This is how you use AI in payroll.

Dec 26, 2025

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

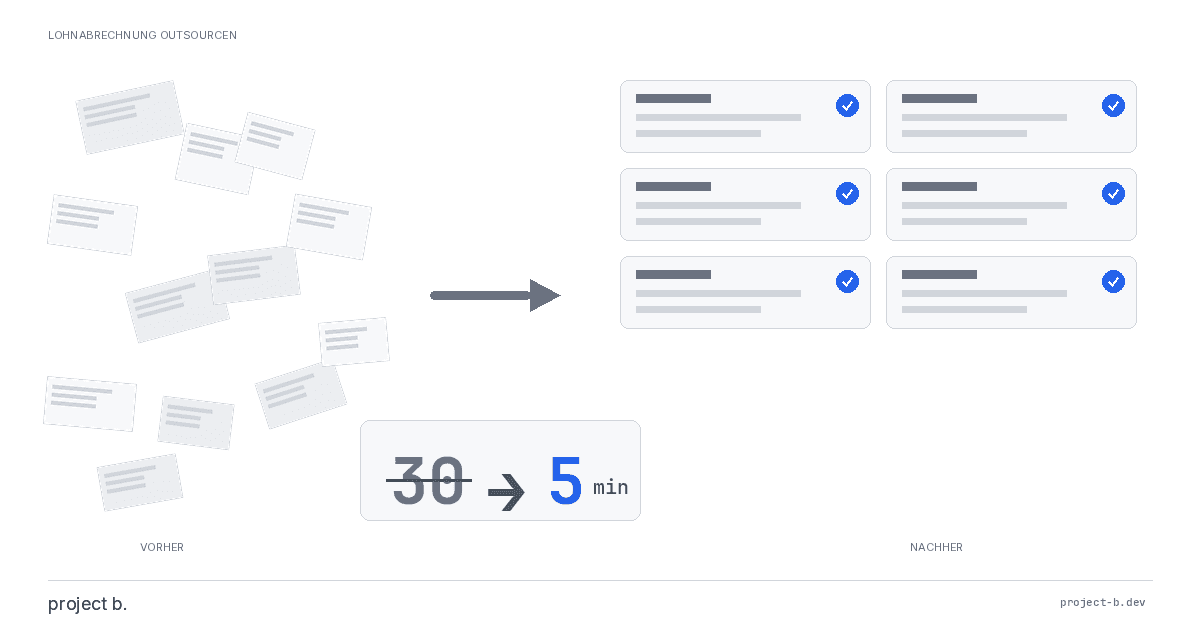

Anyone working in payroll knows the scenario: An email arrives with a sick leave notification. The attachment needs to be opened, the data extracted, the correct employee found in the system, and the absence recorded. Then the next email. And the next one. Timesheets, address changes, new bank details. Every piece of information must be processed manually.

This routine work consumes time. Time that is lacking for the actual core competency: accurate billing and advice. This is where artificial intelligence comes into play. Not as a replacement for professionals, but as a tool that takes away repetitive preliminary work.

At project b., the AI assistant RITA takes on this task. She structures incoming data, assigns it to the correct records, and prepares it for review. The result: 85 percent of the data is automatically structured before a clerk even sees it.

The Most Important Points in Brief

AI automates data capture: Emails, timesheets, and documents are automatically structured and assigned to the right employees.

Humans retain control: RITA makes suggestions, clerks review and approve in the cockpit.

Integration instead of isolated solutions: Ready-made interfaces to DATEV, SBS, and Agenda allow for direct integration into existing payroll systems.

Seamless workflow: From data capture to review to GDPR-compliant payslip distribution, everything runs on one platform.

What AI Means in Payroll

The term artificial intelligence often raises false expectations. Some picture a system that calculates salaries completely autonomously and initiates transfers. Others fear that machines will soon replace payroll clerks.

The reality lies in between. AI in payroll means: intelligent support for structured tasks. The system recognizes patterns in documents, extracts relevant information, and assigns it. The decision-making authority remains with the human.

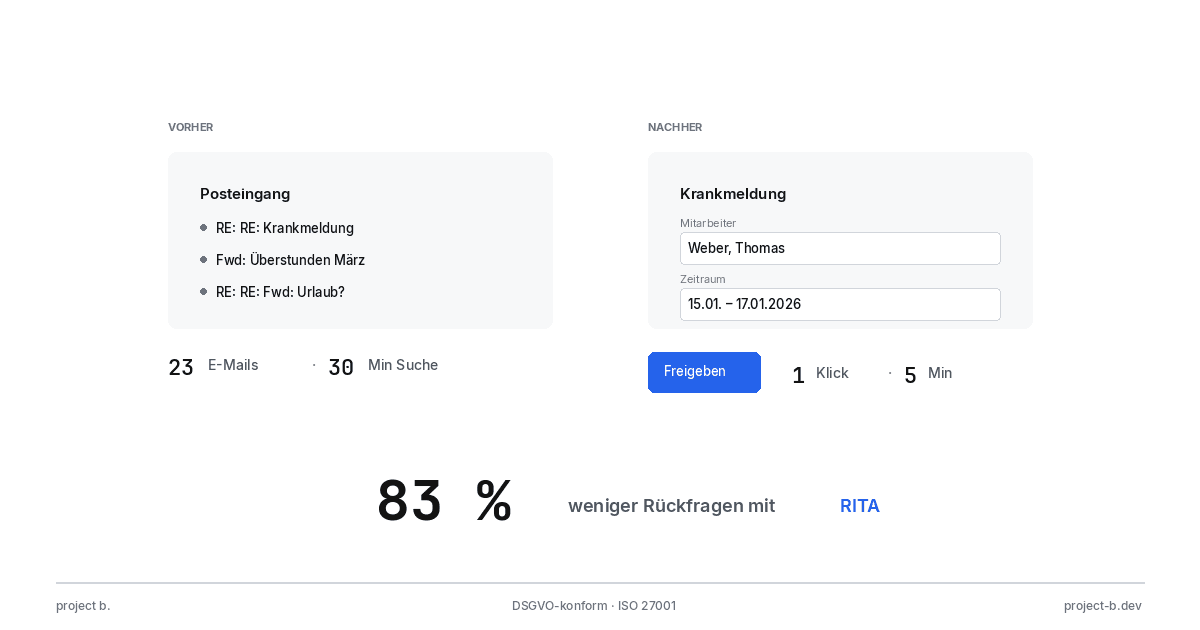

RITA, the AI assistant from project b., embodies this approach. She reads incoming emails, identifies the content (sick leave, address change, timesheet) and suggests which employee and data field the information should be assigned to. The clerk sees the suggestion, reviews it, and confirms with a click. Or corrects it if necessary.

This principle distinguishes modern AI systems from simple automation. An automated rule can only cover predefined scenarios. AI also recognizes variations and learns from corrections.

Processing Master Data and Transaction Data

Master data forms the foundation of every payroll: name, address, bank details, tax class, social security number. Transaction data captures what changes: working hours, absences, bonuses.

Traditionally, this information arrives at the payroll office through various channels. The managing director sends an email with a new employee attached. The HR department reports a resignation by phone. A foreman submits handwritten timesheets.

Every piece of information must be entered manually. This not only takes time but also poses sources of error. A mistyped IBAN leads to a failed transfer. A forgotten sick leave distorts the billing.

The master data management of project b. digitizes this process. All incoming information flows through a central platform. RITA automatically structures the data.

Example: Sick Leave

1. An email arrives with the subject "Sick Leave Müller"

2. RITA identifies the document type (sick leave certificate)

3. RITA recognizes the employee's name and suggests the appropriate data record

4. RITA extracts the date and the expected duration

5. The clerk sees the suggestion in the cockpit and confirms

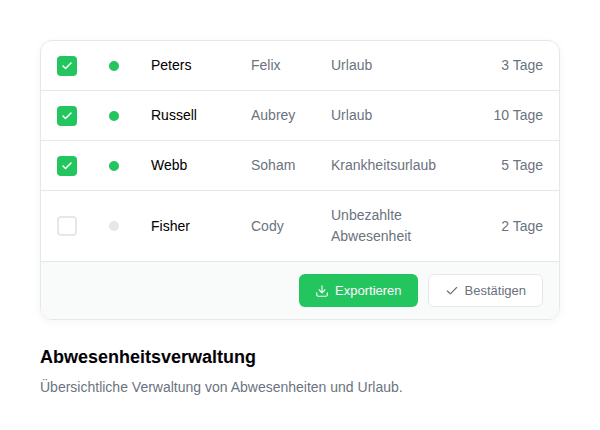

The same process works for address changes, new bank details, or working time records. The absence management captures vacation, illness, and special leave. The transaction data processing takes care of variable components such as overtime or bonuses.

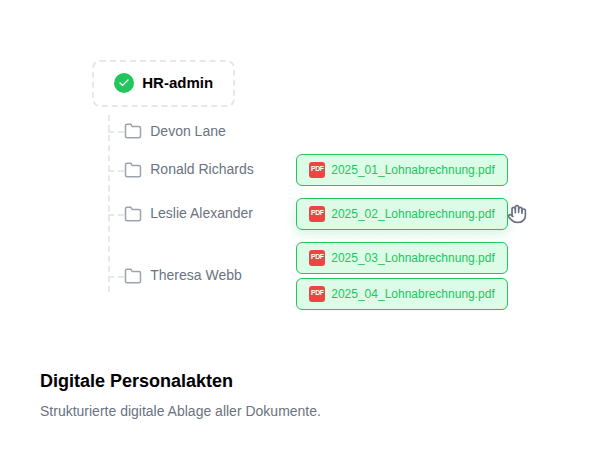

Using the Digital Personnel File

Paper files are a thing of the past, at least theoretically. In practice, many companies still have parallel systems: some documents digital, others in folders, some as email attachments on the clerk's server.

This fragmentation complicates work. When searching for an employee's employment contract, one often has to look in several places. This becomes a problem during an audit.

The digital personnel file from project b. creates a central storage location for all employee-related documents. The AI integration goes a step further: When a new document arrives, RITA identifies the document type and automatically assigns it to the correct employee.

A work contract goes into the "Contracts" folder, a salary adjustment goes to "Compensation," a warning goes to "Personnel Actions." The assignment is done automatically, the filing structure remains uniform.

For companies already using a document management system, project b. offers DMS synchronization. Changes are transferred automatically, avoiding duplicate records.

From the Cockpit to Payslip Distribution

The workflow at project b. follows a clear process:

1. Data Entry: Emails, documents, and forms are captured centrally.

2. AI Structuring: RITA analyzes the entries and assigns them.

3. Review in the Cockpit: Clerks see all suggestions at a glance. Each entry shows what needs to be changed and why. With a click, approval or rejection is done.

4. Change Lists: All approved changes are documented. This creates transparency for inquiries and audits.

5. Integration into the Payroll System: Approved data flows directly into the billing system. project b. provides interfaces to DATEV, SBS, and Agenda. Manual transfer is eliminated.

6. Payslip Distribution: After billing, the payslips are automatically distributed to employees. Delivery is done in compliance with GDPR through secure digital channels.

This seamless process eliminates media breaks. Data is entered once and flows through the entire system without re-entry.

Benefits for Payroll Offices, Tax Advisors, and Companies

The benefits of AI in payroll differ depending on the user group.

For Payroll Offices, efficiency is paramount. Those managing hundreds of clients spend a large part of the day on data entry. If RITA takes over 85 percent of this work, more time remains for actual billing and supporting complex cases.

For Tax Advisors, automation alleviates the payroll department's burden. The capacity gained can be used for higher-value consulting services. At the same time, the risk of errors in data entry decreases, easing liability concerns.

For Companies with Their Own HR Departments, AI offers a way to manage growing employee numbers without proportionally increasing personnel costs. Scaling becomes easier because the system grows along.

An often underestimated advantage is consistency. Humans make mistakes, especially in monotonous tasks. An AI works according to the same pattern, whether at eight in the morning or four on a Friday.

Challenges in Implementation

The implementation of AI in payroll is not a given. Three hurdles regularly confront companies:

Data Quality: AI can only work with what it gets. If master data is outdated or inconsistent, even the best AI will produce faulty suggestions. Often, a cleansing of existing data is necessary before implementation.

Employee Acceptance: New systems generate skepticism. Clerks wonder if they will become unnecessary. Transparency helps here: RITA replaces no one; she only takes over the part of the work that no one enjoys doing. The demanding tasks remain with humans.

Integration into Existing Systems: Many payroll offices and tax advisors have been working with DATEV, SBS, or Agenda for years. A new system must not replace this infrastructure but must fit in. project b. addresses this with ready-made interfaces that allow for direct connection.

Those who understand and address these challenges can significantly accelerate implementation. Pilot projects with selected clients or departments help collect experience before broad deployment.

Conclusion: AI as a Partner in Payroll

Artificial intelligence will not revolutionize payroll. But it will change it. The repetitive tasks that currently take hours can be automated. Clerks can focus on what machines cannot do: assessing complex cases, advising clients, taking responsibility.

The approach of project b. shows how this collaboration can work. RITA structures and suggests. The human reviews and decides. The cockpit provides an overview and control. The interfaces ensure smooth integration.

For payroll offices, tax advisors, and HR departments, the question is no longer whether they will use AI. But when and how. The earlier the engagement with the topic begins, the better the competitive position.

Does AI replace the payroll clerk?

No. AI in payroll takes over repetitive tasks such as data entry and document assignment. The decision-making authority remains with humans. At project b., RITA makes suggestions, but caseworkers review and approve every process in the cockpit. Complex cases, consulting, and responsibility remain tasks for specialists.

Which systems can be connected to project b.?

project b. offers ready-made interfaces to common payroll systems DATEV, SBS, and Agenda. Approved data flows directly from the cockpit into the respective payroll system, eliminating the need for manual transfer. Additionally, project b. synchronizes with existing document management systems, ensuring that the digital personnel file remains automatically up to date.

What exactly does RITA do at project b.?

RITA is the AI assistant of project b. that automatically analyzes incoming emails, documents, and time sheets. She recognizes the document type, identifies the relevant employee, and suggests which data field the information should be assigned to. 85 percent of the data is structured automatically this way. The caseworker reviews the suggestions in the cockpit and confirms or corrects them with a click.

Finn R.

Further articles

Feb 9, 2026

·

Payment

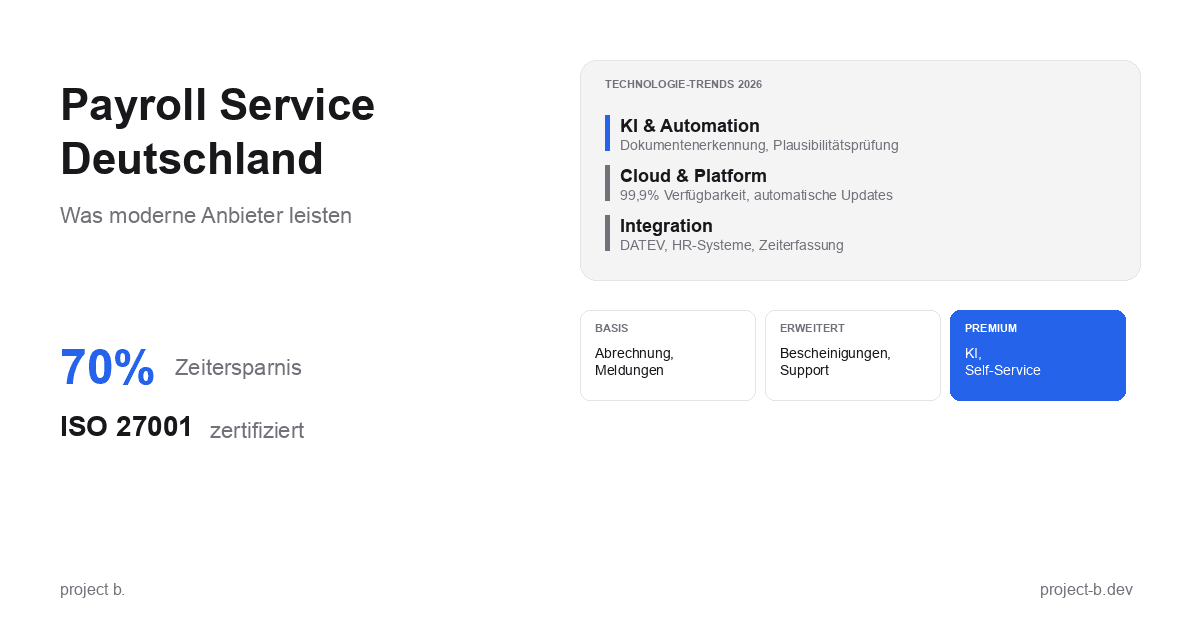

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

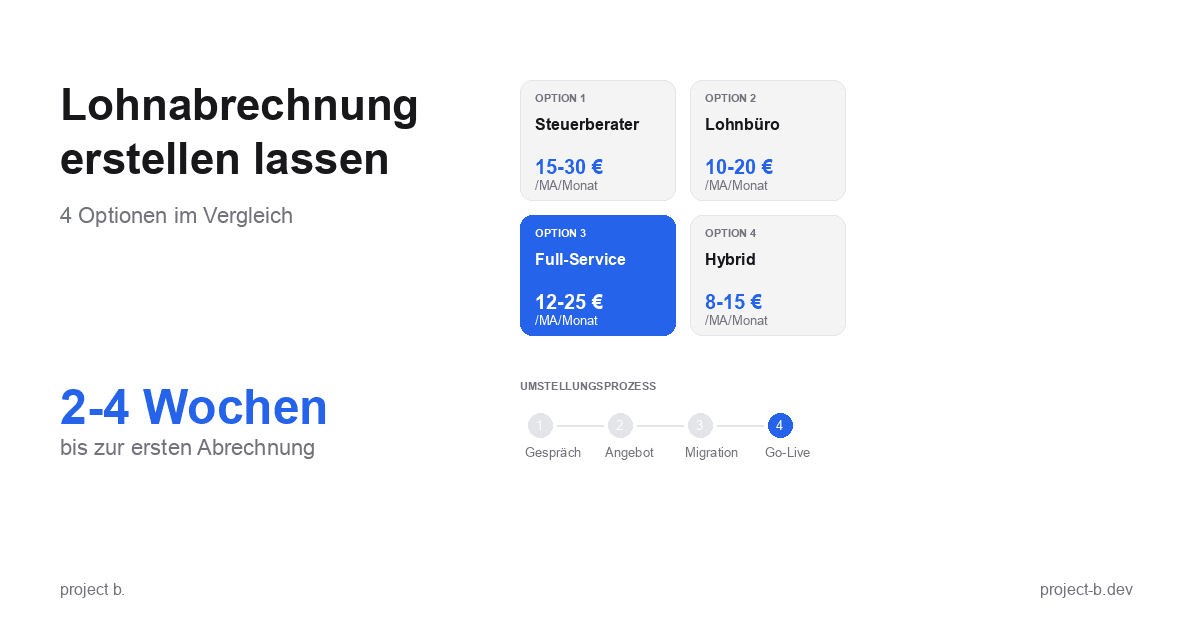

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

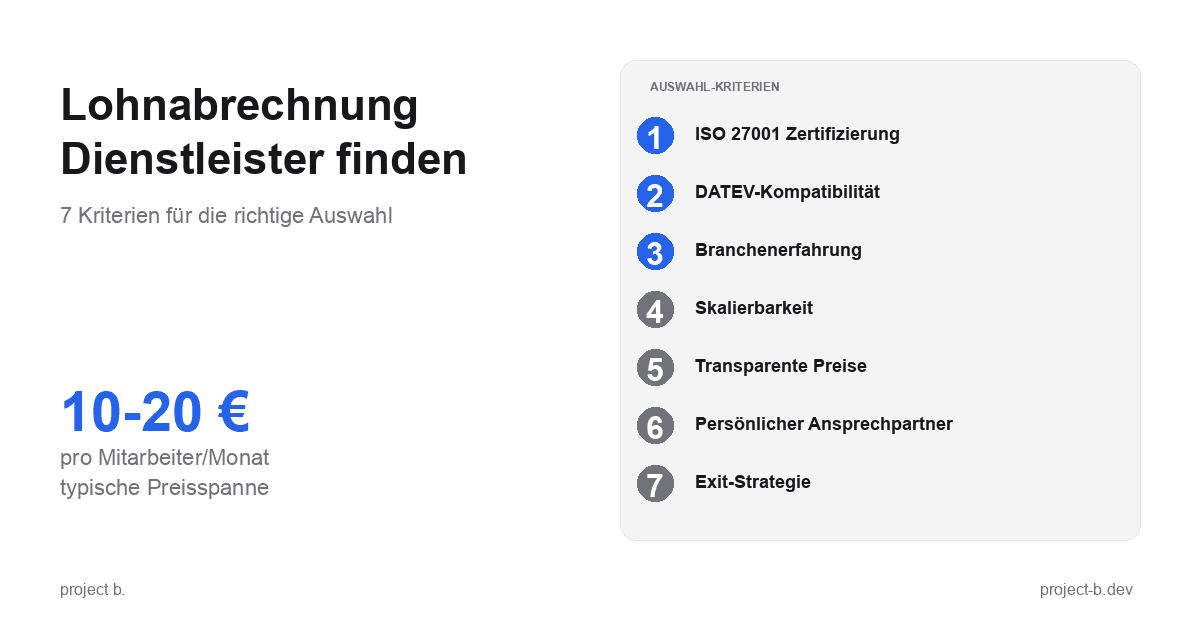

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

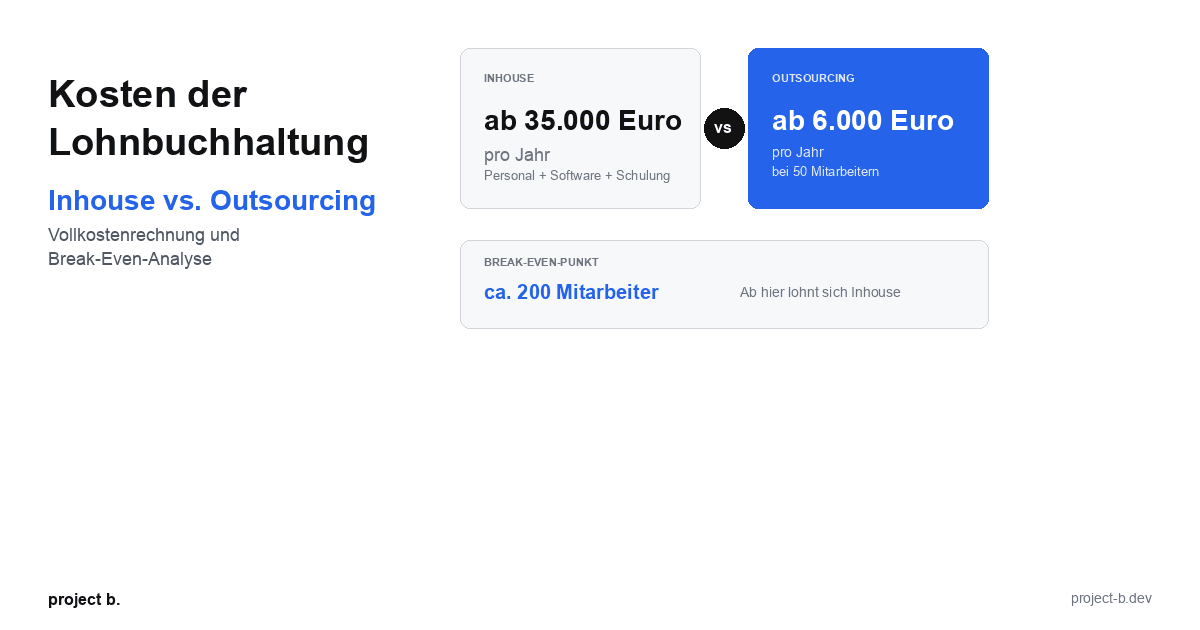

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

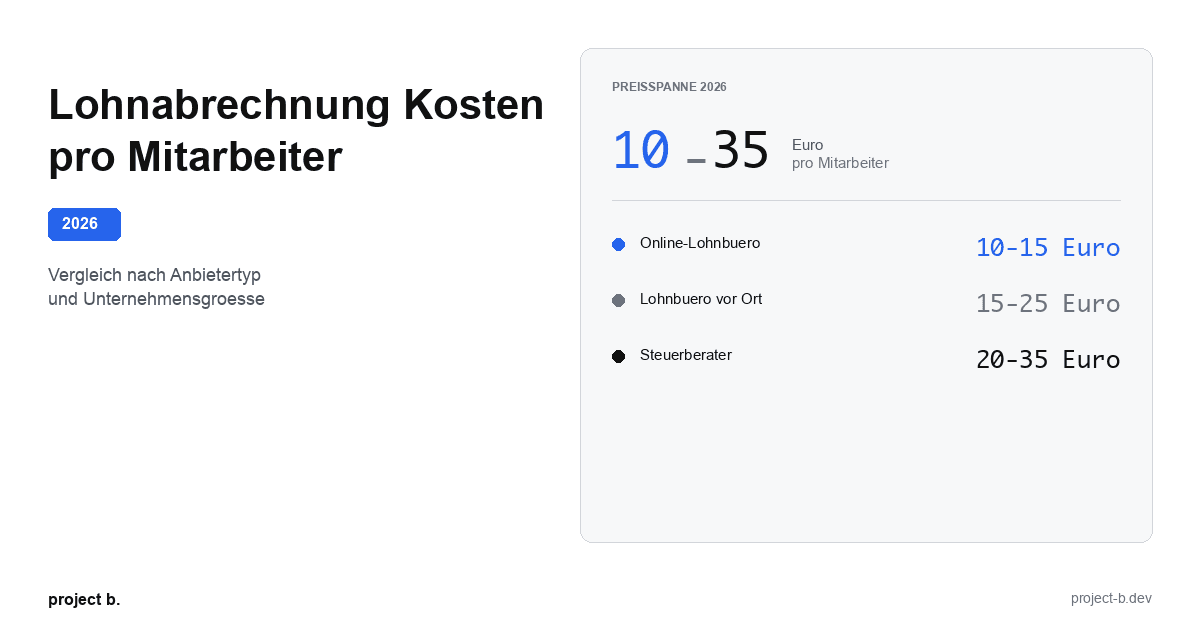

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

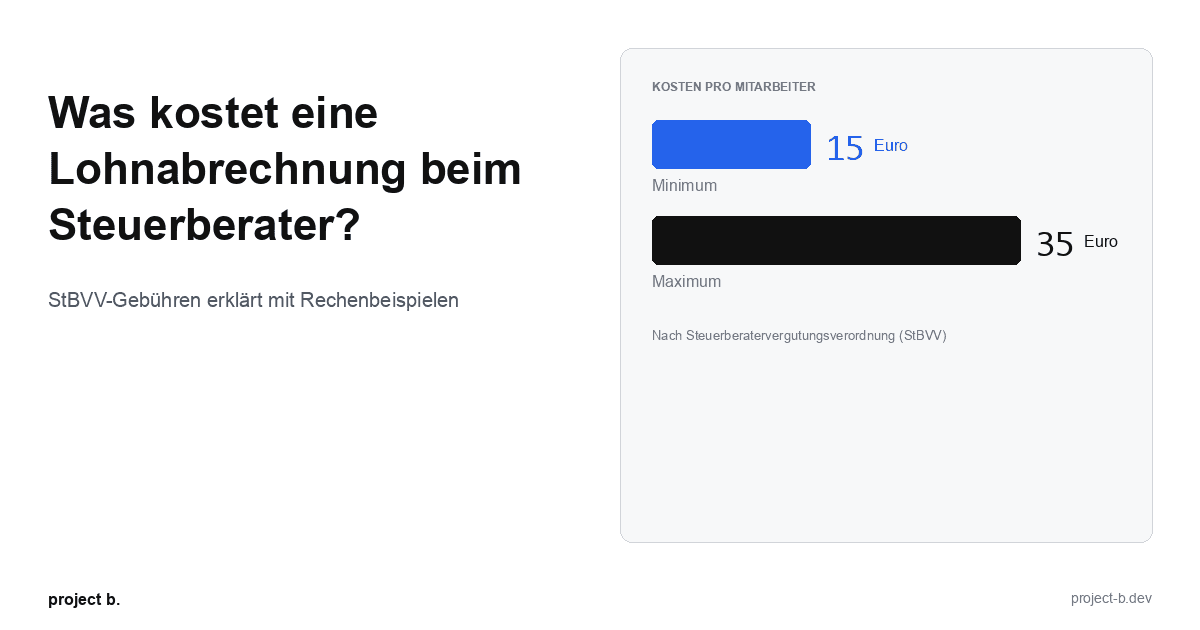

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

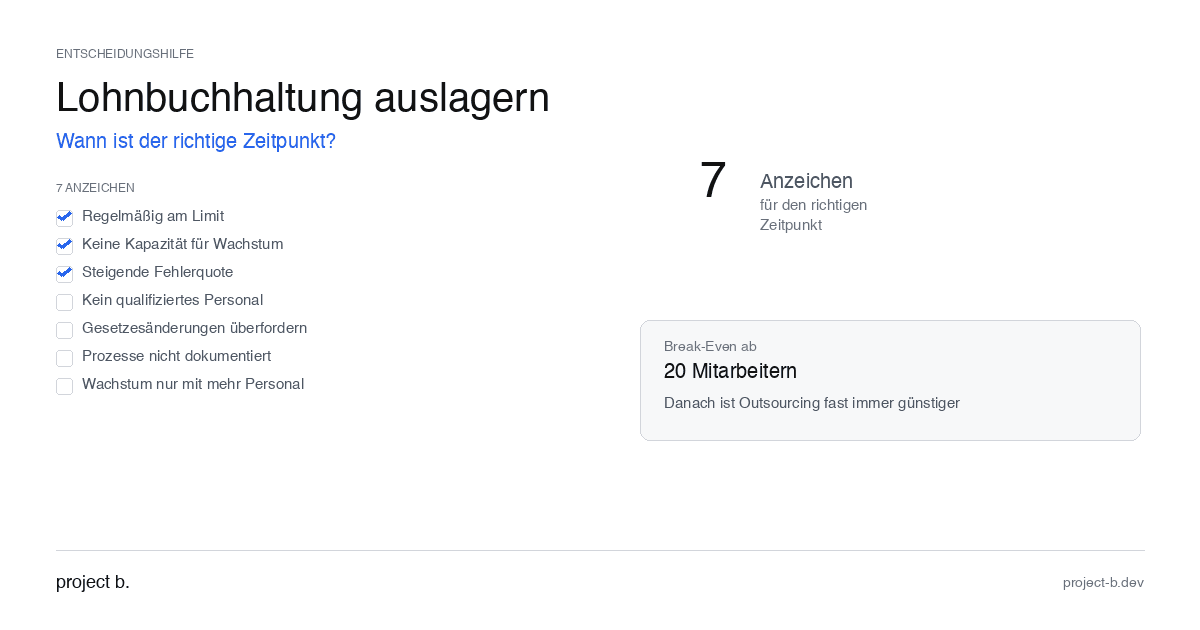

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

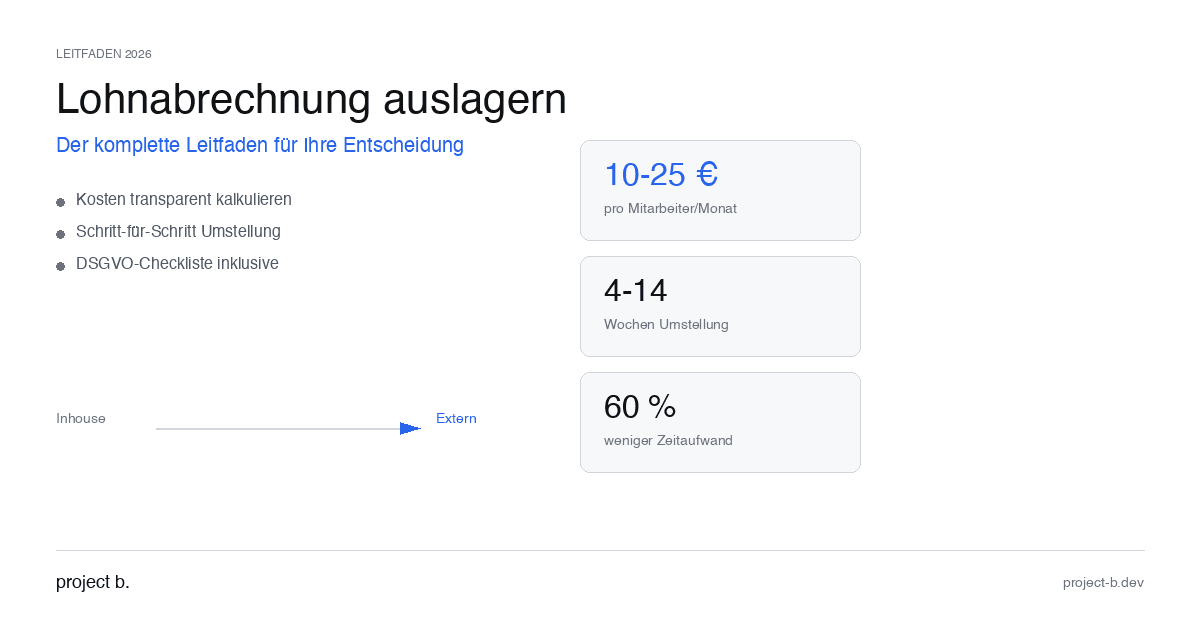

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

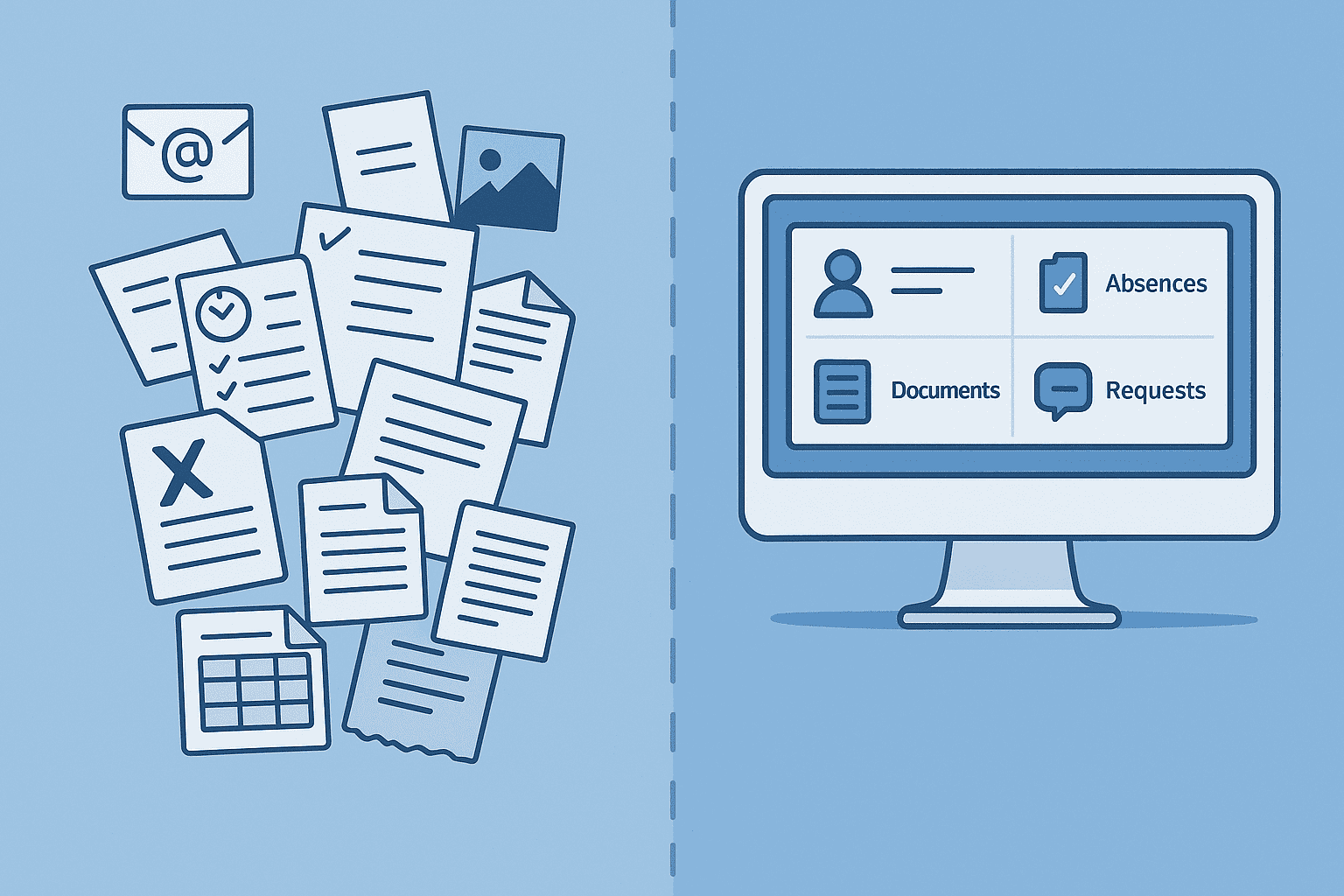

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 22, 2025

·

AI

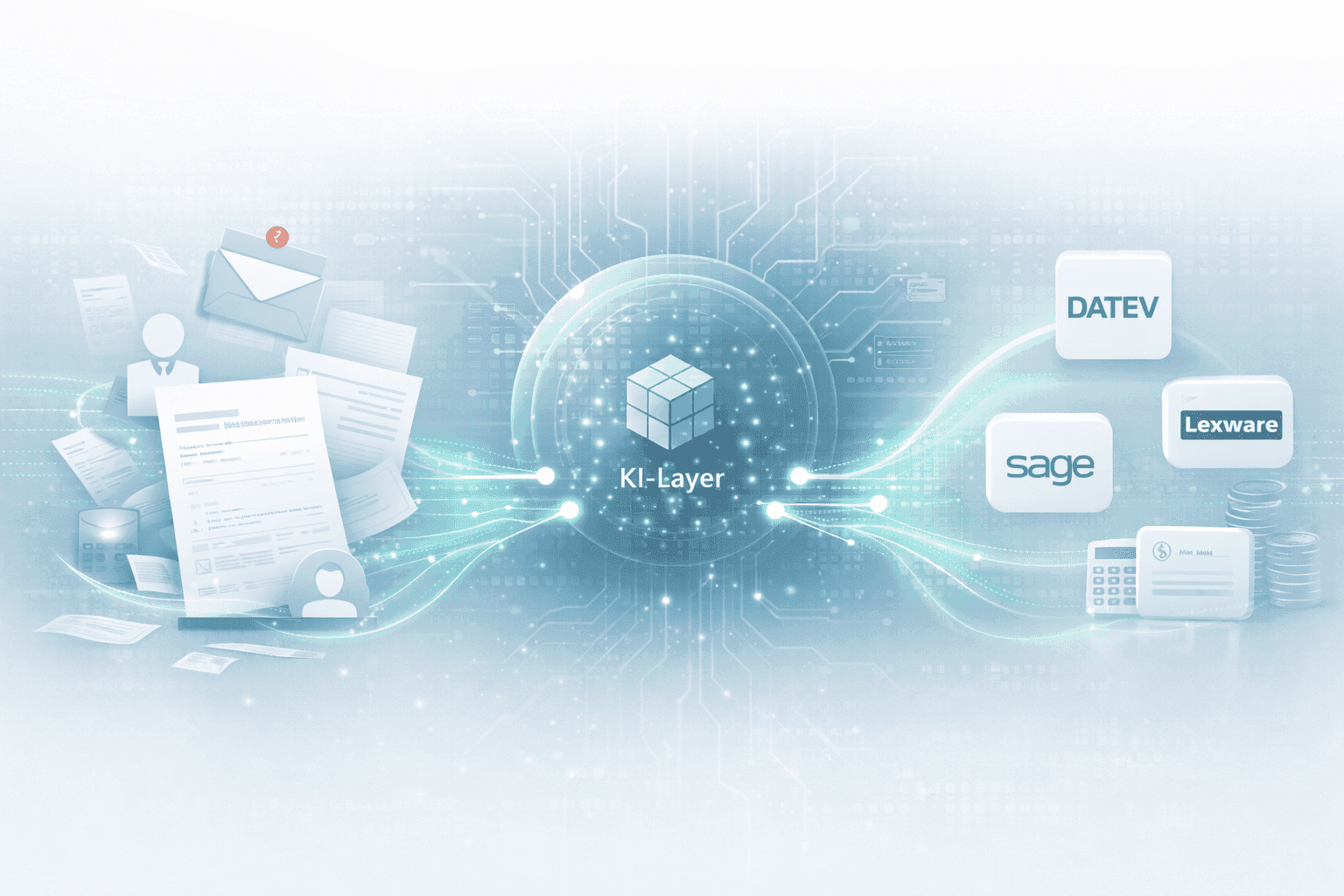

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 17, 2025

·

AI

Payroll accounting with AI: 5 terms that every payroll clerk should know

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

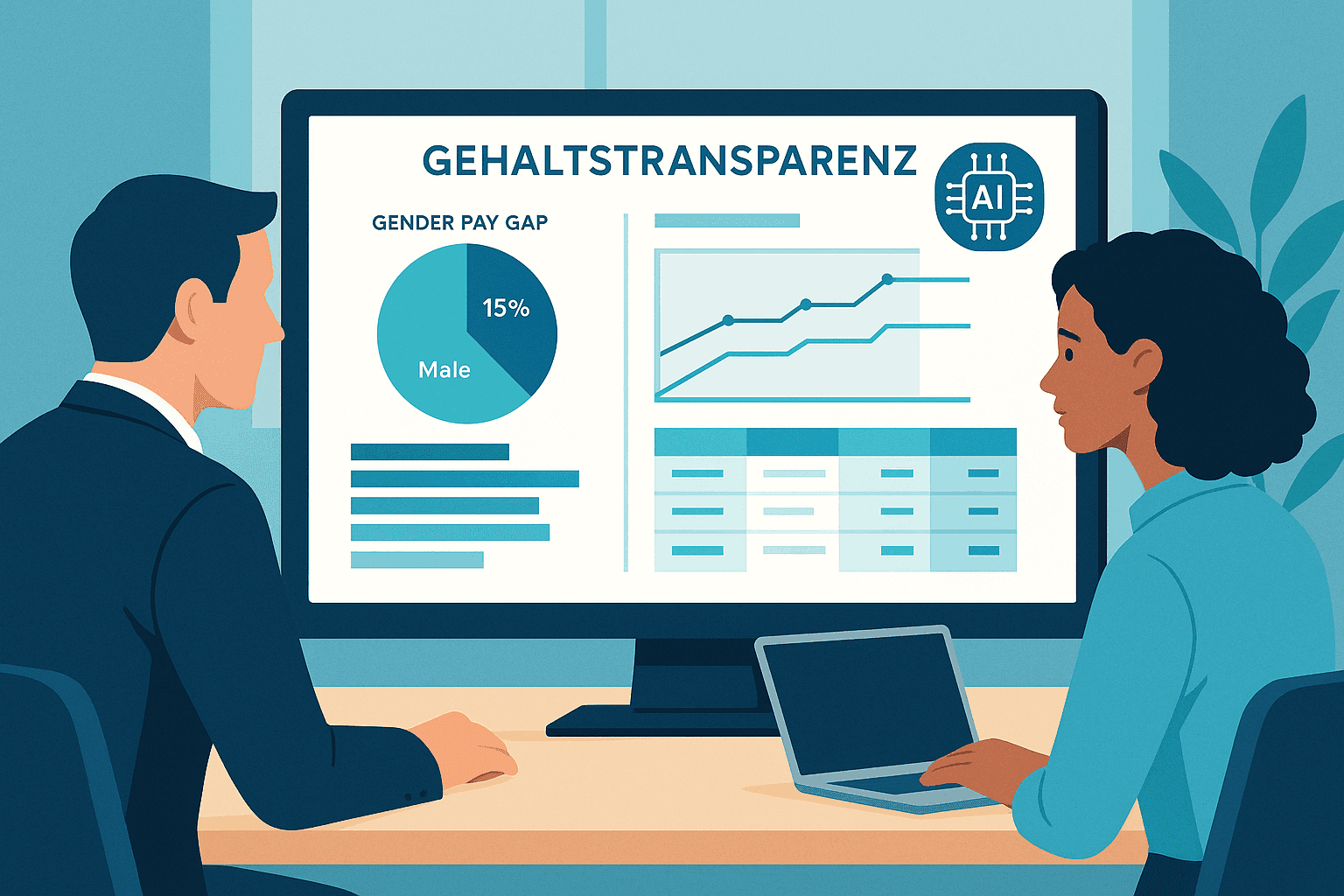

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.