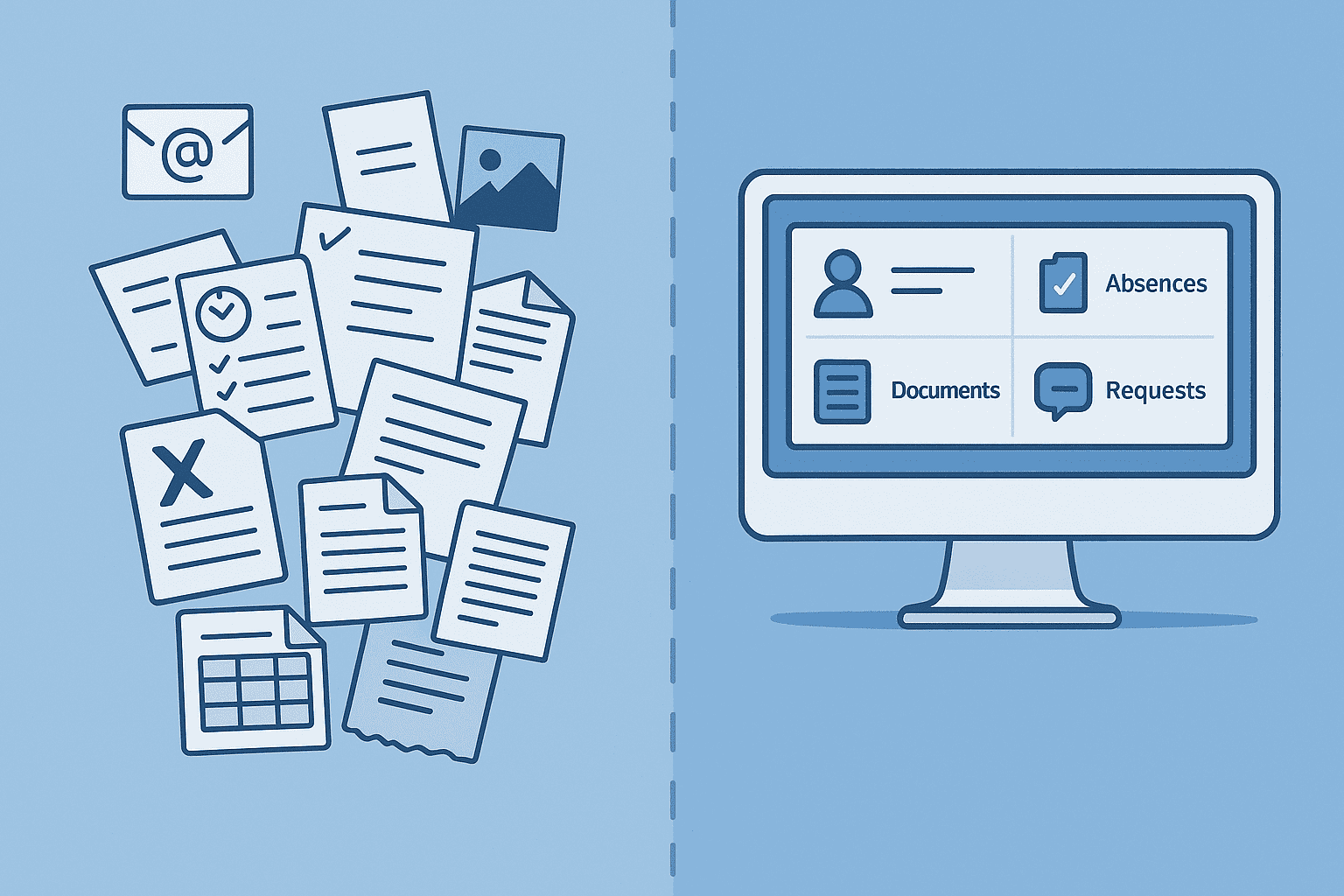

Client portal vs. Email chaos: What modern payroll processing is all about

Jan 22, 2026

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

Monday, 8:47 AM. 23 unread emails. Seven of them contain payroll data: a sick note as a photo, two Excel spreadsheets with hour changes, a follow-up to a follow-up that you had answered last week.

Welcome to the everyday life of payroll accounting.

Email communication has long been standard. Today, it is the biggest obstacle to efficient payroll processing. And a data protection problem that many underestimate.

project b. has developed a client portal that solves this problem. With RITA as an AI assistant, which automatically processes incoming documents. This article shows how the transition works.

The Problem with Email in Payroll

Email is a means of communication. Not a data management system.

The Data Protection Nightmare

Payrolls contain sensitive data: salaries, social security numbers, sick notes, absences. These are personal data within the meaning of GDPR.

An unencrypted email with payslip is comparable to an open postcard. Anyone with access to the data stream on the way can read along.

The BSI regularly warns: Sending sensitive data via standard email is problematic under data protection laws.

The Legal Situation:

GDPR requires "appropriate technical and organizational measures"

Unencrypted emails do not meet this requirement

Fines can be substantial: up to 4% of annual revenue or 20 million euros

And even if you encrypt: Who archives, who deletes, who has access to old emails? These questions are hard to answer with email.

The Chaos Problem

Emails are linear. Payroll processing is not.

A typical sequence:

Client sends sick note for employee A

You ask: "From when exactly?"

Client replies on a different email thread

In the meantime, a master data change for employee B comes in

Client corrects: "The sick note was only until Friday"

You search for 10 minutes for the original email

The result: Information spread across dozens of emails. No overview of which data is current. High probability of error.

The Time Problem

Studies show: Knowledge workers spend an average of 28% of their working hours on emails. In payroll accounting, it is often more.

Every follow-up question via email means:

Formulating and sending an email

Waiting for an answer (often days)

Reading and understanding the response

Transferring information into the correct system

In case of uncertainties: asking again

A single sick note can cost four to five emails and 30 minutes of time. With 20 sick notes per month, that amounts to 10 hours, just for one subject.

How the project b. Portal Solves the Problem

The project b. client portal is not an email replacement. It is a structured workspace with AI support.

Structured Input Instead of Free Text

In the portal, there are no free text fields for payroll data. There are input masks.

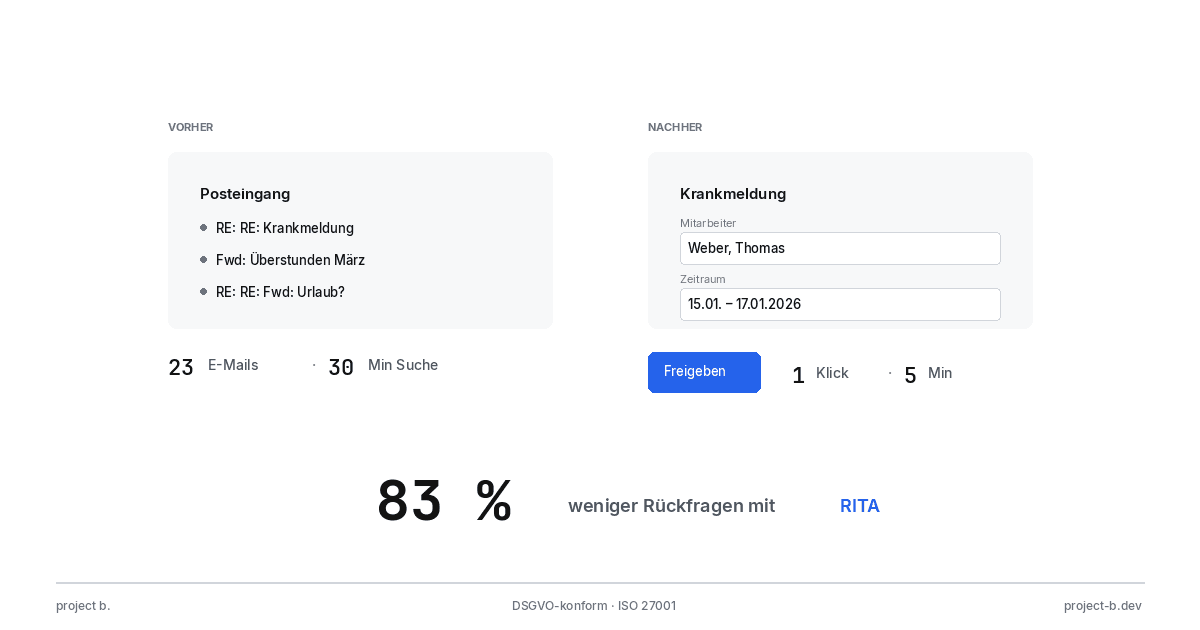

Sick note in the project b. portal:

Select employee (dropdown with autocomplete)

Date from (datepicker)

Date to (datepicker)

Upload certificate (file)

Done

The system automatically validates: Is the employee known? Is the date in the future? Does the sick note overlap with vacation?

Incorrect or incomplete entries are displayed immediately, not three days later through follow-up questions.

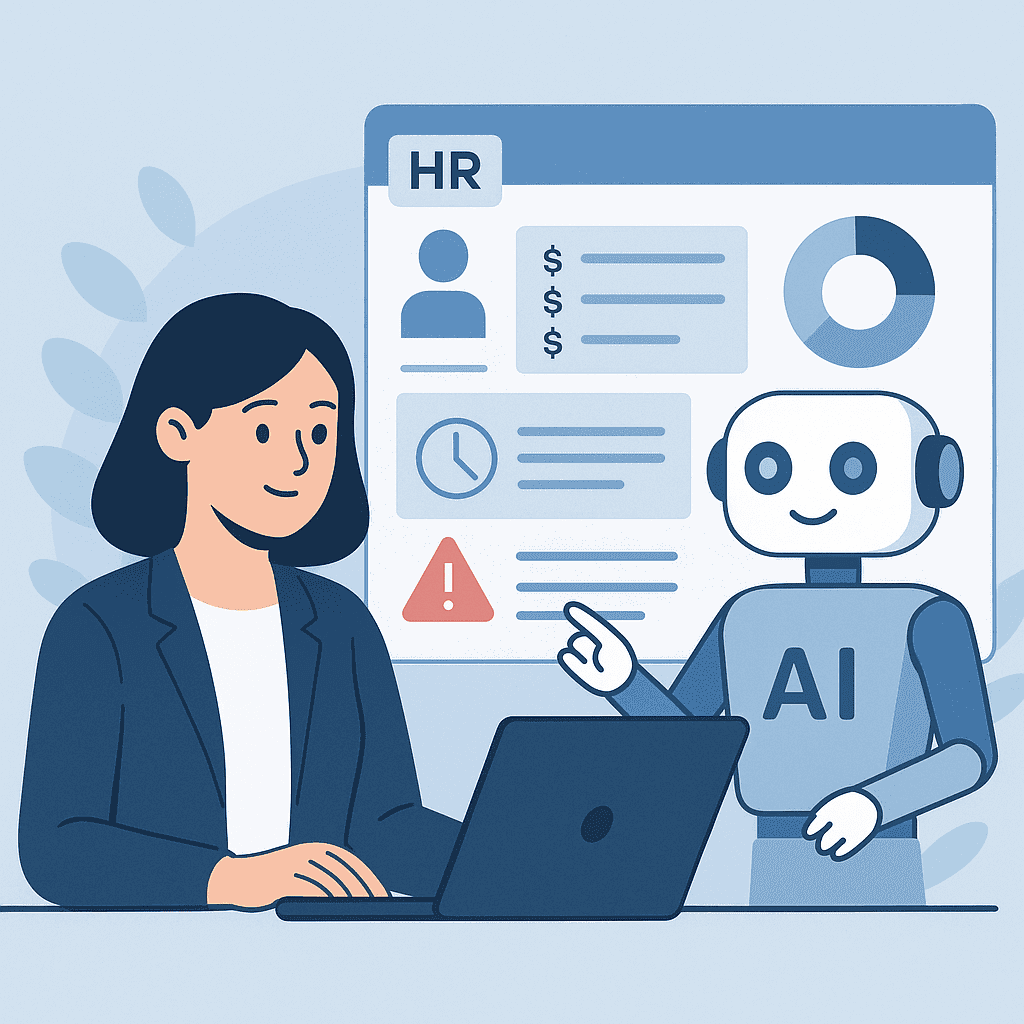

RITA: AI-Powered Document Processing

The client doesn't even have to fill in all the fields themselves.

Example: The client simply uploads a photo of the sick leave certificate.

RITA takes over:

Recognize document (sick leave certificate, employment contract, termination…)

Extract relevant data (name, date from, date to)

Assign employee (based on name and personnel number)

Check plausibility (overlap with other absences?)

Make ready for approval in the cockpit

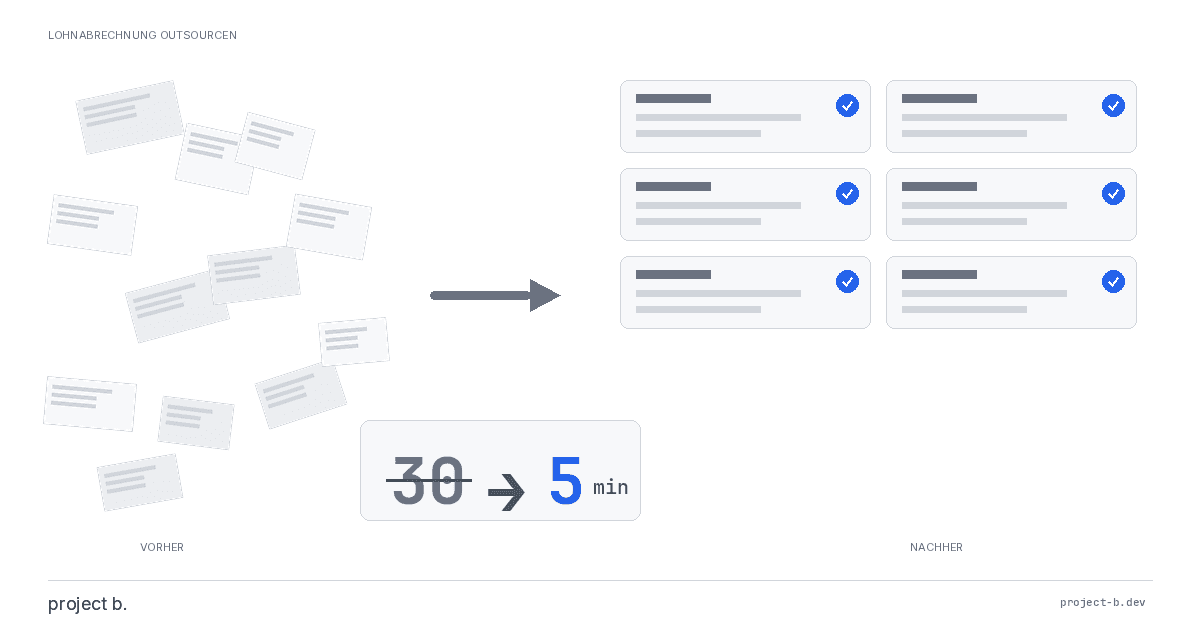

The client needs 30 seconds. RITA needs 10 seconds. You need one click for approval.

Central Data Storage in the Cockpit

All information in one place. No searching through 200 emails.

The project b. cockpit shows:

When was the information entered?

By whom?

Has it already been processed?

Are there any changes or corrections?

Which approvals are pending?

Documented in a tamper-proof manner. During an audit, you can prove every step.

Automatic Validation by RITA

RITA checks before you even see the data:

Plausibility: 400 overtime hours in a month? Warning to the client.

Completeness: Sick note without certificate after 3 days? Automatic reminder.

Consistency: Termination and salary increase at the same time? Follow-up question.

Duplicates: Same sick note submitted twice? Notice.

You only work with already validated information.

The Digital Personnel File: Mandatory from 2027

The development is clear: Digital will be mandatory.

Legal Requirements

From January 1, 2027, payroll documents must be maintained electronically as mandatory. This has been regulated by the legislator in the Seventh Act to Amend the Fourth Book of the Social Code.

This means:

Paper archives are no longer sufficient

Electronic storage must comply with GDPR

Access must be logged

Deletion deadlines must be observed

Email inboxes do not meet these requirements. The project b. portal does.

What the BAG Says

The Federal Labor Court decided in January 2025: Employers can provide payslips digitally. The text form is fulfilled.

This is an important clarification. You no longer need to create and send a paper copy for each employee by mail. A secure portal like project b. is sufficient.

590 Search Queries Per Month

590 people search every month for "DATEV digital personnel file." 320 search for "digital personnel file requirement." The topic has entered public consciousness.

project b. integrates the digital personnel file directly into the portal. All documents of an employee in one place, stored GDPR-compliant, with access logging.

Concrete Benefits with project b. in Numbers

Time Savings: 1,400 Hours Per Year

A firm with 10 employees can save up to 1,400 hours per year through the project b. portal. This is almost equivalent to one full-time position.

The savings are distributed as follows:

Area | Time Savings | How project b. helps |

|---|---|---|

Elimination of follow-up questions | 35% | Structured input masks, RITA validation |

Automatic data validation | 25% | RITA checks before approval |

Faster document search | 20% | Cockpit overview instead of email search |

Structured data collection | 15% | Portal instead of free email texts |

Elimination of manual archiving | 5% | Automatic digital personnel file |

Error Reduction with RITA

Every manual data entry is a source of error. Every email that is misinterpreted is a source of error.

RITA reduces both:

Structured input masks prevent formatting errors

AI document recognition eliminates typos during transcription

Validation rules detect plausibility errors

Automatic data transfer to DATEV prevents transfer errors

The SV error rate decreases measurably. Fewer corrections, less rework, less frustration during audits.

Client Satisfaction

Clients benefit from the project b. portal:

No more forgotten follow-up questions (RITA reminds automatically)

Transparent status in the portal (when will my change be processed?)

Faster processing (less waiting time due to email ping-pong)

Anytime access to their own documents and payslips

This improves the relationship. Satisfied clients stay. And they recommend further.

GDPR Compliance with project b.

Encryption and Security

The project b. portal offers:

End-to-end encryption for all data transfers

Server location in Germany (no data transfer to third countries)

ISO 27001:2022 certification (highest security standards)

Access logs (who saw what and when)

Automatic deletion after legal deadlines expire

This is more data protection than any email inbox can provide.

Technical and Organizational Measures

The GDPR requires appropriate TOM. project b. meets this through:

Modern encryption methods

Secure authentication (optional with 2FA)

Regular security updates

Clear access permissions per role

Logging all accesses

During a data protection audit, you can prove every access.

The Concerns that Payroll Accountants Have

"My clients don't want new software"

This is understandable. But: Most clients already have digital experience.

89% of Germans use online banking

82% shop online

67% carry out official transactions digitally

The project b. portal is not more complicated than these applications. Often it is easier because it has a specific purpose.

The trick: Don't switch all clients at once. Start with the digitally inclined. The others will follow when they see the benefits.

"I will lose personal contact"

A portal does not replace conversation. It replaces searching through emails, waiting for answers, correcting misunderstandings.

The time you save with project b. can be used for real consulting. For the phone call when a client has a complex question. For the conversation about salary optimization.

Digitalization does not make contact less personal. It makes it more valuable.

"Can I trust RITA with payroll data?"

RITA makes suggestions. The final decision always lies with the human.

When RITA recognizes a sick note, you see in the cockpit:

The original document

The extracted data

Any warnings or follow-up questions

You can correct before anything is released. RITA is an assistant, not a black box.

"That is too expensive"

The costs for project b. are typically in the low three-digit range per month. Depending on the number of clients.

Consider the following:

Hours for email management × hourly rate

Costs for errors and corrections

Opportunity costs (rejected mandates due to lack of capacity)

Most firms achieve a return on investment within 6-12 months.

The Transition to project b.: Step by Step

Phase 1: Preparation (Week 1-2)

Analysis of the status quo:

How many emails do you exchange per month with clients?

What types of data are transmitted by email?

Which clients generate the most follow-up questions?

Get to know project b.:

Arrange free demo

Clarify questions (DATEV integration, pricing model, implementation time)

Make a decision

Phase 2: Setup (Week 3-4)

Your personal Customer Success Manager at project b.:

Sets up your cockpit

Configures the DATEV interface

Trains you and your team

Create first client:

Import master data

Set up portal access for client

Run first test entries

Phase 3: Pilot Project (Month 2-3)

Using one client productively:

All payroll data via the portal

Use RITA for document recognition

Gather feedback

Document:

What works well?

Where are the problems?

How much time do you actually save?

Phase 4: Rollout (Month 4-12)

Gradual expansion:

2-3 new clients per month

Priority: more demanding clients first

Individual introduction meetings

Accompanying measures:

Short instructions for clients (project b. provides video tutorials)

Support hotline from project b. for the first weeks

Regular feedback to your Customer Success Manager

Conclusion: From Email Flood to Structured Workflow

Email was good enough when there was no alternative. Today there is project b.

The portal with RITA is:

Safer: GDPR-compliant data transfer, ISO 27001 certified

More efficient: RITA does the preliminary work, you only approve

More transparent: Cockpit overview instead of email search

Future-proof: Prepared for the digital personnel file from 2027

The question is not whether, but when you will switch. And: when will you start to take advantage of the benefits?

Do you want to see how the project b. portal and RITA work in practice? In a 15-minute demo, we show you real processes. No presentation, real software. Free and without obligation.

Further Links

When is the digital personnel file mandatory?

As of January 1, 2027, payroll documents must be maintained electronically as a requirement (§ 28f Abs. 7 SGB IV). project b. integrates the digital personnel file directly into the portal. All documents are automatically assigned to the correct employee and archived in compliance with GDPR.

Can clients also provide data without a portal?

Yes. Not all clients need to switch immediately. They can work in parallel: a portal for digitally savvy clients, other ways for the rest. Also, data that comes via email can be recorded in project b. Cockpit. RITA will still validate, and you will have all data in one place.

How do I convince skeptical clients about the portal?

Demonstrate the concrete benefits: faster processing, no forgotten follow-up questions, anytime access to your own documents and pay slips. Project b. provides short video tutorials that you can pass on to clients. Offer a personal introduction; ten minutes via video call is often sufficient.

Finn R.

Further articles

Feb 9, 2026

·

Payment

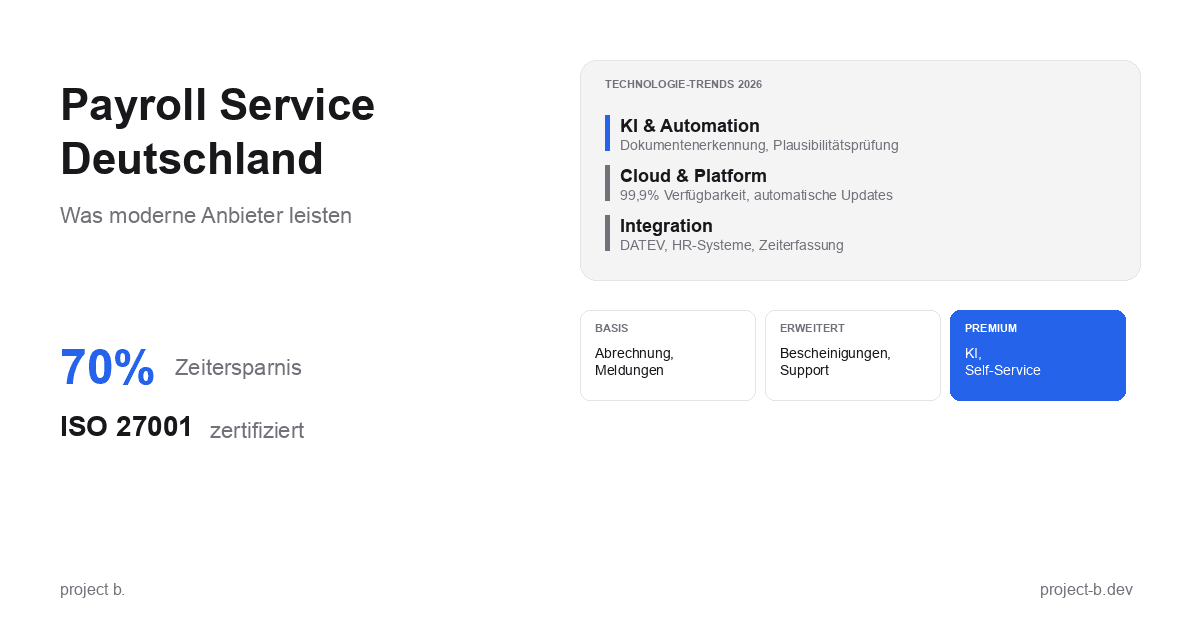

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

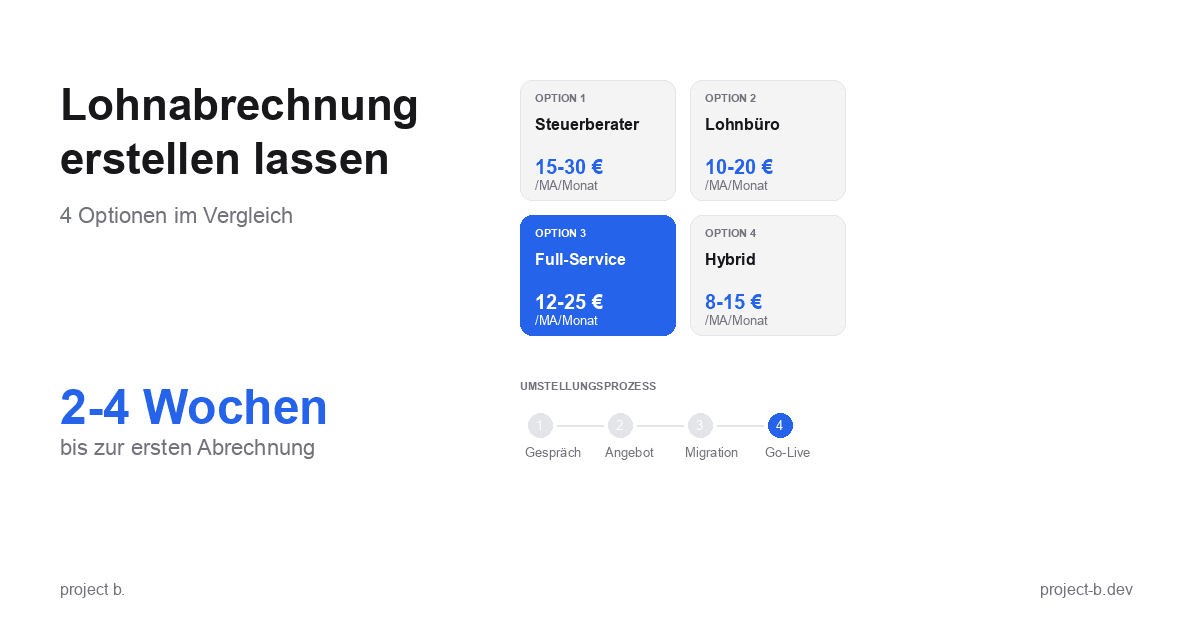

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

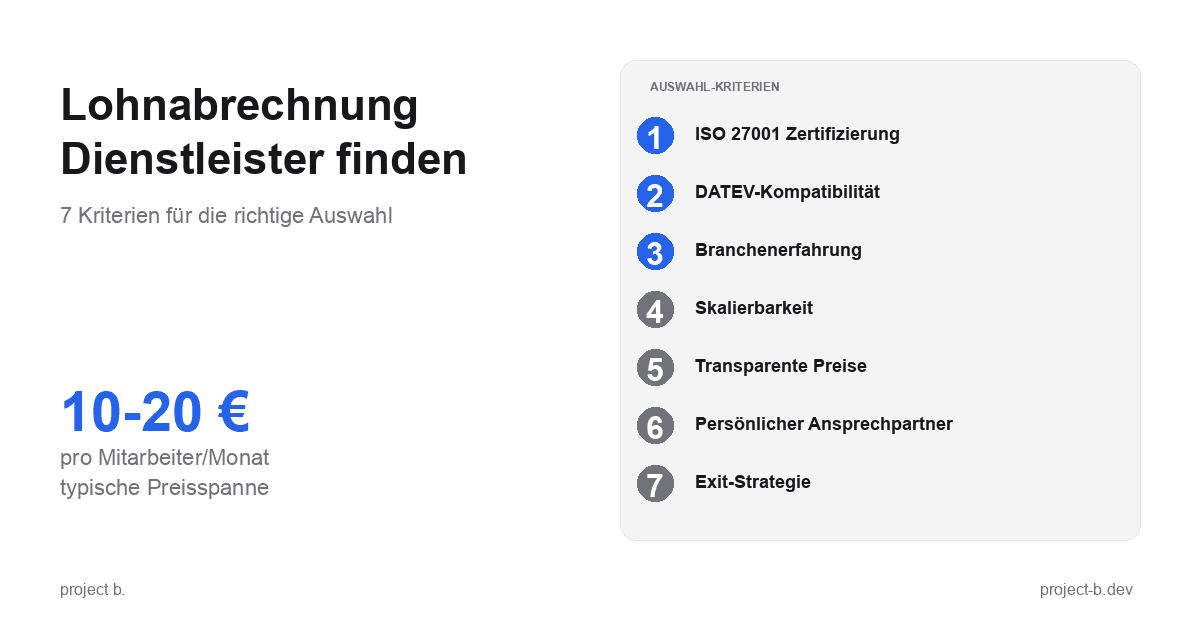

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

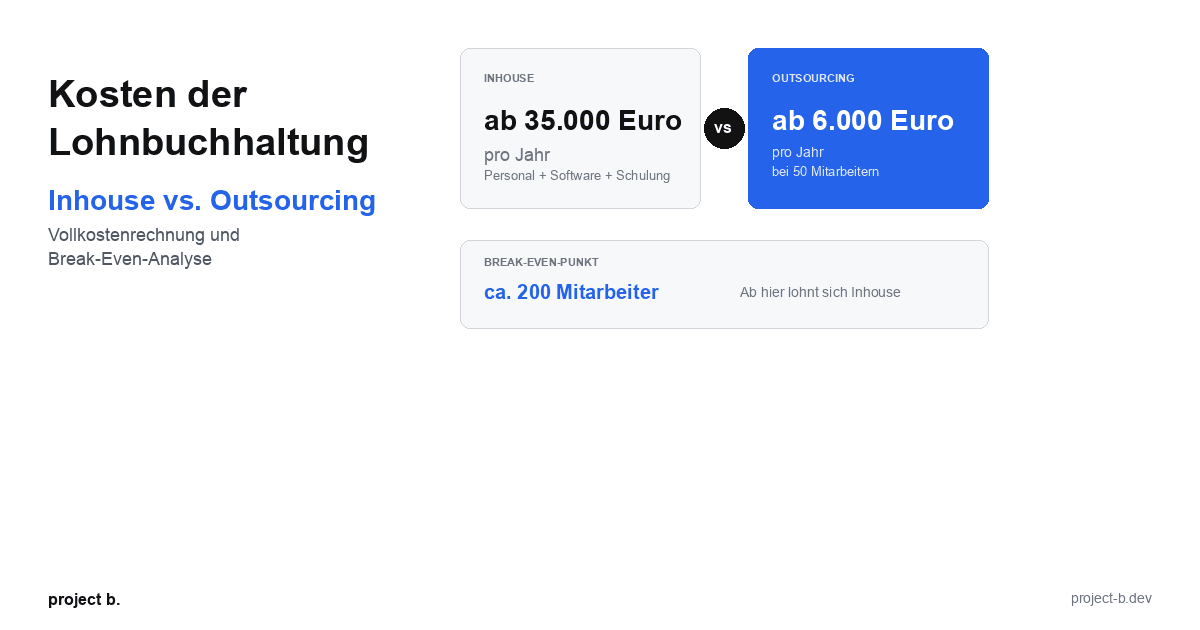

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

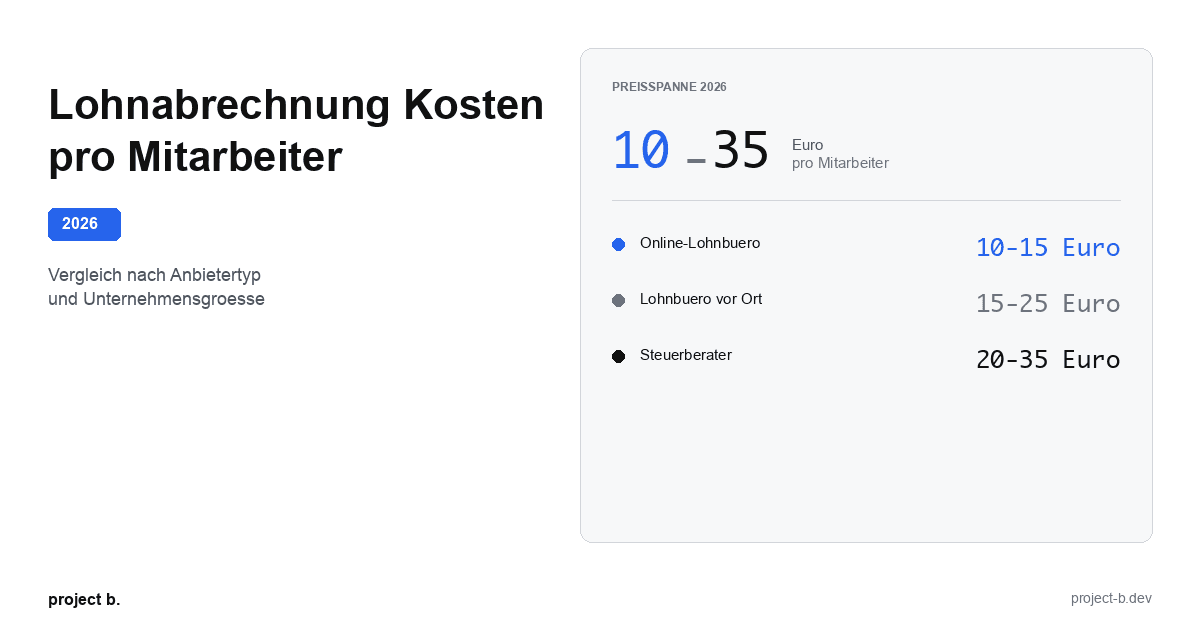

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

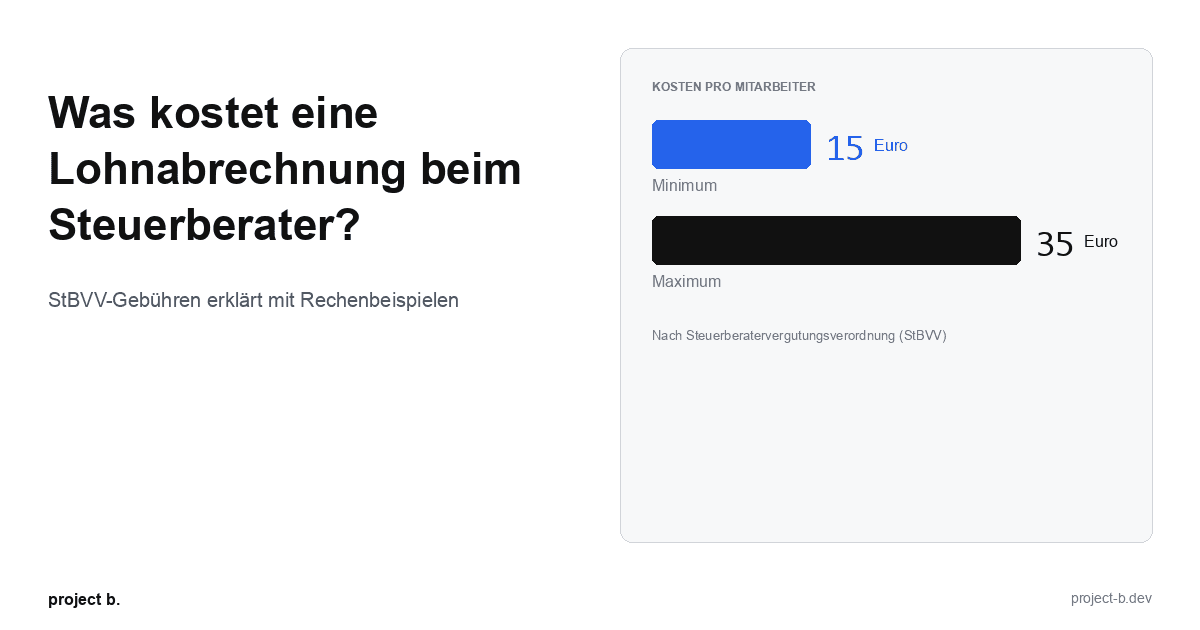

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

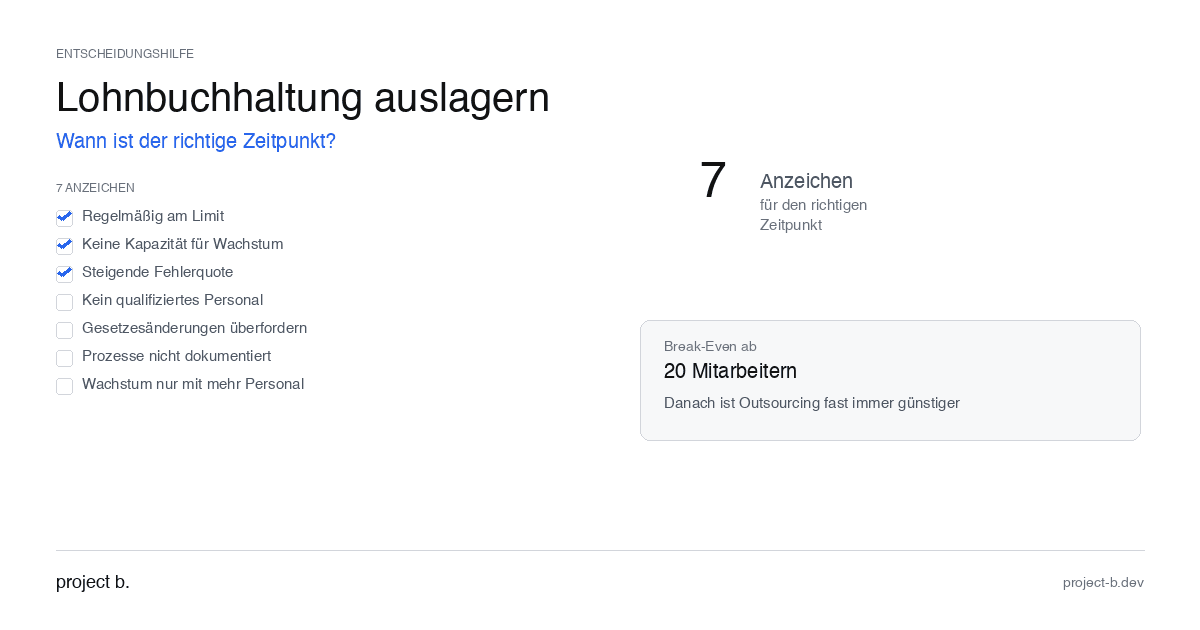

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

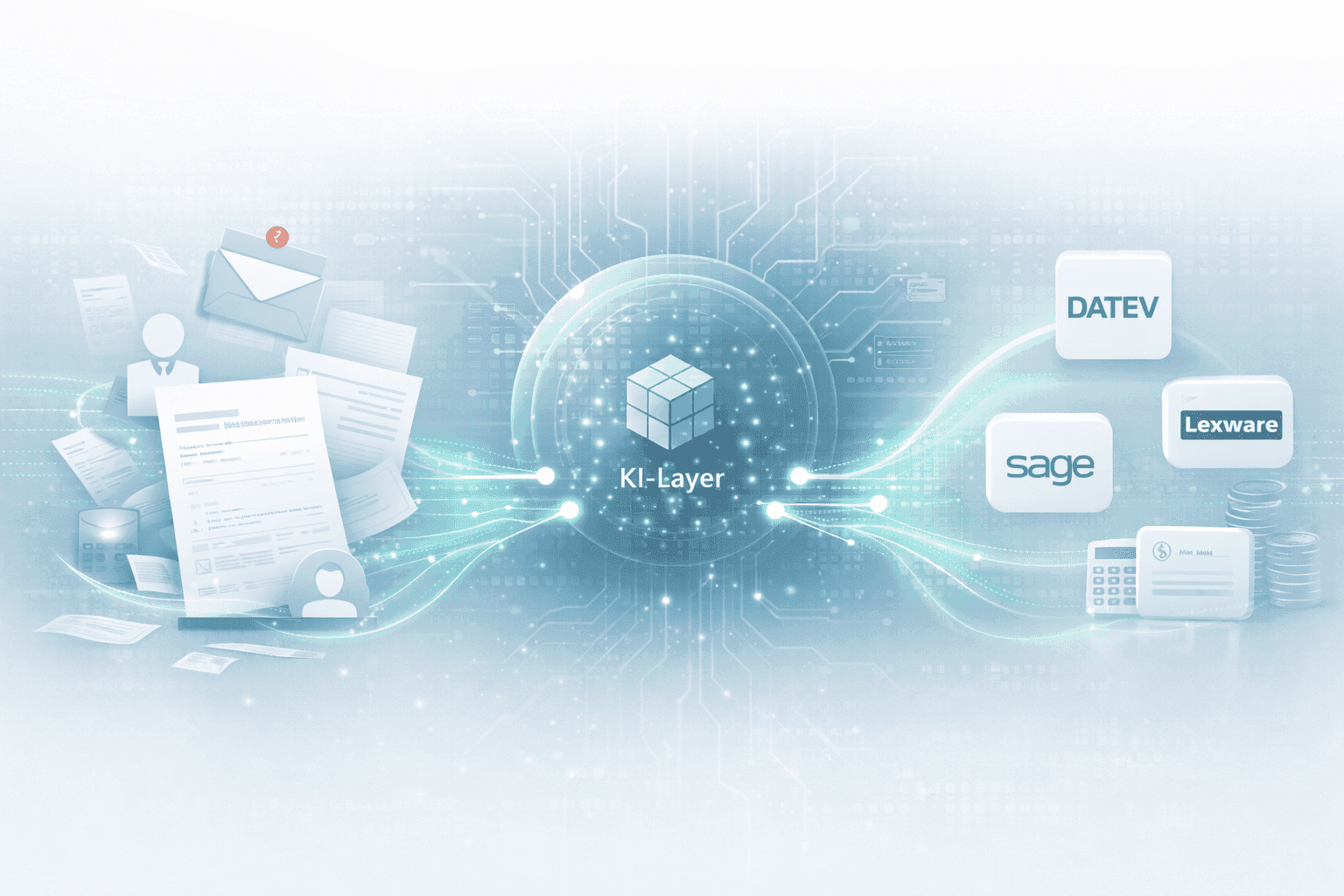

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.