Outsourcing payroll accounting: The complete guide for 2026

Jan 28, 2026

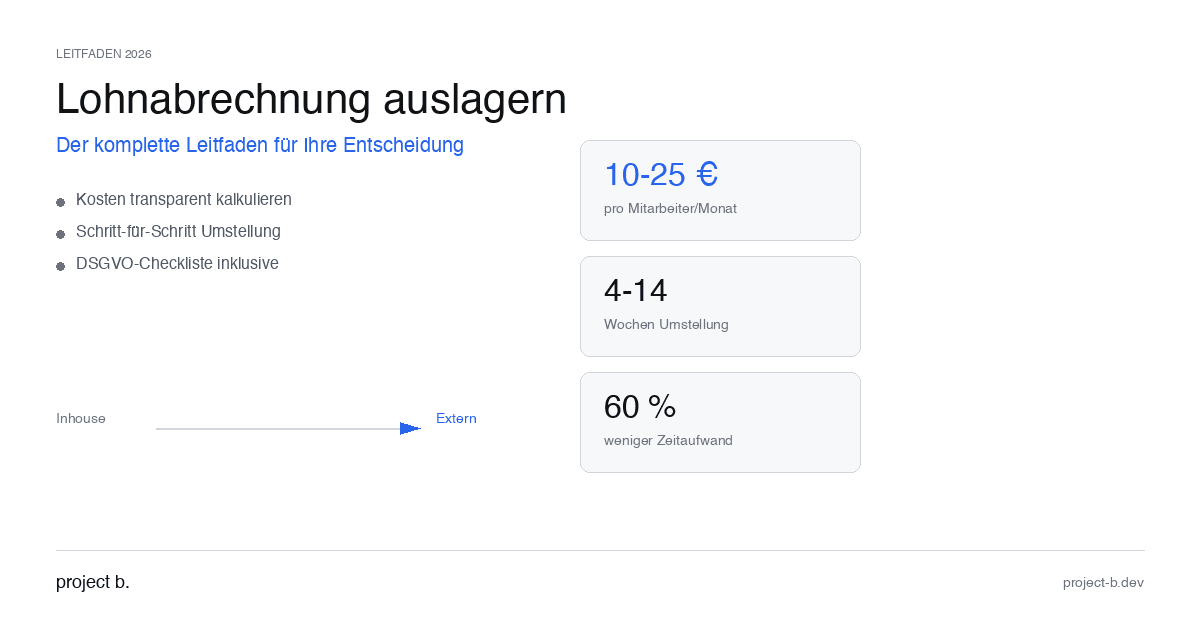

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

You spend days each month on payroll. Sorting emails, typing data, clarifying inquiries, correcting mistakes. And in the end, there is hardly any time left for the work that is actually your core business.

It doesn’t have to be this way. More and more companies are opting to outsource their payroll. The reasons are diverse: a shortage of skilled workers, increasing complexity, the desire for greater efficiency. But how does outsourcing work in practice? What do you need to pay attention to? And is it worth it for your company?

This guide provides you with all the information you need for a well-informed decision.

What does outsourcing payroll mean?

Outsourcing payroll means that an external service provider takes over the payroll processing for your company. This can be an accountant, a specialized payroll office, or a full-service provider with its own platform.

The external partner receives the relevant employee data, calculates salaries and wages, creates statements, and submits reports to social security agencies and tax authorities.

Important to note: Outsourcing does not mean passing on responsibility. As the employer, you remain legally responsible for correct payroll processing. The service provider acts on your behalf and is liable for its work within the framework of the service contract.

Three models of outsourcing

1. Classic outsourcing: The service provider takes over the complete processing. You provide the data, and they do the rest.

2. Hybrid solution: You use a software platform for data collection and communication; the actual processing is done by the partner.

3. Tech-enabled service: AI-supported platforms automate initial data collection; a payroll expert checks and approves. This is the most modern approach and combines efficiency with control.

Which model fits you depends on your company's size, your internal resources, and your quality standards.

In-house vs. external: The honest comparison

Before you outsource, you should know what the alternative costs. Many companies underestimate the actual costs of in-house payroll.

What in-house payroll really costs

The obvious costs are personnel costs. An experienced payroll clerk costs between 45,000 and 65,000 euros annual salary, depending on the region, plus employer contributions to social security.

Additionally, there are:

Software licenses: DATEV, Agenda, or comparable programs cost between 150 and 500 euros monthly

Training: Changes in laws require regular training; budget for 1,000 to 2,000 euros per year

Substitute costs: Who handles payroll during vacations or illness?

Opportunity costs: What could your team achieve if it weren't occupied with payroll administration?

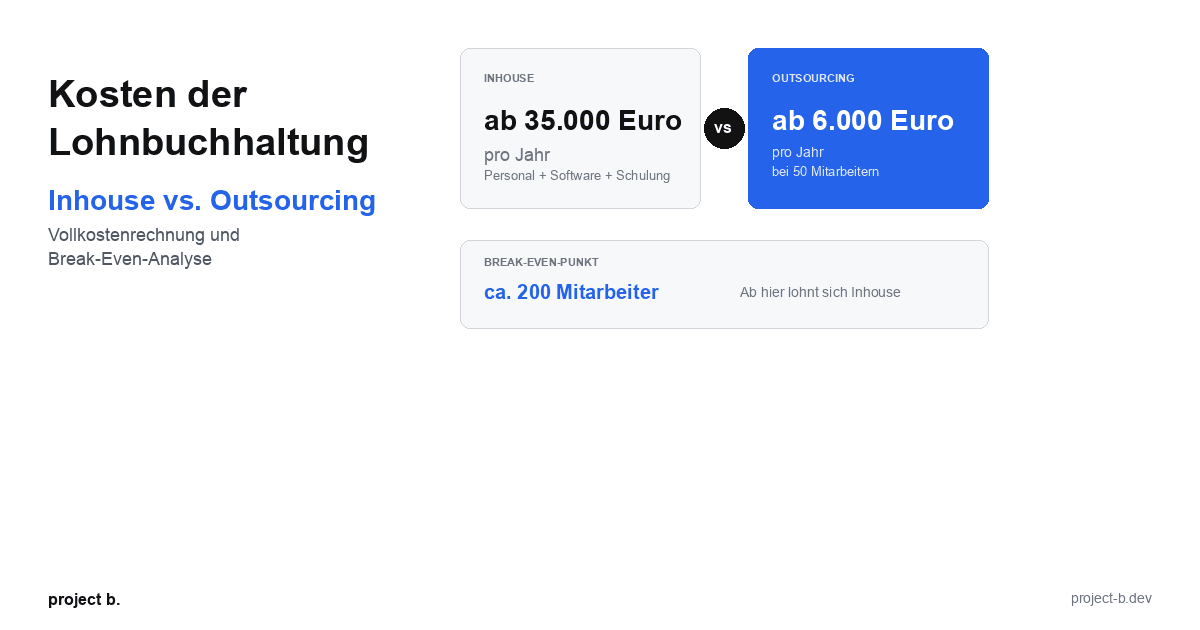

With 50 employees and a dedicated payroll clerk (50% of working time), you quickly reach total costs of 35,000 to 45,000 euros per year.

What external payroll costs

Most service providers charge per employee per month. The range is between 10 and 25 euros, depending on complexity and service level.

With 50 employees, this means 500 to 1,250 euros monthly, or 6,000 to 15,000 euros per year.

The difference is significant. Even with a premium provider, you often save 20,000 euros or more per year.

The less obvious advantages

Costs are not everything. Outsourcing brings further benefits:

Scalability: Hired 40 new employees? With in-house processing, you need more staff. With the service provider, you just pay for 40 more payrolls.

Expertise: Specialized payroll providers deal with labor law, social security, and tax law all day long. They are up-to-date on changes in legislation.

Error reduction: Professional service providers have established auditing processes. The error rate is typically under 1%, while in-house processing often requires 5 to 10% corrections.

"We currently have no capacity for new clients and even have to decline."

This is how a payroll office owner describes the current market situation. The shortage of skilled workers affects not only your company but also traditional service providers. Tech-enabled services can be a solution here.

Step by step: How the transition works

The decision has been made, you want to outsource. How does it work in practice?

Phase 1: Preparation (2 to 4 weeks)

Inventory: Gather all relevant documents. Employment contracts, collective agreements, works agreements, current employee master data, payroll from the last months.

Provider selection: Obtain offers from at least three providers. Pay attention to:

Experience in your industry

Technical integration with your systems

References from comparable companies

Response times and availability

Certifications (ISO 27001, GDPR compliance)

Contract: Clarify service level agreements (SLAs), notice periods, and liability issues. A good service provider has transparent contracts without hidden clauses.

Phase 2: Onboarding (2 to 6 weeks)

Data transfer: Your employee master data will be transferred to the service provider's system. With modern providers, this happens digitally, not via Excel ping-pong.

System setup: If you use a shared platform, you will receive access. Your team will be trained.

Test payroll: Reputable providers conduct parallel payroll in the first month. They compare the result with your previous payroll and resolve differences.

Phase 3: Regular operation

Monthly process:

You provide variable data (working hours, absences, changes)

The service provider creates the payroll statements

You check and approve

The service provider submits reports and payment data

Most companies report that the process becomes established after two to three months.

"The client data comes to us in different ways, and overall it is very unstructured."

This is a typical problem during data transfer. Modern platforms solve this by accepting all formats: email, PDF, Excel, even photos of handwritten notes. The AI extracts relevant information and automatically structures it.

Realistically assess the timeline

Many providers promise "transition in one week." This is possible for simple cases, but not the norm.

Plan realistically:

Small businesses (up to 20 employees): 4 to 6 weeks

Medium-sized companies (20 to 100 employees): 6 to 10 weeks

Complex structures (collective agreements, multiple locations): 10 to 14 weeks

Better to allow a bit more time than to make mistakes under pressure.

Data protection and compliance: What you need to know

Payroll data is particularly sensitive. Salaries, sick notes, bank details: These are personal data that require special protection.

GDPR requirements for outsourcing

If you commission an external service provider, they process personal data on your behalf. You need a data processing agreement (DPA) under Article 28 of the GDPR.

The DPA must at least cover:

Object and duration of processing

Type and purpose of processing

Categories of data subjects

Technical and organizational measures

Rights and obligations of both parties

Every reputable payroll provider has prepared a DPA. Still, review it or have it reviewed.

Technical security measures

Ask potential providers about:

Encryption: Are data encrypted during transmission and storage?

Access controls: Who has access to your data? Is there an authorization concept?

Server location: Where is the data stored? Be cautious with US providers without EU servers.

Certifications: ISO 27001 is the gold standard for information security. Ask for current certificates.

The Federal Office for Information Security (BSI) provides extensive information on IT security standards that good service providers adhere to.

Notification obligations remain with you

Even if the service provider creates the payroll: The responsibility for correct social security notifications and income tax returns lies with you as the employer.

Ensure that your provider:

Submits notifications on time

Provides you with documentation

Supports you during audits by authorities

The Federal Ministry of Labor and Social Affairs provides information about current reporting obligations for employers.

Avoiding typical mistakes in outsourcing

Outsourcing can go wrong. Here are the most common mistakes and how to avoid them.

Mistake 1: Choosing the cheapest provider

Cheap is good; too cheap is suspicious. If a provider offers significantly below market price, either service or quality is missing.

Better: Compare price-performance. Ask what is included in the price. A more expensive provider with better service can be cheaper than a cheap one with many additional costs.

Mistake 2: Not defining clear processes

"Just send us the data" sounds flexible but leads to chaos. Without clear processes, questions, delays, and errors arise.

Better: Define together with the service provider:

What data you will provide and when?

In what format?

Who is the contact person on both sides?

What happens in case of deviations?

Mistake 3: Underestimating the transition

"We'll do it on the side" is a recipe for problems. A payroll transition requires attention.

"But I don't have time to improve it."

This is how a payroll clerk describes her situation. Day-to-day business leaves no capacity for improvements. Therefore, it is even more important to consciously carve out time for the transition phase.

Better: Appoint an internal project manager. Plan time. Inform affected colleagues in advance.

Mistake 4: No fallback plan

What happens if the service provider fails? If the platform is unreachable?

Better: Clarify emergency scenarios. Do you have access to your data? Is there a backup process? How quickly can you revert to in-house processing in case of emergency?

Mistake 5: Neglecting communication

Your employees notice the transition. New pay slips, perhaps a new portal for documents.

Better: Communicate proactively. Explain why you are transitioning and what is changing. Appoint contact persons for questions.

Practical example: An accounting firm transitions

A concrete example shows how the transition can proceed.

Initial situation

A medium-sized accounting firm in Bavaria manages 60 payroll mandates with a total of 850 employees. The payroll department consists of three full-time employees.

The problems:

Flood of emails with up to 70 messages per day per person

Clients provide data in all formats: email, Excel, PDF, WhatsApp, handwritten notes

High time expenditure for sorting, typing, inquiries

No capacity for acquiring new clients

One position unfilled for months

"Every incoming email we then have to first check, process and place in the separate folder for this client, which takes an extremely long time."

The decision

The firm decided on a tech-enabled service with an AI-supported platform. Key factors included:

DATEV integration: Existing workflows remain intact

Client portal: Data arrives structured, no matter how the client sends it

AI pre-processing: Automatic data extraction saves time

Flexibility: No minimum contract duration

The transition

Month 1: Ten pilot mandates were transitioned. The team got to know the platform, and first processes were defined.

Months 2 to 3: Gradual expansion to all mandates. Clients received access to the portal.

After 4 months: Complete regular operation. The payroll week, which previously took four days, was reduced to one and a half days.

The result

Time savings: 60% less effort in initial processing

Error rate: Dropped from an estimated 8% to less than 2%

New mandates: 15 new mandates accepted in the first half of the year

Employee satisfaction: Fewer overtime hours, less stress during payroll week

"We see the most efficiency gains with you when the client can still do what they want, but we receive the data uniformly."

The firm was able to resolve its capacity bottlenecks without hiring additional staff.

Why project b. for outsourcing?

If you are considering outsourcing, you should get to know project b. The Munich-based company offers exactly the combination of technology and service that modern payroll needs.

RITA: AI that makes your work easier

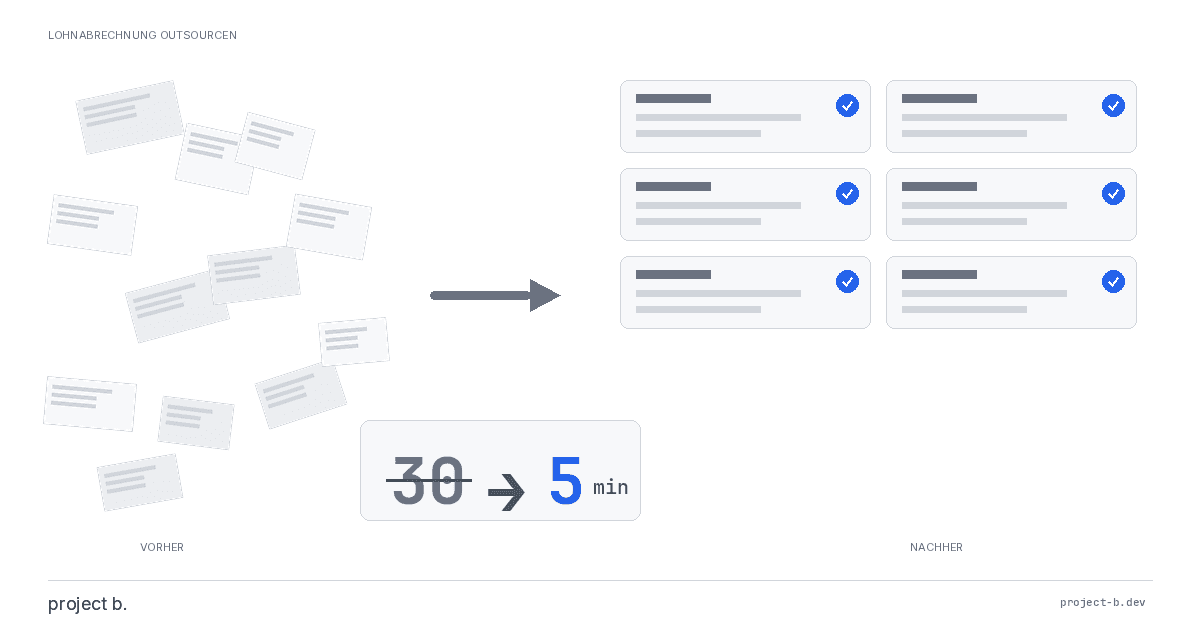

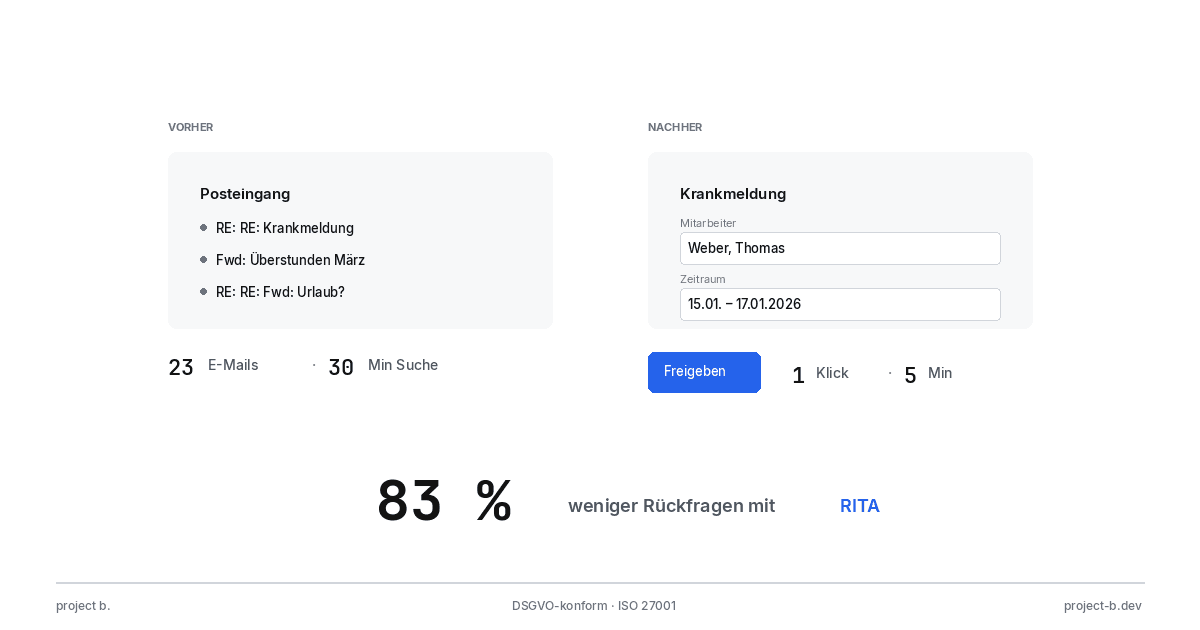

The AI assistant RITA reads incoming documents, extracts the relevant data, and checks for plausibility. A sick note that previously required 30 minutes of manual work can now be completed in under 5 minutes.

It should be noted: RITA makes suggestions; you decide. The final approval always lies with humans.

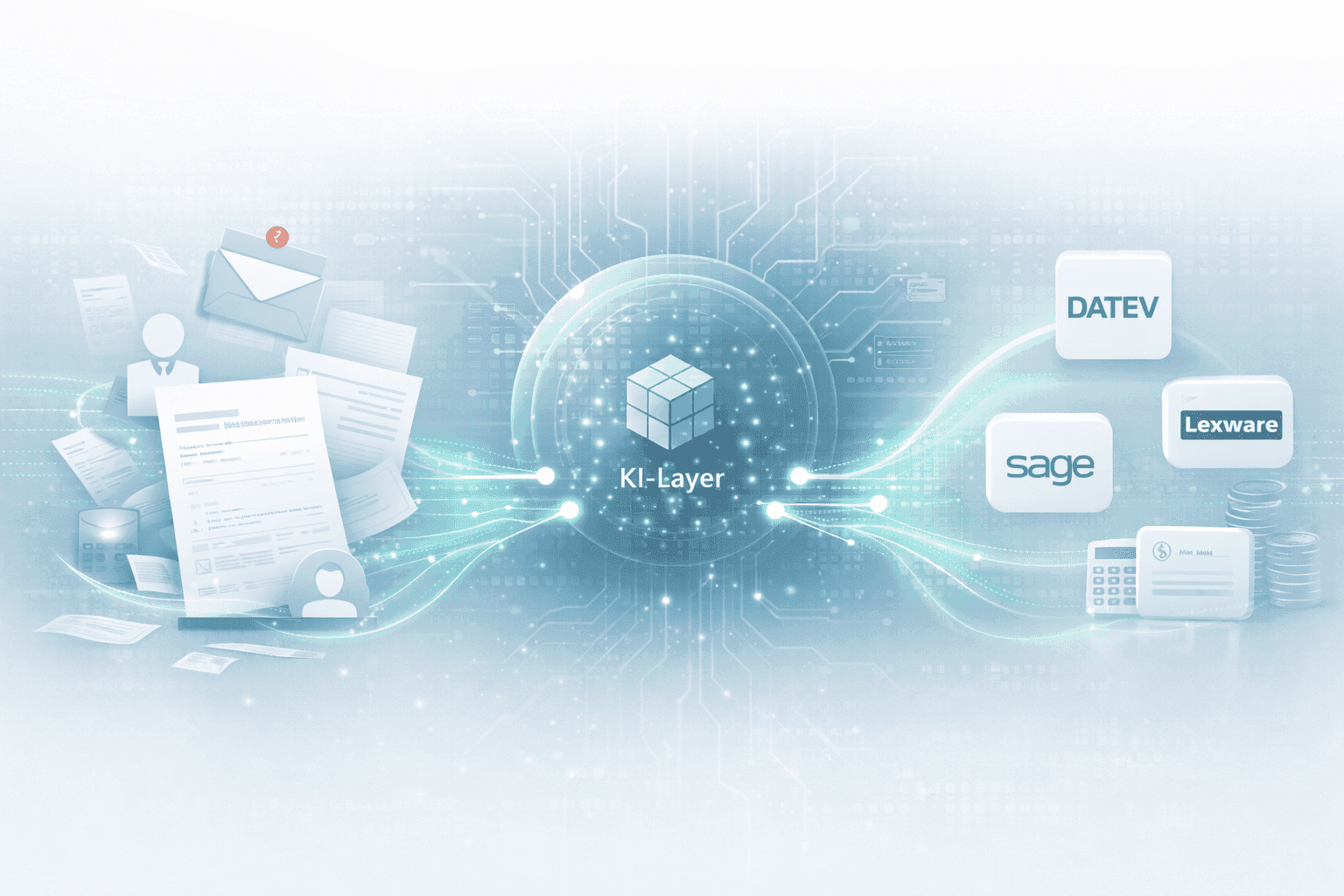

DATEV integration without media breaks

Project b. does not replace DATEV but complements it. Approved changes flow directly into the payroll system. No double data entry, no export-import games.

You can read more about this in the article 10 processes in payroll that AI already handles today.

Two options for your situation

Platform: You maintain control and use the software for your own payroll. Ideal for firms and payroll offices that want to become more efficient.

Payroll by project b.: Complete outsourcing by a network of experienced payroll professionals. Ideal for companies that want to focus on their core business.

Both options combine technological efficiency with human expertise. Detailed information is available on our Payroll Outsourcing page.

Security and compliance

ISO 27001:2022 certified

GDPR compliant, servers in Germany

Investors like Lakestar (Spotify, Delivery Hero) and QED (Klarna) trust project b.

No risk when starting

Setup in 30 minutes

No minimum contract duration

Free demo with real data

You don’t have to make any decisions today. But if you want to know what modern payroll looks like: Schedule a non-binding consultation.

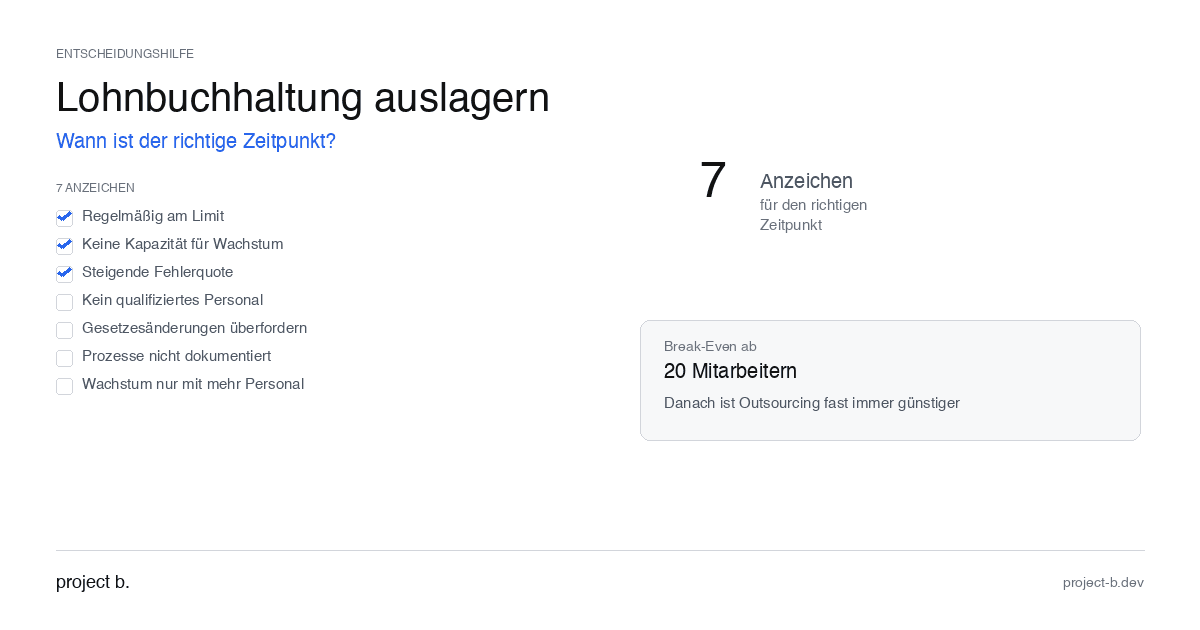

Conclusion: When should you outsource?

Outsourcing payroll is not a question of whether, but when and how.

Outsourcing makes sense if:

You have more than 20 employees

Your payroll department is regularly overwhelmed

You have difficulty finding qualified personnel

You want to grow without proportionally hiring more staff

You want to focus on your core business

The right approach:

Examine different models (classic vs. tech-enabled)

Compare at least three providers

Allow sufficient time for the transition

Define clear processes

Communicate with your team

Payroll is too important to leave to chance. But it is also too time-consuming to handle inefficiently. You will find the right balance with the right partner.

Further information is available in our article Outsourcing payroll: Costs, benefits, and providers.

How long does the transition to an external service provider take?

Depending on the size and complexity of the company, the transition takes 4 to 14 weeks. Small companies with simple structures are faster, while complex setups with collective agreements take more time. Allow for a buffer.

Can I continue to use my tax advisor?

Yes. Modern payroll platforms integrate into existing structures. Your tax advisor retains access to all relevant data. The systems complement each other instead of replacing one another.

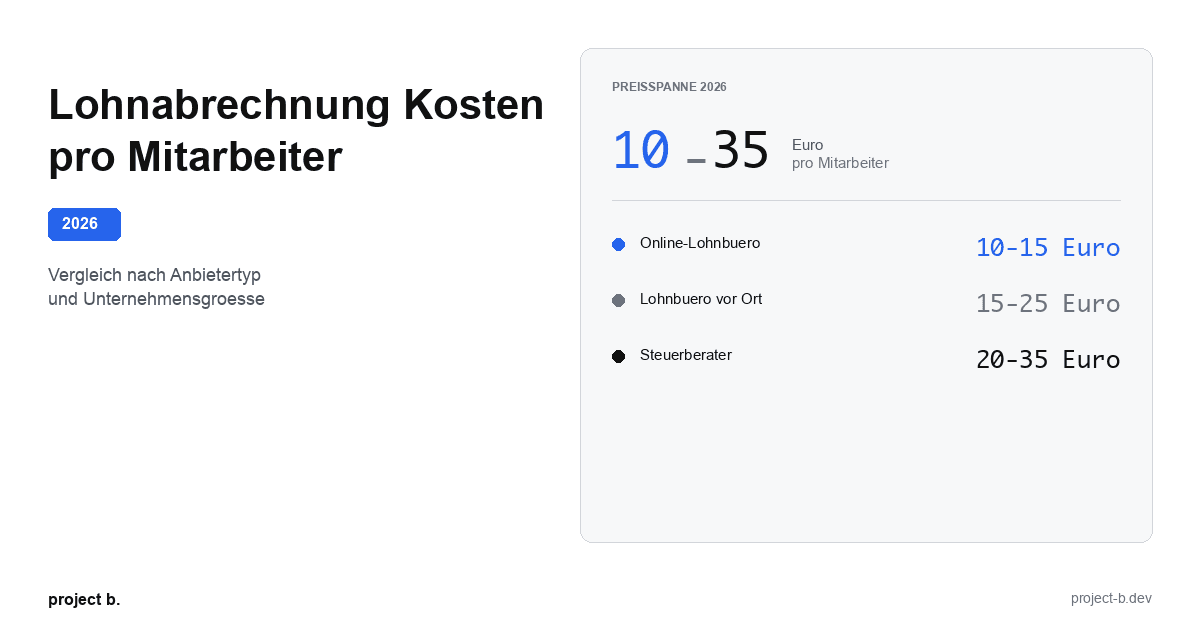

What does outsourcing payroll processing cost per employee?

The costs range from 10 to 25 euros per employee per month, depending on the service level. Full-service with a personal contact person is more expensive than pure software solutions.

Finn R.

Further articles

Feb 9, 2026

·

Payment

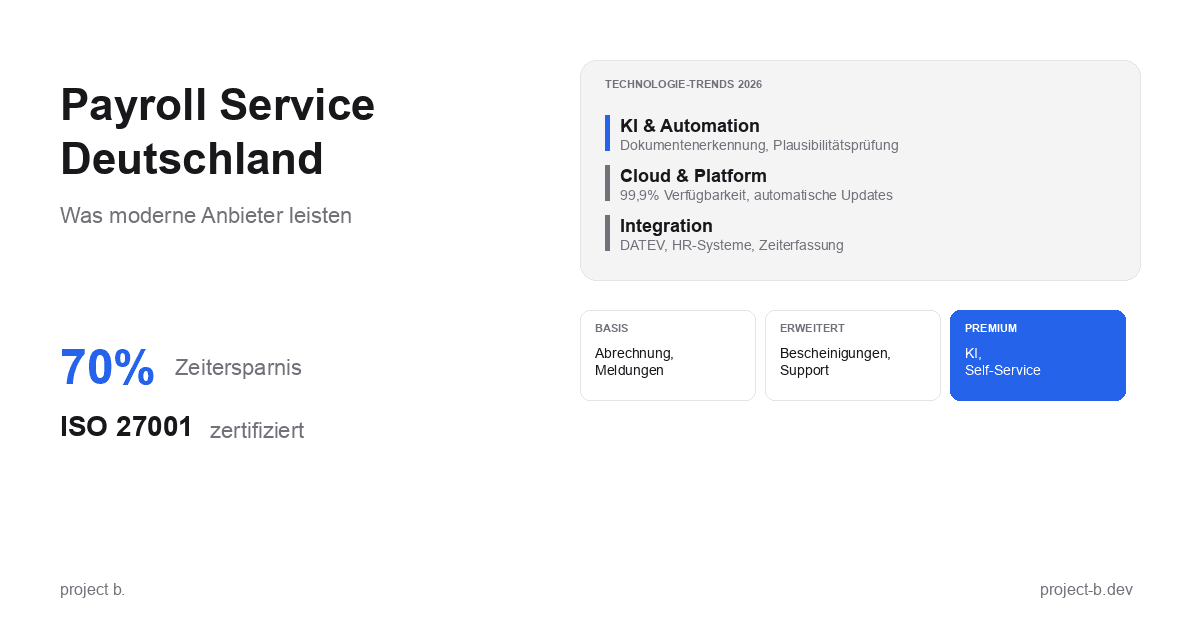

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

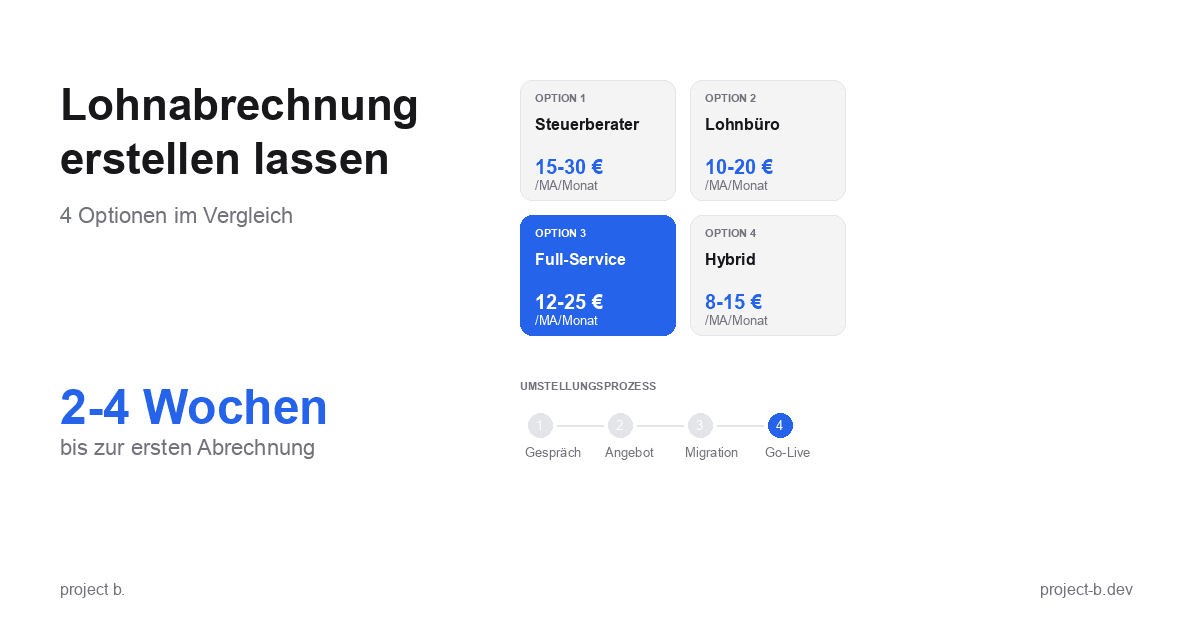

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

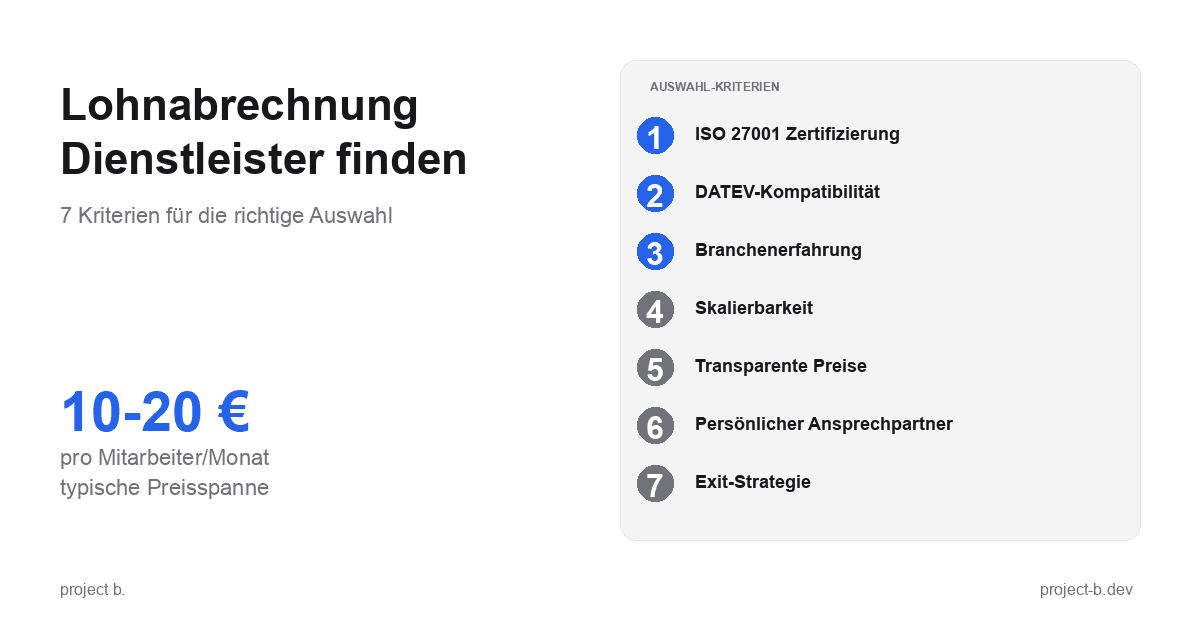

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

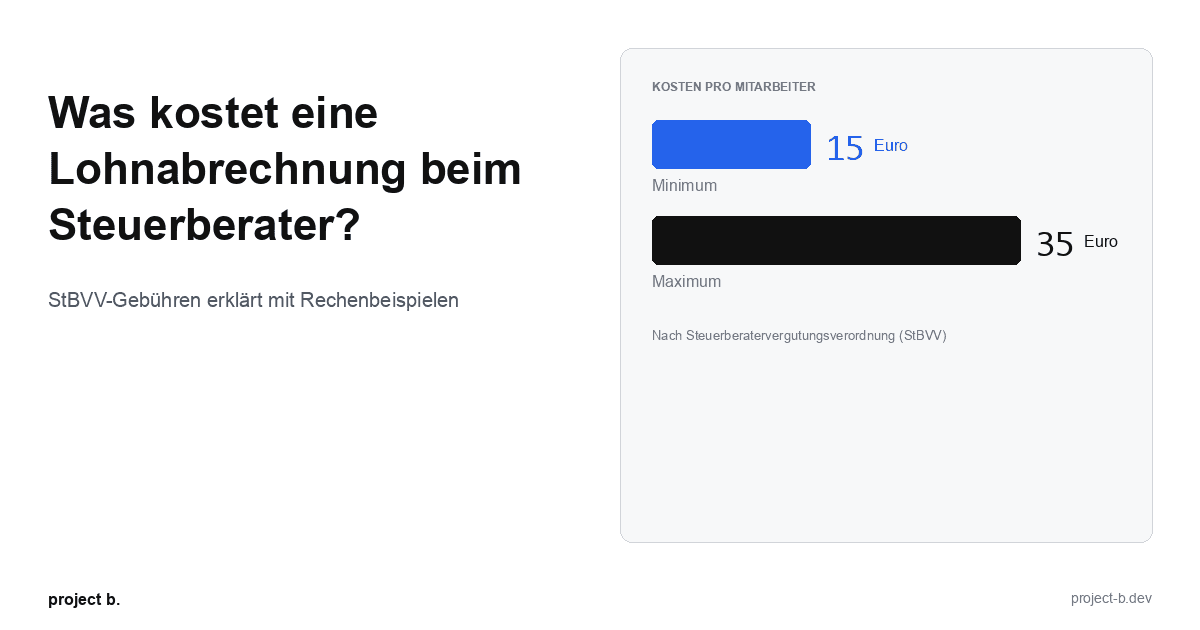

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

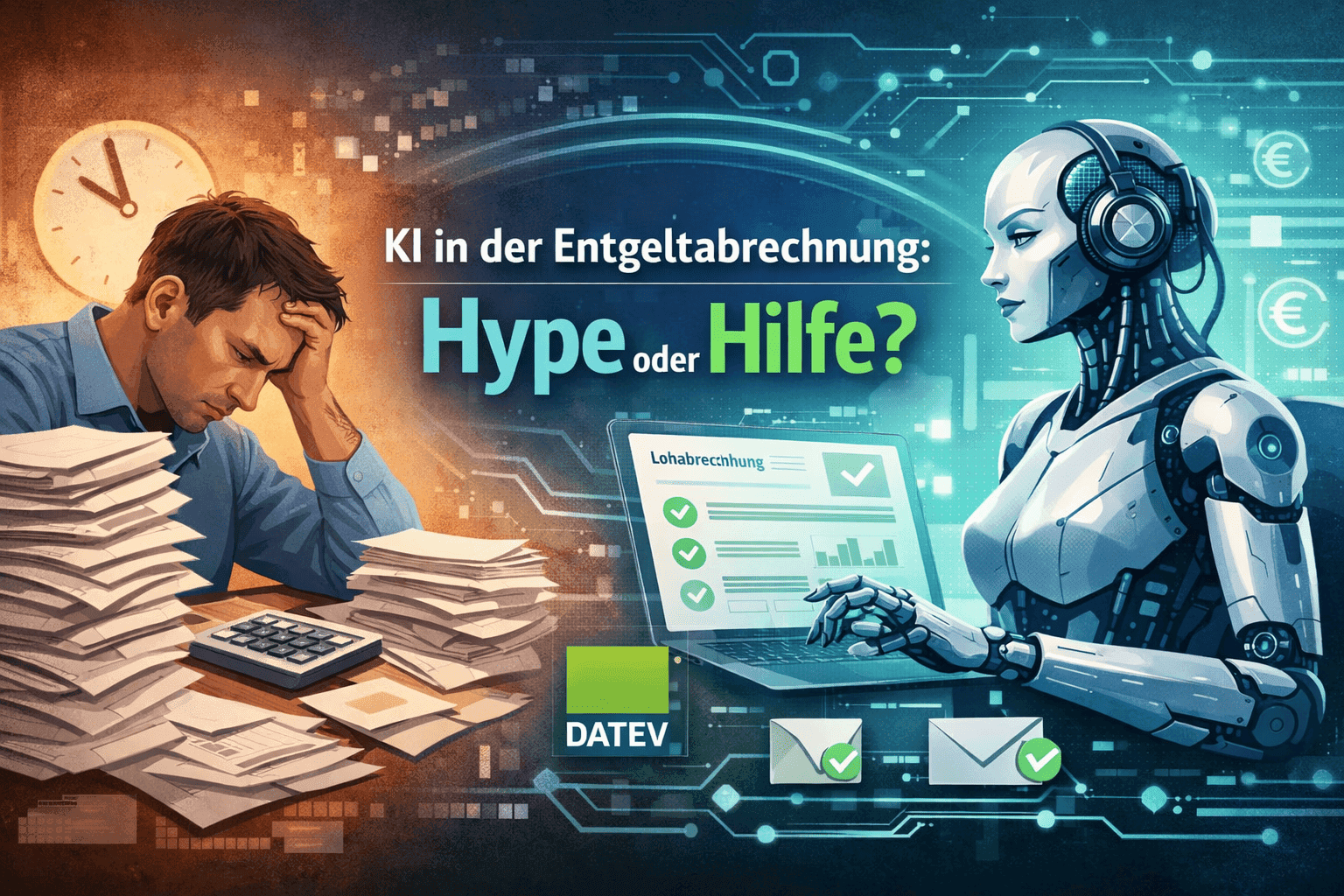

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

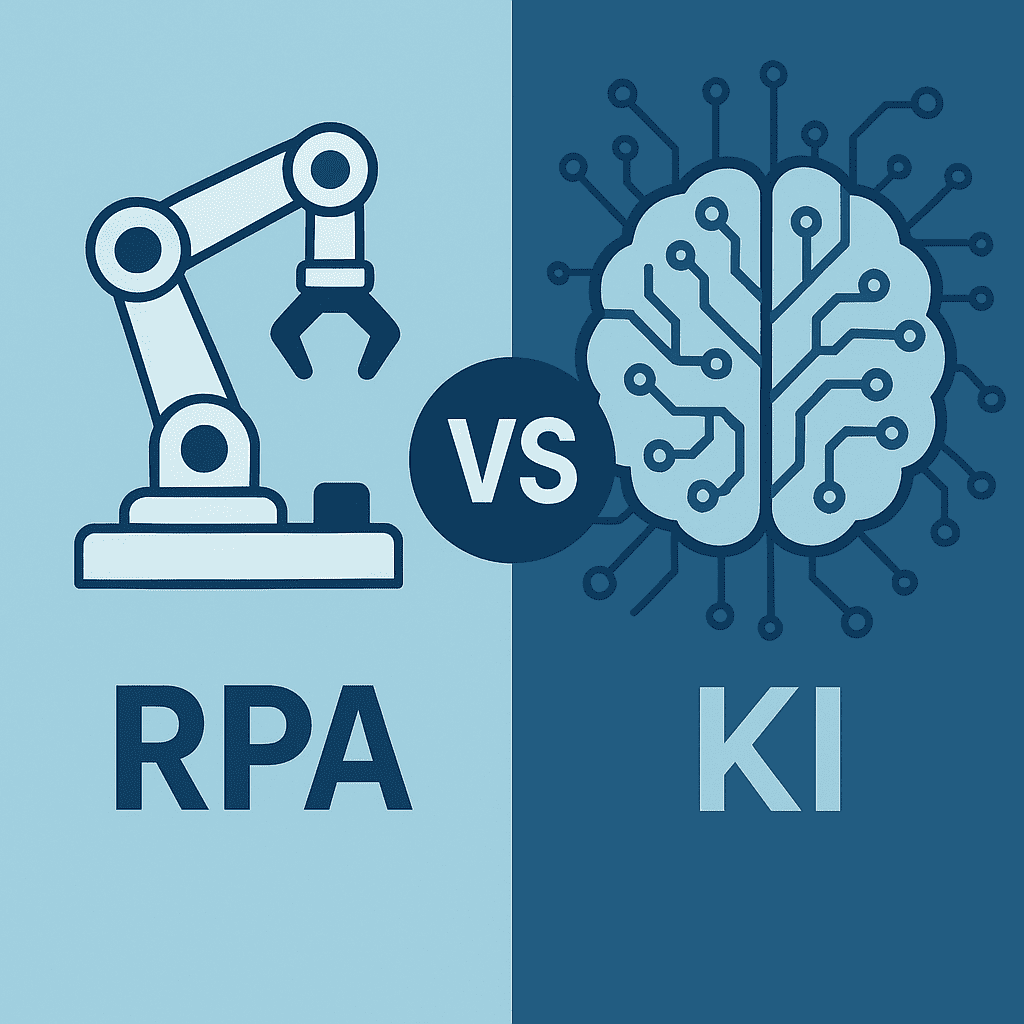

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.