Payroll accounting with AI: 5 terms that every payroll clerk should know

Dec 17, 2025

Payroll processing explained clearly with AI: These 5 key AI terms payroll accountants should know to automate processes, reduce errors, and work more efficiently.

Ready for payroll that finally takes the pressure off?

Leave your contact details - we will get back to you shortly.

Payroll Accounting with AI: 5 Terms Every Payroll Clerk Should Know

The digital transformation of payroll accounting is advancing relentlessly, and Artificial Intelligence (AI) plays an increasingly central role. For payroll clerks, this means not only a change in their daily work processes but also the necessity to become familiar with new technological terms and concepts. Understanding these technical terms is essential to optimally utilize the capabilities of modern AI systems.

In modern payroll accounting, as implemented at project b., traditional accounting expertise merges with innovative AI technologies into a powerful overall system. The integration of AI-powered solutions allows for the automation of repetitive tasks, the minimization of error rates, and the execution of complex analyses in real time. It is essential for professionals to master the fundamental concepts and terminologies to make informed decisions.

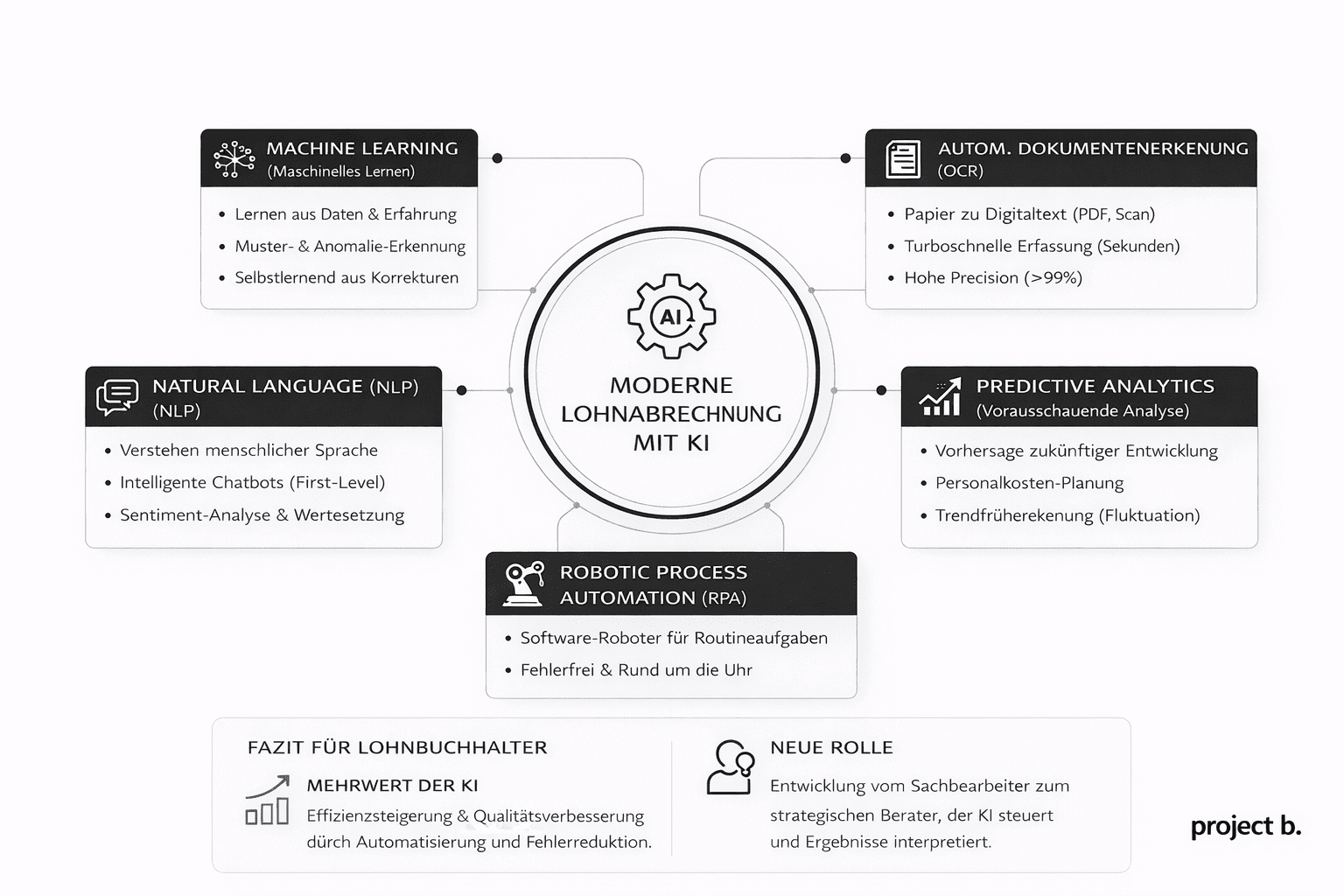

The following five key terms from the field of AI are particularly relevant for payroll clerks and will significantly shape their work in the coming years. They form the foundation for understanding modern payroll systems and enable active participation in digital transformation. From Machine Learning to Robotic Process Automation - knowing and understanding these terms is not only a competitive advantage but is increasingly becoming a professional necessity.

1. Machine Learning in Payroll Accounting

Machine Learning is the core of modern AI systems in payroll accounting and revolutionizes how salary data is processed and analyzed. At its core, Machine Learning describes the ability of computer systems to learn from experience and continuously improve their performance without being explicitly programmed to do so. This technology allows for the effective implementation of AI in Payroll Accounting: Basics and Trends and for recognizing complex patterns in salary data.

In practical application, the strength of Machine Learning is particularly evident in processing payrolls with various allowances, supplements, and bonuses. The system learns from historical data and can automatically recognize, for example, which employees are entitled to certain bonuses or when special payments are due. Project b. uses this technology to identify anomalies in salary data and detect potential errors early, even before they affect payroll processing.

The implementation of Machine Learning in payroll accounting leads to a significant increase in efficiency and accuracy. Algorithms can analyze thousands of data records in seconds, recognizing patterns that may remain hidden to the human eye. This not only enables more accurate payroll processing but also frees up payroll clerks to focus on strategic and advisory activities. Particularly noteworthy is the system's ability to learn from corrections and apply these insights to future calculations.

2. Automated Document Recognition (OCR)

Automated Document Recognition, also known as Optical Character Recognition (OCR), represents a fundamental building block in modern payroll accounting. This technology allows for the automatic conversion of printed or handwritten text from documents into machine-readable text. As the Current AI Processes in Payroll Accounting show, OCR is revolutionizing the processing of sick notes, time sheets, and other payroll-related documents.

In practical application, the OCR technology analyzes incoming documents using complex algorithms and extracts relevant information such as personnel numbers, working hours, or sick days. Project b. relies on advanced OCR systems that not only recognize individual characters but also understand the contextual relationship. This enables precise assignment of the information to the corresponding database fields and significantly minimizes the manual post-processing effort.

The integration of OCR into the payroll process leads to a substantial increase in efficiency: While manually capturing a sick note takes an average of 3-5 minutes, an OCR system processes the same document in a few seconds. Modern systems achieve recognition accuracy of over 99%, provided that the document quality is sufficient. Incorrect recognitions are marked by integrated validation mechanisms and can be specifically checked by qualified personnel, further ensuring data quality.

The technology continues to evolve continuously and learns steadily through the application of Machine Learning. Modern OCR systems can already recognize various document layouts and automatically adapt to new form types. This makes them an indispensable tool in digitized payroll accounting, saving not only time and costs but also significantly reducing the likelihood of errors in data entry.

3. Natural Language Processing (NLP)

Natural Language Processing (NLP) represents a crucial advancement in the communication between humans and machines in the context of payroll accounting. This technology enables AI systems to understand, interpret, and respond to human language. In payroll accounting, NLP is particularly applied in processing employee inquiries, analyzing employment contracts, and automating responses to standard queries.

The practical implementation of NLP in payroll accounting primarily manifests in the form of intelligent chatbots and automated response systems. These can independently answer questions about payrolls, vacation entitlements, or tax allowances. The systems are capable of understanding the context of a query and aggregating relevant information from various data sources. Project b. utilizes this technology to ensure efficient initial consultations and significantly reduce the processing time for routine inquiries.

Particularly notable is the ability of modern NLP systems to conduct sentiment analyses and assess the urgency of inquiries. This allows for the automatic prioritization of employee concerns, ensuring that critical cases are addressed promptly. The technology can also process and translate various languages automatically, which is particularly advantageous in international companies. The continuous development of NLP algorithms leads to a steadily improved understanding accuracy and more natural communication, thus increasing acceptance among employees and users.

4. Predictive Analytics

Predictive Analytics represents a forward-looking approach in modern payroll accounting that enables precise predictions for future developments based on historical data. This advanced technology uses complex statistical models and machine learning to recognize trends in personnel data and derive valuable forecasts. As detailed in the Guide to AI Software Selection, this functionality is one of the critical criteria in evaluating modern payroll systems.

In practical application, Predictive Analytics allows for precise forecasting of personnel costs, identification of potential overtime developments, and early detection of turnover patterns. The technology analyzes various data points such as salary developments, working time patterns, sick days, and seasonal fluctuations. Project b. uses these insights to support companies in strategic personnel planning and budgeting to identify potential cost risks early.

The implementation of Predictive Analytics in payroll accounting leads to a significant improvement in planning certainty. By analyzing millions of data points, patterns can be recognized that would not be visible to the human eye. Modern systems achieve prediction accuracy of over 90%, providing a reliable foundation for strategic decisions. Particularly valuable is the system's ability to simulate various scenarios and calculate their impact on personnel costs, significantly facilitating informed decision-making.

Application Area | Prediction Accuracy | Typical Lead Time |

|---|---|---|

Personnel Costs | 92-95% | 6-12 months |

Overtime Development | 85-90% | 3-6 months |

Turnover Rates | 80-85% | 4-8 months |

Sick Leave | 75-80% | 2-4 months |

5. Robotic Process Automation (RPA)

Robotic Process Automation (RPA) represents the systematic automation of repetitive processes in payroll accounting through software-based robots. These digital assistants are specialized in executing rule-based tasks precisely and without signs of fatigue. Unlike traditional automation solutions, RPA operates on the user interface of existing systems and emulates human interactions, enabling seamless integration into existing processes.

In payroll accounting, RPA takes over numerous time-consuming routine tasks such as transferring data between different systems, generating standardized reports, or performing plausibility checks. Project b. employs this technology, for example, to automatically transfer master data changes to various systems, archive payrolls, or generate certificates. The RPA bots operate around the clock, achieving a processing speed that is many times higher than manual processing.

The implementation of RPA leads to a significant increase in efficiency while reducing error rates. While humans have an average error rate of 3-4% in repetitive tasks, RPA systems operate with an accuracy of nearly 100%. The technology allows payroll clerks to focus on more complex tasks requiring human judgment and expertise. Particularly valuable is the ability of the bots to document their activities comprehensively, significantly improving traceability and compliance.

Conclusion

The five AI terms presented form the fundamental framework for understanding modern payroll accounting and its digital transformation. Machine Learning, OCR, Natural Language Processing, Predictive Analytics, and RPA are not just theoretical concepts but are already practically applied technologies that demonstrably increase the efficiency and precision of payroll accounting.

The successful integration of these technologies requires payroll clerks to engage in continuous education and be willing to familiarize themselves with new digital tools. Project b. observes a clear trend: companies that invest early in AI-powered solutions and train their employees accordingly gain a significant competitive advantage. The automation of repetitive tasks allows professionals to focus on strategic and advisory activities.

The outlook for the coming years shows a clear trend toward even smarter and more integrated AI systems in payroll accounting. The technologies are becoming increasingly sophisticated and user-friendly, which will further enhance their acceptance. For payroll clerks, this means an evolution of their role from mere clerks to strategic advisors who use AI systems as powerful tools to tackle complex challenges and provide real value to companies.

Sources

How does AI work in payroll?

The integration of AI into payroll processing is done gradually through the implementation of specialized software solutions. Starting with the automation of simple processes such as document recognition (OCR), the system is continuously expanded with more complex functions like machine learning and predictive analytics. A structured introduction with appropriate training for the employees is crucial.

How to implement AI in payroll?

The implementation typically occurs in four phases: First, a current analysis is conducted to identify automation potentials. Next, suitable AI tools are selected and their technical integration is performed. In the third phase, employees are trained and processes are adjusted. The final phase includes the continuous optimization and expansion of AI functionalities.

What requirements must be met for AI integration?

Prerequisites include a digital infrastructure, structured data storage, and clearly defined processes. Additionally, you need trained personnel who can work with AI systems, as well as a sufficient data base for training the AI models.

Finn R.

Further articles

Feb 9, 2026

·

Payment

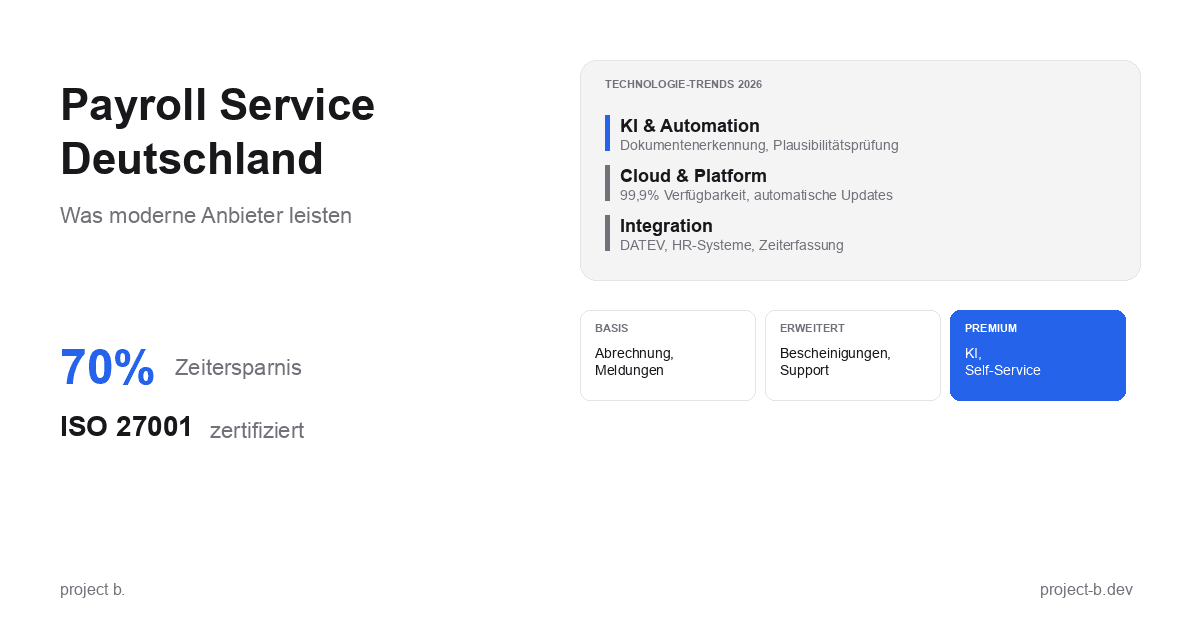

Payroll Service Deutschland: Was moderne Anbieter leisten

Payroll Service in Deutschland gesucht? Erfahren Sie, was moderne Anbieter leisten, welche Technologien sie nutzen und worauf Sie bei der Auswahl achten sollten.

Feb 11, 2026

·

Outsourcing

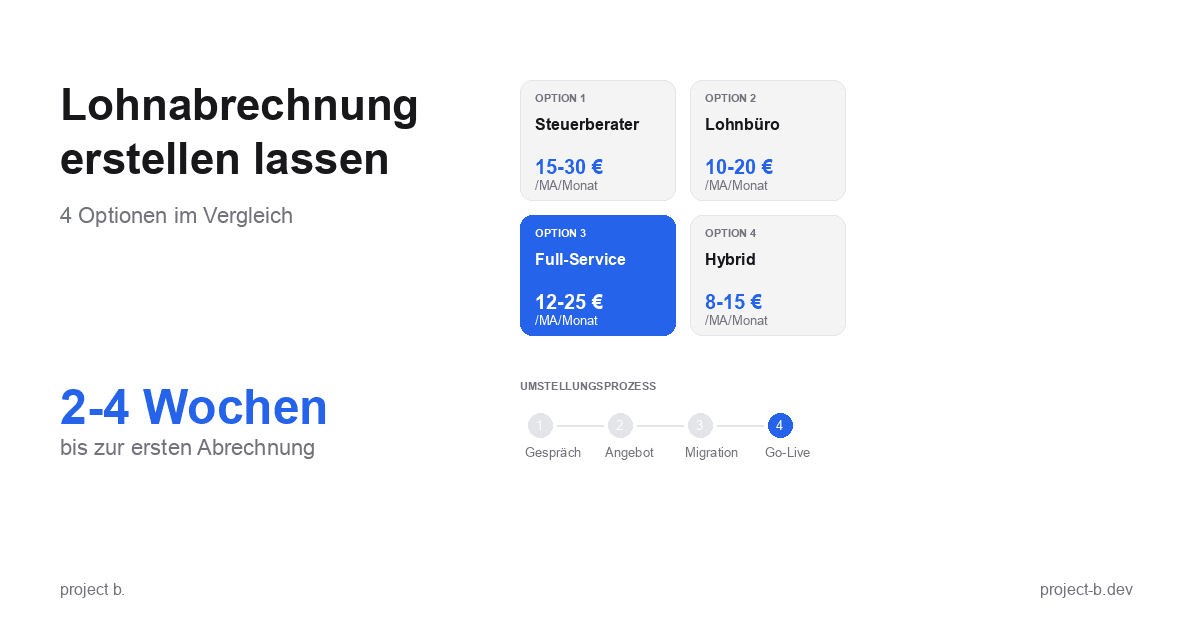

Lohnabrechnung erstellen lassen: Ihre Optionen im Vergleich

Lohnabrechnung erstellen lassen statt selbst kämpfen? Erfahren Sie, welche Optionen Sie haben, was es kostet und wie schnell Sie starten können.

Feb 9, 2026

·

Outsourcing

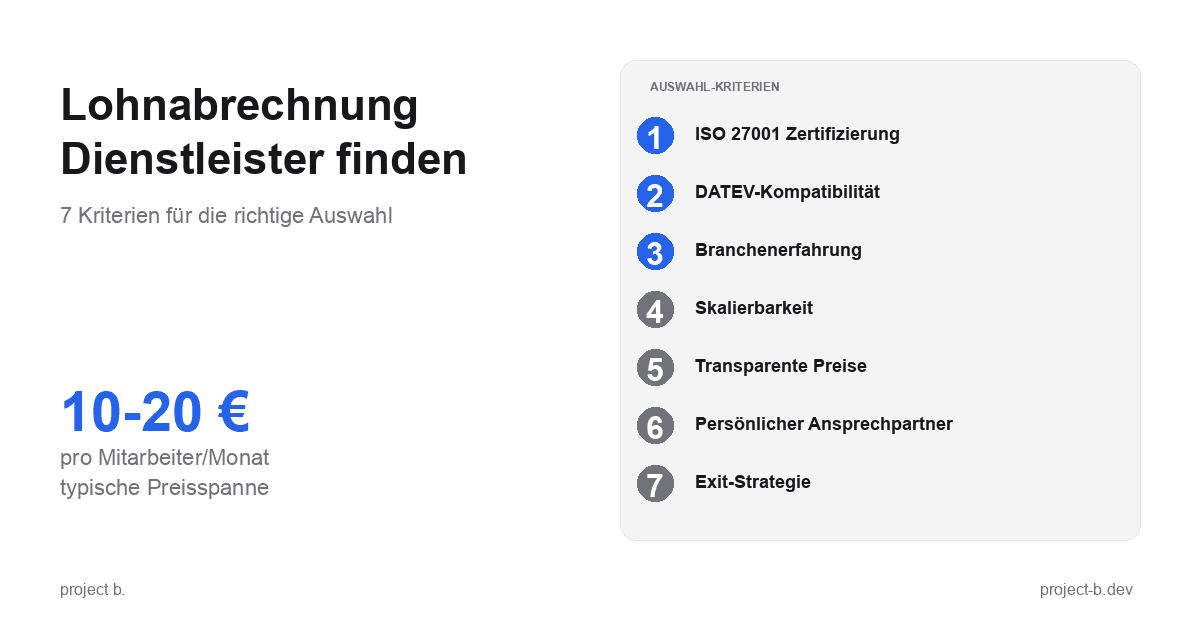

Lohnabrechnung Dienstleister: So finden Sie den richtigen Partner

Lohnabrechnung Dienstleister gesucht? 7 Kriterien für die Auswahl, Preisvergleich und Checkliste fürs Erstgespräch. Finden Sie den Partner, der zu Ihnen passt.

Feb 6, 2026

·

Outsourcing

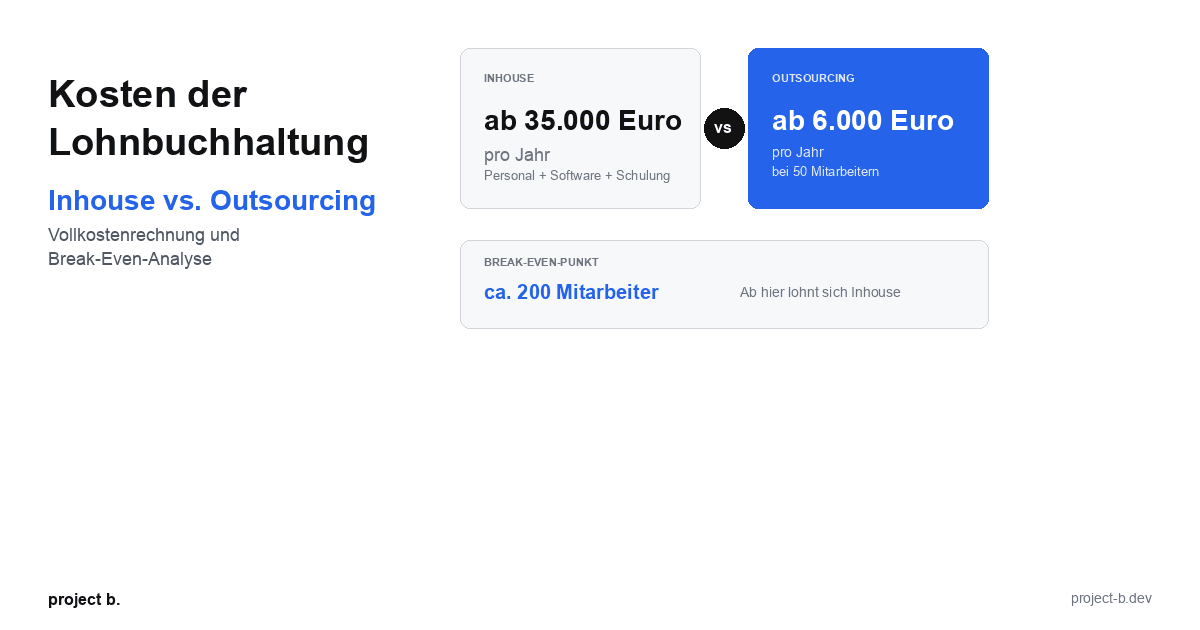

Kosten der Lohnbuchhaltung: Inhouse vs. Outsourcing im Vergleich

Lohnbuchhaltung Kosten: Inhouse ab 35.000 Euro/Jahr vs. Outsourcing ab 6.000 Euro/Jahr. Break-Even-Analyse, ROI-Rechnung und Entscheidungshilfe.

Feb 4, 2026

·

Outsourcing

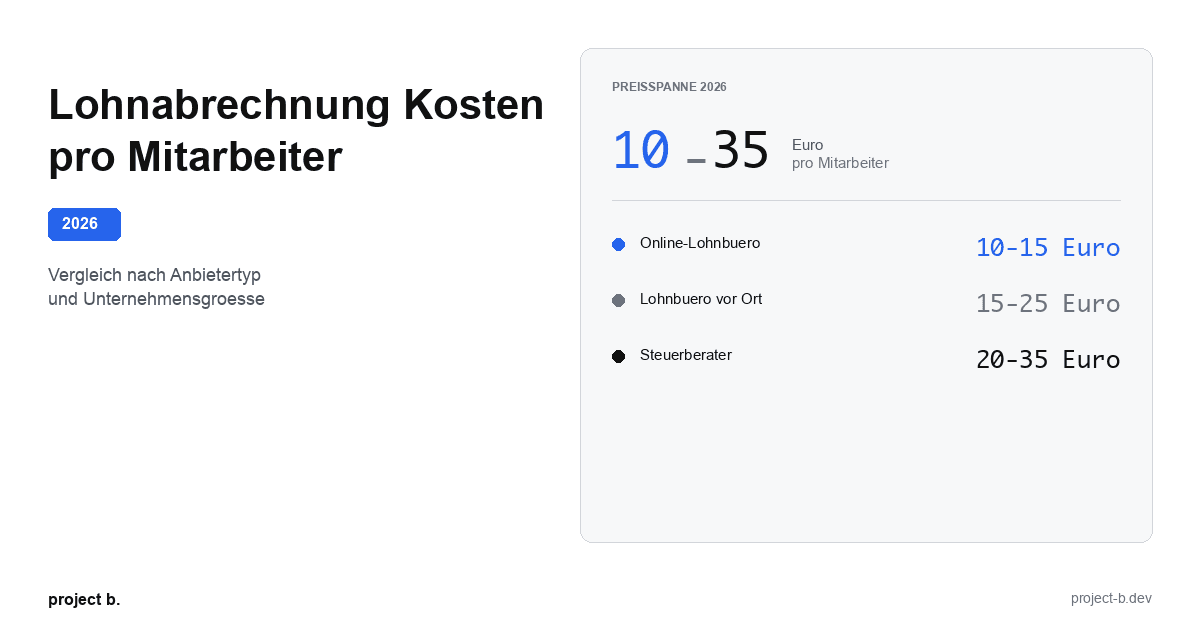

Lohnabrechnung Kosten pro Mitarbeiter: Was Sie 2026 zahlen

Lohnabrechnung Kosten 2026: 10-35 Euro pro Mitarbeiter je nach Anbieter. Vergleich nach Unternehmensgroesse, Branche und versteckte Kosten aufgedeckt.

Feb 2, 2026

·

Outsourcing

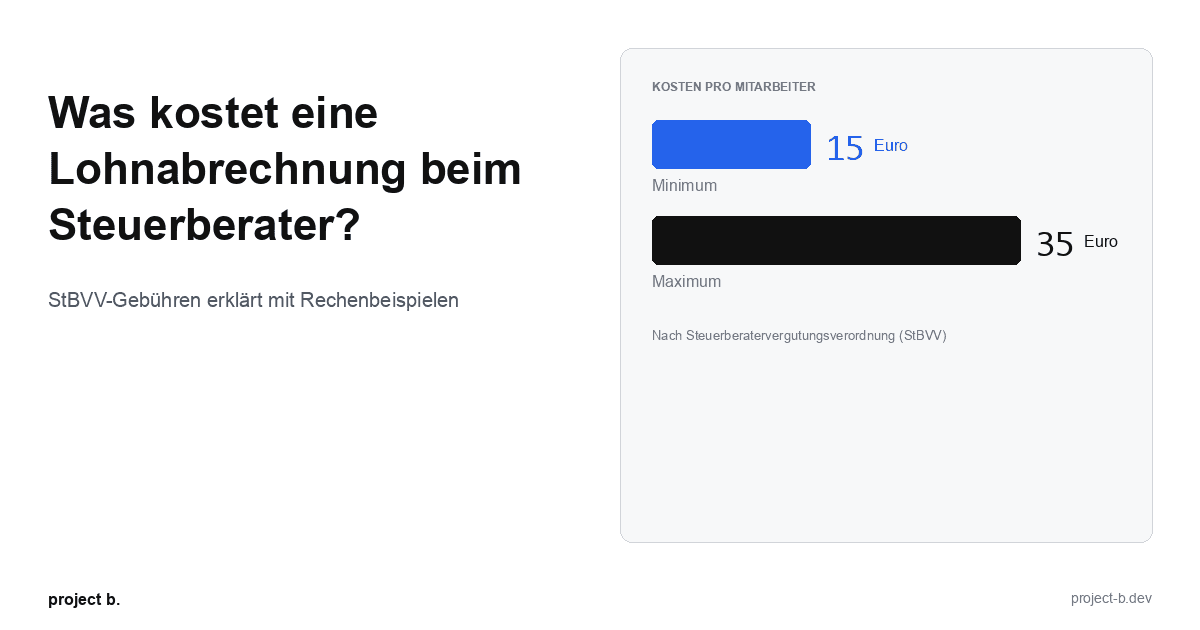

Was kostet eine Lohnabrechnung beim Steuerberater?

Lohnabrechnung beim Steuerberater: Kosten von 15-35 € pro Mitarbeiter. StBVV-Gebühren erklärt, Preisvergleich und Rechenbeispiele für 10, 50, 100 Mitarbeiter.

Jan 30, 2026

·

Outsourcing

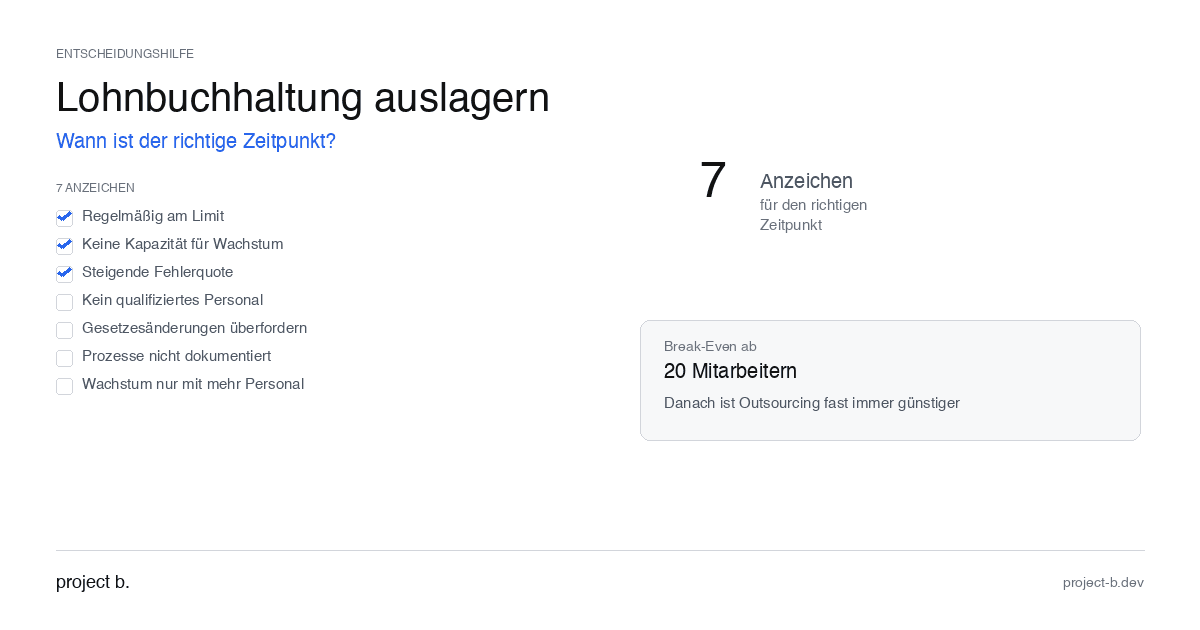

Outsource payroll accounting: When is the right time?

Outsourcing payroll: 7 clear signs that now is the right time. Including break-even analysis and DATEV integration check.

Jan 28, 2026

·

Outsourcing

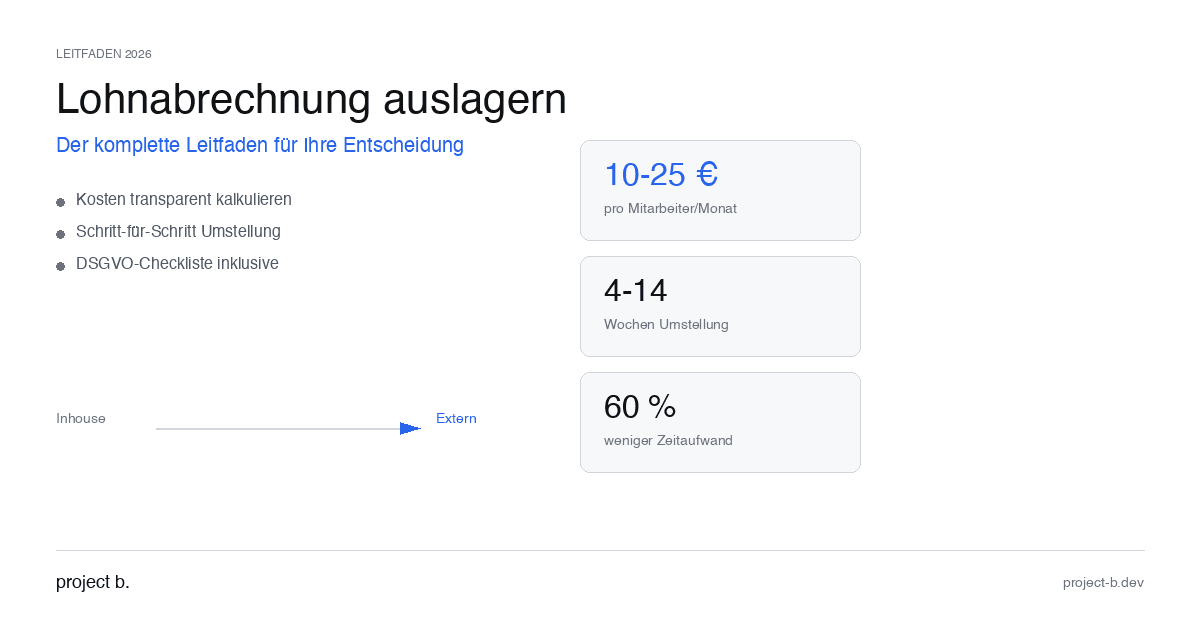

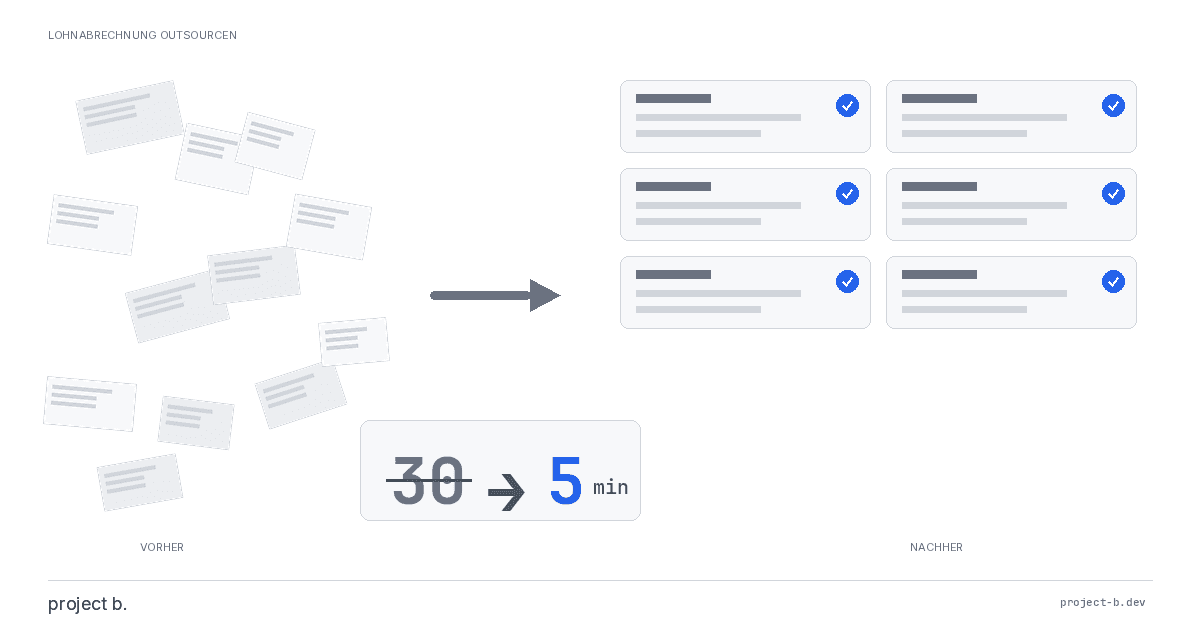

Outsourcing payroll accounting: The complete guide for 2026

Outsource payroll processing 2026: Costs from €10 per employee, step-by-step guide and GDPR checklist. This is how to make the transition without risk.

Jan 26, 2026

·

Outsourcing

Outsourcing payroll: Costs, benefits, and providers at a glance

Outsource payroll accounting from €10 per employee. Learn about the benefits of outsourcing, its costs, and how to find the right provider.

Jan 22, 2026

·

AI

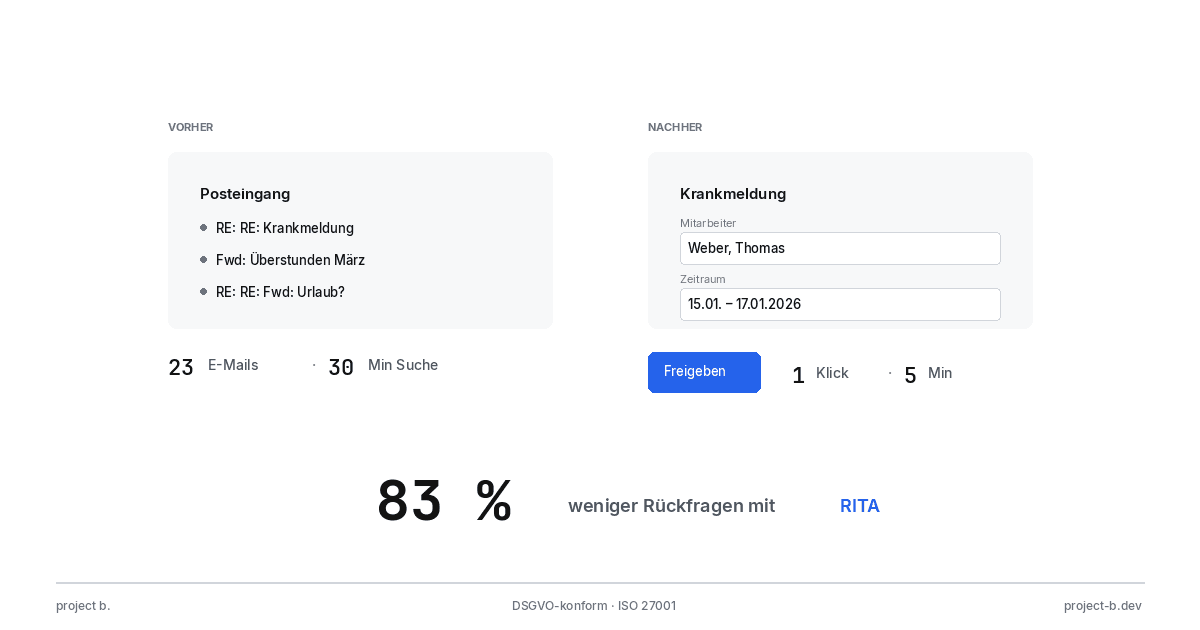

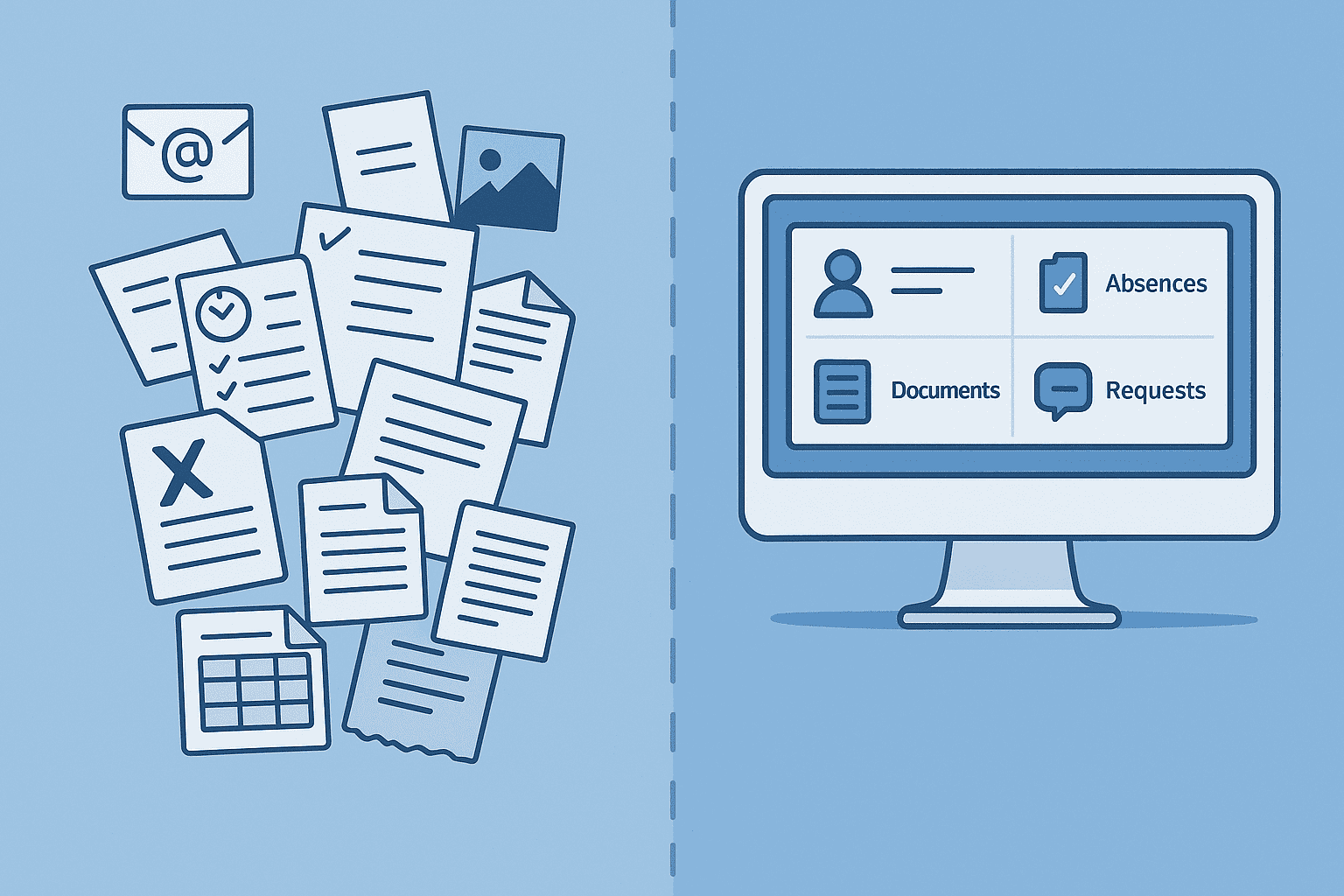

Client portal vs. Email chaos: What modern payroll processing is all about

Payroll statements by email pose a GDPR risk. With the project b. Portal and RITA, you save 1,400 hours/year. This is how secure data exchange works.

Jan 20, 2026

·

AI

From Excel to the Cockpit: How Payroll Offices Will Make the Leap into Digitalization in 2026

Digital payroll instead of Excel: With RITA and the project b. cockpit, payroll offices save 40% time without switching to DATEV. Practical guide with checklist.

Jan 15, 2026

·

Personal

ELStAM Procedure 2026: This is how the new private health insurance notification for employers works

From 2026, employers will report private health insurance contributions digitally via the ELStAM procedure. Find out which systems are affected and how you can prepare now.

Jan 14, 2026

·

AI

Active pension 2026: What payroll offices and HR departments need to prepare now

Pension from January 2026: Up to €2,000 tax allowance for retirees. Learn about the changes in payroll processes and how AI facilitates implementation.

Jan 13, 2026

·

AI

AI-Powered Payroll Software: How Tax Advisors Will Save Time in 2026

AI payroll accounting for tax consultants: Learn how project b. reduces manual work by 80% with RITA and helps combat the skilled labor shortage.

Jan 8, 2026

·

Payment

Personio vs. project b.: Which tool really fits your payroll?

Personio or project b.? Comparison for StartUps & Scaleups: DATEV integration, AI automation, costs. Why specialized payroll tools are gaining traction.

Jan 4, 2026

·

Payment

Power outage in Berlin: Why employers still have to pay wages

Power outage Berlin 2026: 2,200 businesses affected. Find out why employers must still pay wages according to § 615 BGB - and what applies to payroll.

Jan 5, 2026

·

AI

Payroll 2026: All Changes at a Glance (with AI Automation)

Minimum wage €13.90, mini-job limit €603, new contribution assessment ceilings: An overview of all changes for payroll in 2026. Learn how AI automatically implements these updates.

Dec 31, 2025

·

AI

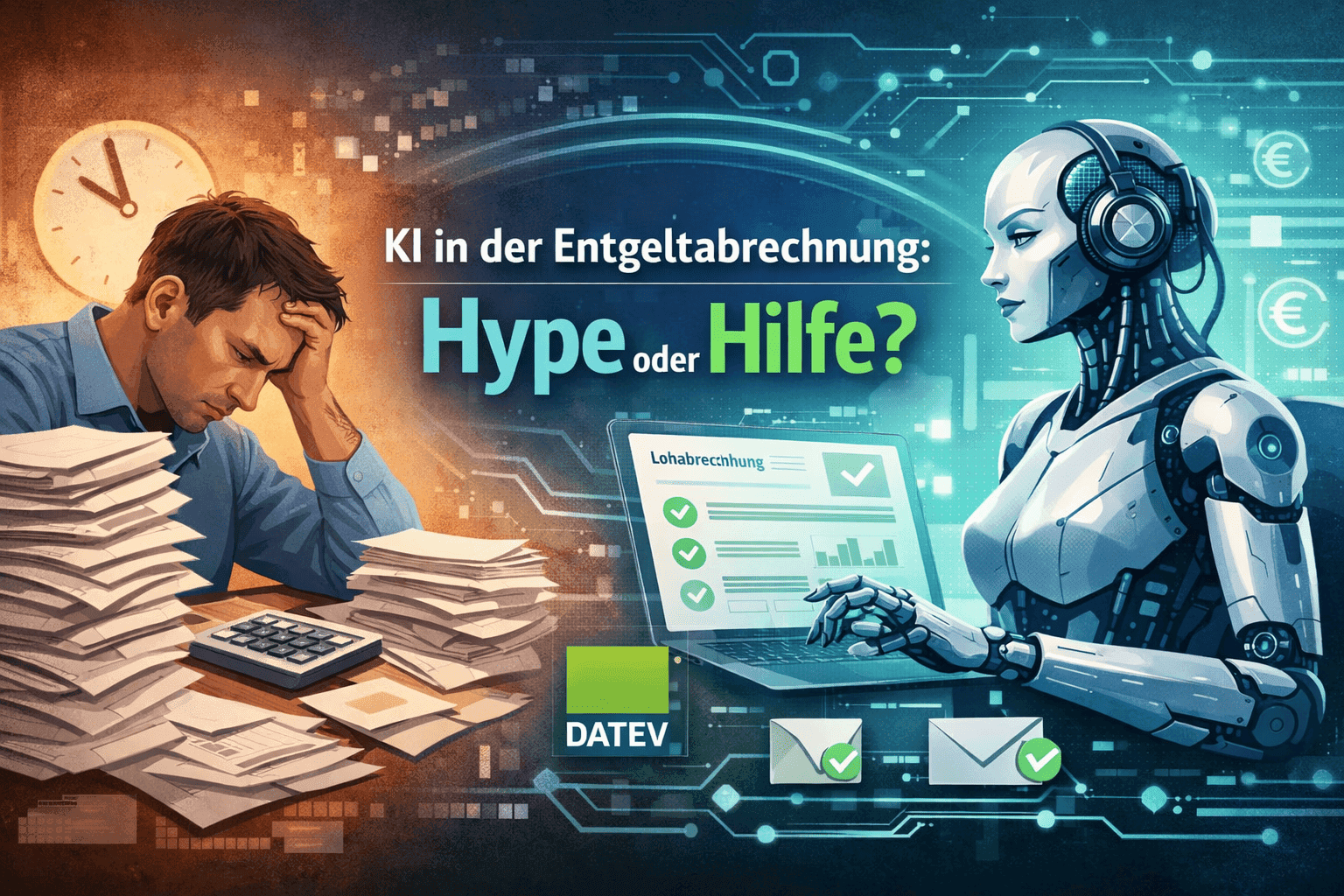

AI in Payroll: Hype or Help?

AI in payroll processing: What is behind it? A guide for anyone who wants to understand the topic before making a decision.

Dec 29, 2025

·

AI

Payroll without professionals? This is how AI will help in 2026

AI in payroll: 70% less routine work, 0.1% error rate. This is how companies are solving the skilled labor shortage in payroll accounting in 2026.

Dec 26, 2025

·

AI

This is how you use AI in payroll.

Enough with manual data collection: This is how AI supports payroll accounting in case of sickness notifications, master data, and billing - without loss of control.

Dec 22, 2025

·

AI

How an AI layer works in payroll.

Digital payroll, but manual data entry? An AI layer closes the gap between employees, HR, and DATEV & Co.

Dec 10, 2025

·

AI

How companies automate payroll accounting with Rita

Learn how Rita from project b. has automated the preliminary payroll accounting. From data collection to DATEV integration: This is how payroll agencies and tax consultants save up to 70% time.

Dec 8, 2025

·

AI

AI Software for Payroll Accounting: The Ultimate Selection Guide

Discover the ultimate selection guide for AI software in payroll. Compare AI tools and find the best payroll software for your business.

Dec 2, 2025

·

AI

5 Reasons for Payroll Processing with project b.

Discover 5 reasons why tax consultants and payroll offices digitize their preparatory payroll accounting with project b. AI-assisted data collection, fewer queries, full DATEV integration.

Dec 5, 2025

·

AI

10 processes in payroll that AI is already handling today

Discover 10 payroll processes that AI has already automated: from master data validation to compliance monitoring. Save up to 94% time on digital payroll.

Dec 3, 2025

·

Payment

EU Salary Transparency Directive: How to Prepare Your Payroll for June 2026

Discover the best tools for implementing the EU Pay Transparency Directive – including AI solutions like project b. for fair and data-driven salary analyses.

Dec 4, 2025

·

Payment

The story of DATEV and how it became an unshakable power in German accounting.

DATEV is more than software – it is the infrastructural foundation of German accounting. The text shows how a cooperative of tax advisors became the central backbone of accounting and payroll through regulatory entanglement, standardization, and decades of trust-building. At the same time, it explains why this very structure is hindering innovation today: closed data architectures, high switching costs, and a system built for stability rather than AI-based automation. A look at how the past and present shape digital progress.

Nov 25, 2025

·

AI

5 Easy Ways to Automate Payroll in 2026

5 practical ways to automate payroll: from digital time tracking to AI-driven software. With cost-saving examples for medium-sized businesses, tax consultants, and payroll offices.

Nov 26, 2025

·

AI

AI in payroll processing: What will be possible in 2026 and what will not?

AI in Payroll 2026: What can artificial intelligence really achieve in payroll? Reality check with maturity assessment, practical examples, and an honest analysis of the limits. For payroll offices, tax advisors, and SMEs.

Nov 27, 2025

·

AI

RPA vs. AI in Payroll: The Ultimate Technology Comparison 2026

RPA or AI in payroll accounting? The major comparison for 2026 shows advantages, costs, areas of application, and practical examples for the right automation strategy.

Nov 24, 2025

·

Payment

Pension flat-rate reform 2026: What employers need to adjust in their payroll software now

Major income tax reform from 2026: The retirement allowance will be recalculated. Learn how this affects net wages, payroll software, and employers.

Nov 18, 2025

·

Payment

Continuous Payroll 2026: How Real-Time Payroll Processing is Replacing Monthly Payroll Statements

Continuous Payroll revolutionizes payroll processing: real-time salary data, on-demand pay, and fewer errors. This is how SMEs and HR teams benefit in 2026.

Nov 20, 2025

·

Payment

Predictive Analytics in Payroll: How Tax Advisors Avoid Costly Mistakes

Discover how predictive analytics reduces error rates in payroll, saves costs, and transforms your payroll from reactive to proactive.

Nov 13, 2025

·

Personal

AI in Payroll Accounting: Practical Guide for Payroll Offices and Tax Advisors 2026

AI in Payroll Accounting 2026: Practical Guide for Payroll Offices with Software Comparison (project b., DATEV, Lexware), ROI Calculation and Step-by-Step Instructions.