5 Reasons for Payroll Processing with project b.

Dec 2, 2025

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

5 Reasons for Payroll Processing with project b.

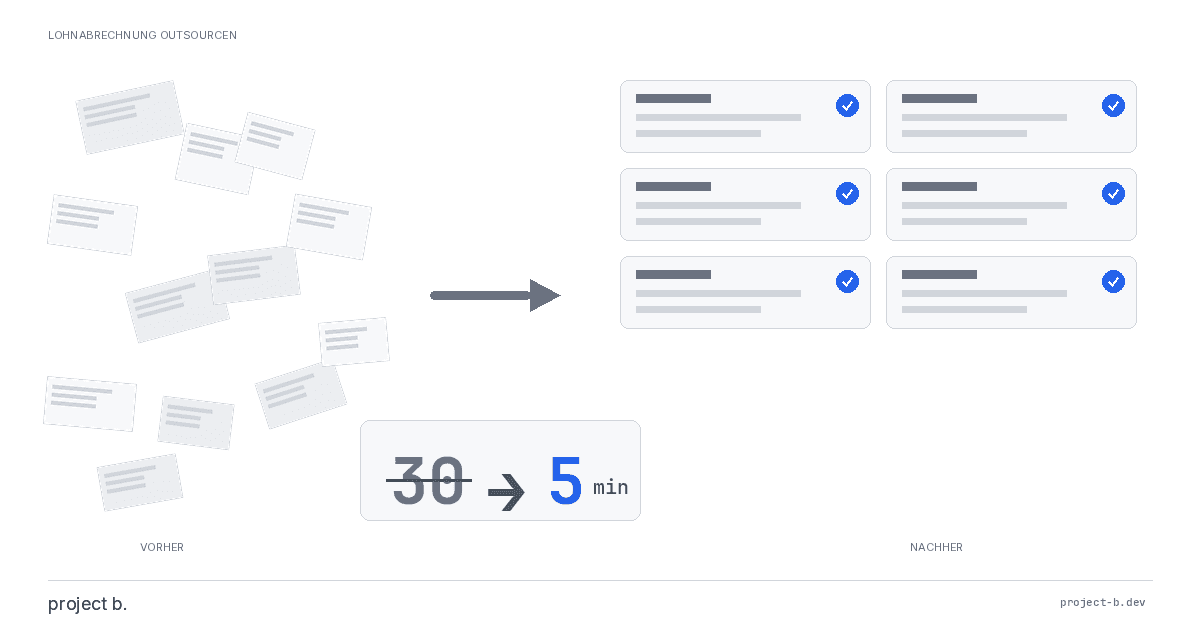

The preparatory payroll processing in tax consulting firms and payroll offices is characterized by media discontinuities, manual data collection, and time-consuming inquiries. Clients provide information in various formats: emails with attachments, scanned time sheets, Excel spreadsheets, or handwritten notes. The result? Clerks spend more time preparing data than on the actual payroll.

project b. solves exactly this problem. The AI-powered platform from Munich was specifically developed for payroll offices and tax consulting firms that want to digitize and scale their processes. Rita, the integrated AI, takes over the preliminary data entry and data validation, while the final control remains with the human.

At a glance: project b. vs. traditional preliminary data entry

Criterion | Traditional | With project b. |

Data collection | Manual typing | Automatic extraction by AI |

Inquiries | By email, often multiple times | Structured in the client portal |

Error rate | High due to manual entry | Low due to plausibility checks |

Integration | Manual transfer | Direct connection to DATEV, Agenda |

Document storage | Distributed in email, DMS | Central in digital personnel file |

Scalability | Limited by personnel | Grows with the client base |

1. Ends the data chaos: All formats are automatically structured

The core problem in preparatory payroll processing is not the payroll itself. It is the data that must be collected beforehand.

The reality in many firms:

Clients send payroll-relevant information in every conceivable variation:

Emails with free text ("Ms. Müller was sick last week")

PDF scans of sick notes

Excel lists with overtime

Photos of handwritten time sheets

Clerks must manually screen, interpret, and transfer this information into the payroll system. This not only costs time but is also error-prone.

What project b. does differently:

Rita, the AI from project b., recognizes and extracts payroll-relevant information from all common formats. The technology is based on OCR (Optical Character Recognition) and Natural Language Processing.

Sick notes are automatically linked with the period and employee

Time sheets are digitized and checked for plausibility

Email contents are structured and assigned to the correct data sets

The result: Clean, verified, uniform data records. No typing, no searching in email inboxes, no error-prone manual data entry.

Practical example:

A tax consulting firm with 180 payroll clients received over 400 emails with payroll data monthly. The manual entry took an average of 2.5 working days. With project b., this effort was reduced to 4 hours, as Rita automatically structured 85% of the data.

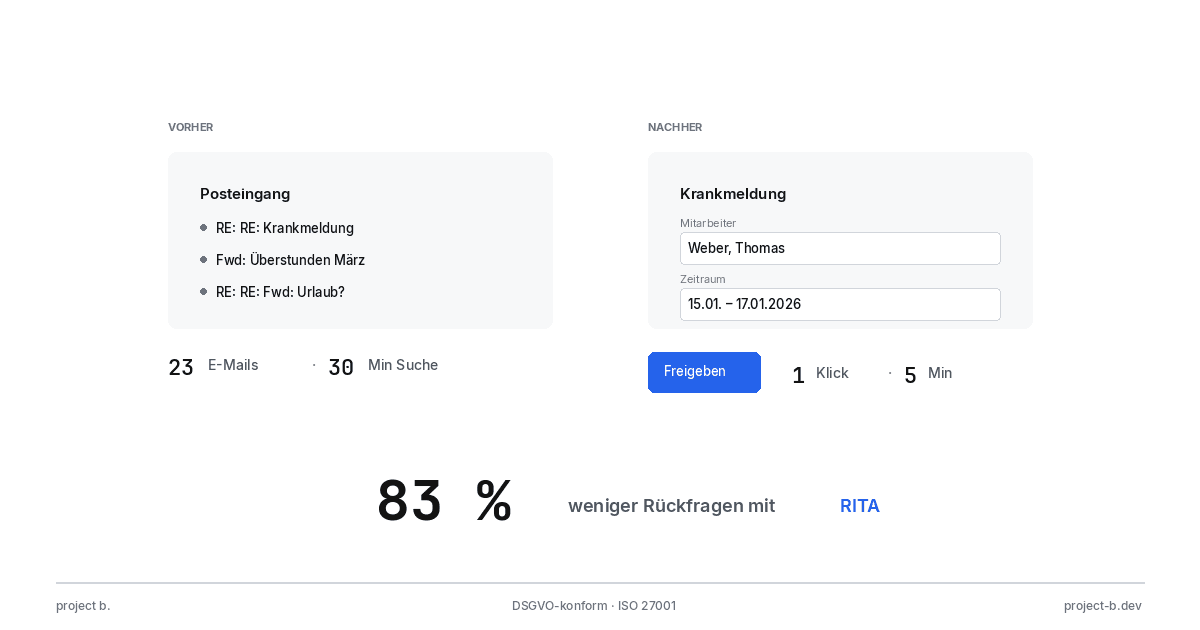

2. Reduces email ping-pong and inquiries

Ask payroll clerks what their biggest time waster is. The answer is rarely "the payroll". It is the inquiries.

The problem:

"Which Müller is meant? You have three."

"The hours from the 15th are still missing."

"Is this sickness or unpaid leave?"

"The bank account details do not match our data."

Every open question means an email to the client. Often, follow-up questions, misunderstandings, and delays ensue. During payroll week, the open points pile up.

How project b. solves this:

project b. automatically structures incoming information and assigns it to the corresponding employees. In doing so, Rita recognizes:

Missing mandatory information (e.g., start date for new hires)

Implausible data (e.g., 60 overtime hours for part-time employees)

Contradictions to existing master data

Incomplete sick notes or leave requests

Instead of writing dozens of emails, clerks see all open points clearly in a cockpit. Clients can directly complement missing information in the portal.

Practical example:

A payroll office with 12 employees processed an average of 120 inquiry emails per week before project b. After implementation, this number dropped to 25, as clients independently clarified open points in the portal.

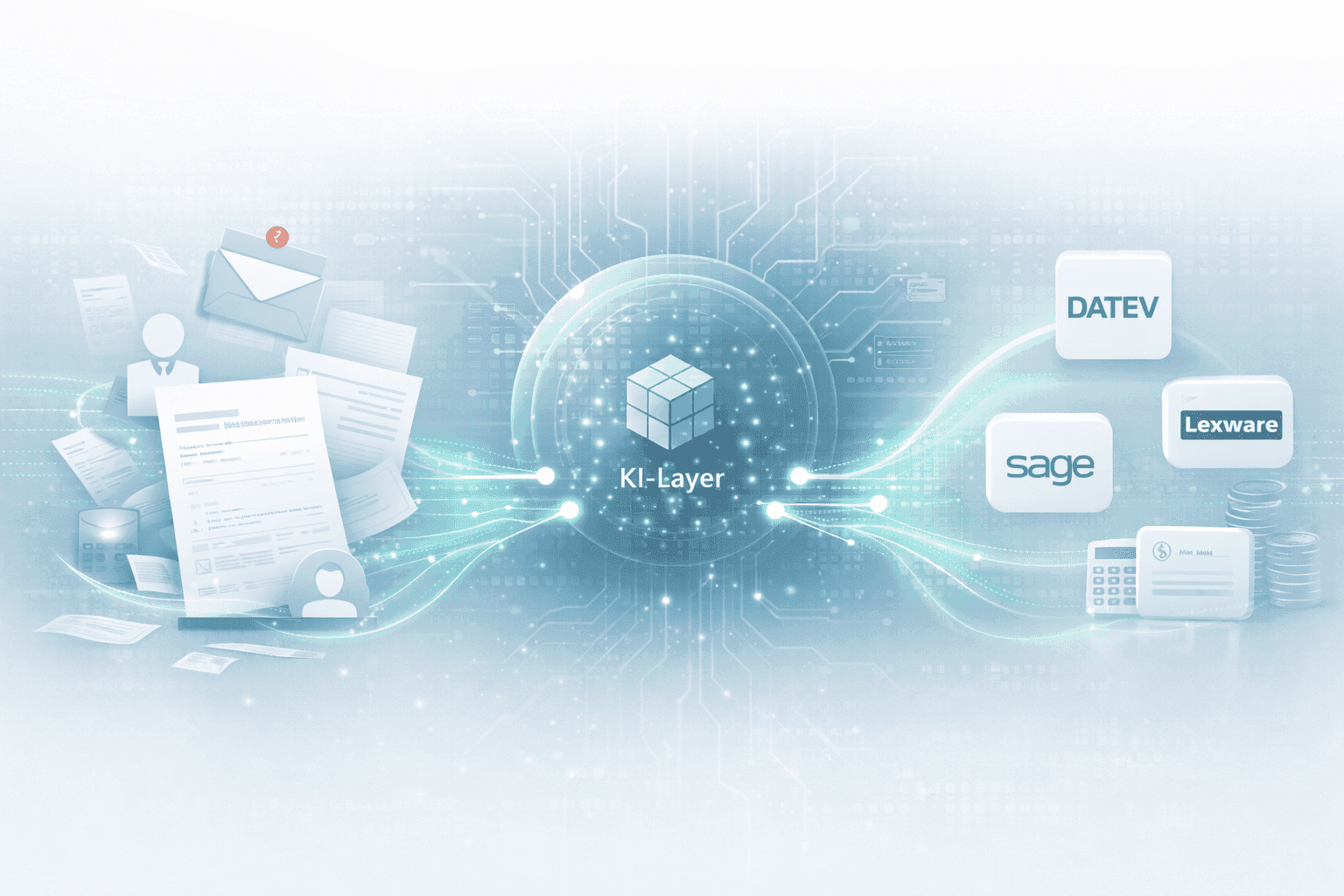

3. Works as an intelligent layer over existing payroll systems

Many firms shy away from software changes. The training for a new payroll system takes months, client data must be migrated, interfaces need to be set up again. project b. understands this.

The approach:

project b. does not replace DATEV, Agenda, SPS, or other established payroll systems. Instead, the platform acts as an intelligent preprocessing layer that seamlessly integrates into existing processes.

This is how the integration works:

1. Data entry: Clients send information to project b. (portal, email, upload)

2. Processing: Rita structures, validates, and assigns the data

3. Approval: Clerks review and approve in the cockpit

4. Export: Approved changes flow directly into the payroll system

Even downstream processes like payroll slip distribution or DMS synchronization run through project b. The entire process chain is digitized.

Supported integrations:

DATEV LODAS and Payroll

Agenda Payroll

SPS Payroll

Other systems on request

Practical example:

A firm with a 15-year DATEV history implemented project b. as a preprocessing layer. The existing DATEV processes remained unchanged. After three weeks of training, the team was productive. The cutover effort? Minimal.

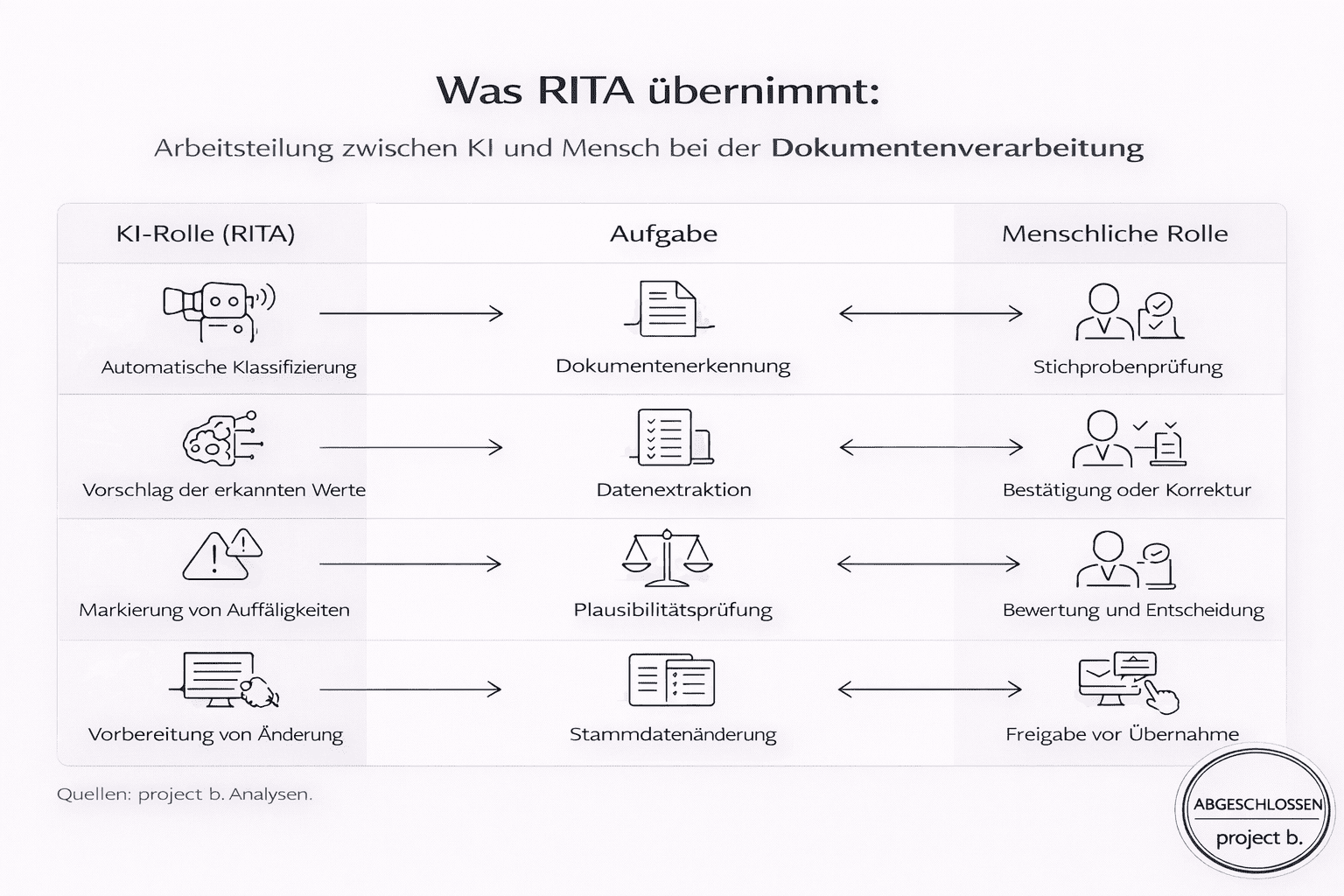

4. AI as co-pilot: Full control remains with the payroll clerk

The skepticism towards AI in payroll processing is understandable. Errors have direct consequences: incorrect salaries, issues with clients, and in the worst case, legal problems. Fully automated black-box systems are therefore not an option.

The project b. approach:

Rita makes suggestions. The final decision always lies with the human.

This means concretely:

Transparency: Every AI action is traceably documented

Control: Clerks review and confirm changes before adoption

Revision security: All steps are logged and audit-ready

Correction capability: Misinterpretations can be overwritten at any time

This "Human-in-the-Loop" principle meets both professional and legal requirements.

What Rita takes over:

Practical example:

Rita recognized a date incorrectly in a scanned sick note (15.03. instead of 13.03.). The clerk saw the suggestion in the cockpit, corrected the date with two clicks, and approved the change. Without the AI preliminary work, she would have had to manually type the document.

5. A platform for all steps of preparatory payroll processing

The fragmentation of tools is an underestimated problem. Client portal here, email inbox there, DMS elsewhere, payroll system somewhere else. Every system change costs time and carries sources of error.

What project b. unites:

project b. offers a single cockpit for the entire preparatory payroll processing:

Client and employee portals: Self-service for changes to master data, document uploads, transparency about processing status

CRM and client management: Overview of all clients, deadlines, and deadlines, communication history

Data validation: Automatic plausibility checks, matching with master data, highlighting anomalies

On- and offboarding: Structured capture of new employees, checklists, automated notifications

Absence management: Central capture of vacation, sickness, parental leave

Payroll slip distribution: Digital provision, GDPR-compliant delivery

The effect: Standardization as a basis for scaling

When all processes run on a single platform, standardization arises. And only standardized processes can be automated and scaled. Firms working with project b. can grow their client base without proportionately hiring more staff.

Practical example:

A growing payroll office took on 40 new clients with a total of 600 employees within 18 months. Without project b., two additional full-time employees would have been needed. With the platform, half a position sufficed for the additional workload.

Who is project b. suitable for?

project b. is aimed at:

Tax consulting firms with payroll clients who want to digitize their preliminary data entry

Payroll offices that want to scale without building linear staff

Accountants and payroll clerks who want to spend less time on admin tasks

Conclusion: More time for consulting, less for admin

The preparatory payroll processing is a bottleneck in many firms. Not due to a lack of competence, but because of inefficient processes. Searching through emails, typing data, asking questions: These are not value-adding activities.

project b. automates exactly these steps. The AI Rita structures the data chaos, the cockpit consolidates all tasks, the connection to DATEV and Co. completes the circle. Control remains with the human, the work is done by the machine.

For firms that want to grow without proportionately hiring more staff, this is the crucial lever. For clerks who want to leave on time, too.

Sources and further links

project b.: https://project-b.dev

DATEV: https://www.datev.de

Federal Chamber of Tax Advisors: https://www.bstbk.de

What does project b cost compared to the tax advisor?

Project B complements the work of tax consultants and payroll offices; it does not replace them. The platform reduces internal preparatory effort by up to 70%. Pricing is per client or employee.

Can a tax advisor still handle payroll?

Yes. Project b. takes over the preparatory payroll accounting, including data collection and validation. The actual payroll calculation continues in the usual payroll system (DATEV, Agenda, etc.) by the tax advisor or the payroll office.

What does the tax advisor need for the payroll with project b.?

Clients do not need any special software. They can submit data via email, upload, or directly through the client portal. For the law firm, only a browser and connection to the existing payroll system are required.

Aaron H.

Further articles

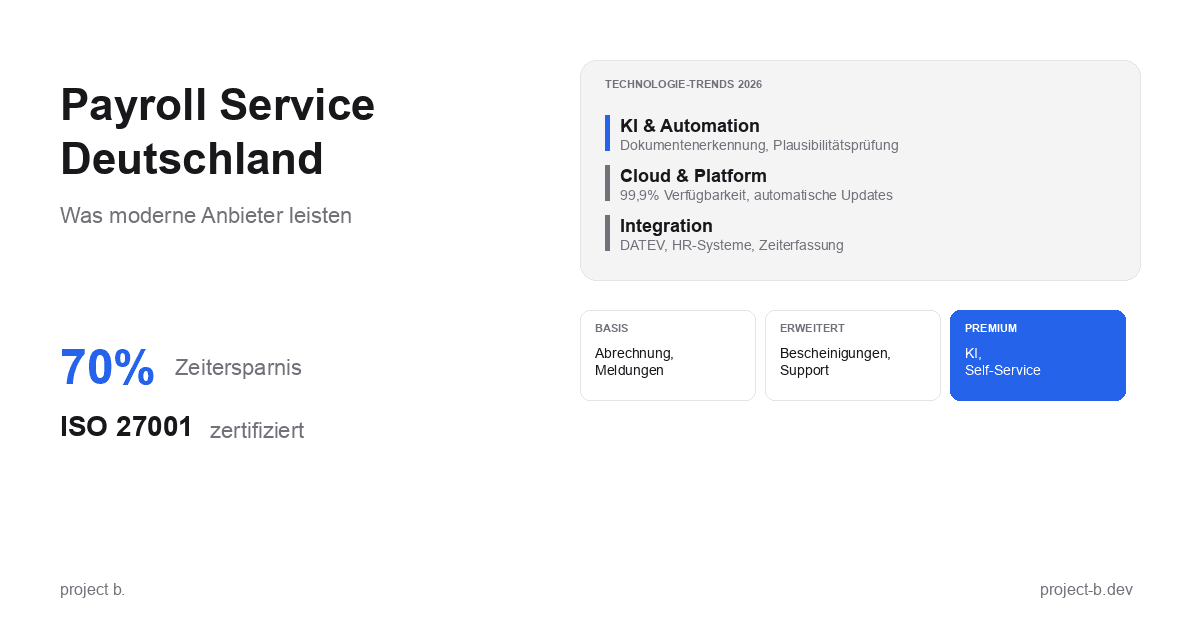

Feb 9, 2026

·

Payment

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

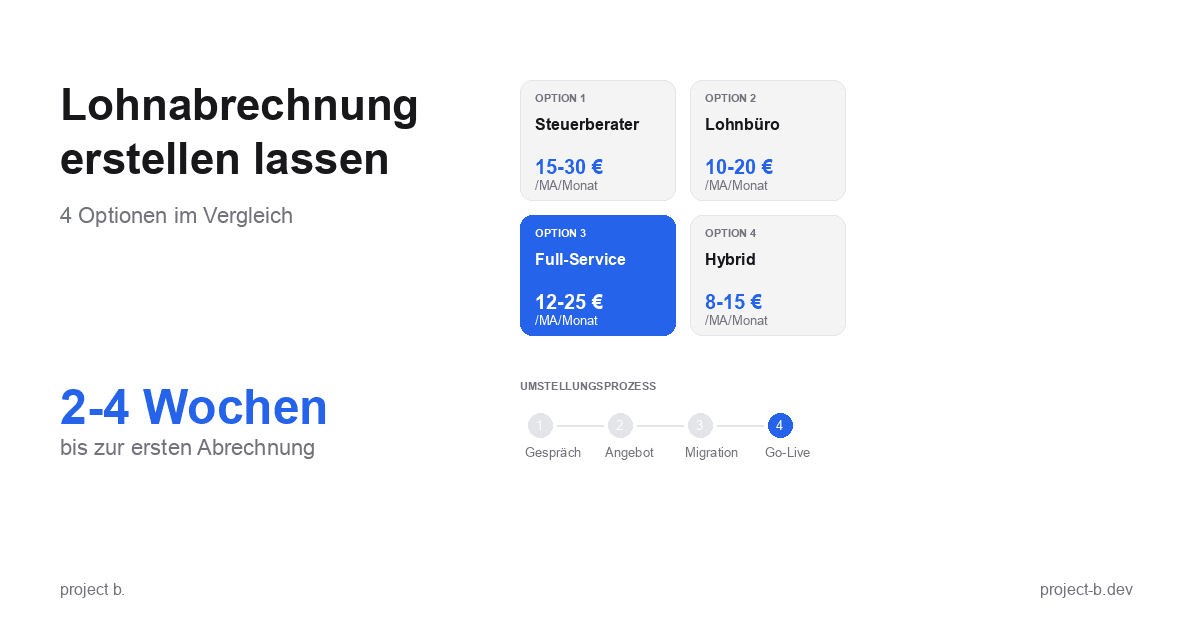

Feb 11, 2026

·

Outsourcing

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

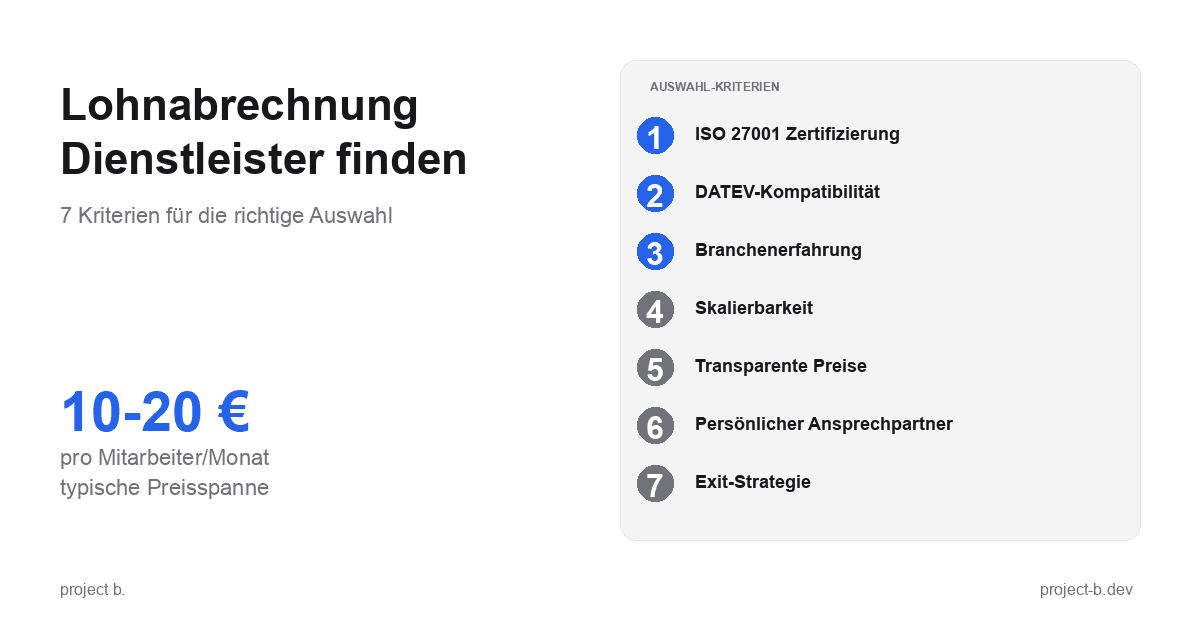

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

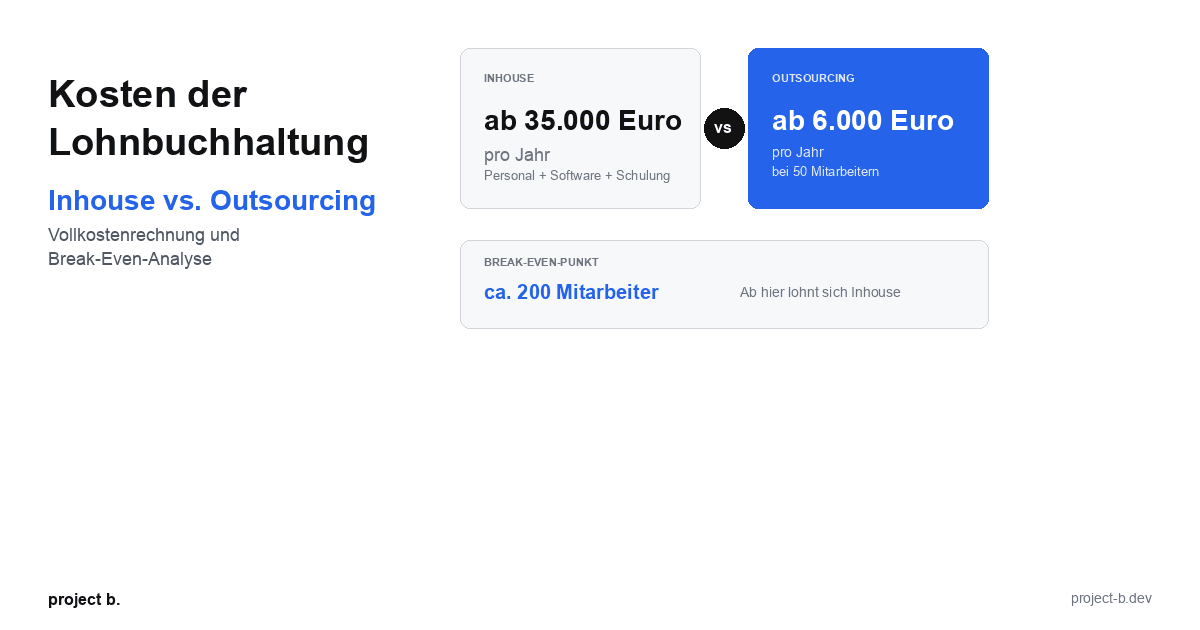

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

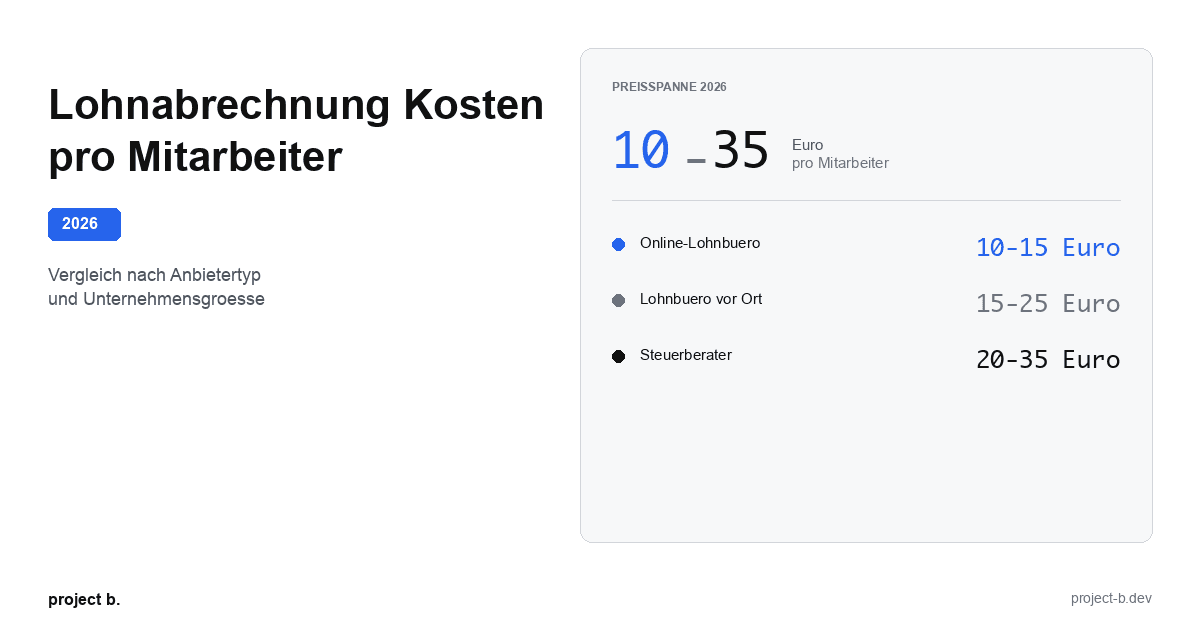

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

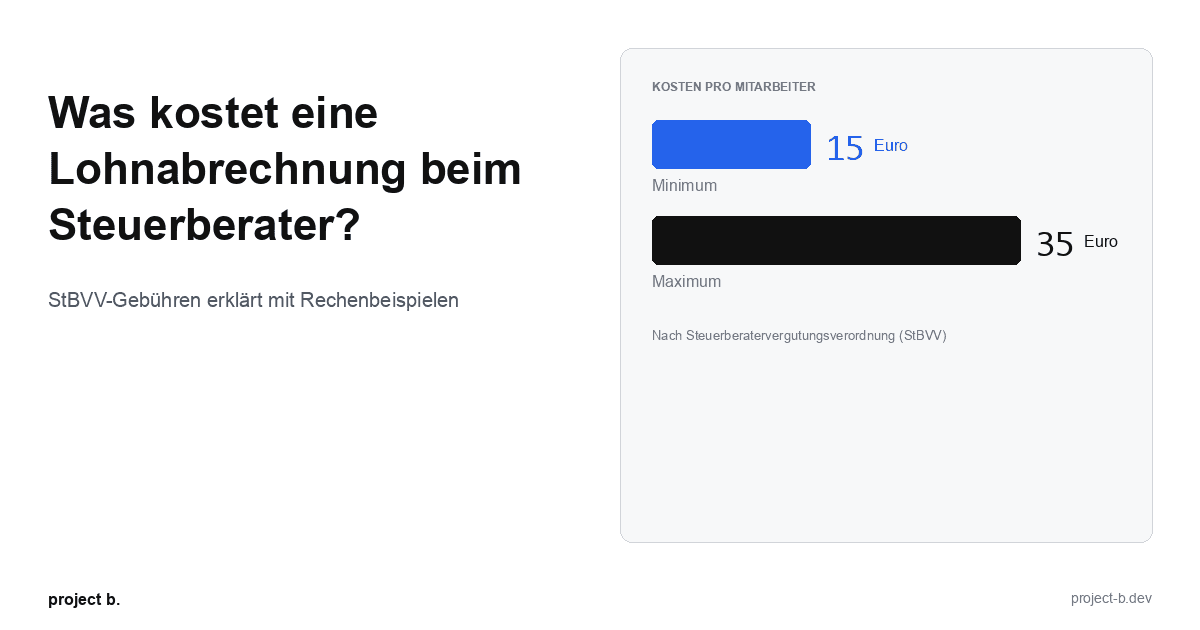

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

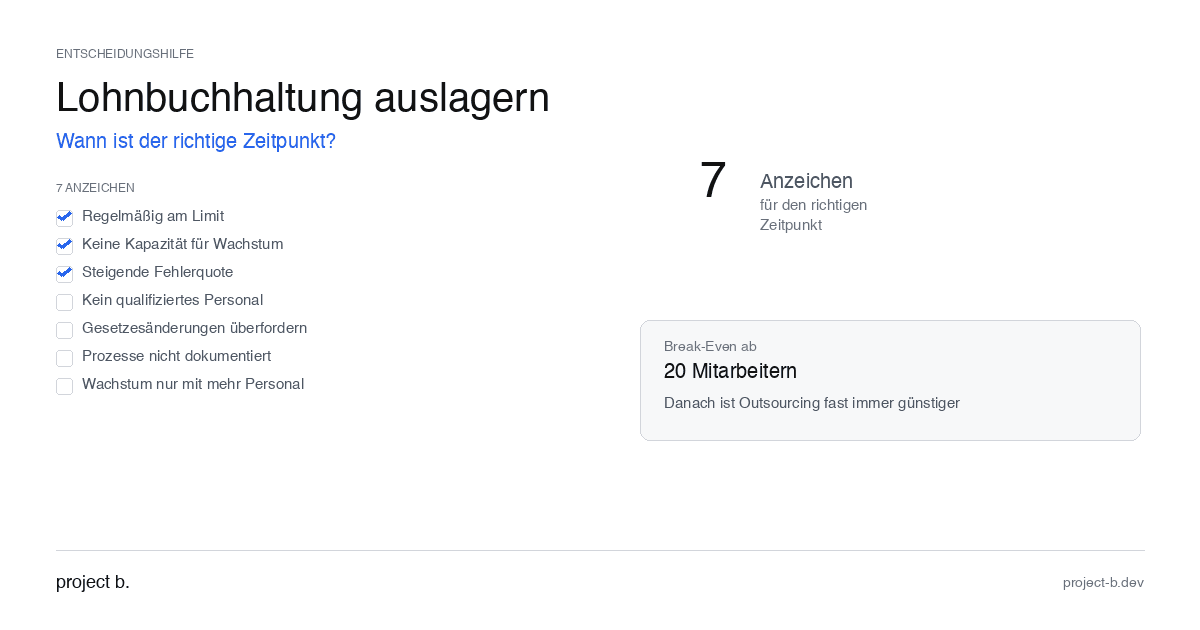

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

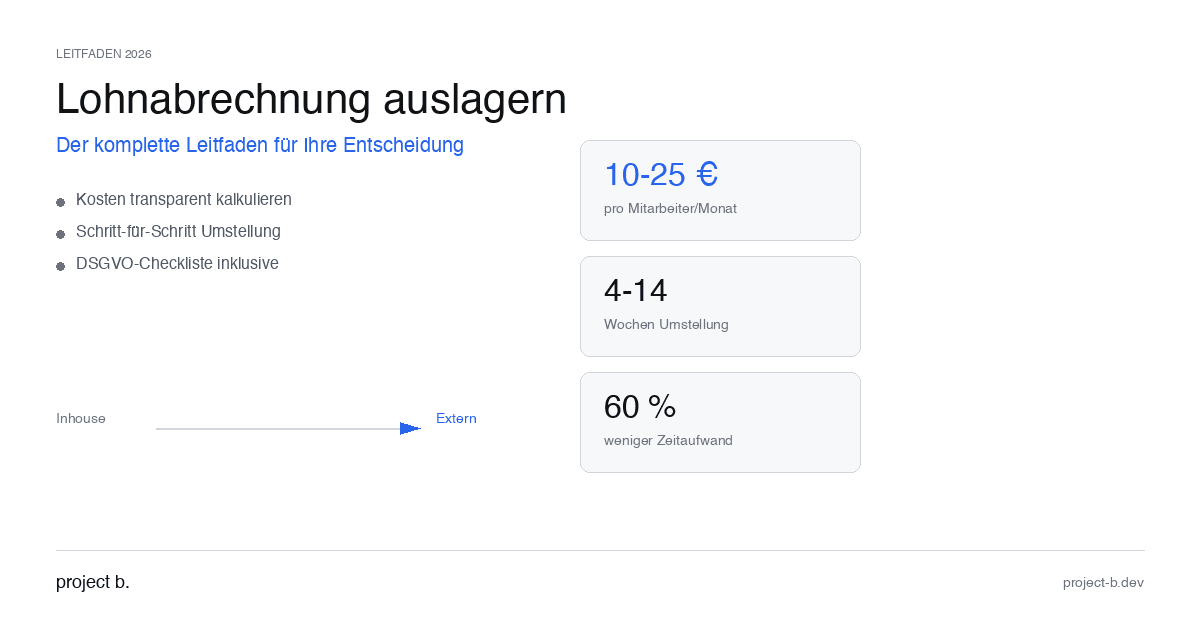

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.