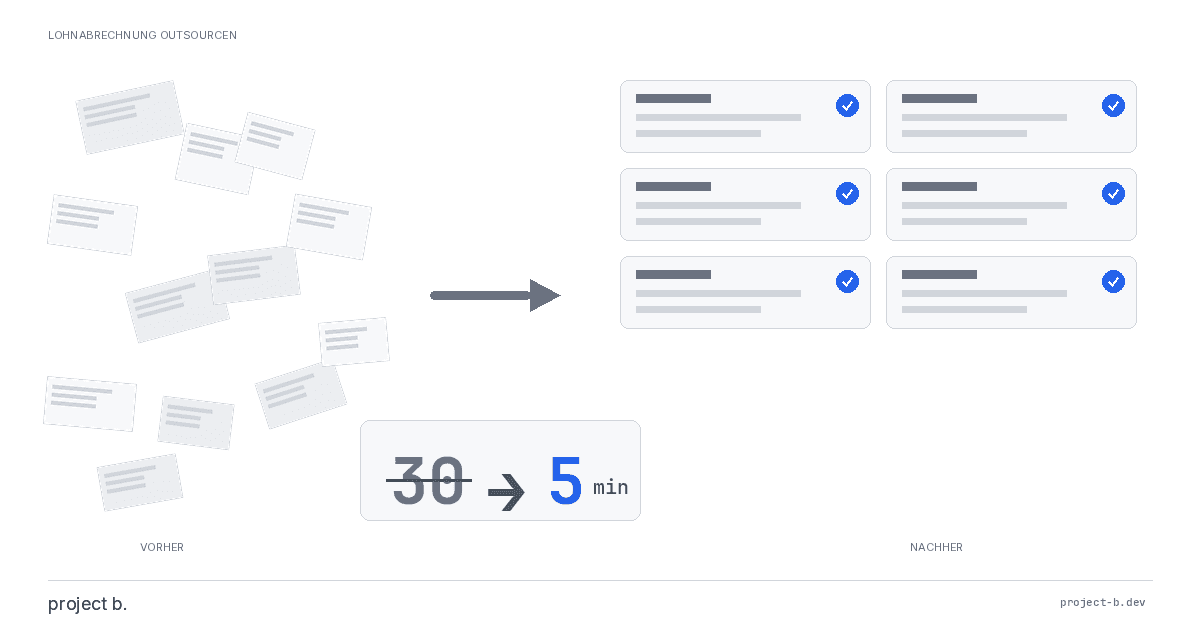

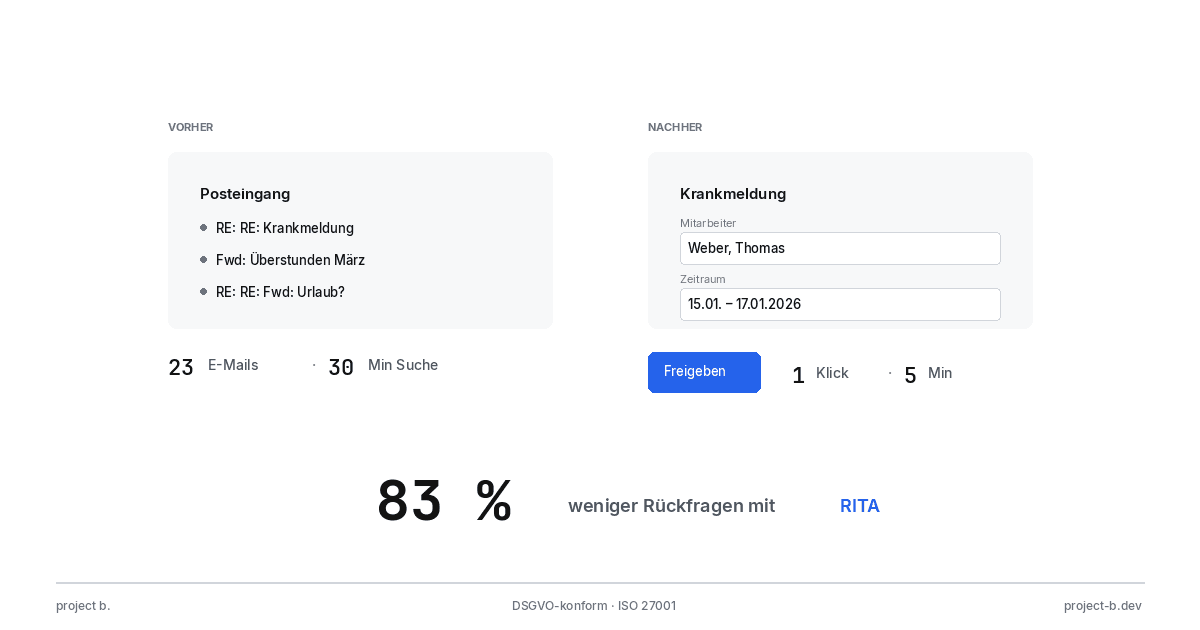

The reality of AI-supported payroll accounting exceeds many expectations today. Modern systems like project b. not only automate individual steps but also take over entire process chains. One example: The automatic processing of sick notifications – from digital capture to calculating wage continuation to generating reports to health insurance. What used to require 30 minutes of manual work is now done by AI in seconds.

A detailed overview of the current AI processes in payroll accounting shows impressive efficiency gains. This is particularly evident in the error rate: While humans make an average of 3-4% errors in manual data entry, the AI error rate is below 0.1%. At the same time, the system continuously learns – the longer it is in use, the more precise the results become.

Process | Time Savings due to AI | Degree of Automation |

|---|---|---|

Processing Sick Notifications | 95% | Fully Automated |

Travel Expense Reports | 80% | Partially Automated |

Creating Certifications | 90% | Fully Automated |

Social Security Notifications | 75% | Partially Automated |

Payroll Tax Registration | 70% | Partially Automated |

Particularly noteworthy is the ability of modern AI systems to learn from exceptional cases. An example from practice: In a medium-sized company with 500 employees, the time required for monthly payroll processing was reduced from four days to six hours today. The responsible payroll clerk now focuses on advising executives and optimizing compensation models – tasks requiring real expertise and providing direct value to the company.

How to Implement AI in Your Payroll Accounting

The transition to AI-supported payroll accounting does not begin with technology, but with a careful analysis of your existing processes. First, track the actual time spent on recurring tasks for two weeks. Experience shows: Usually, 60-70% of the time is spent on routine tasks that can be easily automated. Learn how to use AI in payroll accounting to optimize these processes.

Implementation then occurs in three clearly defined phases:

Data Preparation: Standardization of input formats, cleaning historical data

Parallel Operation: AI system runs one month parallel to manual accounting

Gradual Takeover: Starting with non-critical processes like certification creation

Crucial for success is the early involvement of all stakeholders. Train your employees not only in using the new tools but also explain the advantages: More time for complex cases, less routine work, and lower error rates. A medium-sized company from Stuttgart reports: After initial skepticism, no one wanted to go back to the old system after just two months. The reason: Employees could finally focus on what really matters.

Plan realistically for a full transition of six to eight months. Important: Keep an eye on the DATEV interfaces and clarify early with your tax advisor how the new working method affects their processes. Practice shows: Modern AI systems like project b. integrate seamlessly into the existing software landscape and meet all legal requirements for data protection and documentation.

Finding the Right AI Solution

The choice of the right AI solution is crucial for the success or failure of digitalization. The rule here is: It’s not the system with the most features that wins, but the one that best fits your specific requirements. A recent study by the Digital Association Bitkom shows: 64% of failed AI projects in payroll accounting fail due to a lack of compatibility with existing systems – not because of the technology itself.

Key selection criteria include:

DATEV interface with certification

German support with expertise in payroll tax law

Documented data protection compliance (GDPR)

References from comparable companies

Scalable pricing models

How systematically you select AI software for payroll accounting also depends on your company size. While small companies with up to 50 employees are often well served with standardized cloud solutions, medium and large companies usually require individual adjustments. One example: A machine manufacturer with 250 employees specifically looked for a solution that can automatically calculate complex shift allowances. With project b., the company found a platform that met this requirement and also enabled integration with the existing time tracking system.

Be particularly aware of hidden costs: In addition to the obvious licensing fees, costs for training, data migration, and system adjustments often arise. A transparent total cost calculation over 24 months should be part of every selection decision. The good news: Most companies achieve amortization after 8-12 months through saved personnel costs and avoided errors.

Future Outlook 2026/2027: Payroll Trends and Labor Market Forecasts

The development of payroll accounting until 2026 will be shaped by three key trends:

Fully automated standard processes

90% of all routine payrolls are processed without manual intervention

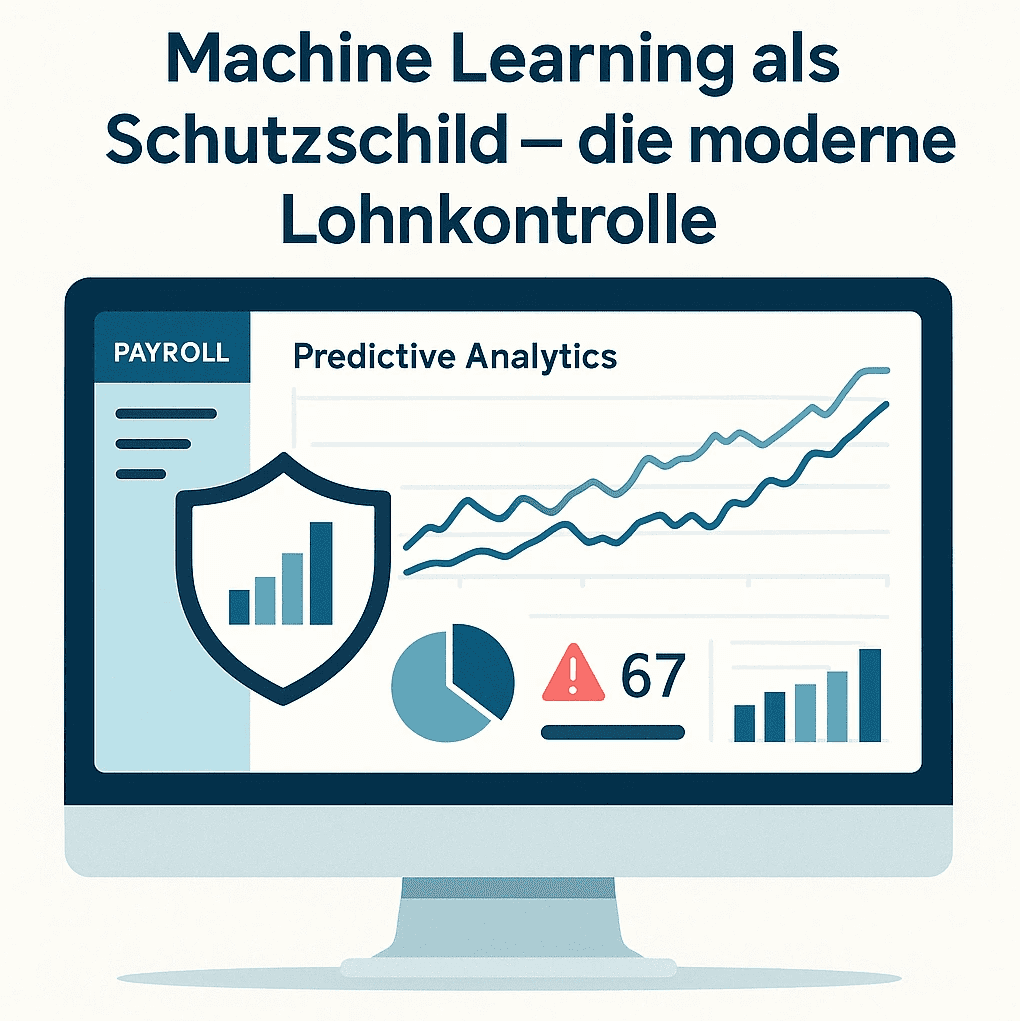

AI-supported predictive models identify anomalies proactively

Real-time payrolls become the standard

New competency profiles in payroll accounting

Shift from data entry to process management and analysis

Increasing demand for "Payroll Technology Consultants"

Hybrid profiles: Fach expertise + digital competencies

Technological Integration

Seamless connection of time tracking, personnel management, and payroll accounting

Blockchain-based salary payments become prevalent

AI-supported compliance checks in real-time

The Federal Employment Agency predicts a transformation of the job profile by 2026: Instead of traditional payroll clerks, "Digital Payroll Managers" will increasingly be sought. They combine expertise with technological understanding and project management skills.

Development until 2026 | Forecast | Impact |

|---|---|---|

Degree of Automation | 90% | Strongly increasing |

Demand for Skilled Workers | -30% | Declining |

Average Salary | +25% | Increasing |

Technology Investments | +80% | Strongly increasing |

Experts expect a rapid consolidation of the market: Small payroll offices without digital expertise will be taken over by larger providers. At the same time, new business models such as "Payroll-as-a-Service" and AI-supported consulting offerings are emerging.

For companies, this means:

Investments in employee qualification will become more important

Hybrid work models will prevail

Stronger focus on strategic HR work

DATEV predicts that by 2026, over 75% of all German companies will use AI-supported payroll accounting systems. The return on investment will decrease to an average of 6 months.

Conclusion

The automation of payroll accounting is no longer an option, but a necessity. The shortage of skilled workers will continue to worsen. Companies that invest in digital processes now gain a crucial competitive advantage. It is important to note: Technology does not replace humans, but supports them. Payroll experts can focus on strategic tasks while software robots take over routine work. The entry does not have to be complex – with the right tools and a step-by-step approach, transformation can be successfully mastered.

Sources

https://www.datev.de/web/de/aktuelles/datev-news/digitalisierung-der-lohnabrechnung-2023/

https://www.bitkom.org/Presse/Presseinformation/Ki-Einsatz-Unternehmen-2023

https://www.bpm.de/sites/default/files/hr-trends-2023-studie.pdf

https://www.arbeitsagentur.de/datei/arbeitsmarktprognose-2026_ba147950.pdf

https://www.datev.de/web/de/m/ueber-datev/das-unternehmen/datev-trends-2026/

Can AI handle payroll?

Based on the current state of development, AI can automate about 70-80% of the standard processes in payroll accounting. Complex decisions, such as those regarding special payments or labor law issues, still require human expertise. AI assists by providing suggestions and plausibility checks.

Will accountants still be needed in 10 years?

The current development suggests that accountants will continue to be needed – albeit with a changed profile. The focus is likely to shift from pure data entry to analysis, consulting, and strategic planning. Current forecasts from the Federal Employment Agency indicate a growing demand for qualified accountants with AI skills.

Are payroll accountants being replaced by AI?

As of now, AI is changing the job profile, but it is not fully replacing it. The current development suggests that payroll accountants are increasingly taking on advisory and strategic roles. Previous experiences show that companies using AI do not employ fewer, but rather differently qualified employees in payroll accounting.

Aaron H.

Further articles

Feb 9, 2026

·

Payment

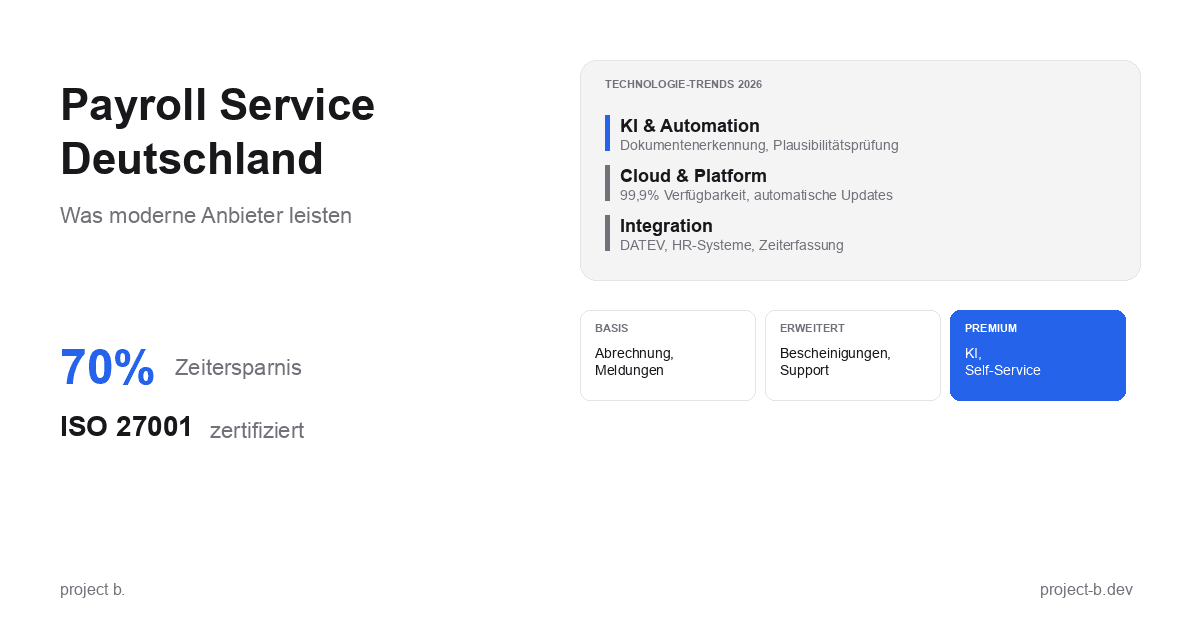

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

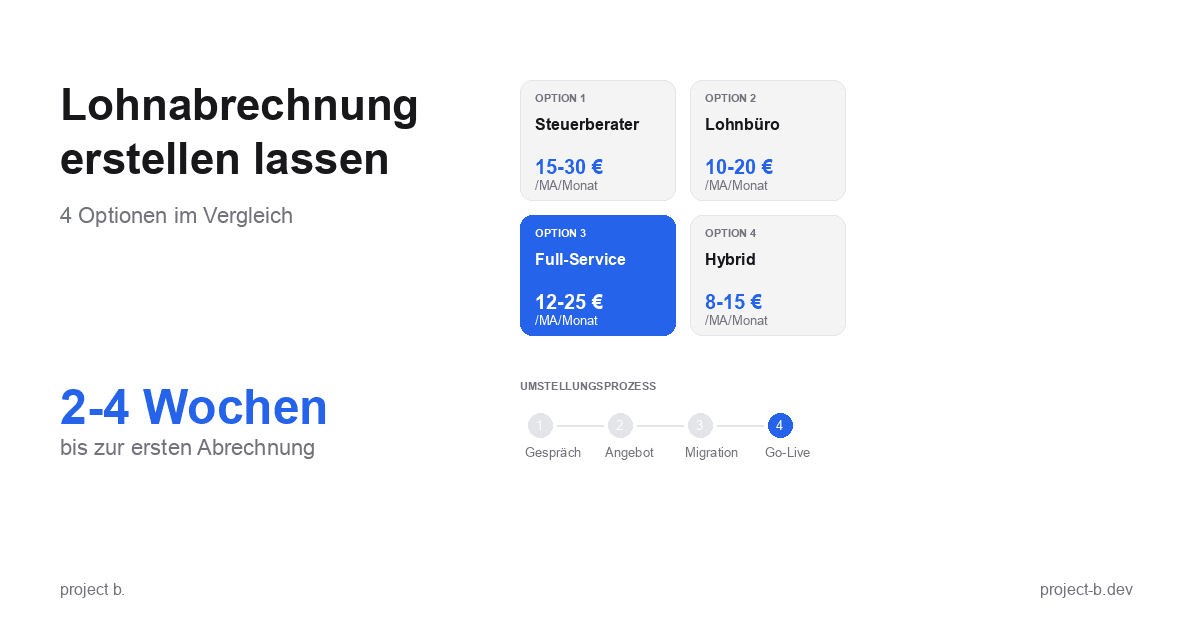

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

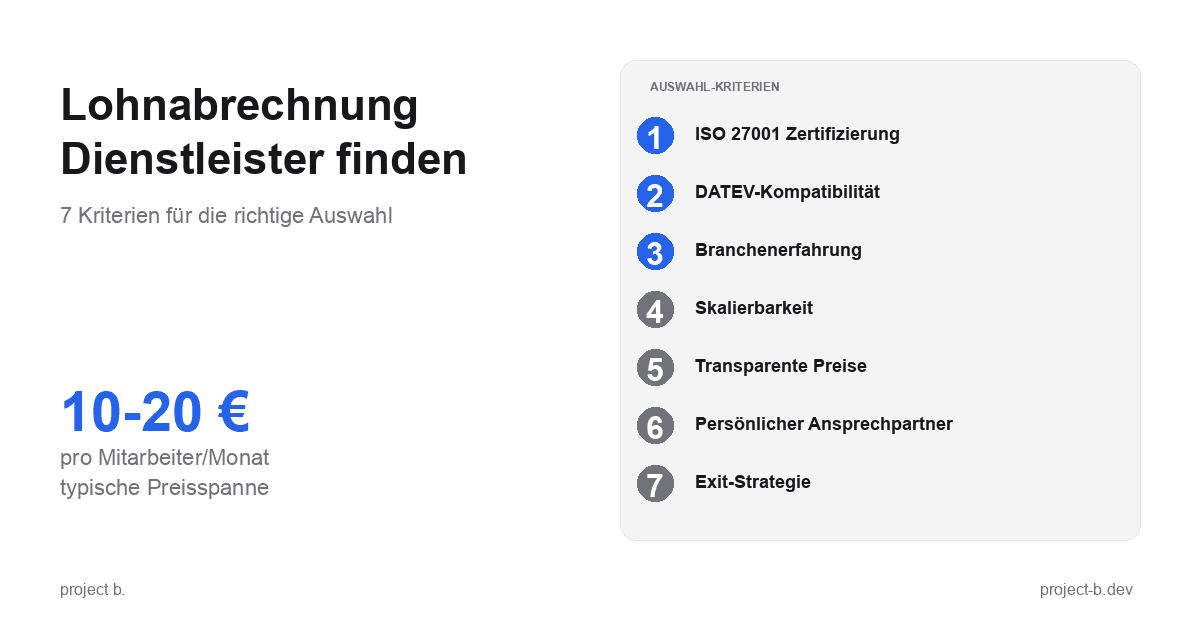

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

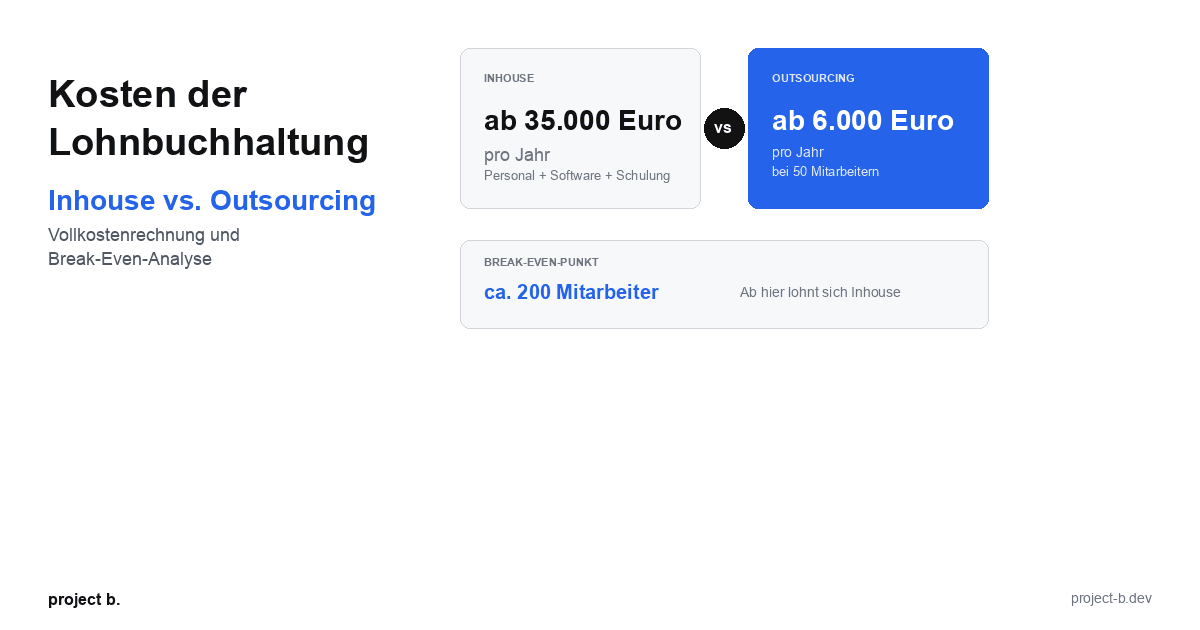

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

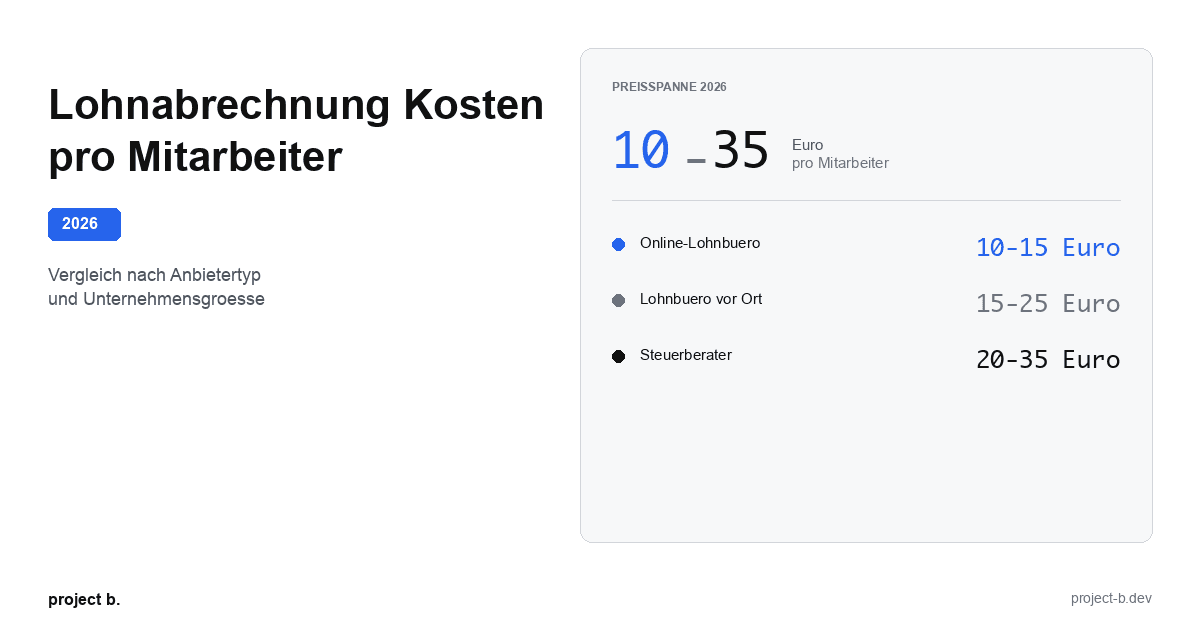

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

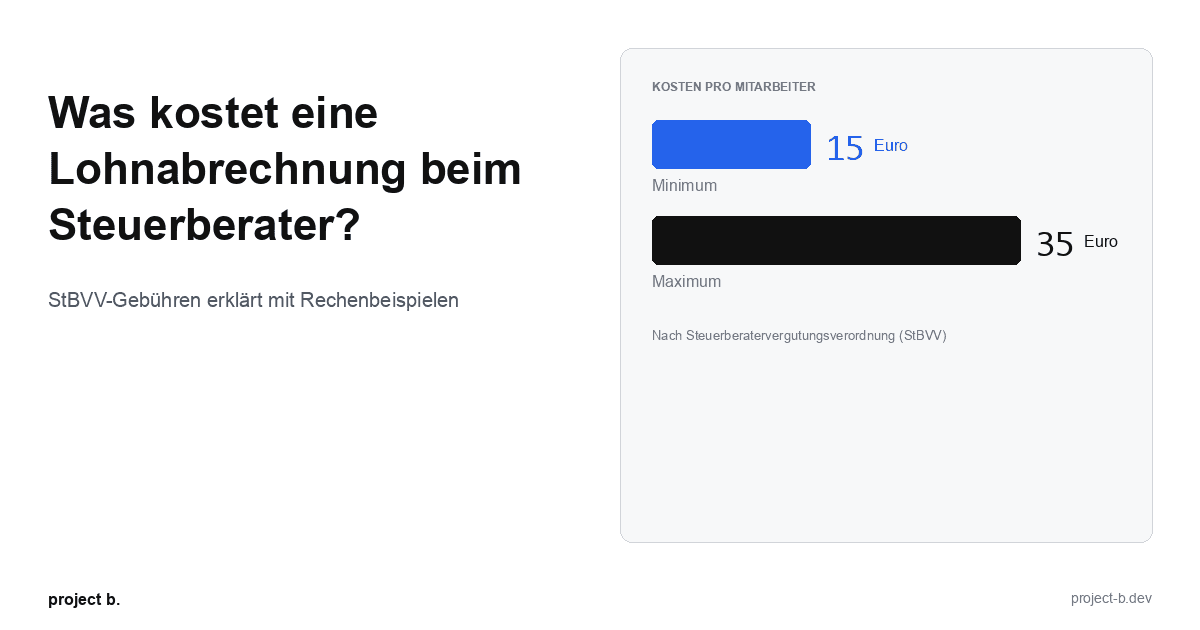

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

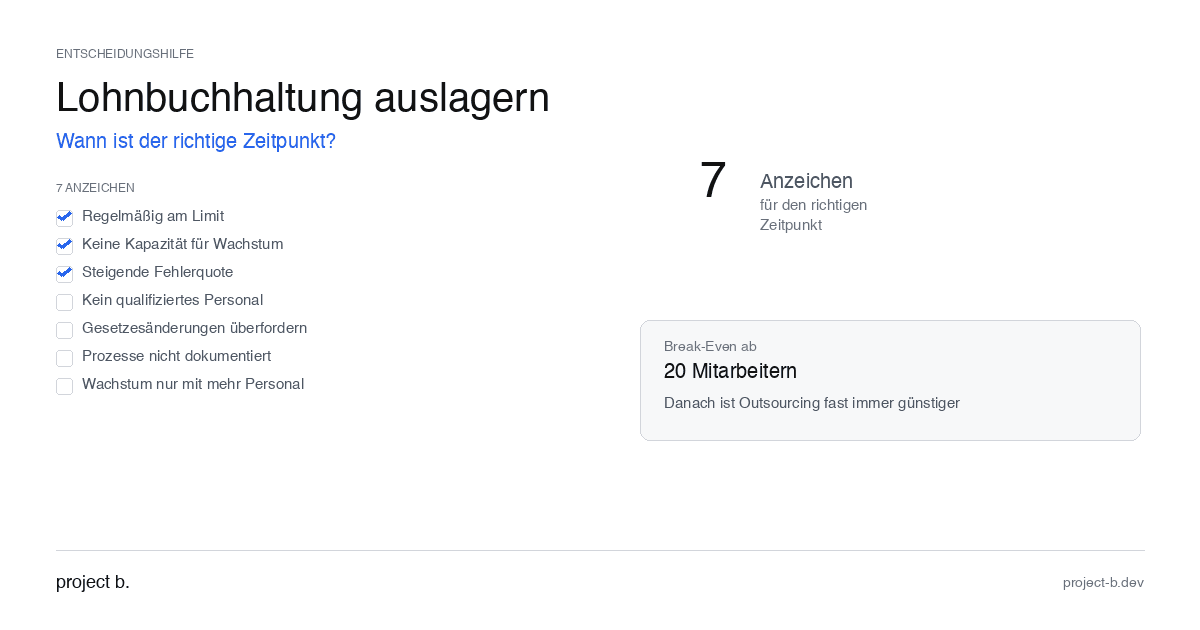

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

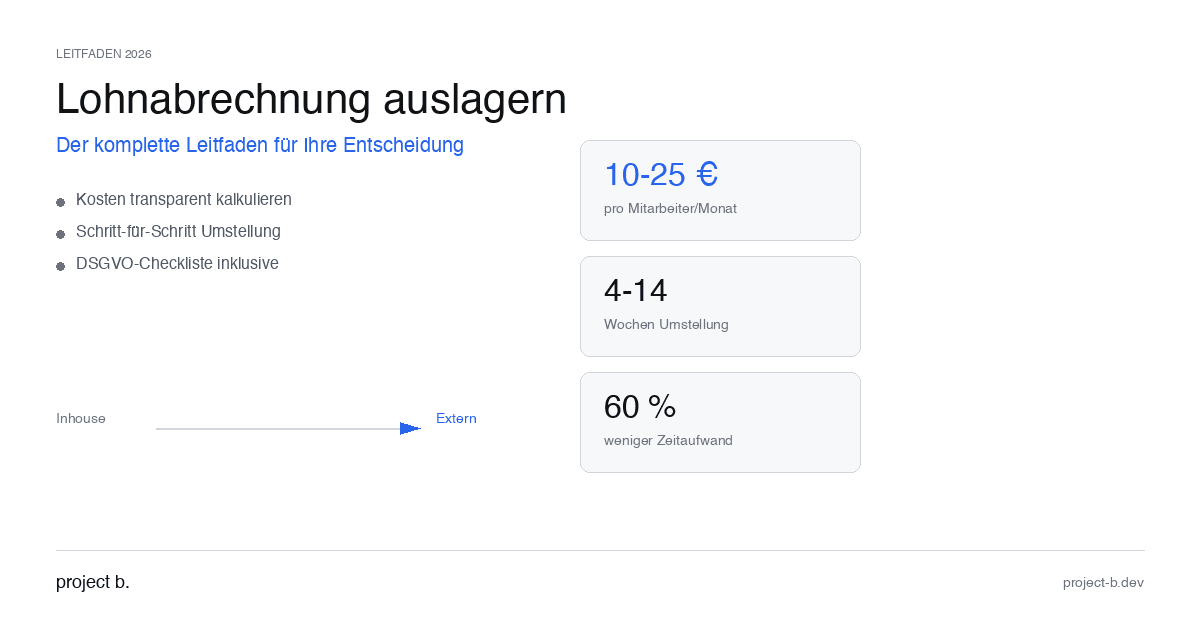

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

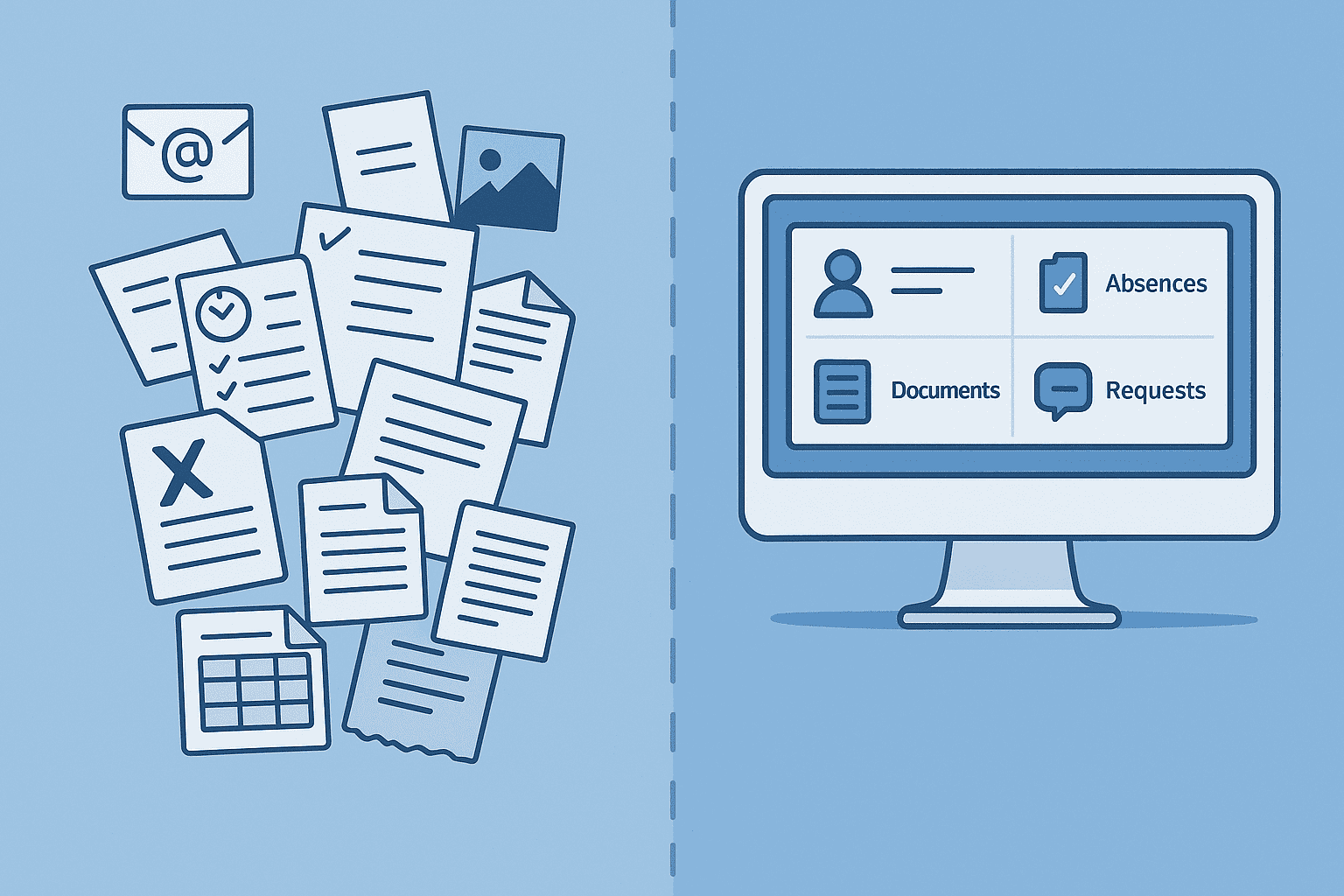

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

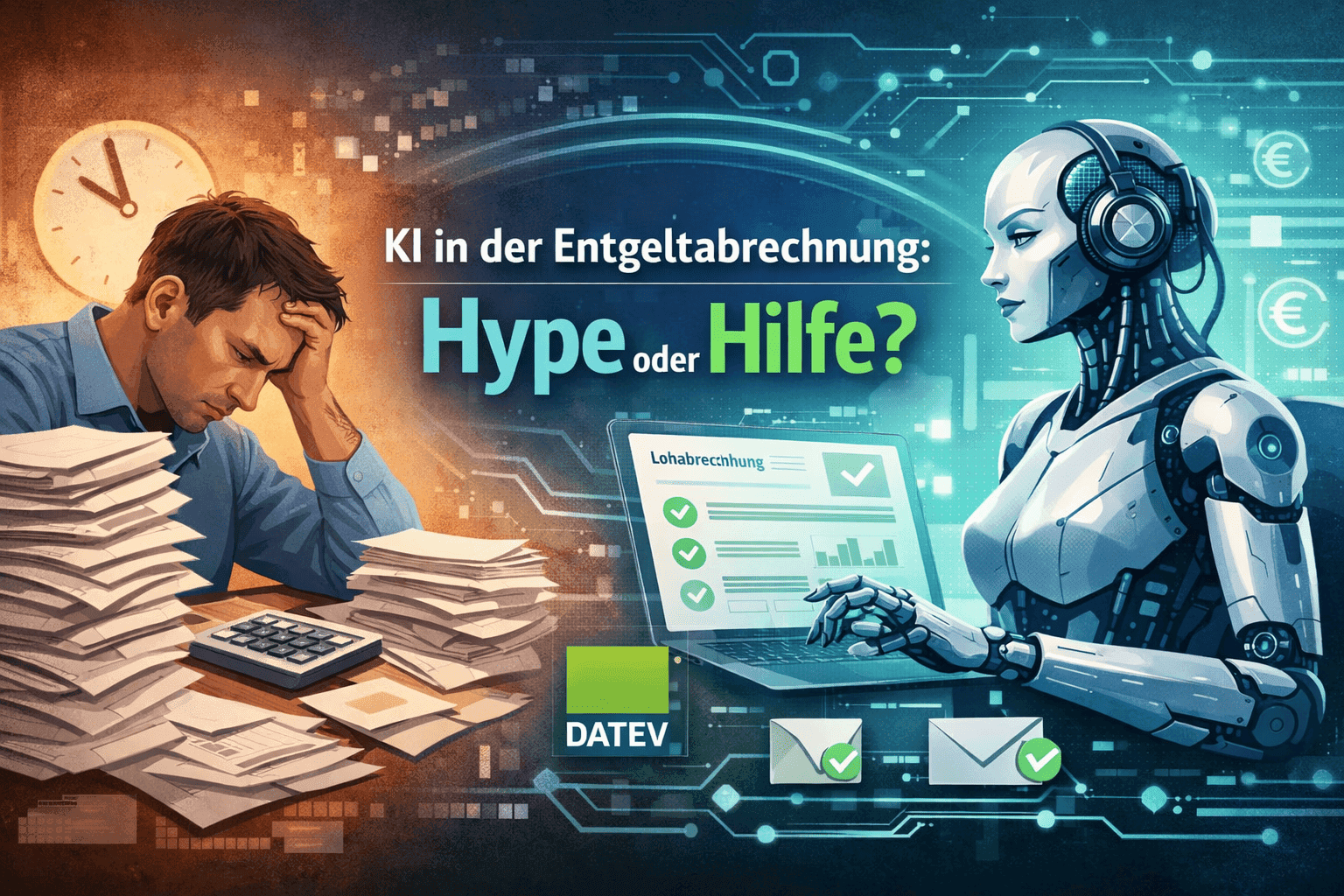

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.