AI Software for Payroll Accounting: The Ultimate Selection Guide

Dec 8, 2025

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

AI Software for Payroll: The Ultimate Selection Guide

Introduction

In today's digital world, Artificial Intelligence (AI) plays an increasingly significant role in various business processes. Particularly in the area of payroll, AI software can help companies make processes more efficient and error-free. Given the multitude of available solutions, selecting the right AI software for payroll can be challenging. In this article, we provide you with a comprehensive overview and selection assistance for AI-based payroll software. You will learn which factors are crucial for selection and how to find the best solution for your specific needs.

Definition & Core Concept

AI software for payroll utilizes artificial intelligence technologies to automate manual processes and improve accuracy. These software solutions are capable of efficiently handling routine tasks such as payroll calculations, tax calculations, and the management of employee data.

Simple Definition

AI software for payroll is a digital tool that automates and optimizes labor-intensive payroll processes using algorithms and machine learning.

Advanced Understanding

The core of this software lies in data processing and analysis. By integrating machine learning, these programs can learn from previous inputs and improve their accuracy over time. Another important aspect is the ability to adapt to legal changes, which is essential for regulatory compliance. The use of algorithms allows the software to recognize patterns in large datasets, enabling more precise predictions and decisions. This is particularly important as payroll is regularly confronted with changing legal frameworks.

The software's ability to make these adjustments automatically substantially reduces manual effort and minimizes the risk of human error. With the continuous learning capability of AI, the software becomes increasingly efficient and accurate over time, ensuring a constant improvement of processes.

Essential Components

Data Processing: AI software can efficiently process and analyze large volumes of data. This enables accurate and timely payroll and tax calculations.

Automation: Routine tasks are automated, increasing efficiency. This automation encompasses not only the calculation of salaries and deductions but also the management of vacation entitlements and other employee data.

Adaptability: The software can adapt to changing legal and operational requirements, which is crucial for regulatory compliance. This includes the automatic updating of tax regulations and social security contributions.

Common Misunderstandings

A common misunderstanding is that AI software can completely replace human labor. While it automates many tasks, human intervention remains essential for complex decisions. Additionally, companies should not assume that implementing such software can be done without training and adjusting the workflow. Integrating AI software requires a shift in organizational thinking and careful planning to ensure a smooth transition.

Why This Topic Matters

Practical Significance

AI software for payroll offers a multitude of benefits, including time savings, cost efficiency, and error reduction. Particularly in small and medium-sized enterprises, where resources are often limited, the use of such tools can make a significant difference. By automating routine tasks, employees can focus on strategically more important tasks that have a direct impact on the growth and success of the company.

Who Benefits?

Companies of all sizes and industries, especially small and medium-sized enterprises (SMEs) as well as tax consulting firms, can benefit from the advantages of AI-supported payroll. Start-ups, which often operate with limited personnel, also find valuable support in these tools. The automation provided by AI software allows these companies to compete with larger competitors by leveraging the same efficiency advantages.

Industry Relevance and Emerging Trends

In modern payroll, the use of AI software is already widespread. An emerging trend is the integration of AI into mobile applications, enabling companies to access their payroll data from anywhere. This mobility is particularly important in times of increasing remote work, as it ensures flexibility and accessibility. Additionally, the development of cloud-based solutions will make implementation and maintenance even easier. These cloud solutions not only offer scalability but also increased security and regular updates that comply with the latest legal requirements.

How It Works / Underlying Mechanisms

Step-by-Step Explanation

Data Integration: The software imports existing employee data and historical payroll records. This step ensures that all relevant information is available to perform accurate calculations.

Data Processing and Analysis: Algorithms analyze the data and identify patterns and anomalies. This enables the software to early detect and correct potential errors or inconsistencies.

Process Automation: Routine tasks such as calculating wages, taxes, and deductions are performed automatically. This considerably reduces manual effort and speeds up the entire payroll process.

Reporting: The software generates reports and analyses that assist management in making informed decisions. These reports not only provide insights into current payroll costs but also into future budgeting requirements and strategic planning.

Frameworks and Models

A common model used in AI-supported payroll is the neural network, which can recognize complex patterns in large datasets. These networks continuously improve through machine learning by learning from new data and enhancing their accuracy. Neural networks are particularly effective at detecting anomalies in large data sets, making them ideal for payroll where small errors can have significant impacts.

Another frequently used model is the decision tree model, which enables the software to make logical decisions based on a set of rules and data. This model is particularly useful for performing complex tax calculations based on various variables.

Real-World Analogies

Think of the AI software for payroll as a highly qualified assistant who never gets tired, makes no mistakes, and is always up to date with legal requirements. Just as an experienced accountant can quickly and accurately perform complex calculations, the AI software can do this on an even larger scale and with greater speed. It acts as a silent partner in the background, ensuring that all payrolls are processed accurately and on time without requiring human intervention.

Point | Description |

|---|---|

Definition | AI software that automates payroll processes |

Core Components | Data processing, automation, adaptability |

Practical Significance | Time savings, cost efficiency, error reduction |

Functionality | Data integration, analysis, automation, reporting |

Benefits | Efficiency increase, error reduction, adaptability |

Examples | Automated tax calculations, management of employee data |

Benefits & Limitations

Benefits

Efficiency Increase: By automating routine tasks, efficiency is significantly boosted. Employees can focus their time on value-creating activities instead of dealing with repetitive tasks.

Error Reduction: The precision of AI algorithms reduces human errors. This is particularly important in payroll, where small mistakes can lead to significant financial losses.

Adaptability: AI software can adapt to legal changes, making compliance easier. This ensures that companies operate in compliance at all times and do not risk penalties for non-compliance.

Challenges

High Initial Investments: Implementation can be costly, particularly for small businesses. The acquisition costs for the software and the necessary hardware can represent a significant investment.

Training Needs: Employees need to be trained in using the new technology. This requires time and resources but can be minimized with a well-thought-out training strategy.

Data Protection: The protection of sensitive employee data must be ensured. Companies need to ensure that the software used complies with the latest data protection regulations and that all data is securely stored and processed.

Trade-offs

A major trade-off is that while the software automates many processes, human intervention is still necessary to make complex decisions. Companies therefore need to find a balanced approach between automation and human control. Additionally, they must ensure that their employees have the skills and knowledge to use and manage the technology effectively.

Nuances and Edge Cases

In some cases, such as unexpected legal changes or specific operational requirements, the software may reach its limits. Therefore, it is important for companies to remain flexible and be ready to intervene manually if needed. It is also crucial that companies regularly review and update their processes and the software used to ensure they meet current demands.

Practical Examples

Example 1: Automated Tax Calculations

A medium-sized company has implemented AI software to automate monthly tax calculations. The software processes employee payroll data and automatically calculates the taxes owed, saving accountants time and increasing accuracy. Through automation, they were able to speed up the payroll process by 50%, resulting in significant cost savings.

Example 2: Management of Employee Data

A start-up uses AI tools to manage employee data. The software automatically updates employee files and ensures that all information is correct and current. This considerably reduces administrative effort and allows the HR team to focus on strategic tasks. The accuracy of the data has also increased employee satisfaction, as there are fewer errors in payroll and vacation entitlement calculations.

Why These Examples Matter

These examples illustrate how companies can increase their efficiency and simultaneously reduce error rates by utilizing AI software in payroll. They also highlight the versatility of these technologies across various company sizes and types. By implementing such solutions, companies can not only improve their internal processes but also strengthen their competitiveness in the market.

Summary & Key Insights

AI software for payroll is a powerful tool that helps companies optimize and automate their payroll processes. By integrating machine learning and data analysis, these solutions can increase efficiency, reduce errors, and adapt to legal changes. While there are some challenges, such as high initial investments and training needs, the benefits clearly outweigh them. Companies that opt for using this technology can benefit from significant time and cost savings.

This comprehensive overview provides you with a solid foundation to choose the right AI payroll software for your needs. In upcoming supporting articles, such as the comparison test of AI providers, the cost analysis for SMEs, and the comparison of cloud and on-premise solutions, you will find more valuable information to assist you in your decision-making.

Can AI software completely replace my accountant?

No. AI software automates routine tasks such as payroll calculations and tax deductions, but for complex decisions, special cases, and strategic issues, human expertise remains indispensable. Technology is a powerful assistant, not a replacement.

Is the investment worthwhile for small businesses?

Small and medium-sized enterprises (SMEs) often benefit particularly strongly, as they work with limited resources. The time savings from automation allow them to focus on value-adding activities. However, initial investments and training efforts should be realistically planned – cloud solutions often lower the entry barrier.

How does the software stay current with changes in legislation?

Modern AI payroll accounting software automatically updates tax regulations and social security contributions. In cloud solutions, this is done through regular updates from the provider. Nevertheless, it is advisable to randomly check critical changes – especially in unusual situations.

Aaron H.

Further articles

Feb 9, 2026

·

Payment

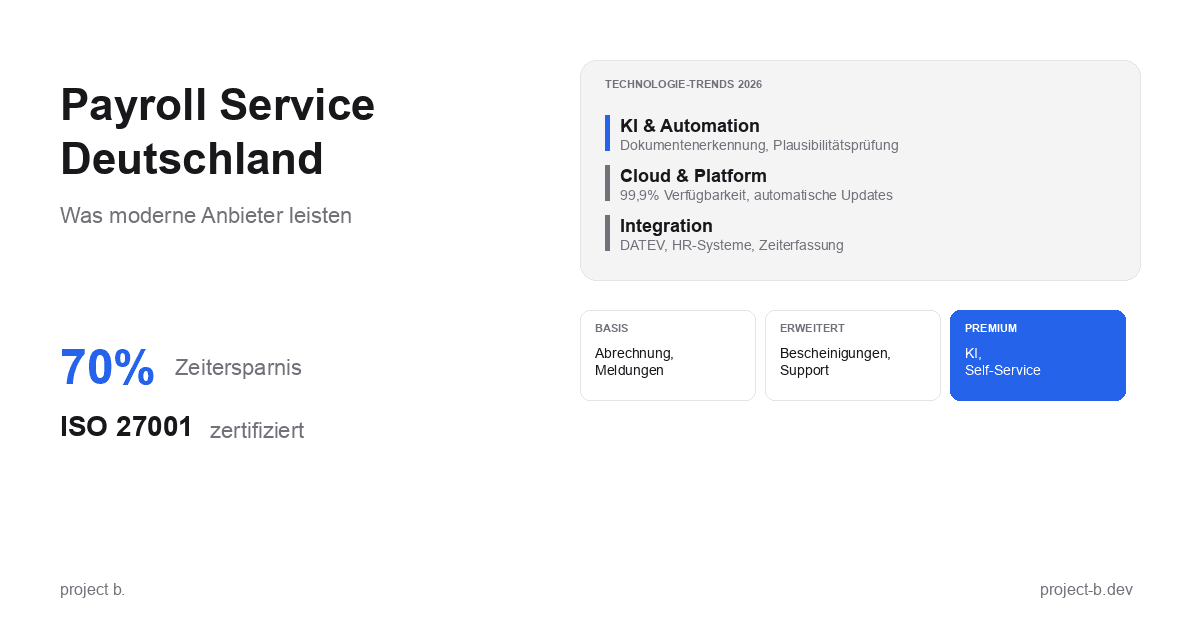

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

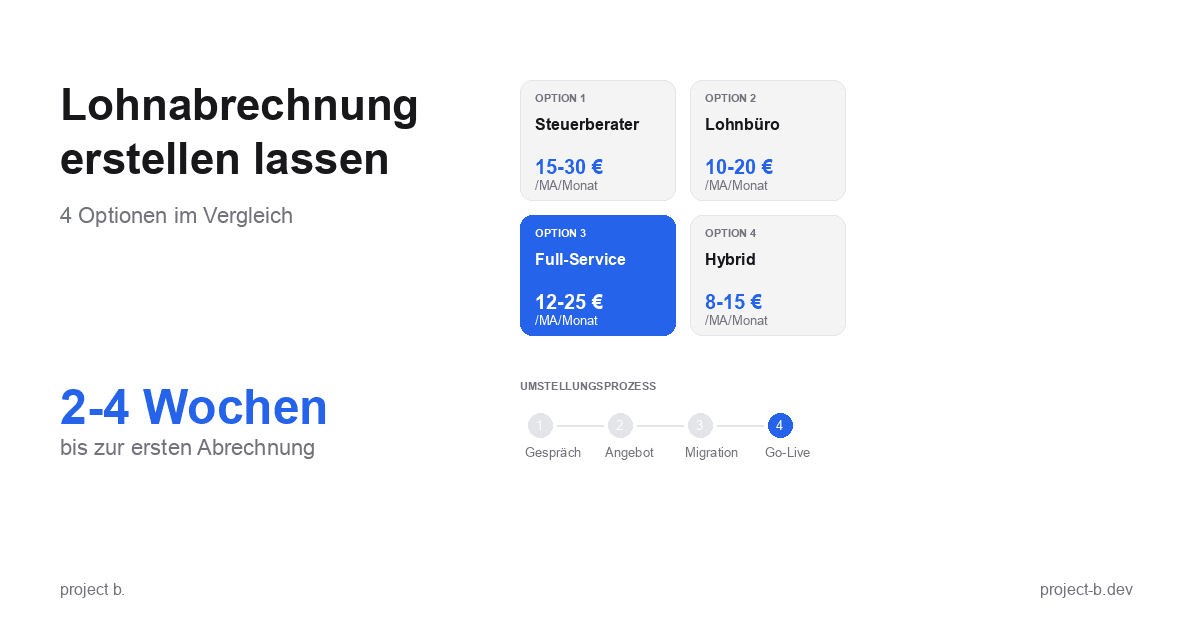

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

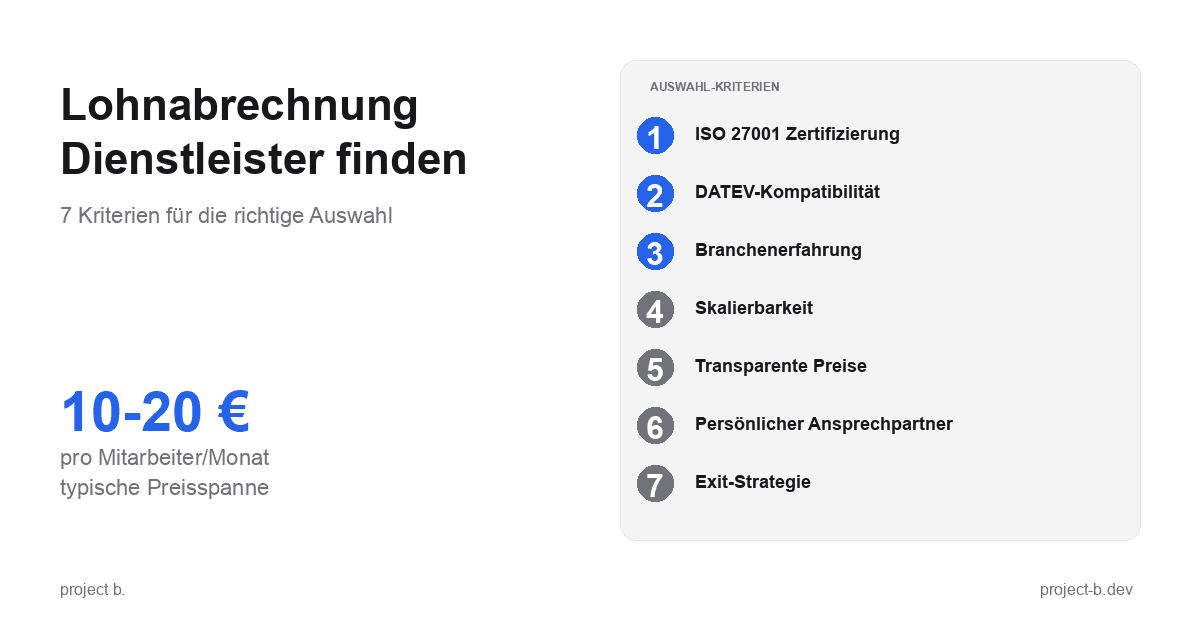

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

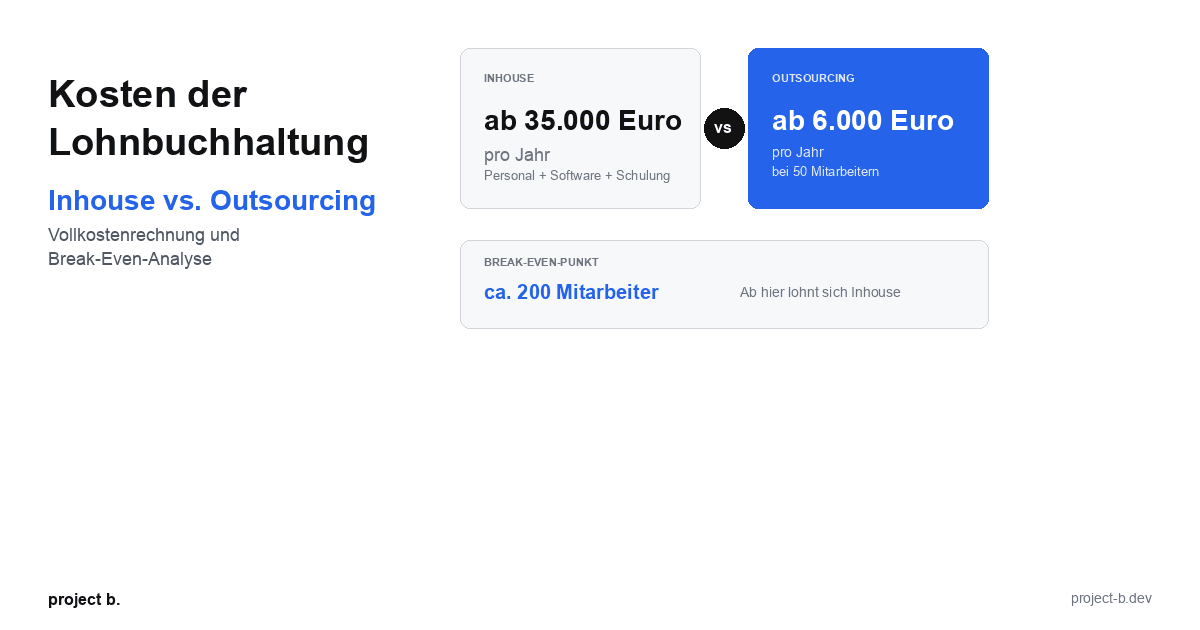

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

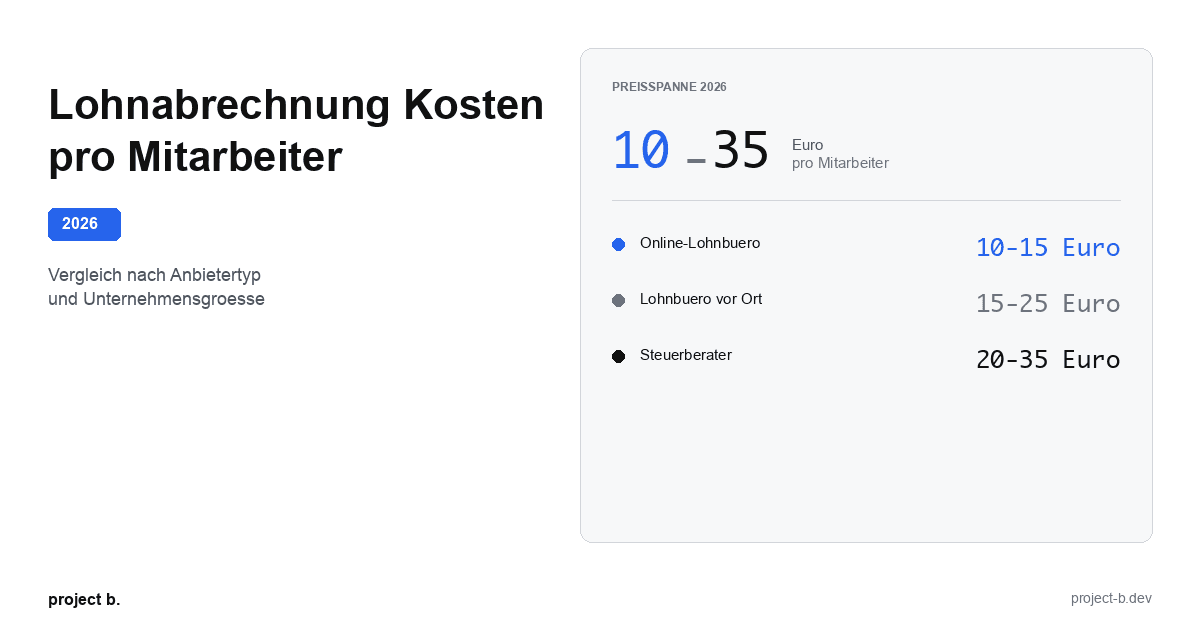

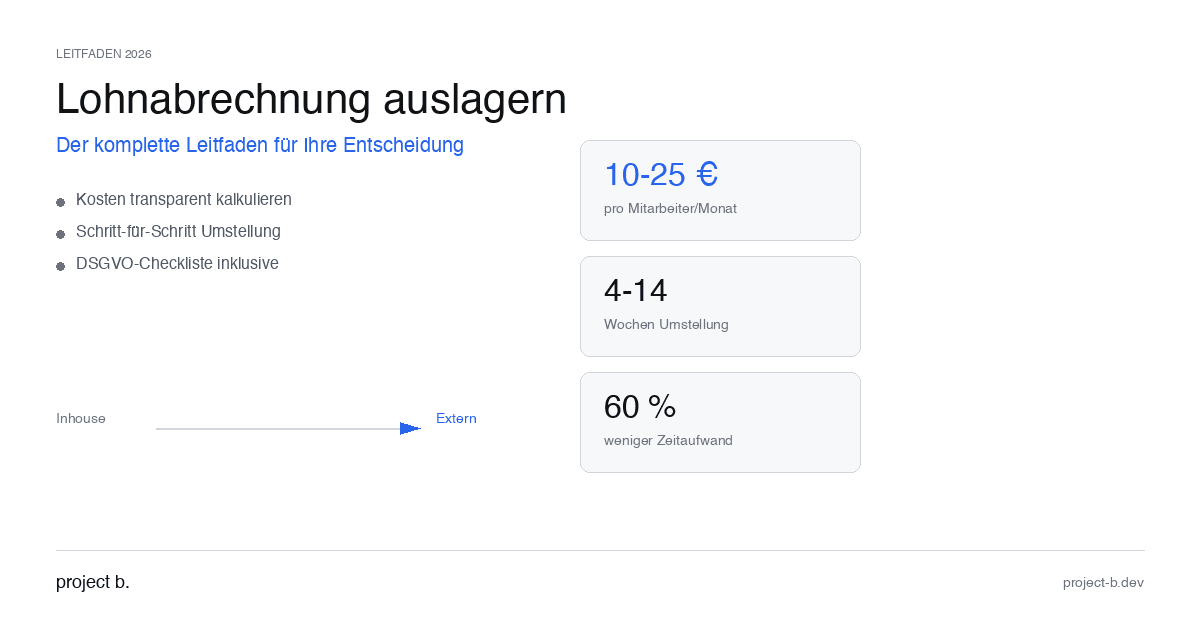

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

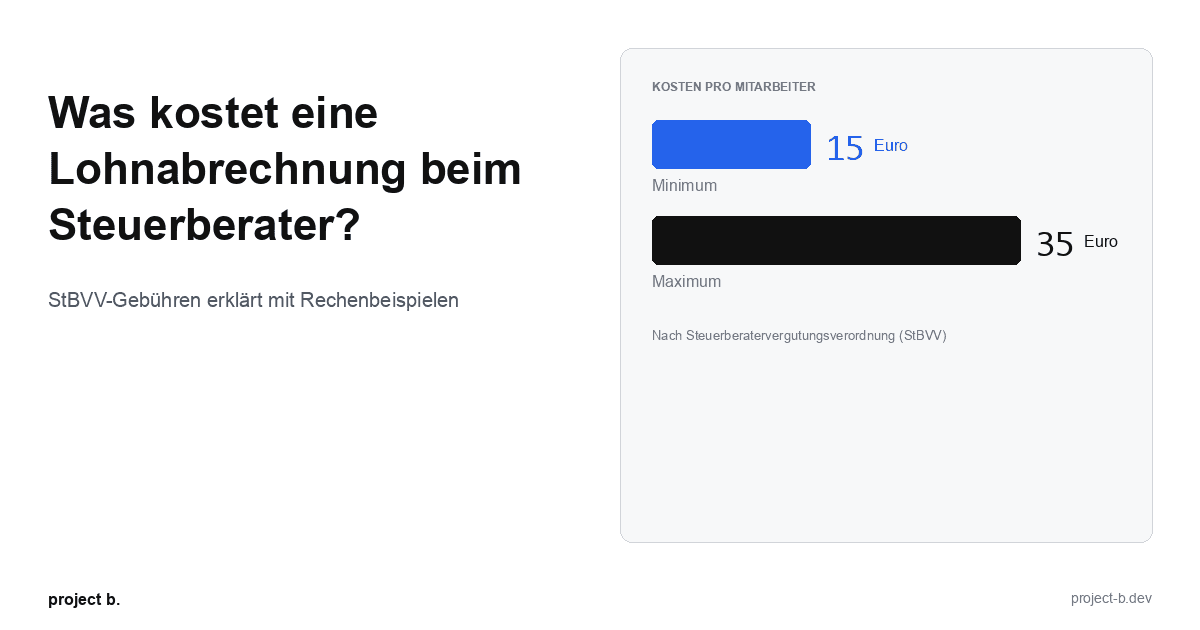

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

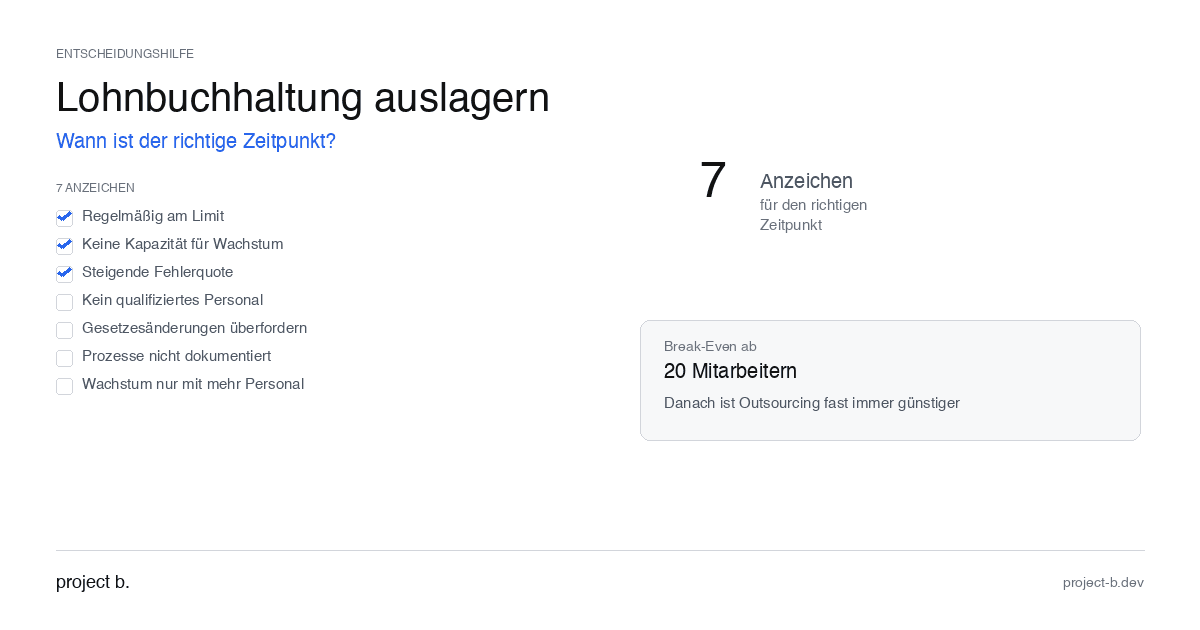

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

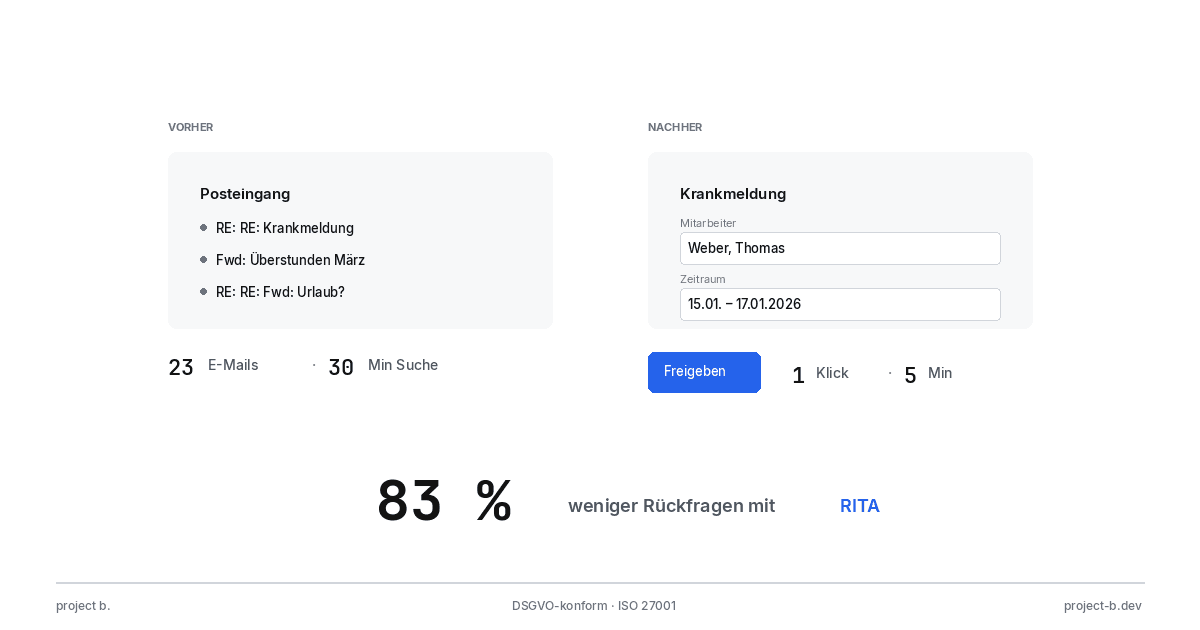

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

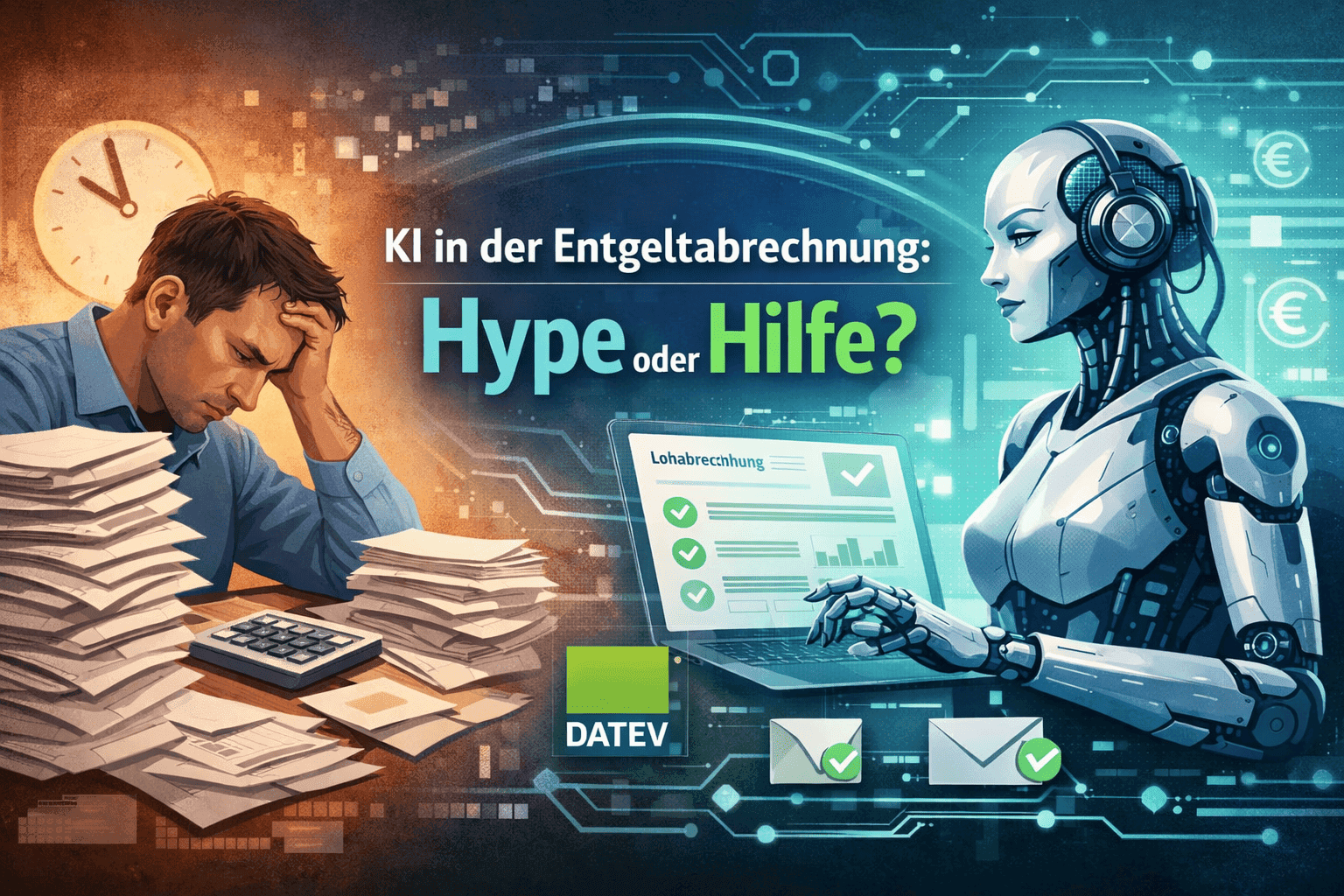

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

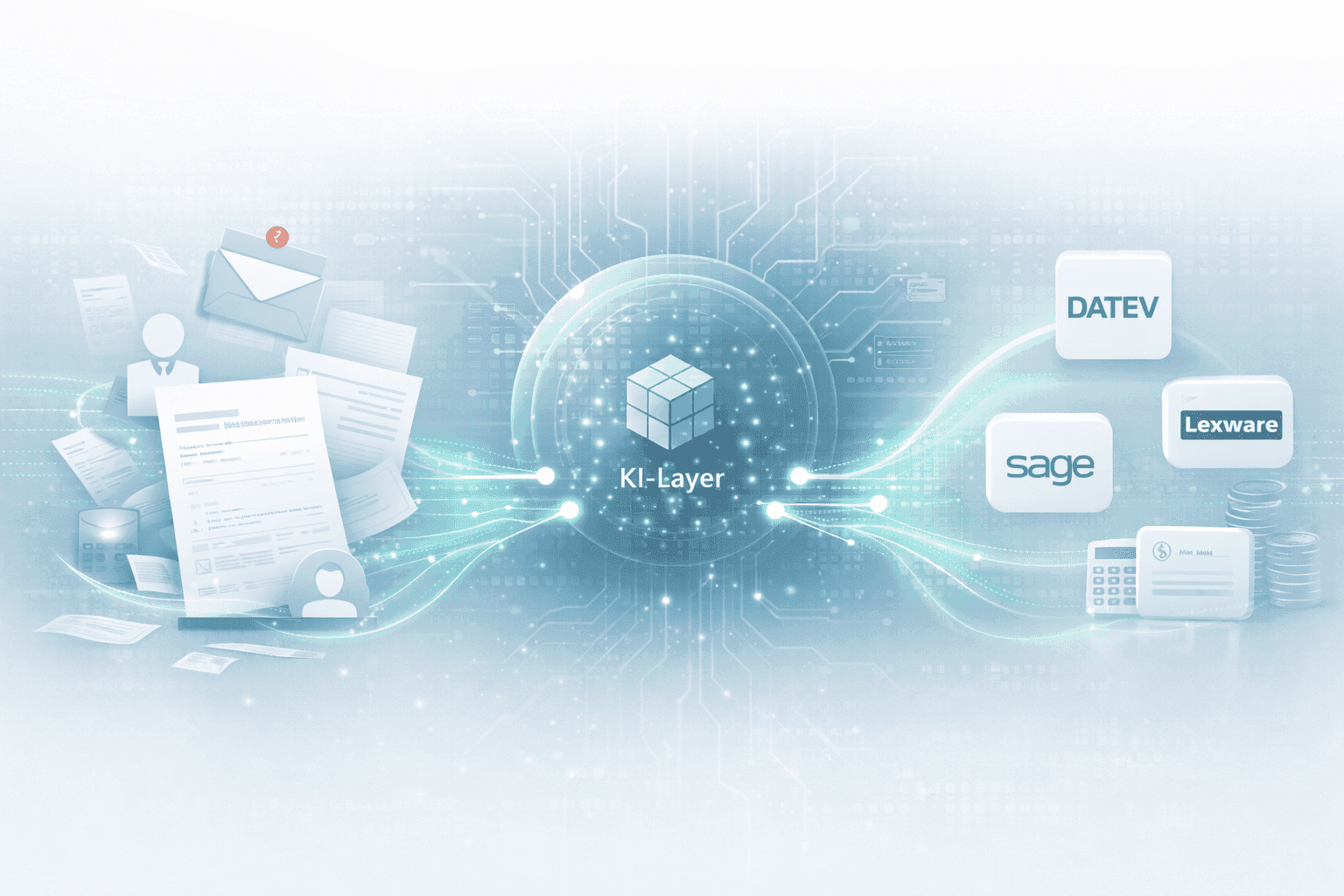

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

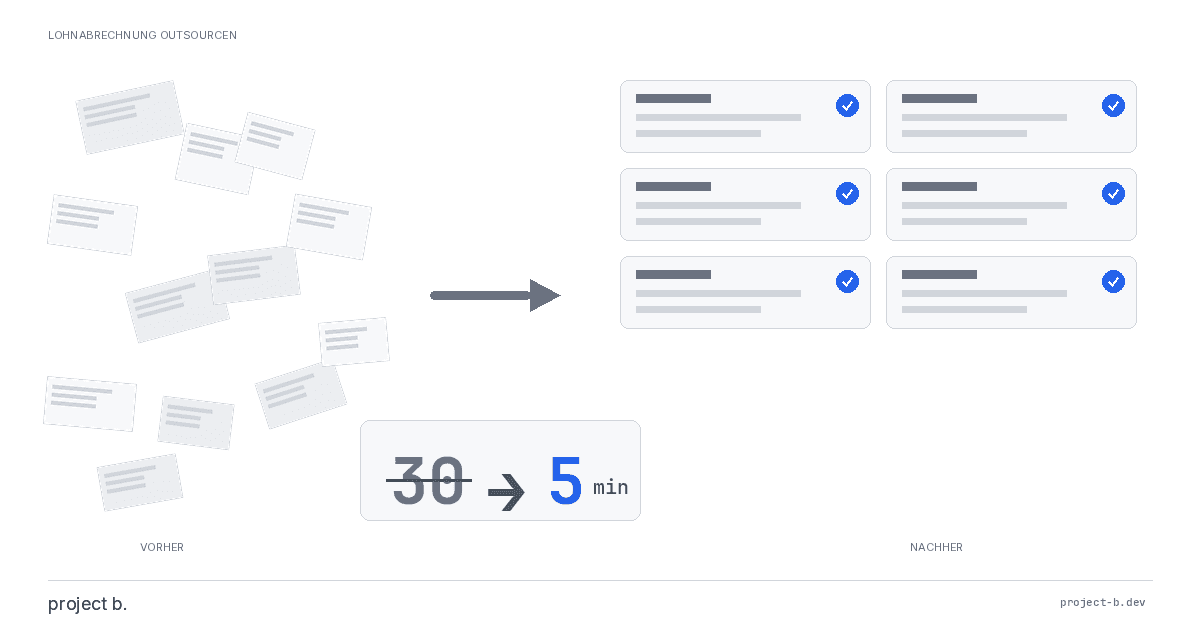

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

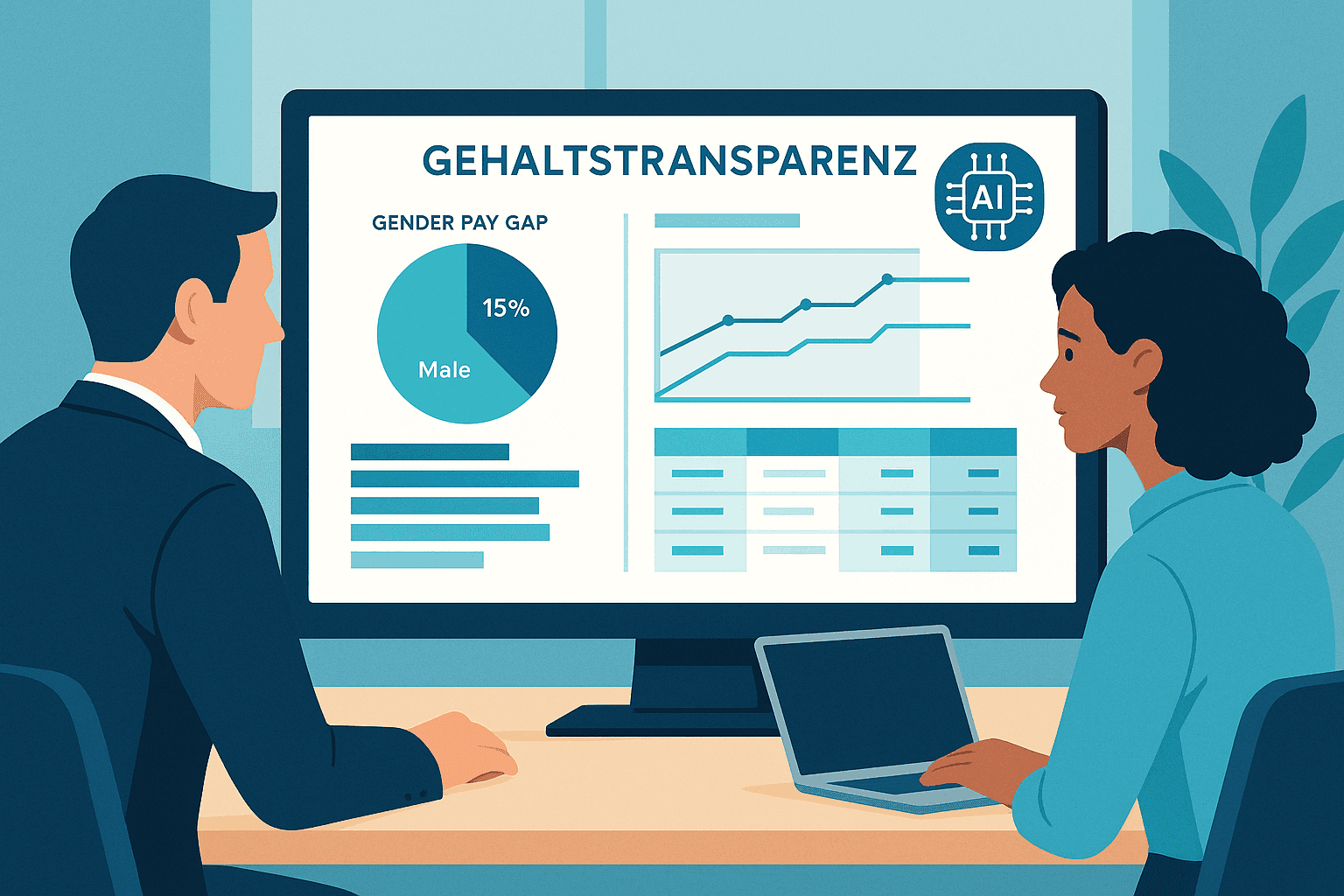

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.